Press Release: IMF Executive Board Approves €1.2 billion Stand-By Arrangement for Serbia

February 23, 2015

February 23, 2015

The Executive Board of the International Monetary Fund (IMF) today approved a three-year, SDR 935.4 million (about €1.2 billion, 200 percent of quota) new Stand-By Arrangement for Serbia. The Serbian authorities have indicated their intention to treat the program as precautionary.

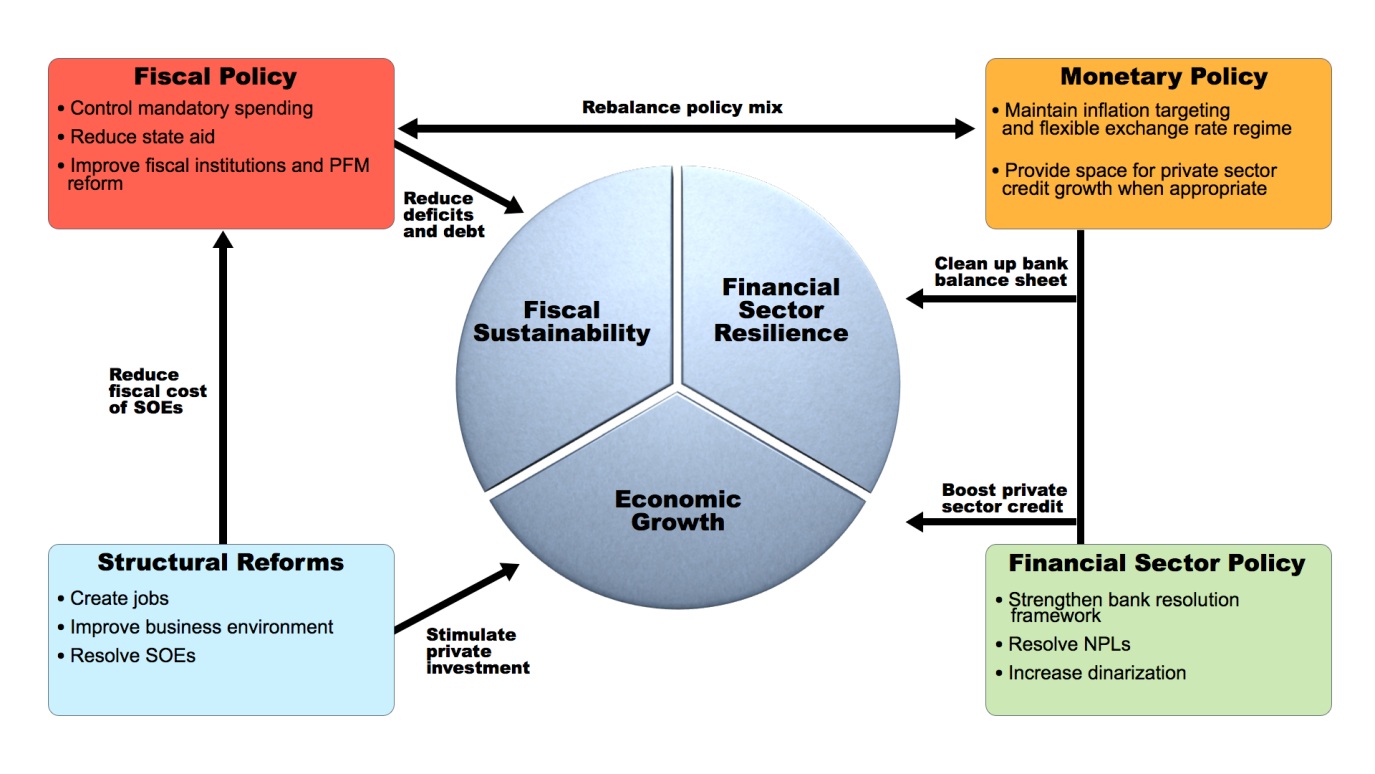

The program is based on three main pillars: restoring public finances’ health; increasing the stability and resilience of the financial sector; and implementing comprehensive structural reforms, to form a solid foundation for job creation and return to sustained high growth.

Following the Executive Board’s decision, Mr. David Lipton, First Deputy Managing Director and Acting Chair, issued the following statement:

“The Serbian economy faces serious fiscal imbalances and entrenched structural weaknesses, in the context of slower growth and adverse regional spillovers. The authorities’ Fund-supported program offers an opportunity to restore public debt sustainability, rebalance macroeconomic policies, enhance financial sector resilience, and improve competitiveness and medium-term growth potential. The authorities should be commended for strengthening the credibility of reform plans by taking difficult but necessary measures in 2014, including labor and pension reforms.

“Serbia’s high and rising public debt calls for fiscal consolidation in the period ahead. The authorities’ fiscal package, which aims to place the debt-to-GDP ratio on a downward path by 2017, is appropriate. The focus on containing mandatory expenditure, reducing state aid, and minimizing fiscal risks arising from state-owned enterprises is warranted. The fiscal program will also be supported by improving the public financial management framework.

“Fiscal consolidation creates room for gradual monetary easing, which will support domestic demand as the fiscal stimulus is withdrawn. The pace of monetary policy adjustment should take into account external financing conditions and the evolution of inflation expectations. Exchange rate flexibility remains an important shock absorber for Serbia and foreign exchange interventions should remain limited to smoothing excessive volatility.

“Preserving the stability of the financial sector and strengthening its resilience will safeguard the economic recovery. Special diagnostic studies should verify the health of banks and guide financial sector policies, going forward. A comprehensive strategy to address high non-performing loans would help clean up balance sheets and improve financial intermediation. Recent reforms to the bank resolution framework will improve the efficiency of the system and mitigate fiscal risks.

“The authorities’ commitment to broad-based structural reforms is welcome. Wide-ranging reform of state-owned enterprises, especially large ones, will be critical for reducing state aid and limiting the drag on the budget. The business climate needs to be improved to attract new investment, foster job creation, and support growth over the medium term.”

The Executive Board also concluded the 2014 Article IV consultation with Serbia. A press release will be published in due course.

ANNEX

Recent Economic Developments

Serbia’s GDP contracted in 2014 due to continued falling domestic demand aggravated by floods, and weak economic activity among trading partners. A high rate of unemployment remains one of the largest social concerns, as chronic structural rigidities continue to undermine the overall competitiveness of the economy. The recession in 2014 was the third in the last six years.

Public debt has risen rapidly to uncomfortably high levels, and despite some fiscal consolidation efforts in recent years, the fiscal deficit rose to 6.6 percent in 2014, due to higher state aid to loss-making SOEs and mandatory spending. Public debt reached over 70 percent of GDP in 2014.

Program Summary

The program’s three main pillars are:

• Strong fiscal consolidation over the program period and rebalancing of policy mix. The fiscal adjustment, already initiated in late 2014, is largely based on curbing mandatory spending and reducing state aid to state-owned enterprises (SOEs). The tighter fiscal stance will create space for easing of monetary policy, which will foster credit growth to the economy. Some of the major measures, related to pensions and public sector wages, have already been introduced in 2014 or are included in the 2015 budget, highlighting high ownership of the program.

• Strengthening of the financial sector. The program aims to support financial sector stability and resilience and improve financial intermediation. While the banking sector (composed mostly of foreign-owned banks) has remained adequately capitalized and highly liquid, nonperforming loans (NPLs) are a significant challenge. Addressing high NPLs will be essential to improve the creditworthiness of potential borrowers and recovery of credit to the economy, which has been contracting until recently. The Serbian authorities are committed to designing and implementing a comprehensive strategy for reducing NPLs. Increasing the dinarization of the economy is also one of the key objectives.

• Boosting competitiveness and growth. Structural reforms are essential to enhance Serbia’s growth potential. There are three broad priorities to be implemented over the medium term: job creation; improvement of the business environment and competitiveness; and resolution and reform of SOEs, aiming at a significant reduction in the number of these enterprises (a first group of about 500 companies are slated for resolution or privatization). In terms of job creation, the Serbian authorities already took important steps in mid-2014, amending the Labor Law to remove disincentives to hiring, and making wage bargaining and employment procedures more flexible. One important measure in fostering investment is a revamp in the regulatory framework for issuing construction permits, aimed at streamlining the process.

Serbia has been a member of the IMF since December of 1992 and has a quota of SDR 467.7 million.

Main Pillars of Serbia’s Adjustment Program

IMF COMMUNICATIONS DEPARTMENT |

| Media Relations |

|---|

| E-mail: media@imf.org |

| Phone: 202-623-7100 |