Fiscal Politics

A historic meeting laid the foundations of US finances

On the evening of June 20, 1790, James Madison and Alexander Hamilton met at Thomas Jefferson’s home on Maiden Lane, in New York. Over a long dinner, the three struck a historic deal that laid the financial groundwork for the fledgling nation. Madison agreed to have the US federal government take over the states’ Revolutionary War debt; in return, Hamilton agreed to support the move of the nation’s capital to the banks of the Potomac River, a location favorable to Madison’s home state of Virginia. The deal is an early and vivid example of how fiscal politics can shape history. The episode remains relevant because it shows that politics plays a crucial role in far-reaching reforms of public finances. Public finance reform is fundamentally political, and it has the potential to shape the political system itself. As this most famous dinner shows, political negotiation can help overcome apparently insurmountable obstacles and become a force for institutional transformation. Today’s policymakers who disregard political realities are doomed to be ineffective.

About 18 months before that historic dinner, when George Washington was elected as the nation’s first president, the federal government was bankrupt. The Treasury Department was not created until September 1789, and the first federal revenue had yet to come in. Yet by 1792, the new administration would manage to put its fiscal house in order. In addition to assuming the debt of the states, it restructured its own wartime debt, built strong federal tax capacity based on tariffs and an effective customs service, laid the foundations of public credit, created a national bank, and promoted the development of financial markets. These steps gave the federal government tools to carry out a policy of active economic development.

Rarely in the history of finance has so much been achieved in so short a time. Building and shaping the nation’s capacity to manage public finances was a profoundly political process. It divided the Founding Fathers into two opposing camps: the Federalist Party of Hamilton and John Adams, which advocated a strong federal government, and the Democratic-Republican Party of Jefferson and Madison, which favored a decentralized government with limited federal powers. This partisan split has been a feature of American politics ever since.

Pragmatic vision

Hamilton recognized that the Constitution alone would not make the federal government strong; it was also necessary to build the infrastructure of public finance. Guided by a vision that was pragmatic and concrete rather than abstract and theoretical, Hamilton laid out his program in three landmark reports: on public credit (January 1790), a national bank (December 1790), and manufactures (December 1791). Taken together, these reports addressed five core areas: taxation, public credit, financial markets and organizations, financial stability and crisis management, and trade policy. Hamilton was inspired by a new kind of state that had emerged from Britain’s Glorious Revolution of 1688–89: one capable of mobilizing resources for war and international competition and actively engaged in economic and financial development. This program of state building dominated political debate in the United States for the next decade.

Famously, Madison and Hamilton initially were close political allies. They collaborated on The Federalist Papers, which succeeded in their purpose of persuading the states to ratify the Constitution. They continued to work together in the field of taxation. On April 8, 1789, two days after a quorum was achieved in the Senate, Madison introduced the First Tariff Act, which would become law on August 1, to mobilize the resources needed to service the public debt and ensure the orderly functioning of the federal government. Tariffs were the most expeditious way of collecting revenue; direct taxes, on the other hand, were harder to collect and deeply unpopular. Tariffs ensured a stable source of revenue and contributed about 90 percent of the total. This key foundation was in place even before Hamilton took office as the first Treasury secretary.

The next order of business was to deal with the public debt, which led to initial controversy among key allies. The goal was to make sure that Treasury securities would come to be regarded as safe assets and a reliable source of financing for the federal government. Hamilton estimated the stock of public debt at $79 million (roughly 40 percent of GDP), of which $54 million was owed by the federal government and $25 million by the states. Even though that level does not appear high from today’s perspective and was much lower as a proportion of GDP than Great Britain’s at the time, debt service costs alone exceeded tax revenues.

To keep taxation at reasonable levels, Hamilton’s report on public credit proposed to offer domestic creditors the choice of swapping their existing government notes for new debt. The debt conversion was meant to reduce the rate of interest from 6 percent to 4 percent, thereby saving about one-third of domestic interest costs. To sweeten the proposal, the Treasury Department would offer call protection that limited the government’s ability to redeem the debt early if market interest rates declined. In his report, Hamilton wrote that such a decline could be expected if effective measures to establish public credit were taken. He concluded: “It ought to be the policy of the government to raise the value of the stock to its true standard as fast as possible.”

Contentious issues

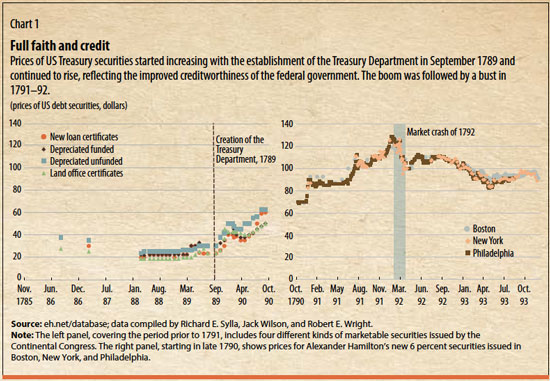

Hamilton’s debt proposal raised a couple of contentious political issues. First, the debt swap would be carried out at face value. This meant windfall gains for many current debt holders who were speculators and had purchased the original securities at a small fraction of their face value—sometimes as little as 20 percent—from the patriots who bought them at issuance. Should not the original creditors be rewarded and financial speculation curbed? Hamilton thought not: the original holders sold voluntarily, obtaining needed cash and showing little faith in the creditworthiness of the US government. Retroactive government intervention in a private financial transaction would be inappropriate. Public credit was founded on the government’s willingness to honor the terms of financial contracts. On that foundation, the US financial system would be built. Credibility was gained rapidly after the passage of Hamilton’s proposals. In 1791, prices rose above par before falling again during the financial crisis of 1792 (see Chart 1).

Second, Hamilton’s proposal envisaged federal assumption of states’ debt. He argued that the debt had been incurred by the states in pursuit of the common good: the financing of the War of Independence. That was clearly a common good for the fledgling nation.

Liquid markets

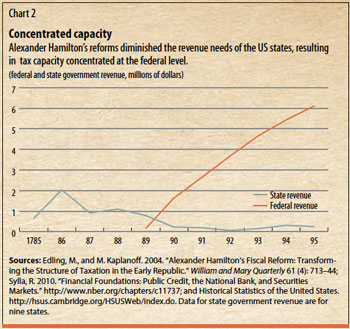

Hamilton was motivated by several additional considerations. Politically, he sought to ensure the allegiance of creditors to the federal government; institutionally, he wanted to foster deep and liquid markets for Treasury securities. A further political motivation was related to the fundamental matter of assigning taxation across levels of government. There were two issues to consider: first, the Constitution gave the federal government the exclusive right to levy tariffs. Overlapping authority for other instruments of taxation opened the door for tax competition among the states. Second, the federal government would assume states’ debt and therefore the interest payments that comprised the biggest expenditures in most states. In this way, the federal government would diminish the revenue needs of the states, with the result that the ability to tax would be concentrated at the federal level (see Chart 2). Hamilton proposed to shape the structure of government through the structure of the public finances.

Given the controversial nature of Hamilton’s report, it is not surprising that by June 1790, Congress had not yet decided to assume the debt of the states. On June 2, the House of Representatives passed Hamilton’s funding bill, but without the debt-assumption provision. Then another divisive issue emerged: where to locate the nation’s capital. The choice would not only increase the economic well-being of the host city but would have an indirect, albeit important, influence on political and policy decisions. Hamilton favored New York, which would thus become the center of political and financial power, like London—a perfect fit for his plan for a strong central government. On the other hand, Virginians such as Jefferson and Madison wanted the seat of government to be on the banks of the Potomac. A compromise was struck at that historic dinner, and in July 1790, Congress passed the Residence and Assumption bills in quick succession.

Jefferson nevertheless remained dissatisfied. More than two years later, in September 1792, the nation’s first secretary of state referred to the episode in a letter to President Washington:

“When I embarked in government, it was with a determination to intermeddle not at all with the legislature & as little as possible with my co-

departments. The first and only instance of variance from the former part of my resolution, I was duped by the Secretary of the Treasury and made a tool for forwarding his schemes, not then sufficiently understood by me; and of all the errors of my political life, this has occasioned me the deepest regret.”

Why the deepest regret? Ensuring financing of federal government operations and the assumption of states’ debt were only the first part of Hamilton’s program. By putting in place centralized public finances in support of a vigorous executive, Hamilton was ready to start carrying out specific policies in the areas of financial stability, crisis management, and trade. From that point of view, agreeing to separate the country’s political capital from its financial center was a minor concession.

It was now clear that the early policy confrontations between the two camps were signs of fundamental differences. In 1792, Madison and Jefferson organized their party to rival the Federalist party. That decision marked the beginning of professional, competitive party politics as a cornerstone of representative democracy in the United States. Fiscal policy, finance, and politics are inextricably intertwined. The same is true of debt, taxes, and state capacity.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Fair, Ray C. 2018. “Presidential and Congressional Vote-Share Equations: November 2018 Update.” Yale Department of Economics Paper, Yale University, New Haven, CT.

Goodman, Peter S., Katie Thomas, Sui-Lee Wee, and Jeffrey Gettleman. 2010. “A New Front for Nationalism: The Global Battle against a Virus.” New York Times, April 10.