Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Good Progress But Testing Times Ahead For Portugal

December 22, 2011

- With program off to a good start, Portugal receives €2.9 billion

- Renewed efforts and bold measures should ensure 2012 fiscal target is met

- Reforms to boost growth and competitiveness key to ensuring recovery

Following elections in June 2011, Portugal’s new government has been working quietly to implement the measures agreed as part of the €78 billion (about $116 billion) international rescue package with the European Union, the European Central bank, and the IMF.

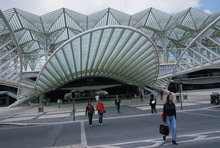

Oriente Station in Lisbon. Reforms are needed in the public sector, including in transportation enterprises (photo: John & Lisa Merrill/Newscom)

PORTUGUESE PROGRAM

The program is broadly on track, according to Poul Thomsen, IMF mission chief for Portugal. “The 2012 budget is in line with the program’s ambitious targets for fiscal consolidation, financial sector policies are being implemented as agreed, and the structural reform program is also off to a good start,” he said in a conference call.

However, the economy, which is expected to contract by 3 percent in 2012, may be heading into a more difficult period because of the continuing sovereign debt crisis in the euro area. “The main risk is that Portugal will face stronger headwinds from a more difficult situation in Europe,” Thomsen said.

The economic contraction is set to deepen in 2012, reflecting delayed fiscal adjustment from 2011, a decline in private demand reflecting cuts in public sector wages, and a significant slowdown in external demand. Overall, the IMF is expecting the economy to contract by 3 percent, with risks skewed to the downside. A cyclical recovery is expected to take hold only in the first quarter of 2013, picking up pace through 2015.

On December 19, the IMF’s Executive Board approved the second review of Portugal’s economic program and released a tranche of €2.2 billion under the country’s €26 billion Extended Arrangement with the IMF.

Catching up on fiscal consolidation

The government is expected to meet its 2011 headline deficit target of 5.9 percent of GDP only through voluntary transfers from bank pension schemes to the social security system. While this is clearly a one-off measure that will not improve the underlying fiscal position, the 2012 budget seeks to make up all the lost ground, and the government is still aiming for a deficit target of 4.5 percent of GDP for next year.

“The good news is that the government is catching up and the 2012 budget gets Portugal back to the original fiscal targets, and does so through high-quality measures,” Thomsen said. As part of its drive to reduce spending, the government has made significant strides in terms of improving revenue administration and restructuring public administration. Other areas, such as public financial management and reform of state-owned enterprises, have faced delays, but these are now being addressed.

“We all know that there are problems with expenditure controls at all levels of government, but not least in state enterprises. Clearly, the feasibility of the target assumes that the government delivers on this process―that is, gradually strengthening expenditure controls in the public sector. This is the key domestic challenge,” he said.

While restoring the sustainability of the public finances is an important goal of the IMF-supported program, Thomsen noted that a significant worsening of the crisis in the eurozone may warrant a reassessment of Portugal’s fiscal target next year. “If the fiscal program is implemented as agreed, if there is no shortfall on measures and expenditure control holds up but there are much stronger headwinds from Europe, then I think one needs to keep an open mind about whether one at that stage would need to relax the fiscal targets,” he said.

Structural reforms key to restoring growth

Implementation of a wide range of reforms to open up the economy to competition is needed to tackle Portugal’s decade-long stagnation. “Portugal’s problem is above all of a structural nature and reforms to boost potential growth and improve competitiveness is key to ensure the success of the program,” Thomsen said.

With unemployment at more than 12 percent, and youth unemployment rising from 27 to 30 percent in 2011, reform of Portugal’s rigid labor market laws is of paramount importance. Given the constraints imposed by the country’s membership of the euro area, which rules out devaluation as an option to make exports more competitive, a significant adjustment in wages is needed.

“If you are in a currency union and you gradually develop a severe competitiveness problem, fundamentally there are two options. You can either try to make your existing wages affordable by becoming more productive or you can reduce your wages and become poorer. We all want it to happen through the first channel and not through the recessionary channel. This is why I say that structural reform in Portugal, where you do not have the benefit of the exchange rate, is so important.”

Recent decisions to reduce public sector wages, extend working hours, and redesign collective wage agreements should reduce pressures on labor costs.

Returning to the markets

The IMF-supported program assumes that Portugal will be able to return to medium and long-term debt sovereign markets by late 2013. Despite the increase in risks, the IMF still thinks this will be possible. “The uncertainty about debt in Europe and the periphery is not going to go away overnight. I am still confident that with the implementation of this program, Portugal can return to the market as expected,” Thomsen said.