Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Geopolitical Risks Cloud Future of Russian Economy

June 30, 2014

- Uncertainties set to hamper growth in the short to medium term

- Capacity constraints continue to weigh on economic growth

- Lingering geopolitical uncertainties likely to impact investment

Russia’s economy continued its slow pace of growth in 2013, reflecting pre-existing structural problems and the fallout of geopolitical tensions with Ukraine.

Russian central bank building in Moscow. A tighter monetary stance is needed over the next year to attain the 2015 inflation target (photo: Yuri Kochetkov/EPA/Newscom)

Economic Health Check

Speaking to IMF Survey at the launch of the IMF’s regular health check of the Russian economy, mission chief Antonio Spilimbergo said Russia needed to build on recent reforms in order to address structural problems related to governance, corruption, and administrative barriers as one way to improve its growth prospects.

IMF Survey: Russia is experiencing a period of slow growth. What factors are behind this, and what can Russia do to reverse the trend?

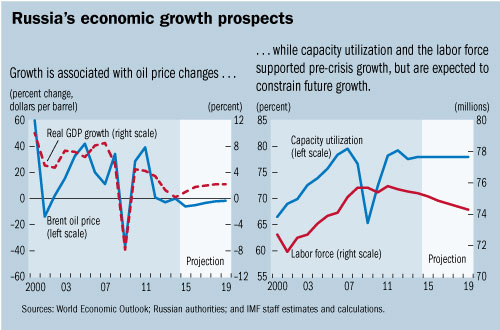

Spilimbergo: First, Russia’s growth model is based on energy exports, which were supported by significant oil price increases since 2000, and the use of spare capacity in the economy. Now that oil prices have stabilized and spare capacity has been exhausted, growth has slowed significantly. In fact, the entire economy hit capacity constraints in 2011, as evidenced by the beginning of the economic slowdown, while inflation remained elevated. Second, geopolitical uncertainties following Russia’s action in Crimea have recently depressed the economy further, with a particularly negative effect on investment.

Russia could implement a number of policies to improve its growth prospects. In particular, Russia needs more and better investment. This requires addressing problems of governance, corruption, administrative barriers, and regulation. While Russia has already implemented some policies to address the situation, much more remains to be done. Continued efforts at global integration are also needed to attract investment and foreign technology. Other areas where improvement is needed include reinvigorating the privatization agenda, improving competition, increasing the size and efficiency of the banking sector, and reducing price distortions, especially utility prices.

IMF Survey: What effect are the sanctions imposed by the United States, European Union, Japan, and other countries having on the Russian economy?

Spilimbergo: Responding to the situation in Ukraine, many countries and the EU adopted sanctions against Ukrainian and Russian individuals and entities. Concerns about the possible escalation of sanctions have increased the perceived risk of doing business in Russia, which is having a chilling effect on investment. Initially, capital outflows increased significantly and bond issuances by the government and Russian companies declined sharply, while borrowing rates increased markedly and the stock market declined. The tensions led to sharp pressures on the ruble, and Russia’s central bank increased interest rates, reduced the flexibility of the ruble, and used its foreign exchange reserves to support the ruble.

However, more recently, as the perceived risk of additional sanctions has subsided, we’ve seen the stock market and the ruble rebound and companies considering issuing bonds externally. Still, despite these recent positive developments, we think that uncertainties will linger as the perception of Russia by investors has changed, hampering growth in the short term and possibly the medium term.

IMF Survey: Like many other countries, Russia is reforming its public pension system. What reforms have been accomplished so far, and what remains to be done?

Spilimbergo: Let me say that, in Russia, as in many other countries, there is growing concern about the viability of the public pension system. In Russia, these concerns arise because of the expected adverse demographic dynamics and the statutory retirement age—60 for men and 55 for women—which is relatively low by international standards. In addition, many exemptions make the effective retirement age even lower than the mandatory ones.

In our view, the recent reform was timid and incomplete. It did not increase the statutory retirement age but introduced financial incentives to delay retirement and increased the minimum years worked required before claiming a pension. In addition, the reform also linked pension benefits to resources available in the pension fund, including government transfers. According to the Russian authorities, the reform is expected to lead to a gradual reduction in the generosity of benefits over time. However, we believe that this may eventually translate into pressure on the government to allocate more money to the pension fund, if the generosity of the system falls below what is socially and politically acceptable.

We think that additional measures are needed to ensure the long-term viability of the system while keeping its generosity at an acceptable level. These measures include increasing in the retirement age, encouraging the formalization of employment in the underground economy, and improving contribution compliance.

IMF Survey: How will Russia’s economy be affected by the difficult economic situation in Ukraine?

Spilimbergo: Clearly, negative economic developments in Ukraine, a neighboring country and trading partner, will affect Russia. However, the impact is likely to be moderate, reflecting the limited trade and financial links between the countries. For example, exposure of Russian banks to Ukraine is less than 2 percent of Russian banks’ assets and the share of Ukraine in Russian exports is less than 5 percent.

That said, given that about half of Russian gas exports to Europe go through Ukraine, disruption of gas delivery to Europe could have an impact on Russia, especially in light of the limited possibility of rerouting through other pipelines in the short run. Moreover, sectors like base metals, transportation equipment, and chemicals are closely-integrated, and disruption of these supply chains could have important impacts within these sectors.

Finally, lingering uncertainties about the situation in Ukraine could undermine the confidence of consumers and investors in Russia, which would further affect domestic consumption and investment.

IMF Survey: Which countries could be affected by the slowdown in the Russian economy?

Spilimbergo: So far, the impact on neighboring countries has been limited but a larger impact is possible. This reflects the fact that some neighboring countries have significant exposure to Russia through trade, financial links, and remittances. For example, countries that have a large trade exposure to Russia include Belarus, Estonia, Lithuania, Lithuania, Turkmenistan, Ukraine, and Uzbekistan. Other countries, like Armenia, Kyrgyz Republic, Moldova, and Tajikistan receive large remittances from Russia. Some financial centers, including Cyprus, Luxembourg, The Bahamas, Saint Kitts and Nevis, and Seychelles also have significant exposure to Russia through foreign direct investment.

Events in Ukraine could also lead to disruption of oil and gas exports from Russia. For example, Finland, the Baltic countries, Belarus, and Czech Republic rely almost entirely on Russian gas for their domestic consumption. Dependence is also high at 40–60 percent in central Europe and southeastern Europe. For these countries, disruption of gas exports by Russia could have significant impact on their economies.