Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Spain: Maintaining the Strong Growth Momentum

August 14, 2015

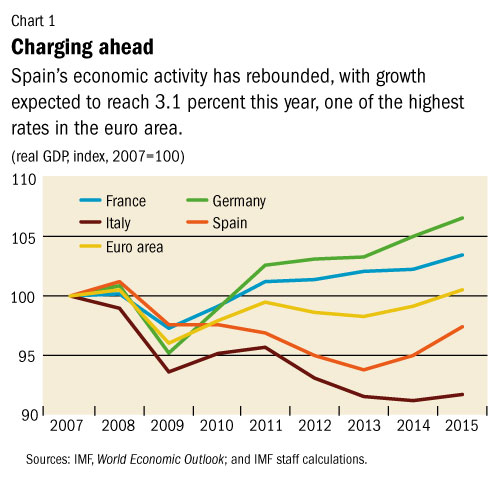

- Strong recovery due to improved confidence, past policy reforms

- Still high levels of unemployment, public and private debt weigh on medium-term growth

- Fiscal consolidation, labor market reforms helping, but further efforts needed

Spain enjoys a remarkable rebound in economic activity, as a result of strong policy implementation and favorable external conditions, but sustaining job-rich growth over the medium term will require continued policy efforts, says the IMF’s annual review of the country.

A woman leaves a shop in Barcelona: Spain’s economic recovery has boosted a rebound in consumption and investment (photo: Albert Gea/Reuters/Corbis)

ECONOMIC HEALTH CHECK

Key priorities include addressing the remaining structural problems in the labor market, creating the conditions for small firms to grow, further reducing firm and household debt, and carrying on with a gradual and growth-friendly fiscal consolidation to maintain strong market confidence and put public debt on a firmly declining path.

In an interview, IMF mission chief Helge Berger discusses with IMF Survey the country’s performance over the past year, the challenges it continues to face, and what it will take to bring down unemployment.

IMF Survey: The Spanish economy seems to have made a remarkable recovery. What’s behind this?

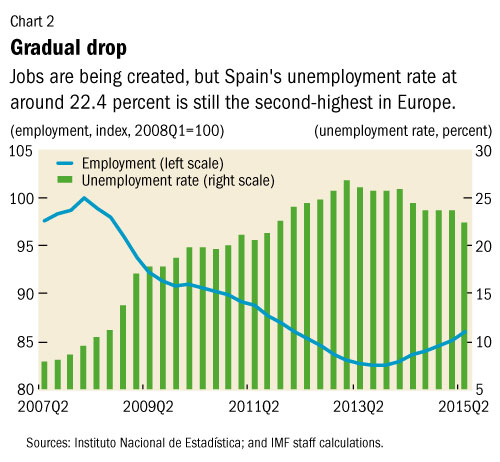

Berger: Indeed, the recovery has accelerated, with growth expected to reach 3.1 percent this year, one of the highest rates in the euro area (Chart 1). More than half a million new jobs have been created in the past 12 months (Chart 2). Financial sector reform, fiscal consolidation, and structural reforms, especially in the labor market, have supported the return of confidence, which, in turn, has boosted the rebound in consumption and investment. Monetary policy and other euro area policies, the depreciation of the euro, and lower oil prices have also helped.

At the same time, nobody should forget that there are still more than 5 million people without work in Spain.

IMF Survey: What are the main risks?

Berger: The potential financial volatility and uncertainty surrounding Greece remain a concern, even if the overall level of contagion risk is certainly lower than it has been in past. This reflects both Spain’s recent reform record and policy measures at the euro area level. All of this is anchoring confidence.

This also means, of course, that undoing past reforms would create uncertainty and hurt the recovery, especially if external conditions were to deteriorate significantly.

IMF Survey: So you think that past reforms are making a difference?

Berger: Yes. The labor market has become more resilient, for example. The reforms increased room for workers and firms to adjust wages and hours worked, and our analysis suggests that this has supported employment and helped Spain regain competitiveness lost during the pre-crisis boom. The “Market Unity Law,” aimed at reducing barriers to trade across Spain’s regions, has started to address some of the obstacles for firms to grow. And the ECB’s comprehensive assessment confirms that banks are stronger.

IMF Survey: Yet you see growth slowing over the medium term?

Berger: The reason is that Spain’s longer-term growth potential is still not as high as it could be. Related to this, there is a very high rate of structural unemployment, caused by long-term changes in market conditions, that the staff currently estimates at around 16.5 percent.

The underlying problems are well known. For example, in the labor market, there are still large differences between the employment protection granted in temporary and in permanent employment contracts. This so-called “labor market duality” hampers productivity and concentrates the adjustment burden on those temporarily employed, typically unskilled, low-wage workers. Another structural issue is Spain’s weak productivity growth, which partly reflects that Spanish firms tend to be smaller, less productive, and less export oriented than many of their European peers. And private and public debt levels remain very high, so deleveraging is likely to continue to weigh on growth.

The positive flip side of this is that Spain has a tremendous potential for higher growth if these structural issues are addressed. Our staff report includes a simple example illustrating how, with the right reforms, reducing structural unemployment and allowing firms to grow and become more productive could double prospects for potential growth.

IMF Survey: What’s Spain’s main economic challenge going forward?

Berger: The goal is to sustain job-rich growth in the medium term and to reduce vulnerabilities further. This means tackling the remaining structural problems I just mentioned. But it also means continuing fiscal consolidation, including in the regions, and making sure that the recent insolvency reform helps reduce private sector debt. Keeping wage growth in line with developments in productivity and external competitiveness and firm-level business conditions and strengthening the skills of the long-term unemployed is another key to support higher and job-rich growth in the medium term.

IMF Survey: Where do Spanish banks stand?

Berger: The positive results of the ECB’s comprehensive assessment last year confirmed that Spain’s banking system has strengthened significantly. Banks’ capital and earnings have increased, asset quality and specific provisioning have improved, and funding and liquidity conditions have become more favorable. Operating conditions remain challenging, reflecting profitability pressures and additional loss-absorbing capacity requirements for some banks. However, the team’s analysis suggests that the banks are in a good position to accommodate the “fresh start” for individual entrepreneurs and consumers introduced in the most recent insolvency reform.

IMF Survey: The IMF has faced criticisms in Spain for recommending fiscal austerity. What is your reaction to that?

Berger: The fiscal deficit has come down at a gradual pace in the last few years. It was almost 9 percent of GDP in 2011 and is expected at around 4.5 percent this year. While this has mechanically taken away from domestic demand, it has also—together with the structural reforms—played a key role in underpinning confidence and supporting the strong rebound of private consumption and investment starting in 2013.

With public debt close to 100 percent of GDP and vulnerable to interest rate volatility, consolidation will have to continue to put debt on a firm downward path. But the recovery will make further reducing the deficit easier, and the staff report discusses how this can be done in a growth-friendly way that protects the most vulnerable.