Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Equatorial Guinea Seeks to Adjust to Lower Oil Prices

September 15, 2015

- Oil price shock comes on top of declining hydrocarbon production

- Effective fiscal adjustment should avoid across-the-board spending cuts

- Policies that leverage infrastructure could support sustainable growth

Equatorial Guinea’s oil-dependent economy is set to contract through 2020, under pressure from low oil prices, falling hydrocarbon production, and reduced capital expenditures, IMF staff economists said.

Africa’s largest methanol plant at Bioko island, Equatorial Guinea, where hydrocarbon revenues are in decline (photo: Pascal Fletcher/Reuters/Newscom)

ECONOMIC HEALTH CHECK

In their regular review of the Central African nation’s economy, IMF staff said Equatorial Guinea’s decade-long hydrocarbon boom is ending and economic activity has stagnated since 2009, with oil and gas extraction having plateaued.

The report said Equatorial Guinea’s outlook for 2015 is dominated by the confluence of lower international oil prices, a high dependence on oil revenues, and a rapidly diminishing government savings buffer. Upfront and substantial fiscal consolidation is unavoidable, particularly on high investment spending.

As a result, the country’s economy is expected to contract by about 9½ percent in 2015, and further by about 2 percent per year during 2016–20 due to lower capital expenditures and falling hydrocarbon production.

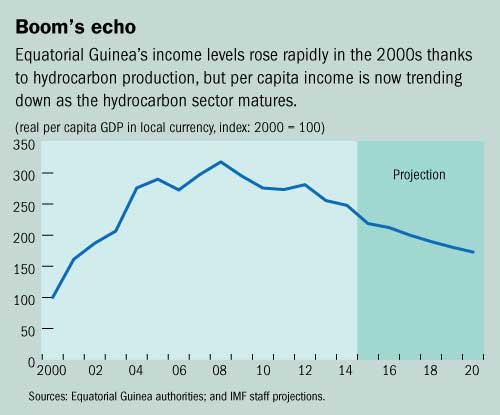

Equatorial Guinea embarked upon a long hydrocarbon boom around the turn of the millennium that turned it into sub-Saharan Africa’s third largest oil exporter and its wealthiest country in terms of per capita income (see chart). It has also enabled a large scaling up of investment spending on infrastructure.

While extensive investment has helped to put in place substantial infrastructure, Equatorial Guinea’s social indicators are similar to those of low-income countries. Furthermore, hydrocarbon revenues are on the decline as oil and gas fields mature. These adverse trends have been aggravated by the price slump that is buffeting oil exporters around the world.

The report notes that Equatorial Guinea’s era of buoyant economic growth is now receding, and the overriding theme of the IMF’s recommendations is for policies to help navigate an environment of much lower anticipated revenue, and to allow Equatorial Guinea to better leverage its existing infrastructure to foster diversification and structural transformation.

Fiscal policy and the oil shock

The authorities have set out a tough 2015 budget that aims to more than halve capital spending and implement strong reductions in spending. For an effective adjustment, the country report stresses the importance of avoiding across-the-board cuts. Instead, it proposes allowing near-complete projects to be finished, while putting in place a rigorous process to evaluate the relative viability of new projects in terms of expected economic and social returns.

At the same time, the government should be looking at progressively shifting spending away from infrastructure toward public services and social projects, which would support human capital development that is essential for the competitiveness of the non-resource economy.

Reducing heavy dependence on the volatile hydrocarbons sector revenues should also be a priority. The authorities have already deployed a series of measures to eliminate widespread tax exemptions and modernize tax administration, and these efforts could be complemented by a comprehensive review of tax policies.

Leverage infrastructure

Equatorial Guinea’s multi-year public investment plan—dubbed Horizonte 2020—has considerably improved transportation infrastructure and the provision of public utilities. This infrastructure constitutes a considerable advantage relative to other sub-Saharan African economies. Nonetheless, economic diversification has remained elusive so far, with hydrocarbons still accounting for more than 90 percent of exports.

To leverage this infrastructure toward a more robust and diverse economy, the report recommends an ambitious structural reform agenda to boost competitiveness and attract potential investors, including

• Accelerating reforms to improve the business climate, in partnership with the World Bank;

• Supporting human capital development by promoting education, especially fully equipping and staffing newly built schools;

• Advocating for lower trade barriers among regional partners in the Economic Community of Central African States (CEMAC) and between CEMAC and other countries; and

• Seeking to partner with international financial institutions on investment opportunities.

Critical data weaknesses

The report urges priority efforts to improve Equatorial Guinea’s weak socioeconomic statistics. Good data are essential to effective decision making, and the cost of ill-informed decisions is especially high in an environment where revenue is constrained. A lack of readily available information could also deter potential investors.

While building statistical capacity takes time, several steps can be taken in the short term, including wider publication of existing statistics and subscription to the IMF’s General Data Dissemination Standards.