Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Emerging Europe Sees Stronger Growth Ahead, but Faces New Risks

November 13, 2015

- Much of the region growing at a healthy pace; CIS economies face challenges

- Growth expected to turn positive next year, but new risks have emerged

- Countries face fiscal challenges; growth-friendly budgets needed

The regional outlook for Central, Eastern and Southeastern Europe (CESEE) shows a mixed picture this year, as countries in Central and Eastern Europe (CEE) continue to grow at a solid pace, while Russia and other Commonwealth of Independent States (CIS) are in recession, according to the latest IMF’s Regional Economic Issues report.

Workers on an oil rig in Russia: While most of the region is growing at a healthy pace, in part, thanks to lower oil prices, demand is contracting in Russia, as the economy adjusts (photo: Gerd Ludwig/National Geographic Creative/Corbis)

Regional Economic Issues

Growth for the region as a whole, however, is expected to turn positive next year, as CIS economies stabilize and start recovering (see Table).

In CEE, Turkey, and most of the Southeastern European (SEE) countries, growth is driven by robust domestic demand, supported by low oil prices and improved prospects in the euro area. In addition, in several European Union (EU) countries, growth is boosted by an increased absorption of EU structural and cohesion funds.

Meanwhile, in CIS, domestic demand is contracting, as Russia’s economy adjusts to low oil prices and Western sanctions, and Ukraine struggles with multiple challenges related to ambitious reforms, significant macroeconomic adjustment and economic dislocations in the East.

Risks have increased

The growth forecast is little changed from the spring 2015 projections, but the risks have shifted to the downside, as new risks have emerged. Even though direct trade links with China are relatively small, commodity exporters (Russia) and more open economies (the Czech and Slovak Republics, Hungary) would be most affected by a decline in the import demand from China. The region remains also vulnerable to contagion from possible renewed volatility in emerging markets that could result in capital outflows and liquidity strains on sovereigns and leveraged firms. In addition, the refugee crisis in Europe could put pressure on public finances and disrupt trade flows, at least in the short-run, as countries struggle to secure their borders.

Policies need to be tailored

Policy priorities depend on how far along the countries are in their post-crisis adjustment and on their exposure to external risks. Where the recovery is well advanced, priorities increasingly shift toward the medium term, including rebuilding fiscal buffers and continuing with structural reforms. At the same time, key crisis legacies––high nonperforming loans and debt overhangs––require further work in some countries (notably in SEE).

For economies that are in recession, the key challenge is to steer the adjustment to terms-of-trade and other shocks with a view to supporting weak demand and reducing high inflation. Countries vulnerable to external shocks need to be prepared to deal with market pressures by using exchange rate flexibility to absorb shocks alongside macro-prudential policies to contain the buildup of risks in the financial sector.

Reconciling fiscal consolidation and growth

A key policy challenge is to restructure budgets to support long-term growth. Many budgets in CESEE countries are relatively growth unfriendly, with an excessively large portion spent on transfers and public consumption. Relatively high labor taxes—especially social security contributions that can generate employment and poverty traps—are also unfavorable to growth.

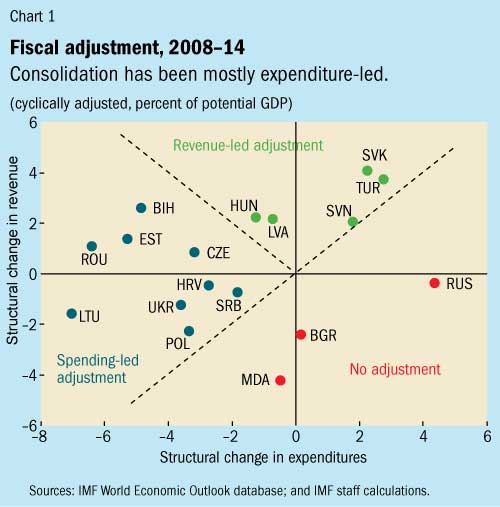

Since the onset of the 2008-2009 global financial crisis, budget structures in the region have changed markedly. The structural quality of budgets often improved in the process. Total fiscal adjustment has exceeded 5 percentage points of potential output in some cases. Most countries frontloaded the effort, and achieved the larger part of consolidation by reducing expenditures rather than increasing revenues (Chart 1).

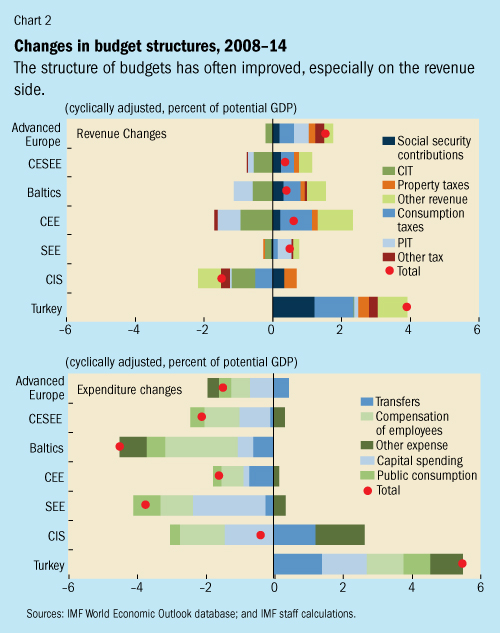

Many countries compensated structural declines in corporate income tax with growth-neutral forms of taxation, such as Value Added Tax (Chart 2). Meanwhile, large savings were realized from reforming entitlement programs and reducing public consumption. Baltic and Central European countries—that have access to EU structural and cohesion funds—often managed to avoid cuts in public capital spending that can hurt growth.

Addressing remaining fiscal challenges

Nevertheless, important fiscal challenges remain. Fiscal consolidation has not yet run its course, with sizable adjustment needs remaining, especially in Southern Europe. Going forward, it will be crucial to make budgets more growth friendly. While policies need to be tailored to the specific circumstances of each country, there are some common avenues for reform.

• Where fiscal adjustment is still needed, countries should target unproductive transfers and reform entitlement programs—including public pension systems—while protecting productive spending on health, education, and public infrastructure. Countries with access to EU structural and cohesion funds should leverage them to avoid cuts in public investment.

• Countries with a sustainable fiscal stance should also reform to enhance the quality of their budgets. Options include shifting the tax burden from direct to indirect taxes while reducing tax exemptions, and enhancing the efficiency of public spending.