Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Oil Price Collapse Vindicates Gabon’s Aim to Diversify

February 26, 2015

- Gabon depends on oil for more than half state revenue, four-fifths of exports

- Oil price shock underscores importance of promoting non-oil growth

- Diversifying requires structural reforms and sustainable fiscal framework

The plunge in oil prices since mid-2014 shows that Gabon’s plan to diversify its economy away from overdependence on oil is clearly the right way to go and is now more relevant than ever, IMF staff said.

Timber consignment in Libreville, Gabon, where plan to diversify economy includes promoting non-oil industries (photo: Martin Harvey/NHPA/Photoshot/Newscom)

ECONOMIC HEALTH CHECK

In a regular review of the Central African nation’s economy, IMF staff added that the oil price shock underscores the importance of fiscal adjustment and acceleration of structural reforms to promote non-oil growth.

The report projected a growth slowdown to 4 ½ percent in 2015 from an estimated 5.1 percent in 2014, but with considerable downside risks. The growth outlook for the current year has weakened due to a sharp cut in capital spending in 2014 and to the oil price shock, but could improve subsequently to average around 5.7 percent in the following five years, driven by public investment, non-oil natural resources, and services. New projects in agro-industry, mining, and wood processing would help sustain non-oil growth.

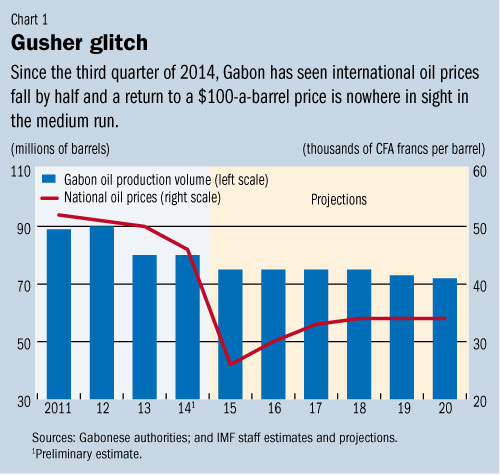

Although the medium-term growth outlook remains robust, the recent collapse in oil prices is a major challenge. Since the third quarter of 2014, international oil prices have fallen by half, and a return to a $100 a barrel price is nowhere in sight in the medium run (see Chart 1). For a country like Gabon, which has traditionally depended on oil for more than half of its government revenue and four-fifths of its exports, the sharp decline is alarming.

The oil price collapse is all the more important because five years ago the government adopted an ambitious plan—the Plan Stratégique Gabon Emergent—to transform Gabon into a diversified emerging economy by 2025. Financing the plan was predicated, among other factors, on continued high oil prices.

Validated objectives

The apparent new normal in world oil markets validates the authorities’ emphasis in recent years on reducing dependence on oil. As the cornerstone of the authorities’ economic policies, the development plan rightly aims for economic diversification, sustainably managing natural resources, and improving social indicators by having more inclusive and job-rich growth.

The government’s plan is broadly appropriate, the IMF report said, because its main pillars include improving the level and quality of infrastructure, and raising the quality of human capital—thus tackling two of the country’s binding constraints to economic growth.

There has been significant progress in implementing the development plan since its launch in 2010. Using most of the revenue windfalls during high oil price years, the government has considerably improved transport and energy infrastructure, and established joint ventures with foreign companies in non-oil, higher value–added sectors—mainly in natural resource processing.

However, marked public financial management weaknesses raise concerns about the efficiency of public investment and therefore about their fiscal costs. The fiscal impact of the implementation of the plan is a major concern also because the authorities have aimed to attract foreign investors through tax exemptions.

Fine-tuning the strategy

Thus, in a new context of much lower oil revenues, the efficiency of the strategy to promote non-oil related investment needs to be fine tuned. The widespread use of tax exemptions erodes the tax base and significantly weakens fiscal sustainability. Cross-country evidence shows that what most investors care about are reliable infrastructure and a predictable legal environment.

Focus should therefore be on structural reforms that will reduce input costs and boost productivity. These notably include reforms to improve the business climate, physical infrastructure, and the quality of technical education. Concentrating on these areas, as well as continuing to improve public finance management and investment quality, are thus key to ensure the fiscal sustainability and success of the development plan.

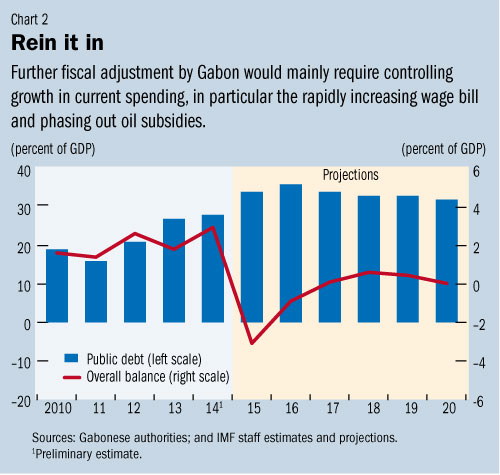

Ensuring fiscal sustainability will be particularly challenging because a massive increase in government spending during the period 2010–13—mainly in public investment—had already severely strained the fiscal accounts before the recent collapse in oil prices.

A rapid boost in capital spending was financed by a large increase in public debt from about 16 percent of GDP in 2011 to about 28 percent of GDP in 2013, a significant accumulation of domestic payments and value-added tax arrears, and a rapid drawdown of deposits at the central bank in 2014.

With pressure to repay large domestic arrears, the authorities recognized the tight fiscal situation and appropriately rectified their 2014 budget in order to scale down their investment program to more manageable levels.

Revising the fiscal framework

Against this background, the authorities’ key objective is to protect infrastructure and social spending while avoiding the rapid accumulation of public debt and arrears. As a result, the authorities are planning to send to parliament a revised 2015 budget based on conservative oil price assumptions. To balance the books, they intend to reduce current spending, especially on goods and services as well as on subsidies.

That said, further adjustment is no doubt needed in the medium run (see Chart 2). This would mainly require controlling growth in current spending, in particular the rapidly increasing wage bill, and phasing out costly, inefficient, and inequitable oil subsidies. There is also a need to expand the non-oil tax base, notably by reducing tax exemptions and improving tax administration.

The authorities recognize the need of these reforms, and have recently announced their decision to move ahead with one of the most important measures to ensure fiscal sustainability: the phasing out of gasoline and diesel subsidies. A decisive attitude to guarantee fiscal sustainability should ensure the success in their plans.