Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Indonesia Navigates Safely Through Uncertain Times

March 15, 2016

- Growth forecast at 5 percent in 2016

- External pressures buffeting the economy

- Business climate, infrastructure, key to economic growth

Indonesia, one of the best performing emerging market economies, can take its economic success to the next level by more investment, particularly in infrastructure, and finding new sources of economic growth, says the IMF in its annual assessment.

Women building a road in Jakarta: Sustaining strong growth will require the government to invest in infrastructure (photo: Nik Wheeler/Corbis)

Economic Health Check

Speaking to IMF Survey, IMF Mission Chief for Indonesia, Luis E. Breuer, credits good economic management and timely reforms, particularly on fuel subsidies, for Indonesia’s favorable prospects. The country is also well positioned to cope with a challenging external environment.

But he noted that sustaining strong growth and development will require the government to push on, and even expand, its ongoing reforms to improve infrastructure, strengthen the business environment, and open up trade.

IMF Survey: The IMF just finished its annual assessment of the Indonesian economy. How is the economy doing?

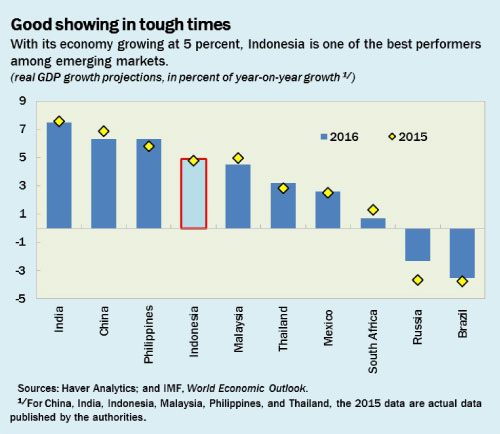

Breuer: Indonesia’s macroeconomic performance was good in 2015. Despite the weaker external environment, economic growth remained among the highest in emerging market economies at 4.8 percent in 2015. Inflation fell to within the central bank’s target range (3-5 percent), and the current account deficit narrowed. Over the past few years, sound monetary management and a prudent fiscal stance have reinforced macroeconomic stability and supported growth.

For 2016, we expect growth to pick up moderately to around 5 percent (see chart). The recovery will be driven by increased investment, especially, public sector spending on transport and energy.

For the medium-term, Indonesia’s prospects are very favorable. Economic fundamentals are set to continue to improve, building further on Indonesia’s many assets—a young population, low public debt, large domestic markets, natural resource endowment, and a participatory and stable political system.

IMF Survey: The global economic landscape is changing: lower commodity prices, China, increased volatility Can you speak about the impact on the Indonesian economy?

Breuer: Indeed, the economic landscape is changing. And like many emerging market economies, Indonesia is facing pressures from the current shifts in the global economy, notably lower growth and rebalancing in China, sluggish commodity prices, and the beginning of monetary policy normalization in the United States.

These shifts have impacted the Indonesian economy through three main channels: commodity prices, trade, and capital flows. They have led to a slowdown in growth in recent years—from the high rates during the commodity boom years—and tighter financing conditions. As a result, risks and vulnerabilities have increased.

Government revenues, in particular oil revenues, have dropped significantly. Foreign direct investment and portfolio inflows have slowed, as foreign investors’ appetite for emerging market assets in general has weakened, even as inflows to Indonesia so far in 2016 have been more favorable than to regional peers. Although from low levels, foreign currency denominated borrowing by firms has increased rapidly in the past few years, while corporate performance has weakened somewhat and banks’ non-performing loans have begun to creep up.

Nonetheless, Indonesia has ample experience in handling such turbulence, as the economy weathered well the global financial crisis and the so-called “taper tantrum” in 2013. Sound policies, including flexible exchange rate and government bond yields, and ample international reserves have helped the economy’s adjustment to the changing world. Indonesia is certainly better able to handle this kind of turbulence than in the past.

IMF Survey: Going forward, how can Indonesia best adapt to this new environment?

Breuer: Indonesia needs to manage short-term risks and, at the same time, increase potential growth in the medium-term. On the fiscal side, the government needs to increase revenues to create space for infrastructure and other priority spending such as well-targeted social programs.

In addition, it is crucial to maintain flexible exchange rates and market-determined government bond yields, to navigate volatile external financial conditions. The Financial System Safety Net law should be enacted quickly to support financial sector stability.

Beyond that, Indonesia needs to continue to diversify its economy from the heavy reliance on commodities—to manufacturing, agriculture, and services, and generate new sources of economic growth. This requires better infrastructure and structural reforms to improve competitiveness and the productivity of investment. The series of policy packages issued since August 2015 are rightly aimed at strengthening the business climate and addressing the burden of multiple layers of regulations. The authorities need to build on these actions and push on with further reforms, particularly on trade liberalization.

IMF Survey: Indonesia has successfully implemented a fuel subsidy reform plan. Could you explain how this was achieved?

Breuer: The landmark reform of energy subsidies was indeed an impressive achievement. Several factors contributed to this positive outcome, including well-targeted social protection measures, a good communication strategy, good timing, and bold political leadership. These elements were particularly relevant and could be useful to other countries.

The government’s communication strategy clearly emphasized the need to shift from subsidy spending toward much needed infrastructure investment to enhance growth prospects. The reforms included measures designed to protect the vulnerable groups, such as cash transfers.

At the same time, the reforms were implemented at a time of falling oil prices, which reduced the need to increase retail prices of fuel. In fact, the government actually cut gasoline and diesel prices by around 22 and 15 percent, respectively, in January 2015, aided by the rapid fall in global oil prices.

IMF Survey: What are the reforms needed to improve the business environment and increase investment?

Breuer: Indonesia will greatly benefit from reforms in infrastructure, investment, and trade. In a country made up of more than 17,000 islands, a modern and efficient infrastructure is crucial to connect people and markets both within the country and with the world. Yet Indonesia’s infrastructure gap remains large compared to its peers. Let me give an example: logistics costs account for 24 percent of GDP in Indonesia, compared to only 13 percent in neighboring Malaysia.

To attract more investment, Indonesia needs to remove constraints that shackle the private sector, including the complex regulations. President Jokowi’s commitment to jump-start investment is very encouraging, especially the implementation of the revamped Land Acquisition Law and a one-stop services shop. The recent changes to the foreign direct investment regime, which, in the aggregate, led to a partial liberalization is further progress in the authorities’ reform agenda.

IMF Survey: How can Indonesia close its infrastructure gap?

Breuer: The government has laid out an ambitious plan for infrastructure development. The plan sets a target of around US$ 480 billion (around 50 percent of GDP) during 2015–19, financed by both the public and private sectors. The authorities have made progress by accelerating government capital spending in 2015 and enhancing the institutional framework, especially the setup of a coordinating body (KPPIP) to focus on top priority projects.

Nonetheless, efforts are required on several fronts to successfully implement the ambitious plan. The government needs to mobilize additional revenue to create fiscal space for capital spending, including with an increase in excise taxes on fuel, tobacco, and vehicles.

In addition, the increase spending in infrastructure should be complemented with an improvement in public investment management, and the strengthening governance at state-owned enterprises and capacity at local governments.

The pace of implementation needs to take into account capacity constraints, including those of local governments, and should carefully consider fiscal risk and the economic impact of increasing the public debt too quickly, including on interest rates and the current account deficit. Finally, the structural reforms related to the business environment described above would greatly complement these efforts.