Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Caucasus, Central Asia Feel Impact of Adverse Shocks

May 19, 2015

- Oil price drop, Russia’s slowdown, appreciation of the dollar are taking a toll

- Fiscal stimulus, exchange rate flexibility helping countries cope in near term

- Deep structural and fiscal reforms are vital for creating jobs, reducing poverty

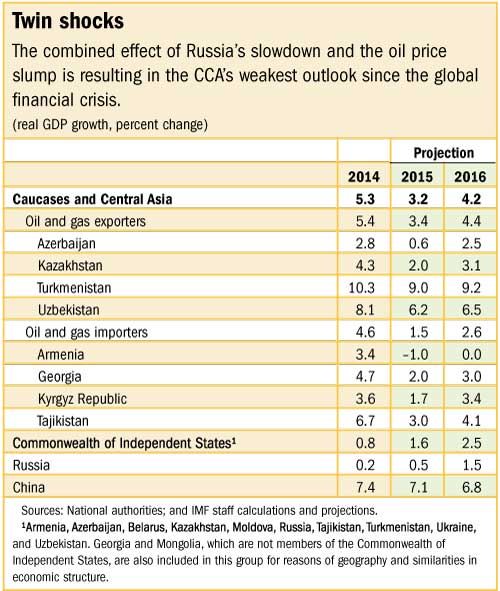

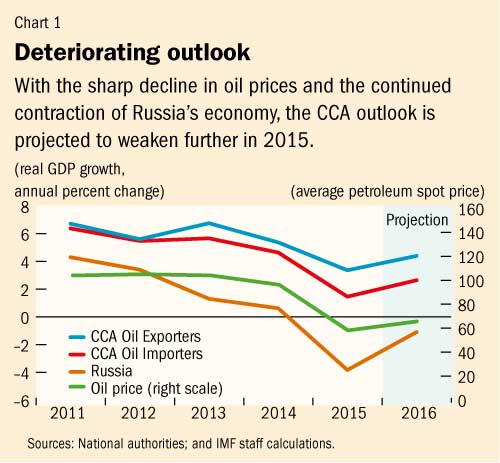

Growth in the Caucasus and Central Asia (CCA) is expected to decline by 2 percent this year as a result of lower commodity prices and the economic slowdown in Russia, says the latest regional forecast by IMF staff.

KazMunaiGas headquarters: Some oil-exporting countries, such as Kazakhstan, are dipping into reserves built up in recent years (photo: Shamil Zhumatov/Reuters)

REGIONAL ECONOMIC OUTLOOK

The Regional Economic Outlook Update for the Caucasus and Central Asia, released on May 19, predicts growth in the region will reach just over 3 percent this year (see table). This latest forecast represents a downward revision of 2½ percentage points from the one released by the IMF in October 2014.

“The twin shocks of the economic slowdown in Russia, a key trading partner, and lower oil prices are taking a toll on the region,” Juha Kähkönen, Deputy Director of the IMF’s Middle East and Central Asia Department told reporters in Almaty, Kazakhstan.

“Exchange rate developments—such as the appreciation of the U.S. dollar and the depreciation of the ruble—are compounding the problem. Overall, the outlook for the region has not been this weak since the global financial crisis in 2008-09.”

Oil exporters use cushions to soften impact of oil price shock

The CCA’s oil and gas exporters—Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan—should see growth decline to 3 ½ percent in 2015 from 5½ percent last year. In some of these countries, the impact from lower oil prices and Russia’s contraction is being amplified by a slowdown in domestic oil production and delays in development of new oil fields, the IMF report says (see Chart 1).

The oil and gas exporters’ external position is set to weaken sharply in 2015. The current account balance is expected to turn from a surplus of 3 percent of GCP in 2014 to a deficit of 2 ½ percent in 2015, reflecting both oil export revenue losses and stronger import growth.

The drop in oil prices is also having a budgetary impact. Some of the region’s oil and gas exporters—such as Kazakhstan and Uzbekistan—are dipping into the large reserves built up in recent years to blunt the impact of the oil price shock. As a result, the oil and gas exporters’ fiscal balance is shifting from a surplus of about 1½ percent in 2014 to a deficit of close to three percent in 2015, according to the report.

Given that many of the oil and gas exporters cannot balance their budgets at currently projected prices, the IMF says these countries should consider taking steps toward fiscal consolidation as soon as conditions allow, to rebuild buffers, strengthen fiscal sustainability, and share the natural resource wealth with future generations.

Oil importers feel strain of lower remittances

In the CCA’s oil importers—Armenia, Georgia, the Kyrgyz Republic, and Tajikistan—growth will slow to 1½ percent this year, the report says. These countries are heavily dependent on remittances from Russia, which have fallen sharply. The drop in remittances has erased any gains from lower oil prices, and the current account deficit for these countries is expected to reach 11 percent this year, the IMF says.

These countries are also experiencing a reduction in export revenues as a result of lower commodity prices in general, as many of them export minerals such as gold, copper, and aluminum.

The oil importers will see a rise in their fiscal deficits, from just over 2 percent in 2014 to about 4½ percent in 2015. While some countries, such as Armenia and the Kyrgyz Republic, are temporarily increasing spending to boost domestic demand, all the oil importers will need to return to fiscal consolidation soon in order to preserve their long-term fiscal health, the report emphasizes.

Financial sector vigilance, structural reforms needed

Across the region, the current economic environment in the CCA is proving difficult for banks, as financial systems are facing pressures from multiple sources. Currency depreciations are increasing credit and solvency risks—especially in the context of dollarized banking systems and foreign currency lending. And the region’s slowing economic growth is heightening credit risks, particularly in countries where bank governance and underwriting standards are weak.

Because of these risks, banking supervisors will need to intensify surveillance of financial systems in the region, the IMF report says, and crisis management frameworks should be strengthened.

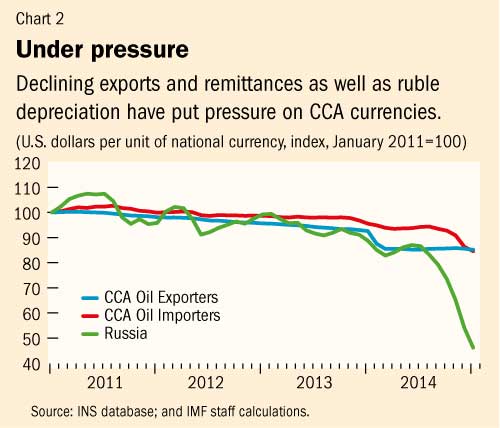

The report also suggests that greater exchange rate flexibility would be needed to help the region’s economies absorb shocks, retain competitiveness in the face of exchange rate pressures, and prevent a drain on reserves (see Chart 2).

As for the region’s medium-term prospects, bold structural reforms will be vital. Policymakers should intensify efforts to enhance the business environment, improve governance, and diversify economies away from their reliance on commodity exports and remittances, the IMF says.