(photo: Jonathan Hayward/iPhoto.ca/Newscom)

A light rail train near Ottawa, Canada: higher spending on infrastructure can help the country secure stronger growth (photo: Jonathan Hayward/iPhoto.ca/Newscom)

Unlocking Canada's Future Growth Through Infrastructure

July 13, 2017

While the Canadian economy has regained momentum, the outlook is less upbeat. In its annual assessment of the Canadian economy, the IMF said higher infrastructure spending can spur short-term and long-term growth.

Related Links

Canada’s economy expanded at an annual pace of nearly 4 percent in the first quarter of 2017—the fastest growth rate among the Group of 7 countries. With the economy’s adjustment to lower oil prices almost complete, growth is expected to accelerate to 2.5 percent this year, up from 1.5 percent in 2016.

However, the recovery comes mainly from stronger consumer demand and housing activity, with business investment and nonenergy exports remaining weak. This raises questions about the sustainability of the recovery at a time when Canada’s economic outlook is subject to significant risks from rising housing market imbalances and greater uncertainty about U.S. trade and tax policies.

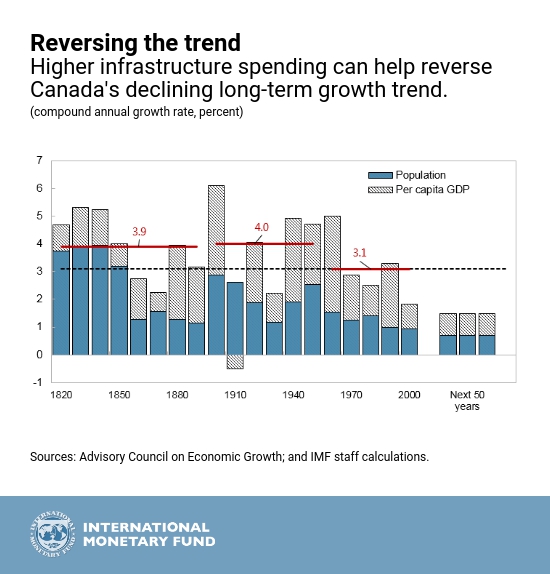

Looking ahead, low productivity growth and population aging will also weigh on potential growth. To support the economy, the Canadian government is looking at ways to raise infrastructure spending—a key factor that improves productivity, the report said.

An aging population

Historically, Canada’s economic growth has been largely driven by growth in the labor market. However, Canada, as many other economies, is experiencing a rapid aging of its population, as the “baby boomers” born after World War II reach retirement age. The number of persons aged 15-64 (the working age) as a share of the total population has fallen by about 2 percentage points since 2010—from about 69 percent—and is projected to fall another 7 percentage points over the next 20 years.

The government has launched ambitious structural reforms to reverse the declining trend in Canada’s long-term growth, such as reducing barriers to internal trade, improving the innovation framework, investing in education and training, and promoting high-skilled immigration. The Canadian government has also made infrastructure spending a cornerstone of its growth strategy as various studies have shown that, if done right, investing in infrastructure brings both short-term and long-term payoffs. The federal government plans to double public investment to Can$187 billion (equivalent to 7½ percent of GDP) over the next decade.

A new infrastructure bank

As part of its infrastructure investment plan, the federal government recently created a new Canada Infrastructure Bank, which will become operational by late 2017. It will focus on large, complex, and revenue-generating projects, which are in the public interest but would not be feasible because the risks are too large and the financial returns too small to attract private investors. The Canada Infrastructure Bank will work closely with provincial and local governments, as well as private sector investment partners, to transform the way infrastructure is planned, funded, and delivered in Canada. The infrastructure bank is authorized to invest Can$35 billion.

By attracting private capital, demand for budget resources would be lowered, reducing public borrowing or freeing up taxpayer money for other high priority projects. The Canada Infrastructure Bank differs from the Public Private Partnerships model, in which the government retains ownership of the asset and funds the project from the budget.

Securing public acceptance

Public acceptance of the Canada Infrastructure Bank’s basic strategy is a precondition to its success. The government and the Canada Infrastructure Bank need to enhance public understanding of the benefits of involving private investors by pointing out that they bring their technical competence, discipline, and creativity to help reduce risk and lower the overall project cost.

Publication of the selection criteria for projects and investors—and competitive selection of investors—will give the public confidence that their interest is being served at the least cost.

The CIB is an important new tool to promote long-term growth in Canada, the report said.