IMF Releases the 2023 Financial Access Survey Results

October 3, 2023

Washington, DC: The International Monetary Fund released the results of its fourteenth annual Financial Access Survey (FAS) , [1] highlighting the resilience of financial access during the tumultuous COVID-19 pandemic years. Data from 2022 indicate a sustained level of financial inclusion, bolstered by the rise in digital financial services. Notably, microfinance institutions played a pivotal role in responding to the financial needs of the most vulnerable segments of society. However, the FAS data also point to a concerning dip in the outstanding value of commercial bank loans extended to small and medium enterprises (SMEs) relative to GDP, indicating that their ability to access bank financing may be more constrained and/or demand for credit might have weakened due to tighter financing conditions. Additionally, a persistent gender gap in financial access remains a pressing concern.

Usage of Digital Financial Services Continued to Make Gains

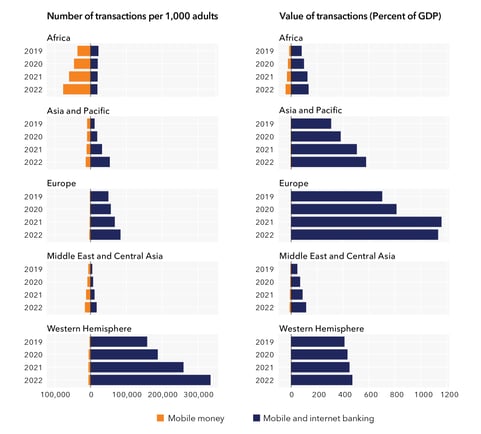

The means to access finance have seen a seismic shift in recent years. Traditional touchpoints like ATMs and bank branches are witnessing a decline while non-traditional platforms such as retail agents and mobile money agents are surging. The proliferation of digital financial service access points has inevitably led to a rise in their usage, as measured by the increase in the number and volume of digital financial transactions. For example, in Africa, a hub for mobile money, the value of these transactions increased from 26 percent to 35 percent of GDP between 2021 and 2022. Meanwhile, in Europe and Western Hemisphere, the preference leans towards mobile and internet banking, where the volume of online banking transactions per 1,000 adults jumped by more than 20 percent in 2022 alone.

Even as bank account uptake has risen globally, there has been a discernible drop in the value of outstanding deposits and loans as a share of GDP across many regions. In the Middle East and Central Asia, for instance, the share of outstanding loans in GDP fell from 59 in 2021 to 55 percent in 2022. The overall decline in loan values can be partly attributed to the unwinding of COVID-19 policy measures that were enacted to encourage bank lending and tighter monetary policy in response to higher inflation.

Digital financial services expand in most regions

Source: Financial Access Survey and IMF staff calculations.

Note: Mobile money is a digital medium of exchange and store of value using mobile money accounts, facilitated by a network of mobile money agents. A bank account is not required to use mobile services. Mobile and internet banking is the use of an application on a mobile or another electronic device to execute banking services. These charts show the weighted average by region for countries whose data are available for 2019-2022. Country coverage differs across indicators depending on data availability. Note that these services may not necessarily exist in all economies. The United States and Canada are not included Western Hemisphere in the charts as they do not report these data to the FAS.

Lending to SMEs is Receding

After an initial spike during the early days of the COVID-19 pandemic, there was a decrease in the outstanding loan amounts to SMEs as a share of GDP across many economies in 2022. Of the 61 economies that have consistently reported SME data over the past four years (2019-2022), a large majority (75 percent or 46 economies) reported a decline in outstanding commercial bank loans to SMEs as a share of GDP between 2021 and 2022. As noted above, this decline can be attributed partly to the unwinding of support measures such as credit guarantees and moratoriums on debt repayments, implemented in 2020 in response to heightened liquidity demands and to stave off potential bankruptcies and job losses in SMEs.

Gender Gaps Remain Persistent in Financial Access

The persistence of the gender gap in financial access across many economies, is both concerning and critical to address. While there is some comfort in the fact that account ownership for both men and women has seen a slight increase between 2021 and 2022, the gap between men and women measured by bank account ownership remains significant for several countries. On average, men own 55 percent more deposit accounts than women in the sample and also hold significantly higher outstanding value of deposits than women. The gender gap widens further if the loan account ownership and outstanding value of loans are taken into consideration. Monitoring these developments is important, and there is an undeniable need for more granular gender-disaggregated data to analyze and bridge these disparities effectively. The broader implications of the gender gap are significant, with macro-critical effects on economic growth, income inequality, and poverty alleviation.

[1] The FAS is a unique supply-side database on access to and use of financial services, including digital financial services and gender-disaggregated data. It covers 191 economies, with 121 data series and historical data from 2004. The latest FAS data with country-specific metadata are available at http://data.imf.org/FAS , and the 2023 FAS Trends and Development can be downloaded here . The 2023 FAS was made possible with the generous support of the Data for Decisions (D4D) Fund .

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Pemba Sherpa

Phone: +1 202 623-7100Email: MEDIA@IMF.org