Middle East and Central Asia

Regional Economic Outlook: Middle East and Central Asia

October 2020

Countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region and those in the Caucasus and Central Asia (CCA) responded to the COVID-19 pandemic with swift and stringent measures to mitigate its spread and impact but continue to face an uncertain and difficult environment. Oil exporters were particularly hard hit by a “double-whammy” of the economic impact of lockdowns and the resulting sharp decline in oil demand and prices. Containing the health crisis, cushioning income losses, and expanding social spending remain immediate priorities. However, governments must also begin to lay the groundwork for recovery and rebuilding stronger, including by addressing legacies from the crisis and strengthening inclusion.

Regional Developments and Outlook

Addressing Economic Scarring from the Crisis

The coronavirus disease (COVID-19) pandemic may inflict a deeper and more persistent economic impact than previous recessions in the Middle East and Central Asia (MCD) region did, as the unique characteristics of a global pandemic shock collided with long-standing vulnerabilities in the region. In particular, the region’s large exposure in the hard-hit services sector (including tourism), strained corporate balance sheets, low ability to work from home, and dependence on remittances will weigh heavily on recovery prospects. Real GDP in the region could remain below precrisis trends for a decade. As the pandemic continues, policymakers must carefully balance preserving livelihoods, minimizing scarring, and promoting recovery, without hampering necessary reallocation. In the medium term, it will be key to rebuild buffers to guard against future shocks.

Fiscal Challenges from the Pandemic

Financial Stability Considerations amid the Pandemic

Statistical Appendix

Statistical Appendix | Excel data

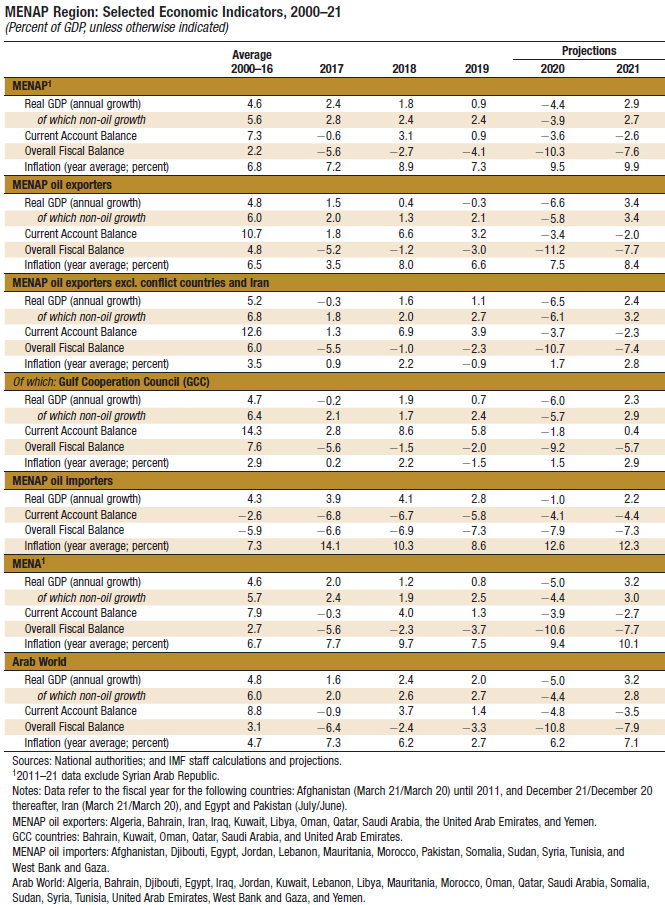

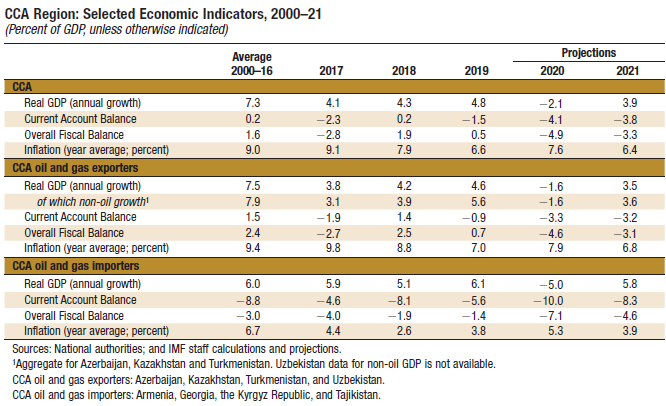

The following statistical appendix tables contain data for 31 MCD countries. Data revisions reflect changes in methodology and/or revisions provided by country authorities. A number of assumptions have been adopted for the projections presented in the Regional Economic Outlook Update: Middle East and Central Asia. It has been assumed that established policies of national authorities will be maintained, that the price of oil1 will average US$41.69 a barrel in 2020 and US$46.70 a barrel in 2021, and that the six-month London interbank offered rate (LIBOR) on U.S.-dollar deposits will average 0.74 percent in 2020 and 0.41 percent in 2021. These are, of course, working hypotheses rather than forecasts, and the uncertainties surrounding them add to the margin of error that would in any event be involved in the projections. The 2020 and 2021 data in the tables are projections. These projections are based on statistical information available through late September 2020.