A container vessel discharges cargo at the port of Djibouti, a key multipurpose port that benefits the economy (photo: Nigel Pavitt/Getty Images)

For Djibouti, Infrastructure Investment Paves Way to Regional Hub

April 6, 2017

Djibouti’s recent investment boom in infrastructure has the potential to transform the economy into a regional hub for East Africa, creating more jobs and helping the country return to a sustainable level of debt, says the IMF in its latest assessment of the economy.

Related Links

"The authorities should advance rapidly with critical reforms aimed at translating investment into strong, inclusive, and job-creating growth," says the IMF’s mission chief for Djibouti Eric Mottu.

The small state in the arid Horn of Africa, neighboring land-locked Ethiopia, largely depends on its deep-water harbor. The country is expanding its transportation and utilities infrastructure to leverage its strategic location as a transshipment hub and host to military bases.

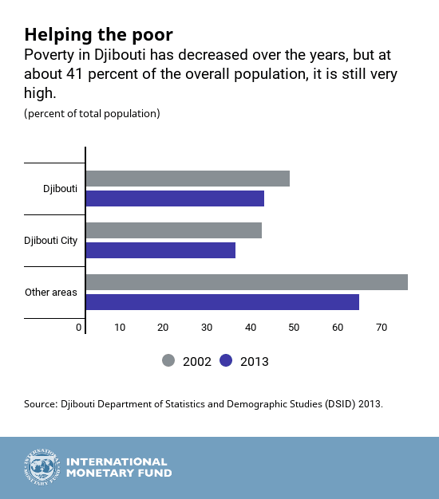

However, the advantages of the strategic location have not been exploited in full. Growth in the past has been uneven and insufficient to lift the population from poverty and provide sufficient jobs. As a result, about 41 percent of the population is poor, 23 percent live in extreme poverty, and the unemployment rate is 39 percent.

Fast Facts

- Population: 999,300 (2016 est.)

- Capital: Djibouti city

- Currency: djiboutian franc

- GDP per capita: $1,908 (2016 EST.)

- unemployment rate: 39% (2015)

Betting on investment

To address these challenges, the authorities’ development strategy Vision Djibouti 2035 aims at transforming the country into a logistics and commercial hub for East Africa. The strategy includes large-scale investments focused on public sector projects—such as the construction of a railroad to Ethiopia and a water pipeline—and targets a medium-term growth of 7.5–10 percent per year, tripling per capita income, and reducing unemployment. Chinese investors finance many of these projects.

Early results of these investments are encouraging. Growth is estimated to have reached 6.5 percent in 2016, driven by public sector investments. For 2017–19, growth is projected to increase to 7 percent supported by the railroad, the multipurpose port, and other public investment, which should stimulate private sector activity and foreign direct investment.

Debt buildup

Despite more growth, the country is now at a high risk of debt distress as most of these infrastructure investments have been financed externally—pushing external debt from 50 to 85 percent of GDP in just two years.

Rising debt service obligations not only present considerable fiscal risks—the 2016 government budget deficit, including spending on the water pipeline and the railroad, reached about 16 percent of GDP—but could also hamper priority social spending.

Focus on reforms

Therefore, to reap the benefits from these massive investments and ensure that they are shared by all, the authorities will need to focus on several key reforms, aimed at translating the investment boom into strong,inclusive growth to reduce poverty, create jobs, and return debt to a sustainable path.

-

Debt strategy: Develop a coordinated debt strategy aimed at establishing debt sustainability, given the high risk of debt distress; adopt a public debt law and set an explicit debt anchor, such as public debt-to-GDP ratio.

-

Fiscal policy: Continue reforming the tax system based on the recommendations of the 2015 National Tax Conference; launch a comprehensive review of tax expenditures, exemptions, and special tax regimes with a view to phasing them out.

-

Structural reforms: Focus on reforming public enterprises to enhance their efficiency, strengthen governance, and improve their capacity to manage investment projects; pursue reforms to improve the business climate and strengthen competition.

-

Financial sector: Focus monetary and financial policies on the stability of the banking system, financial inclusion, and external stability.

-

Data: Improve statistics, in particular GDP calculations and financial statements of the public sector to improve decision-making.