Making European Reforms a Success on the Ground: Leveraging the EU’s production hubs while leaving no one behind

November 13, 2025

As prepared for delivery

Thank you, Governor Villeroy de Galhau, for your warm introduction and for hosting us today. It is a great pleasure to be here at the Banque de France.

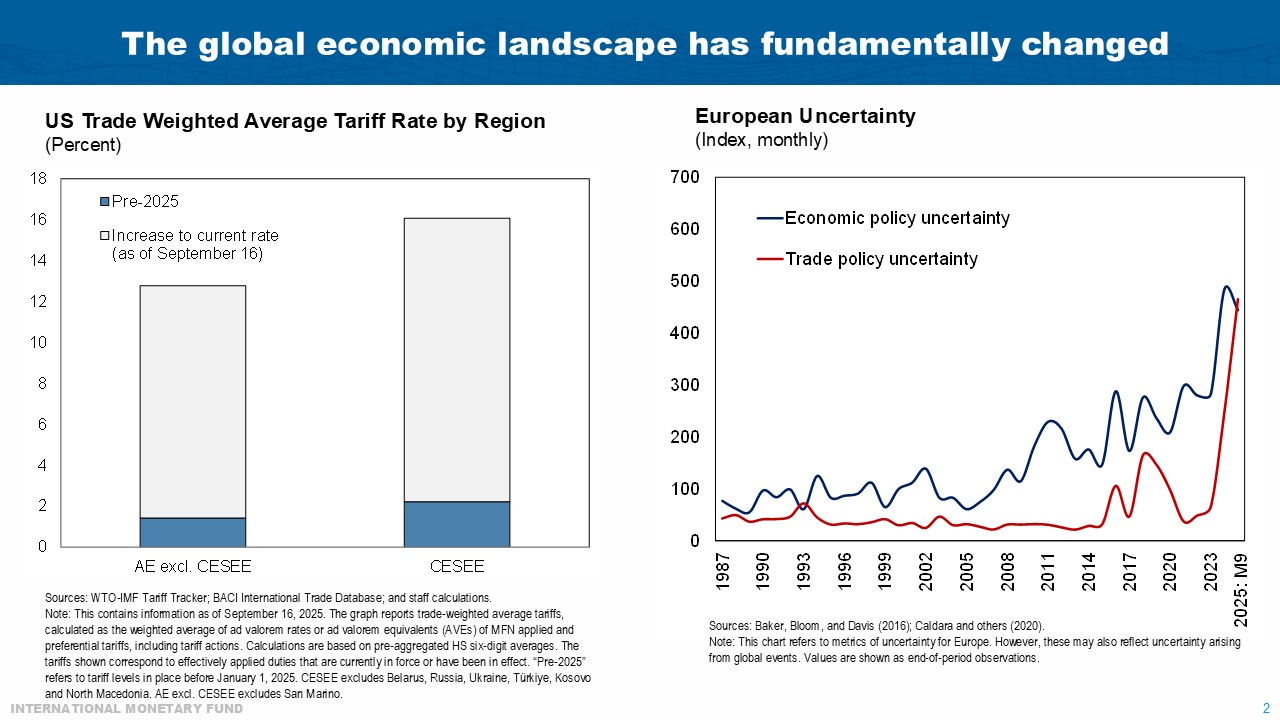

The year 2025 has been one of profound change for the global economy.

Trade and industrial policies are being rewritten—especially in the United States—and Europe has had to navigate an increasingly uncertain global landscape.

Even with the new US–EU trade agreement bringing some clarity on tariffs, uncertainty remains high, and that uncertainty has compounded the scars from successive shocks over the past five years.

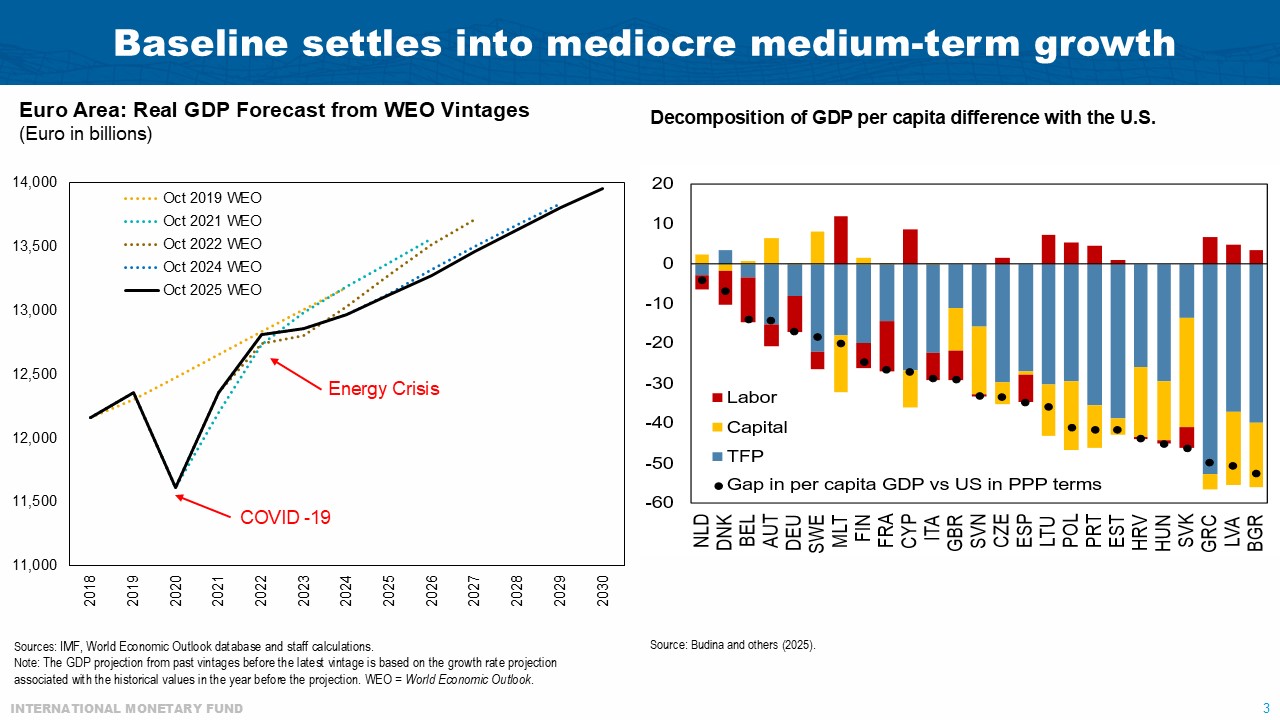

With growth momentum fading, Europe is settling into a slow, mediocre medium-term path.

But this is not set in stone.

Europe has the people, the technology, and the savings to grow faster. As President Enrico Letta’s report last year highlighted, these resources are just not utilized to their full potential.

What is missing for Europe to reach its potential is decisive policy action that turns well-known reform priorities into real progress “on the ground.”

That is what our new Regional Economic Outlook Note addresses: how to make reforms work—for firms, households, and regions across the continent. Our analysis shows that Europe has much to gain acting decisively and, with the right policies, everyone can benefit.

A changed global landscape

Let me start with our latest projections. The announcement of higher future US tariffs last April triggered a surge in exports to the US, temporarily lifting growth.

That boost, however, was short-lived. When the new US-EU trade agreement came into effect—with effective tariffs on EU goods more than 10 percentage points above pre-announcement levels—momentum reversed quickly. Meanwhile, economic policy uncertainty remains high, amplified by repeated tariff adjustments. A weaker renminbi and a stronger euro have added further headwinds.

A paltry outlook

These developments shape our forecast for euro area growth: 1.2 percent in 2025, 1.1 percent in 2026, and a modest peak at 1.4 percent in 2027, supported partly by higher public spending in Germany—before slipping back to 1.1 percent over the medium term.

As I noted in Brussels last week, this path leaves Europe growing well below its pre-Covid trend.

More worrying, Europe’s GDP per person gap to the U.S, of already nearly 30 percent in purchasing power terms, is—if anything—set to widen further.

The core issue is productivity: Europe is not short of capital or labor. It simply does not make enough of its resources. Around three-quarters of the gap with the US stems from lower productivity.

Europe’s untapped potential

Our new analysis shows that it does not have to be this way.

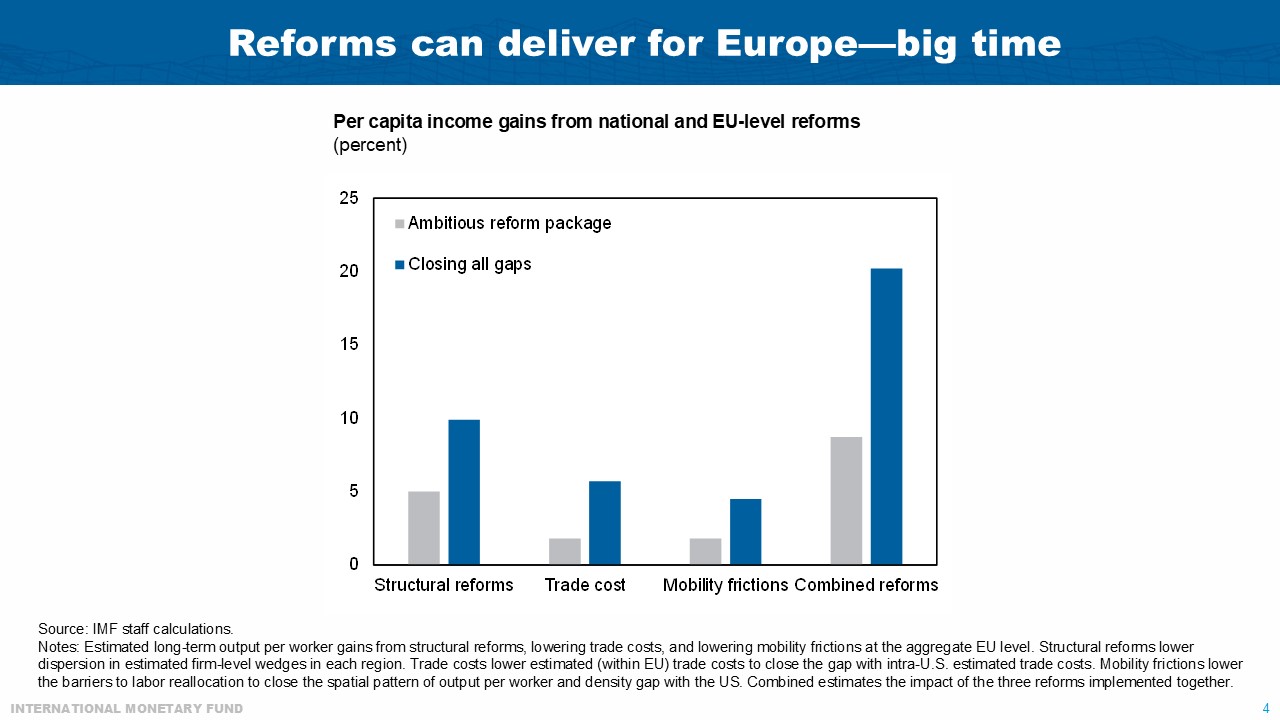

If Europe fully closed its domestic structural policy gaps to the global frontier in national reform key areas and reduced cross-border barriers to trade and labor mobility to levels seen between US states, productivity—and thus income per capita income—could rise by roughly 20 percent.

Because this estimate excludes second-round effects from attracting more talent and capital, long-term gains would be even larger—potentially closing the entire transatlantic income gap.

Closing these gaps completely may be difficult to do—but the simulations give us a benchmark for what is possible.

Even a more realistic, “intermediate” reform package—closing only half of these gaps—would still raise income by nearly 9 percent.

That is the scale of Europe’s untapped potential.

Why focus “on the ground”?

Aggregate numbers can only tell part of the story. We have looked deeper—at how reforms would play out at the regional level, within countries.

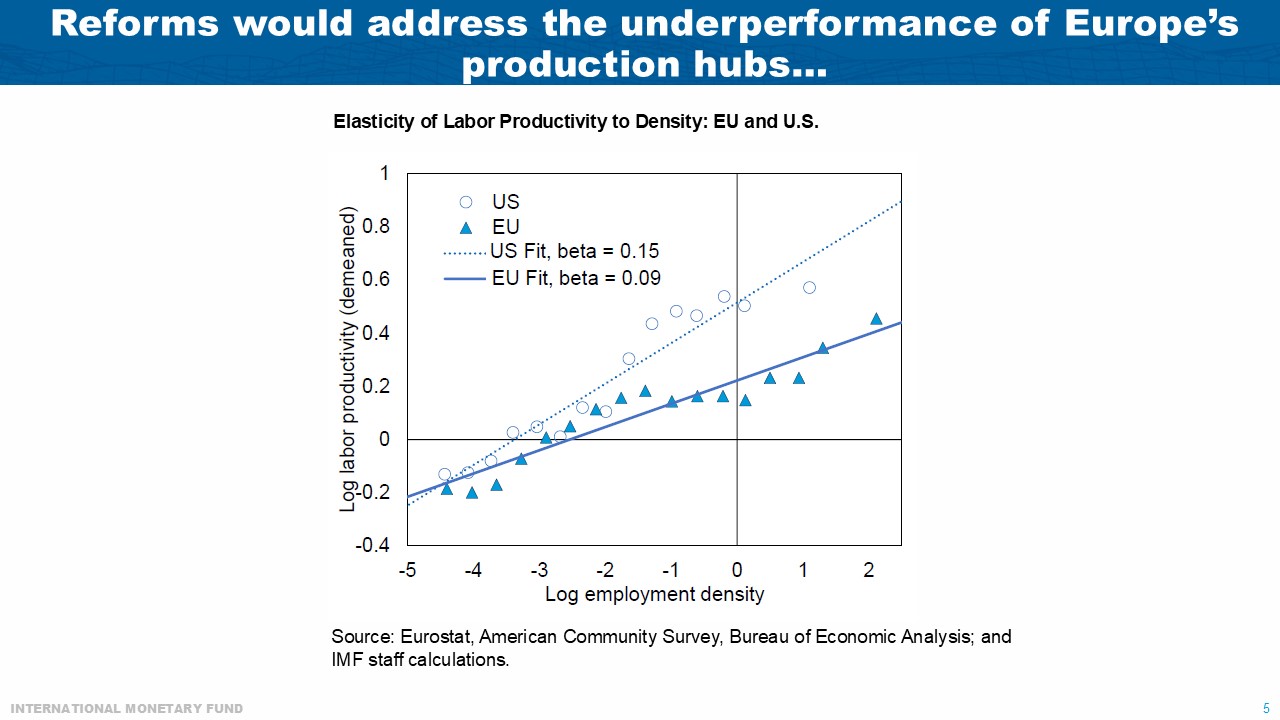

This perspective matters because about 60 percent of EU GDP is generated in Europe’s productivity hubs—places where firms, workers, and ideas cluster together.

Such hubs have a natural productivity advantage: businesses can share deeper pools of resources, access larger markets, and learn from each other. Think of Silicon Valley, the Benelux corridor, Bavaria’s high-tech area, or the Ile-de-France.

Europe is not short of hubs. In fact, it is more densely populated than the US.

Yet, European hubs are, on average, around one-third less effective than American ones in turning density into productivity.

Europe’s cities and industrial clusters—and the firms within—are simply not realizing their full potential.

Local conditions and single market barriers

Productivity thrives when markets are deep, firms can grow freely, and resources move easily.

In Europe, these conditions remain constrained.

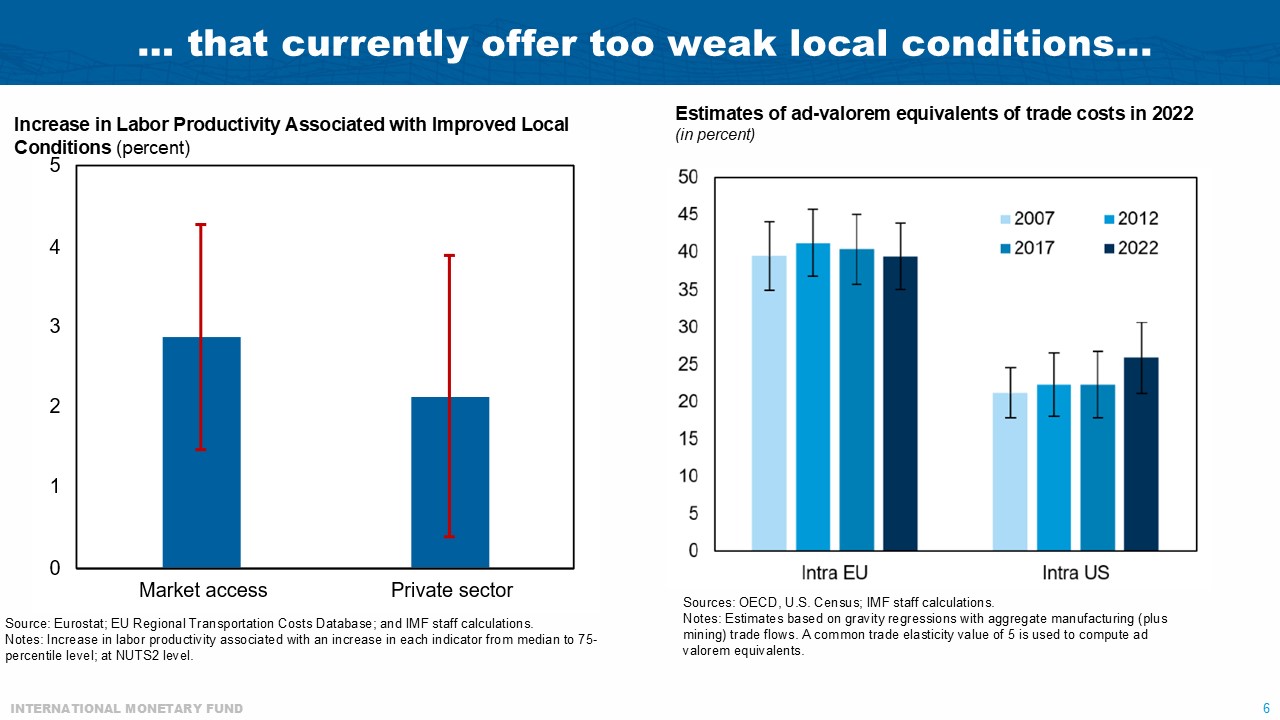

- Fragmented market access: Even within the EU, trade costs between member states are equivalent to an average 40 percent tariff on goods—far higher than those faced by US firms trading across state lines.

- Limited private-sector dynamism: In many regions, private employment accounts for too small a share of total jobs, stifling innovation and competition.

Our analysis shows that if regions improved market access and private-sector participation from the EU median to the 75th percentile, productivity would rise by nearly 5 percent—3 points from better market access and 2 from stronger private sector activity.

These are gains Europe can achieve simply by unlocking what already exists.

Mobility Barriers Also Stifle Agglomeration

Talent and capital must also move freely to where opportunities arise.

Europe needs to unleash its talent.

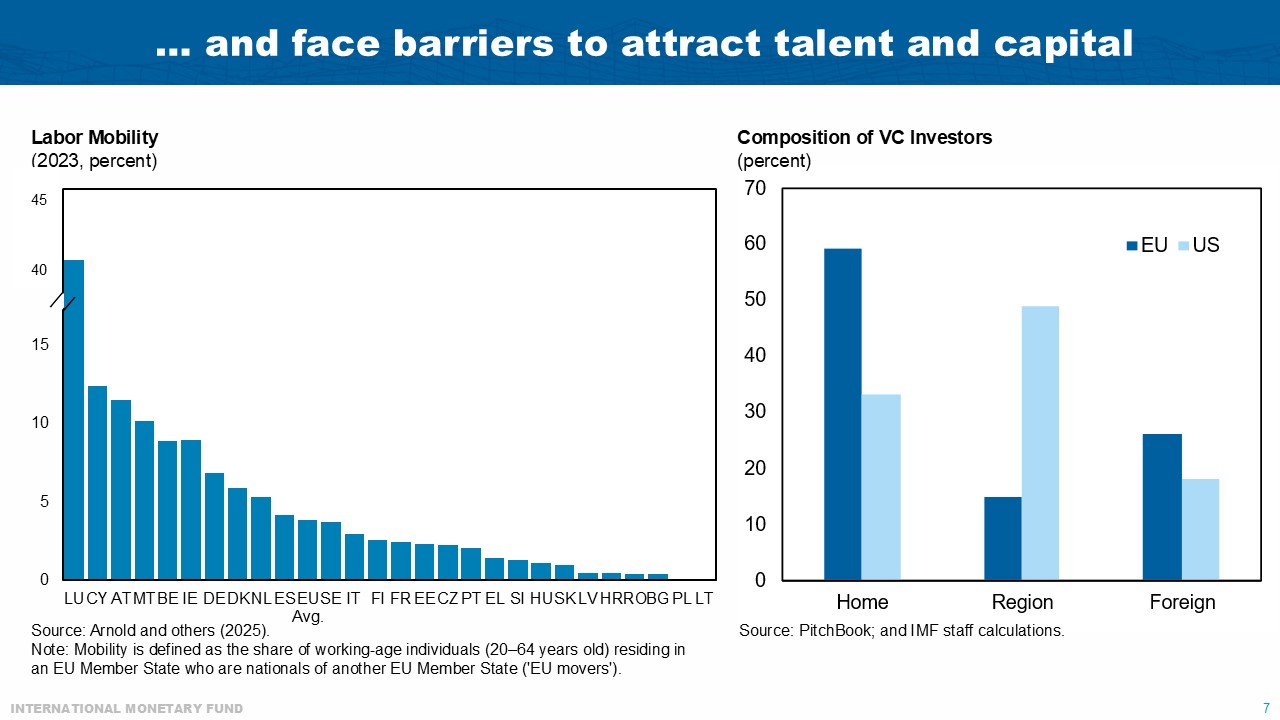

Workers in the US relocate readily to seize opportunities. In Europe, mobility—both within and across countries—is far lower.

A young engineer in Naples or a software developer in Thessaloniki may struggle to take a job in Munich or Lyon, not for lack of skills, but because of obstacles such as non-transferable pensions, non-recognized qualifications, or unaffordable housing in growth centers.

These frictions carry measurable costs.

Lowering mobility costs to reduce the difference in how workers relocate to regions offering higher real wages in Europe and the US by half could raise EU productivity by about 1.8 percent.

We see this dynamic in practice:

- In Ireland, international mobility has helped build a skilled labor force that is among the drivers attracting multinationals to invest in the country.

- In Spain, its increased attractiveness for young mobile high-skilled workers since COVID, for example in IT and consulting services, has served the economy well.

This is not brain drain—it is brain circulation.

A Europe where talent moves freely is a Europe that learns, adapts, and thrives.

Unlocking Capital for Growth

Growth also requires financing. Europe’s financial ecosystem remains fragmented. Venture capital offers a vivid example.

VC is crucial for young, innovative firms to scale up. Yet EU firms are two-thirds less likely to receive venture capital funding than their US counterparts, and when they do, the amounts are roughly half as large.

Initiatives like Tibi in France have shown promise by mobilizing institutional investors to support promising startups. But accompanying such measures with EU-level efforts is critical.

The reason is that Europe’s venture capital markets are shallow in part due to being fragmented, with a high degree of home bias: over 60 percent of venture capital investors are from the same country as the startup, compared to just 30 percent for US states. This limits scale and competition.

This remarkable shortfall in cross-border capital flows within the EU is partly fixable through concrete policies. Our analysis finds that harmonizing corporate legal regimes could raise cross-border venture capital flows in the EU by around 13 percent, and simplifying withholding tax procedures by around 20 percent.

Who Gains—and How to Support Those Who Don’t

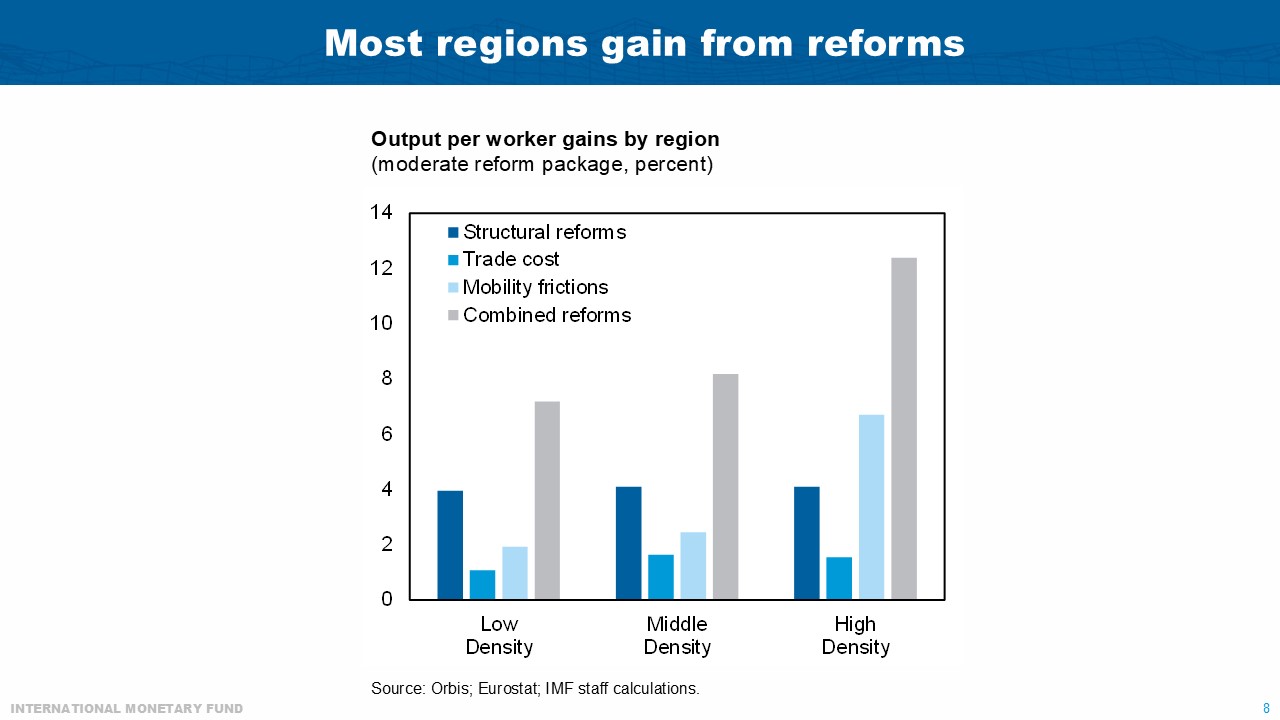

Turning to distributional effects: when we simulate the reform package that closes (just) half of national and EU-level policy gaps, all countries gain, and most regions benefit.

First, existing production hubs become significantly more effective in turning their density into productivity.

Second, growth is not confined to Europe’s largest cities. Productivity gains often arise in high-potential European regions that are able to expand as constraints ease. These are places with solid fundamentals but low initial employment relative to their high underlying productivity. Examples include Antwerp, Eindhoven, Munich, and Warsaw.

Third, some regions may see productivity decline. The impact of reforms on regions with falling productivity can be significant relative to their size, but the impact is generally only a small share of the total gains from reforms.

In the combined reform package, restoring per-capita incomes in these regions to pre-reform levels would require less than 2 percent of aggregate gains.

Because all countries gain in the combined reform package, national mechanisms can do much to share the benefits widely. The EU’s next Multiannual Financial Framework could also play a role by incentivizing productivity enhancing structural reforms.

A Reform Package for the Benefit of All Europeans

What should we take away from these findings?

There is tremendous scope to boost European productivity and incomes, and it can be done inclusively.

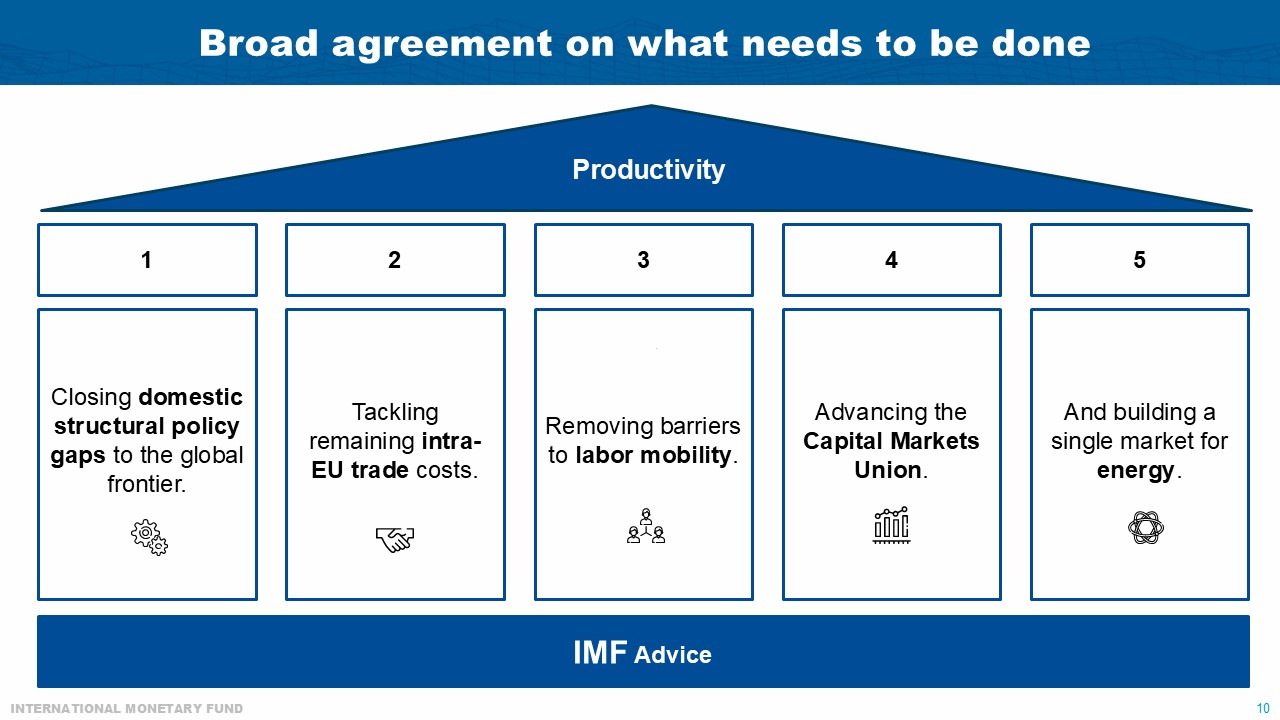

Four priorities stand out:

- Early, ambitious domestic structural reforms must anchor any productivity agenda: modernizing labor-market regulations to enable reallocation, investing in human capital, improving tax systems, and addressing governance weaknesses.

- Deepening the single market is essential: harmonizing regulations—stop gold plating, opening protected sectors, advancing the savings and investment union, and removing barriers to labor mobility.

- Preparing local ecosystems is vital: expanding regions need affordable housing and public services that scale with growth.

- Sharing gains without distorting incentives: support for lagging regions should ease adjustment costs but not prevent resources from moving where they are most productive. Place-based policies can help with adjustment costs from reforms on a temporary basis and should be paired with structural reforms to durably mitigate losses.

With well-designed national and EU-level policies, Europe can unlock the full benefits of its production hubs—and ensure everyone shares in the gains.

Closing Thoughts

Europe’s diversity—its languages, cities, and traditions—is a source of creativity and strength.

When connected by reform and by the single market, that diversity can become a powerful engine of prosperity.

Our message is clear: Reform pays—and it pays for everyone.

By acting boldly—through national reforms, deeper integration, and smarter local policies—Europe can reignite growth, revitalize its hubs, and ensure that prosperity is shared across all its regions.

And we should not forget that these reforms will also make an important contribution to dealing with emerging spending pressures and maintaining Europe’s social welfare state.

Let’s make European reforms a success—on the ground.

Thank you.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org