Saudi Arabia’s Path Forward Amid Lower Oil Prices

December 18, 2025

Prudent fiscal policy, vigilant financial oversight, and deeper labor and investment reforms can keep Saudi Arabia’s transformation on track

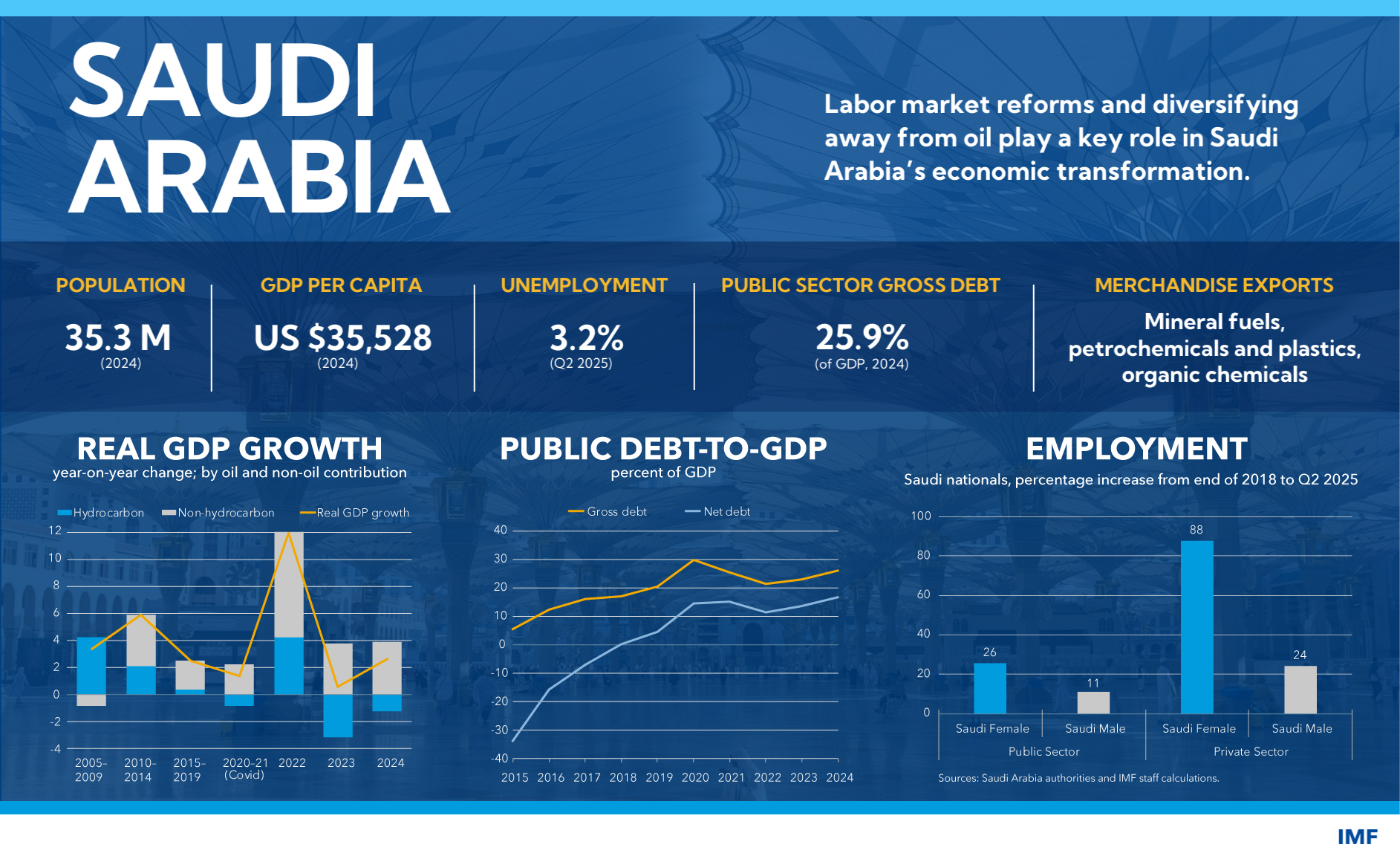

Next year will be pivotal for Saudi Arabia. The country is well placed to move beyond the favorable tailwinds of 2022–2024— when high oil prices and reform implementation facilitated the acceleration of Saudi Vision 2030-related spending—into a more challenging environment characterized by lower oil prices and rising financing needs. At the same time, Saudi Arabia is strategically shifting some of its spending priorities , with some of its investment focus moving toward AI and advanced technologies as part of its broader effort to diversify the economy.

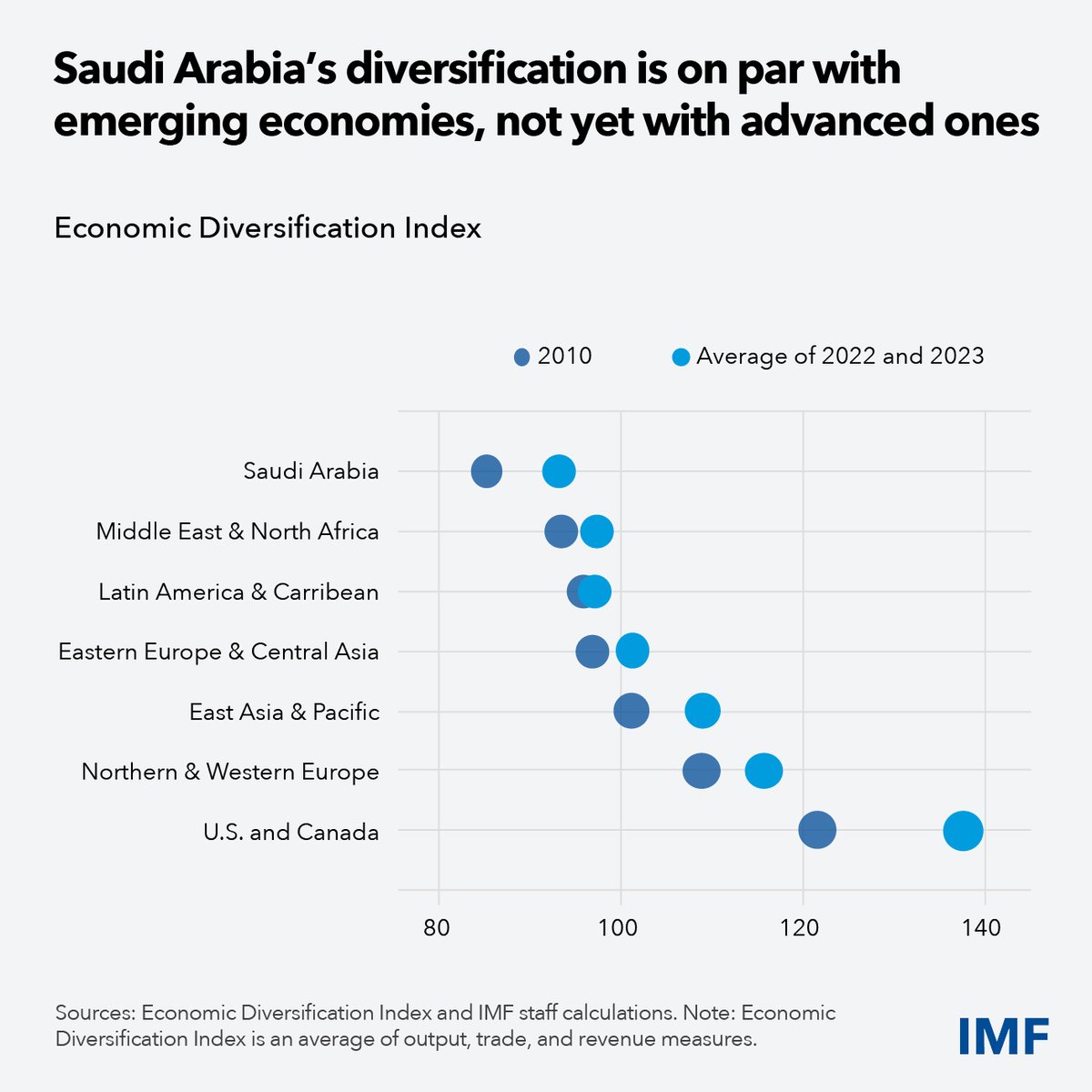

The resilience shown in 2025 underscores the progress already achieved in reducing the economy’s exposure to oil fluctuations. Despite oil prices falling nearly 30 percent below their 2022 peak, the non-oil economy maintained strong momentum. This strength reflects the impact of Saudi Vision 2030 reforms—diversification gaps with emerging markets have narrowed, and the business environment now rivals that of advanced economies. Importantly, growth has been fueled not only by investment, but also by people: private sector job creation has surged, particularly among women, and unemployment rates reached record-lows. Continued efforts, however, remain essential to close the remaining gaps with advanced economies and keep the transformation on track.

Looking ahead, Saudi Arabia faces a new test: how to sustain reform momentum in an era of potentially lower oil revenues without slipping back into the stop-and-go cycles that followed past oil booms. The path forward is clear: diversification must continue through sustained reforms regardless of oil price developments. Fortunately, Saudi Arabia approaches this challenge from a position of relative strength. Public debt-to-GDP ratios remain low and foreign assets are still ample. However, as funding pressures linked to large investment projects rise, Saudi Arabia’s ability to anchor spending decisions within a consistent, multi-year framework will be vital for maintaining long-term sustainability.

Policy priorities

The recent decision to reprioritize some large investment projects has helped focus spending on areas where it matters most, while also mitigating the risk of economic overheating. Prioritizing projects that promise high returns and adhering to established spending ceilings will be key. Over the medium term, continued non-oil revenue mobilization (which has doubled over the past five years), energy subsidy reform, and more efficient public spending will also play a critical role in achieving a sustainable fiscal path. Further improving fiscal institutions—through continued prudent debt management and a proper strategy for managing sovereign assets and liabilities will help preserve fiscal strength and advance Saudi Vision 2030 goals.

Strong financial sector oversight will help support healthy credit growth, especially as banks increasingly rely on short-term external funding. The Saudi Central Bank’s continued vigilance in monitoring emerging risks will be critical in preventing vulnerabilities from building up. As conditions evolve, the central bank should continue to proactively deploy prudential measures to keep the financial system resilient. Over time, deepening capital markets—so that companies can raise more financing through bonds and equity—will help ease pressure on banks, facilitate credit for small and medium enterprises, and create a more balanced mix of funding for the economy.

Sustaining Saudi Arabia’s growth momentum will increasingly depend on two engines: a skilled workforce and a vibrant private sector. Ensuring that workers have the right skills, particularly in fast-growing sectors like technology and hospitality, where gaps are the most pronounced, will help meet the talent needs of emerging industries. At the same time, deeper reforms—including the steadfast implementation of recently enacted laws that ease access for foreign investors— will help foster an investor-friendly business environment and attract more private investment. The sovereign wealth fund can act as a complementary catalyst here by spurring new projects and partnerships, while making sure it leaves ample room for both domestic and international private investors to thrive.

*****

Amine Mati is an assistant director and Yuan “Monica” Gao Rollinson is an economist. Both are in the IMF’s Middle East and Central Asia Department.