As Korea Ages, Fiscal Reforms Can Help Safeguard Government Finances

January 15, 2026

Thoughtful policy changes can help ensure spending pressures remain contained, while creating space to care for elderly people and respond to economic shocks

Korea’s population is aging faster than almost any other country. That’s because people live longer than in most other countries, while the birth rate is one of the lowest in the world.

About one-fifth of the population is 65 and older, more than triple the share in the 1990s. This matters because older people tend to consume less, which can have wide-ranging economic effects, especially as the pace of population aging accelerates and birth rates do not improve, eventually leading to population decline. We estimate that every 1 percent decline in Korea’s population will reduce real consumption by 1.6 percent.

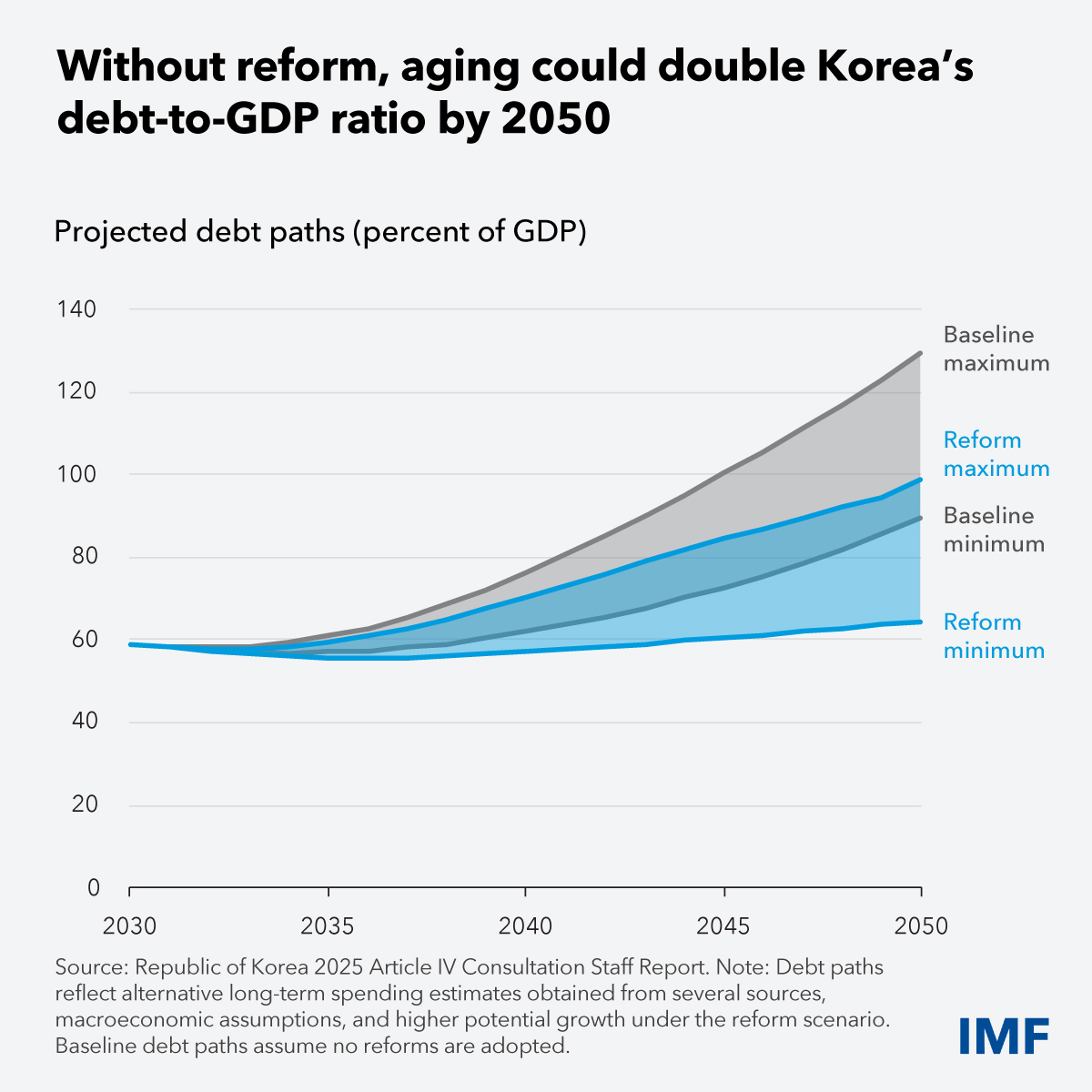

Korea has ample room to meet its current spending needs and respond to unforeseen shocks, with central government debt below 50 percent of gross domestic product. However, age-related government spending pressures are likely to rise significantly in coming years. That would substantially reduce fiscal space unless policymakers implement reforms.

We estimate spending on pensions, health care, and long-term care will rise by 30 to 35 percent of GDP by 2050 depending on alternative estimates for long-term spending by different institutions. However, under our baseline scenario—which includes lower potential economic growth due to aging and no measures to offset this, the debt ratio could reach 90 to 130 percent by 2050 depending on the spending estimate used, increasing risks to long-term debt sustainability.

Structural reforms that maintain potential growth—such as those from AI adoption, greater labor force participation and more efficient resource allocation—would create more fiscal room for Korea to support elderly individuals. However, given high risks and uncertainty around the growth impact of reforms, even with these reforms, debt could still exceed 100 percent of GDP.

Structural reforms that maintain potential growth—such as those from AI adoption, greater labor force participation and more efficient resource allocation—would create more fiscal room for Korea to support elderly individuals. However, given high risks and uncertainty around the growth impact of reforms, even with these reforms, debt could still exceed 100 percent of GDP.

In addition to structural reforms, we also recommend fiscal reforms to help create more room in the budget to meet higher spending without putting pressure on public finances.

Greater efficiency

Raising additional revenue will be particularly helpful. In addition to recent changes, such as reversing some corporate tax cuts, policymakers could reconsider existing personal and corporate tax exemptions and simplify them where appropriate. Reviewing and adjusting certain exemptions for value-added taxes, which have increased, could also help. Similarly, reducing inefficient spending, including streamlining of support for local governments and small- and medium-sized enterprises, could help create space. Over the long term, making government spending more efficient will help boost the economy’s productive capacity.

To reduce the long-term spending pressures, furthering pension reform remains important. Parliament recently strengthened the finances of the National Pension Service, raising contribution rates to delay future losses. Additional reforms should aim to keep the system sustainable while ensuring fair and adequate benefits.

Finally, adopting a clear and credible fiscal anchor to guide policies to reach fiscal objectives, supported by a stronger medium-term fiscal framework, would help keep government finances stable over the long term while still allowing fiscal policy to respond to shocks when needed. Moreover, the medium-term framework could forecast and incorporate expected spending on aging, making fiscal policy more predictable and transparent. This could be reinforced by even longer-term strategies that account for future spending pressures and propose options to finance them.

*****

Rahul Anand is an assistant director in the Asia-Pacific Department, where Hoda Selim is a senior economist.