Published on December 17, 2025

Why gold retains enduring value in an era of digital assets

For more than five millennia, humanity has been captivated by gold—the immutable metal that has illuminated temples, crowned emperors, and underpinned monetary systems. Its story is as much about economics as it is about psychology. Across the centuries, gold has functioned as currency, ornament, reserve, and metaphor—embodying the human desire for permanence in a world of change. In an age of crypto assets, artificial intelligence, and central bank digital currencies, its persistence raises a question both ancient and modern: Why does gold still hold value?

Gold’s legacy as a standard of value began long before modern finance. The Lydians were among the first to mint gold coins in the seventh century BCE, transforming trade through standardization. Ancient Egypt and Rome regarded it as divine, associating its incorruptible gleam with eternity. In economic terms, its durability, scarcity, and divisibility made it uniquely suitable for money. It did not rust, could be stored indefinitely, and existed in limited quantities—a perfect medium of exchange.

By the 19th century, gold had become the foundation of the global financial order. Under the classical gold standard, the British pound, the world’s premier reserve currency, was directly convertible into a fixed quantity of gold held in the Bank of England’s vaults. This system, adopted by much of the industrial world, imposed fiscal discipline and constrained governments from printing excessive money. It fostered confidence in international trade and investment by guaranteeing stable exchange rates. Yet the same rigidity that ensured stability also bred fragility. During the Great Depression, adherence to the gold peg turned downturns into deflationary spirals, deepening unemployment and suffering.

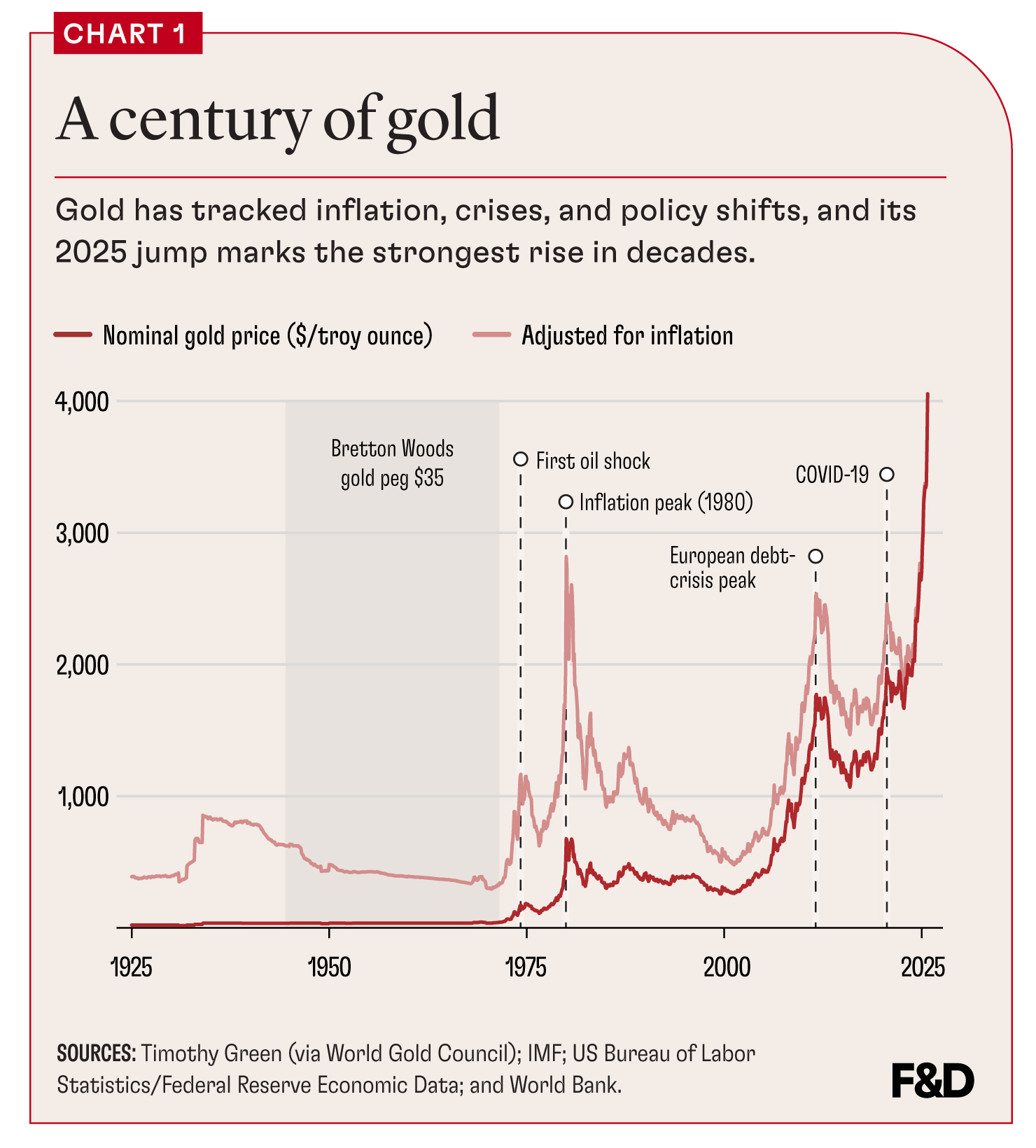

The postwar world sought a compromise through the Bretton Woods system of 1944, which tied the US dollar to gold at $35 per ounce, with other currencies pegged to the dollar (see Chart 1). This arrangement rested on faith in US economic might. But by the late 1960s, US deficits from the Vietnam War and domestic spending made the fixed rate unsustainable. When President Richard Nixon suspended official gold convertibility in 1971, the last vestige of the global gold standard disappeared. Currencies became fiat—backed not by metal, but by confidence alone. This marked not the end of gold’s power, but its transformation.

Investment refuge

In the decades since, gold has evolved from a monetary anchor to an investment refuge—the default asset in times of fear. During the oil shocks and inflationary 1970s, its price rose 20-fold. In the 2008 financial crisis, as credit markets collapsed, it soared past $1,000 per ounce. Again, during the pandemic turmoil of 2020, gold touched record highs near $2,000. Even as central banks raised interest rates in 2023 and 2024, gold continued to attract buyers. China, India, Turkey, and Poland led an unprecedented wave of central bank purchases exceeding 1,100 metric tons, reflecting efforts to diversify reserves away from the geopolitical vulnerability of the US dollar. In an increasingly fragmented world, gold’s neutrality—it belongs to no nation and carries no counterparty risk—makes it the ultimate political hedge.

These central bank purchases helped drive another run-up in gold prices in recent months, with the metal soaring above $4,000 an ounce. Worries about the direction of monetary policy, increasing government debt, and inflation also contributed to the gold rush, which saw prices leap about 40 percent in 2025, the biggest yearly increase since 1979. Gold holdings in US exchange-traded funds increased more than 40 percent, approaching $200 billion.

Economically, gold’s enduring value rests on three traits: scarcity, durability, and trust. Global mining adds barely 1.5 percent to the total above-ground stock each year—far slower than the growth of money supply or digital liquidity. Every ounce ever mined, about 210,000 metric tons, still exists in some form, whether as bullion, coins, or jewelry. This physical near permanence is unmatched by any financial asset. Yet gold’s worth cannot be reduced to geology. It derives from a shared social consensus: a collective belief that this particular metal, among all others, embodies safety and value. As economist Robert Mundell once observed, gold endures not because of intrinsic utility, but because of “the trust we place in its uselessness.”

Gold’s role as an inflation hedge is both celebrated and misunderstood. Its price tends to rise not merely with inflation, but with the erosion of faith in monetary policy. When real interest rates turn negative—when holding cash or bonds yields less than inflation—gold becomes relatively more attractive. Its performance during the stagflation of the 1970s and the uncertainty of the 2010s reflected precisely this mechanism. However, during periods of stable inflation and robust economic growth, gold often languishes. It is not a vehicle of prosperity; it is insurance against prosperity’s absence.

Psychological anchor

For investors, gold functions as a psychological anchor. It promises nothing except permanence. A portfolio allocation of 5–10 percent to gold is often recommended not for returns but for balance—its inverse correlation with equities provides stability during market crises. Modern financial products like exchange-traded funds, sovereign gold bonds, and digital gold accounts have democratized access to the metal, especially in emerging market economies where trust in financial institutions remains uneven.

Culturally, gold remains embedded in societies far beyond the logic of markets. In India, households are estimated to hold more than 25,000 metric tons—more than the combined reserves of the top 10 central banks. It serves simultaneously as adornment, dowry, and saving instrument. Gold purchases peak during festivals and weddings, driven by both tradition and economic prudence. In China, gold’s symbolism is equally enduring: It represents virtue, luck, and stability. During financial downturns, retail investors flock to buy gold ornaments, blurring the line between emotion and investment.

The rise of crypto assets has revived old debates about what constitutes value. Bitcoin, often called “digital gold,” mimics its scarcity through algorithmic design, with a fixed supply of 21 million coins. Yet the comparison is incomplete. Bitcoin is volatile, intangible, and dependent on digital infrastructure. Gold, by contrast, carries the weight of millennia of trust. It is a physical reality, immune to code failures or regulatory bans. If Bitcoin represents the future of speculative belief, gold embodies the memory of collective faith. Both reveal that money, at its core, is a social construct—a shared story we tell about what matters.

Geopolitical buffer

In the political economy of the 21st century, gold is again becoming strategic. As Western sanctions have frozen foreign reserves and weaponized the dollar system, countries like China and Russia have turned to gold as a geopolitical buffer. It is the only asset that lies outside the control of any government or central bank network. The People’s Bank of China, for instance, has been steadily increasing its holdings, now surpassing 2,300 metric tons. The Reserve Bank of India, too, has expanded its reserves to nearly 800 metric tons. Gold has returned to the stage not as a standard of value, but as a sovereign shield in an era of contested multipolarity.

Philosophically, gold raises deeper questions about what we mean by “value.” Economists have long argued over whether value arises from labor, utility, or perception. Gold, while limited in utility, is labor-intensive to extract and immense in perceived worth. Its appeal endures precisely because it reconciles material and metaphysical needs—the tangible assurance of scarcity with the intangible comfort of faith. John Maynard Keynes derided it as a “barbarous relic,” yet even he could not erase its psychological hold. Humanity craves symbols of stability, and gold, impervious to decay, offers that illusion of eternity.

Financial innovation—from tokenized gold on a blockchain to AI-driven trading platforms—may redefine how gold is owned and exchanged. Yet beneath these technological layers, gold’s essence remains unchanged. Its price will continue to fluctuate, but its meaning will not. Gold endures because trust is fragile, and belief—not metal—remains the ultimate foundation of value. In a world awash in digital abstractions, the timeless weight of gold reminds us that real wealth is as much about memory as it is about money.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.