WHERE THE IMF GETS ITS MONEY

The money the IMF loans to its members on its general – or non-concessional – terms comes from member countries, mainly through their payment of quotas. Multilateral and bilateral arrangements can supplement quota funds and play a critical role in the IMF’s support for member countries in times of crisis.

The IMF’s current total resources of about SDR 982 billion translate into a capacity for lending of about SDR 695 billion (around US$932 billion), as of mid-December 2023.

Explainer: How the IMF Finances Itself and Why it Matters for the Global Economy

Countries can count their contributions to the IMF as their own reserve assets under a unique funding model that does not require budget appropriations or any other taxpayer support

READ THE BLOG

Who funds the IMF?

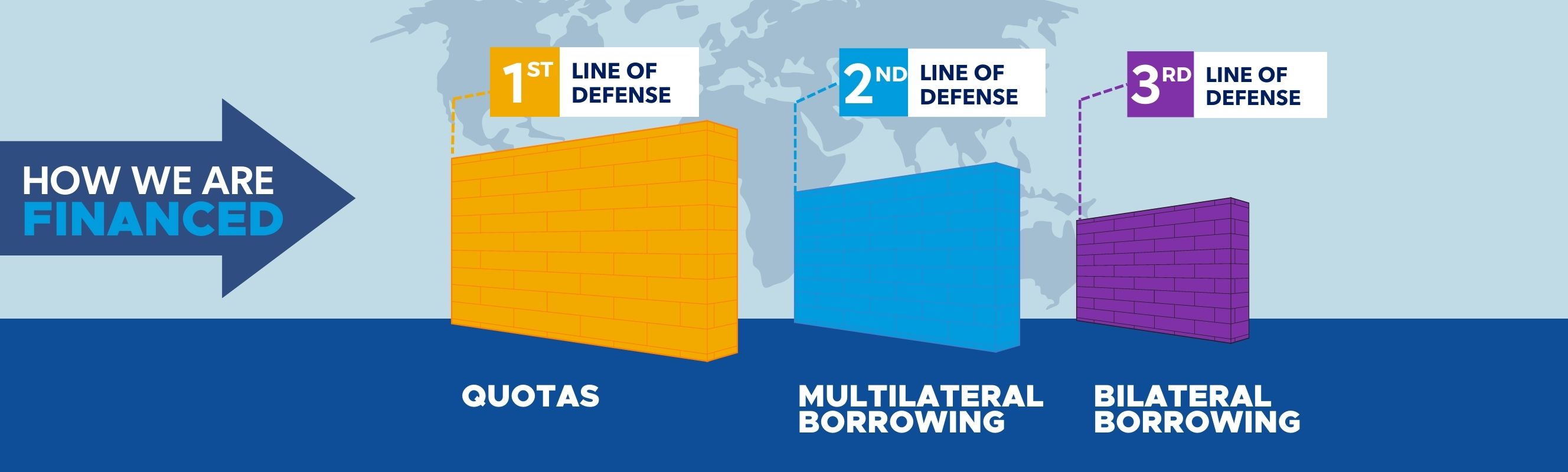

IMF funds come from three sources: member quotas, multilateral and bilateral borrowing agreements.

MEMBER QUOTAS

Member quotas are the primary source of IMF funding. A member country’s quota reflects its size and position in the world economy. Read more on how the IMF regularly reviews quotas.

NEW ARRANGEMENTS TO BORROW

New Arrangements to Borrow (NAB) between the IMF and a group of members and institutions are the main backstop for quotas. The size of the NAB was doubled in 2021. The NAB currently contributes SDR 364 billion, or $489 billion, to total IMF resources.

BILATERAL BORROWING AGREEMENTS

Member countries also have committed resources through bilateral borrowing agreements (BBAs). In 2020, the IMF Executive Board approved a new round of BBAs, which currently contribute SDR 141 billion, or $189 billion, to total IMF resources.

What are member quotas?

Quotas are the IMF’s main source of financing. Each member of the IMF is assigned a quota, based broadly on its relative position in the world economy.

The IMF regularly reviews quotas to assess their adequacy overall and their distribution among members.

Quick Facts:

The IMF Board of Governors concluded the 16th quota review, in December 2023, approving an increase in quotas by 50 percent. The next step is for member countries to consent to their respective quota increases.

The previous review concluded in February 2020 without a quota increase.

The previous increase in quotas, to SDR 477 billion (US$ 640 billion), was agreed to under the 14th Review, which concluded in December 2010 and took effect in January 2016.

What happens if quotas fall short?

The New Arrangements to Borrow (NAB) constitutes a second line of defense. Through the NAB, certain member countries and institutions stand ready to lend additional resources to address challenges to the international monetary system.

Quick Facts:

40 participants: the size of the NAB now stands at SDR 364 billion (US$485 billion), with Greece and Ireland becoming participants in 2022 and 2023.

The size of the NAB was doubled effective January 2021

The current five-year period of NAB effectiveness runs from January 2021 through December 2025

NAB activation requires support from 85% of participants eligible to vote

Activated 10 times between April 2011 and February 2016

MORE INFORMATION:

Which source of funding is the last resort?

Bilateral Borrowing Agreements serve as a third line of defense after quotas and the NAB. Since the onset of the global financial crisis, the IMF has entered into several rounds of bilateral borrowing agreements (BBAs) to meet its members’ financing needs.

Quick Facts:

The 2020 bilateral borrowing agreements include 42 creditors.

Total commitments from 42 effective agreements: SDR 141 billion (US$188 billion)

Initial terms of three years through end-2023, extendable with creditor consents through end-2024

Activation of the agreements requires support of 85% of creditors eligible to vote

MORE INFORMATION:

This page was last updated in May 2025