Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: IMF Proposes "Green Fund" for Climate Change Financing

January 30, 2010

- Strauss-Kahn proposes “Green Fund” to help finance shift to low-carbon world

- Says IMF to release proposals in a few weeks

- Fund could be created partly through issuance of IMF’s special drawing rights (SDRs)

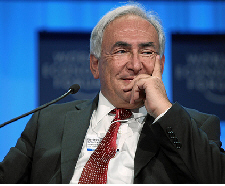

The world must adopt a low-carbon model for growth as it rebuilds from the global economic crisis, Dominique Strauss-Kahn, Managing Director of the International Monetary Fund, said at the World Economic Forum in Davos.

Strauss-Kahn unveils his proposal for a “Green Fund” to assist countries in adapting to a low-carbon growth model and combat climate change (photo: World Economic Forum)

World Economic Forum

To help finance this shift in the global economy, the IMF is working on a set of proposals to create a multi-billion dollar “Green Fund” that would provide the huge sums—which could climb to $100 billion a year in a few years—needed for countries to confront the challenges posed by climate change.

During a panel discussion on the future of the world economy, Strauss-Kahn said it was obvious that developing countries don’t have the cash to finance the measures needed to tackle climate change while developed countries were saddled with enormous debts from combating the global economic crisis.

There was a need to think outside the box and come up with innovative ways to provide the money. “I can’t believe we don’t have the solution to this huge problem,” he told the audience in Davos

Taking it forward

The IMF will start discussions with central banks and finance ministers on the feasibility of creating this Green Fund, possibly partly financed through the issuance of additional Special Drawing Rights (SDRs), a reserve asset created by the IMF.

Strauss-Kahn said that climate change financing was such a big issue that “it cannot be seen as a problem that cannot be solved.” But because of the debt overhang from the global crisis it clearly needed alternative solutions. The IMF will release a paper in a few weeks setting out ideas on how the proposal can be financed.

Earlier during the session, chaired by Martin Wolf of the Financial Times, Strauss-Kahn told the high-level panel that the global crisis had created a problem of fiscal sustainability for many countries that could take up to seven years to fix because of the huge debts built up during the crisis.

IMF reserve assets

The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries' official reserves. Its value is based on a basket of four key international currencies. SDRs can be exchanged for freely usable currencies.

With a general SDR allocation that took effect in August last year and a special allocation last September, the amount of SDRs in use by countries around the world is now SDR 204.1 billion (currently equivalent to about $324 billion). The Managing Director’s proposal would require the release of additional SDRs.

Comments on this article should be sent to imfsurvey@imf.org