Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Larger Latin American Economies Recovering Faster than Expected

October 8, 2010

- Brazil and other countries growing by more than 7 percent in 2010

- Caribbean countries just beginning to recover

- Policy challenges of avoiding overheating, inflation, financial excesses

Latin American countries are recovering more strongly than expected from the global recession, but the pace of that recovery varies across the region, said Nicolás Eyzaguirre, Director of the IMF’s Western Hemisphere Department.

Auto worker in Sao Bernardo do Campo, Brazil: growth in larger countries of South America is stronger than expected (photo: Paulo Whitaker/Reuters)

IMF Annual Meetings

“In the faster growing countries in South America, the immediate policy challenge is to make sure things don’t get too hot, to watch out for excesses,” Eyzaguirre told a press briefing at the IMF-World Bank Annual Meetings in Washington, D.C. on October 8.

But for the United States, the IMF projects that the recovery will be slow, held back by weak balance sheets—the legacy of the U.S. financial crisis. “There’s no quick way out of that situation, so we expect only a gradual recovery and U.S. monetary policy to stay easy for a prolonged period,” Eyzaguirre told reporters.

The U.S. economy is projected to expand by 2.6 percent in 2010 and 2.3 percent in 2011. Canada’s economy is expected to do better than its neighbor—about ½ point stronger growth in both years.

“In essence, we continue to see a relatively cool recovery in the north, particularly in the United States, but a much hotter recovery in the south, particularly in South America,” Eyzaguirre told reporters.

Mixed picture

The former Finance Minister of Chile said that the external environment creates a mixed picture of positive and negative factors for the Latin America and Caribbean region.

Low growth in the advanced economies, including in the United States, will create a drag on growth in the countries with strong real linkages to the United States—namely, Mexico, countries of Central America, and the Caribbean.

On the other hand, low growth in advanced economies also means very low global interest rates. “This is a stimulative factor for the Latin America and Caribbean region—especially for countries with the strongest fundamentals, the ones that appeal most to foreign investors,” Eyzaguirre pointed out.

In addition, stronger growth in the emerging market economies of Asia is keeping world prices of commodities high. “This affects the region in different ways, but clearly it’s another stimulative factor for the commodity exporters of South America,” Eyzaguirre noted.

Growth prospects

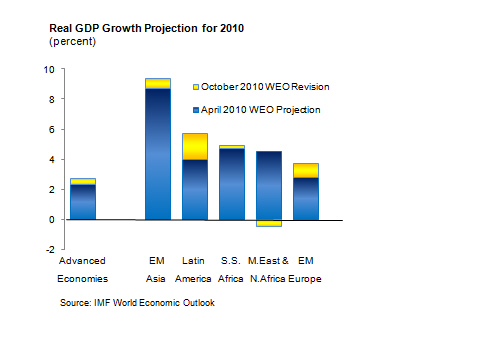

Eyzaguirre noted that this mixed global environment is reflected in a diverse outlook for the Latin America and Caribbean region.

Brazil and a number of other economies in South America are growing by more than 7 percent this year. In fact, for some countries, such as Argentina and Paraguay, surging exports to Brazil have been another strong stimulative factor. But growth is expected to moderate in 2011.

Mexico’s economy has exceeded expectations recently, and will grow by about 5 percent in 2010. “We expect growth of about 4 percent next year—still a relatively good performance considering the lack of dynamism coming from its northern neighbor,” Eyzaguirre said.

In Central America—for which external conditions are not so supportive—growth is projected to average about 3 to 4 percent this year and next.

In the Caribbean, the recovery from the global recession is only just beginning for many of the smaller, more tourism-dependent economies. Most will grow by only about 2 percent next year.

Policy response

The strong recovery of domestic demand this year has been welcome, bringing economies back to their potential levels. But demand growth now needs to moderate to a more sustainable pace—a continuation of rapid demand expansion would bring overheating, inflation, and widening current account deficits. The return of credit growth is also welcome, but care needs to be taken also to avoid financial excesses.

“In the faster growing countries in South America, the immediate policy challenge is to make sure things don’t get too hot, to watch out for excesses,” Eyzaguirre warned.

The timely removal of fiscal policy stimulus will be especially useful since it will allow monetary policy to play a supportive role, and thereby avoid attracting stronger capital inflows. Allowing exchange rate flexibility can also help—too little flexibility can attract more capital inflows and facilitate a credit boom.

Careful financial policies are critical too, stressed Eyzaguirre. The upcoming Regional Economic Outlook for the Western Hemisphere, to be released on October 19 with an event in Colombia, will look at the use of macroprudential regulatory policies to complement—but not substitute for—traditional policies in the current context of easy external financing conditions.