Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Central, Eastern and Southeastern Europe: Mind the Credit Gap

May 10, 2015

- Three speeds of economic activity within the region, but generally weak investment

- Reviving investment a challenge given firms are still overindebted

- Policies need to support domestic demand, and to help resolve debt burden

Countries in Central, Eastern, and Southeastern Europe (CESEE) are facing mixed economic fortunes, according to a new report on the region. In addition to the legacies of the crisis, external forces are at play: the oil price, the strength of the euro area recovery, and geopolitical tensions.

Fuel trucks in Tartu, Estonia. Cheaper oil has given a boost to Baltic countries (photo: Jaak Nilson/Spaces Images/Corbis)

REGIONAL ECONOMIC ISSUES

Policies should aim to support the recovery and address excessive private sector debt, the report says. Some countries need urgent progress on the structural reform agenda to escape the debt trap and sub-par medium-term growth.

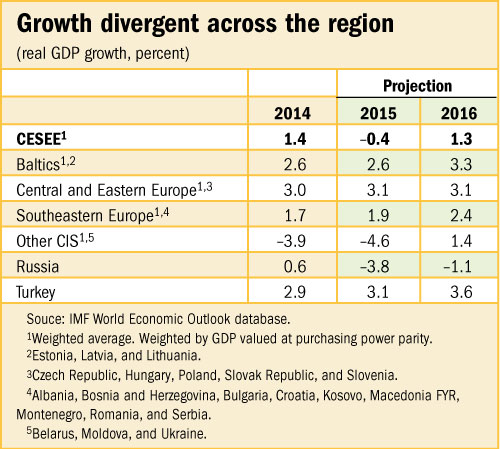

The region’s countries have been diverging down three paths. Baltic countries, Central and Eastern Europe (CEE), and Turkey are faring best, thanks to cheaper oil and a stronger euro area recovery. Southeastern Europe (SEE) is getting a smaller boost from these factors, due to lingering structural weaknesses and private sector debt. Commonwealth of Independent States (CIS) economies are expected to contract this year, with Russia affected by falling oil prices and sanctions and Ukraine in the midst of geopolitical tensions and macroeconomic adjustment.

A number of risk factors going both ways could come into play in the near future. There is a possibility of financial market volatility, for example as the US Fed begins to normalize its monetary policy. This could raise the cost of borrowing and reduce investment in the region. Any intensification of geopolitical tensions related to Ukraine or a prolonged period of turbulence in Greece could also weigh on the region’s prospects. On the upside, growth in the euro area could exceed expectations on the back of the ECB’s monetary policy and lower oil prices.

Sluggish investment, stubborn credit gap

Much of the CESEE region still lacks investment (Chart 1). In the second half of 2014, investment only made a positive contribution to growth in Central and Eastern Europe. Uncertainties about the strength of global and euro area recovery and geopolitical tensions are only partly to blame. The burden of debt in the private sector is another factor.

Since the global financial crisis, most countries in the region have significantly reduced investment and increased savings. However private debt-to-GDP ratios have declined only in a few countries. This reflects a combination of deep recessions, low inflation, and the impact of currency devaluations on debt burdens. CEE countries have seen less of a boom-and-bust cycle and hence, faced less of a deleveraging challenge than elsewhere in the region. While Baltic countries have made progress in reducing private debt and bad loans, a number of SEE countries need further adjustment.

While deleveraging is necessary, it tends to last longer and imply larger output losses if the debt problem is deeply-rooted, if macroeconomic policies are not sufficiently supportive, and if institutional frameworks are less flexible. The strength of the financial sector and external environment also matters. Baltic countries adjusted faster than SEE countries thanks to their more flexible institutions and their stronger links to countries less affected by the crisis.

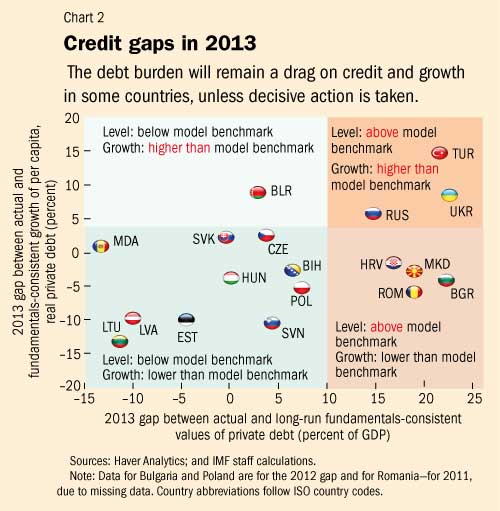

A positive “credit gap” exists when private debt is high, compared to a country’s fundamentals — its GDP and nominal interest rates. Post-crisis deleveraging efforts have not managed to close the gap in many countries. At the end of 2013, credit gaps were still wide in several SEE countries, Ukraine, Russia, and Turkey (Chart 2). Firms in these countries are also typically more exposed to liquidity or solvency risks.

Projections of the credit gap into the medium-term suggest that the debt burden will remain a drag on credit and growth in some countries, unless decisive action is taken. This is particularly true for Bulgaria, Croatia, and Ukraine.

How to grow out of debt

Countries need policies that will support domestic demand and to help resolve excessive debt. This will open the door to better levels of investment and a robust recovery. Supportive macroeconomic policies are essential in countries where debt weighs on demand. While many CESEE countries need to cut their fiscal deficits, measures should be correctly dosed to avoid derailing the recovery. Monetary policy should remain accommodative in countries facing deflationary risks.

Structural and institutional reforms are essential to raise growth potential, especially for countries with a private sector weighed down by debt. Flexibility in labor market rules (for example, lower hiring and firing costs) can be critical. Companies that are paralyzed by excessive debt sometimes need to shed jobs to avoid deeper cuts in investment that might undermine their future viability. Companies also need more help to resolve unmanageable debts, since banks often lack the capacity or incentives to deal with bad loans on their books.

Finally, many SEE and CIS countries also face an extensive unfinished structural reform agenda to improve the investment environment, raise productivity and reduce long-term unemployment.