Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Weaker Growth in Sub-Saharan Africa Amid Deteriorating Global Conditions

October 27, 2015

- Growth forecast lowest in six years

- Headwinds from weak commodity prices,

- tighter financing

- Limited policy scope to counter drag on growth

Economic activity has weakened markedly in sub-Saharan Africa, and the strong growth momentum of recent years has dissipated in quite a few countries, the IMF said in its regional outlook.

Pipeline running through Okrika community near Nigeria's oil hub city of Port Harcourt. Falling oil prices have reduced export revenue for sub-Saharan Africa’s oil producers, which account for about half of region’s GDP (Akintunde Akinleye/Reuters/Corbis)

REGIONAL ECONOMIC OUTLOOK

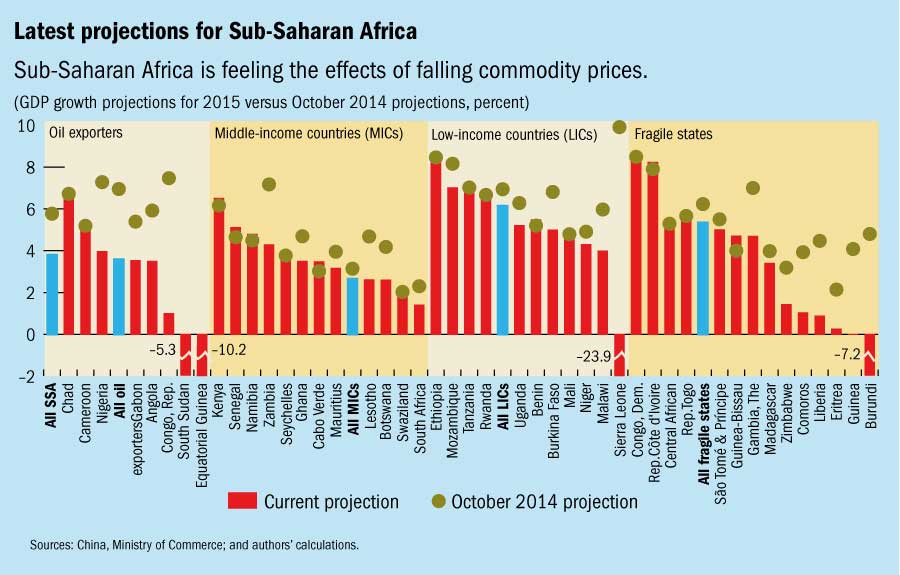

While the business and macroeconomic environment has improved considerably over the past decade or so, other factors that underpinned strong growth—particularly high commodity prices and accommodative financing conditions—have become less supportive. The prices of many commodities exported by the region have fallen by around 40-60 percent in the past two years, and borrowing costs have risen amid a reassessment of global risk in anticipation of a U.S. interest rate hike. In addition, larger external and fiscal deficits weigh on some countries.

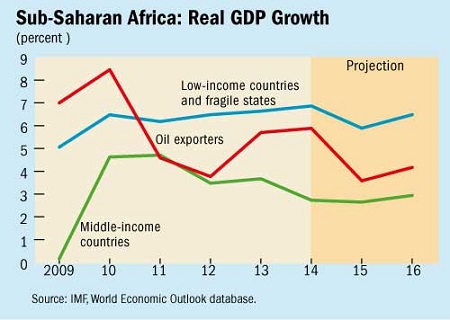

As a result, while growth in sub-Saharan Africa is still stronger than many other regions, the IMF’s latest Regional Economic Outlook for Sub-Saharan Africa puts growth at 3¾ percent this year, even lower than in 2009 in the aftermath of the global financial crisis. The forecast for 2016 is slightly higher at 4¼ percent.

Variation across region

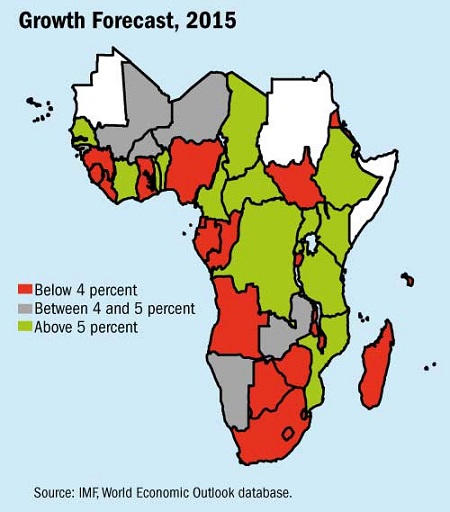

But despite the difficult overall picture, the report finds that there is considerable variation across the region (see charts below). In most low-income countries, growth is generally holding up, supported by infrastructure investment and private consumption. Countries such as Cote d’Ivoire, Ethiopia, and Tanzania are expected to grow at 7 percent or more this year and next. Other low-income countries, however are feeling the pinch from commodity prices, even though cheaper oil has eased their energy import bill.

Hardest hit are the region’s oil exporters as falling oil prices have drastically reduced export revenue and forced a sharp fiscal adjustment. The oil producers account for about half of the region’s GDP and include the largest producers, Nigeria and Angola. Several middle-income countries, including Ghana, South Africa, and Zambia, are also facing unfavorable conditions, ranging from weak commodity prices to difficult financing conditions and electricity shortages.

Limited scope to counter drag on growth

Savings have been modest during the recent period of rapid growth, leaving limited room to counter the drag on activity in the region or smooth the adjustment to the recent shocks. Many countries now have weaker fiscal and external balances than at the onset of the global financial crisis in 2008. And while in many cases this situation reflects countries’ efforts to address large infrastructure needs, it leaves them with fewer resources to contain the effects of the current downturn.

For oil exporters in particular, fiscal adjustment is unavoidable in the face of a sharp and seemingly durable decline in oil prices. Fiscal policy in most other countries needs to balance development needs and debt sustainability, which will become increasingly difficult as higher interest rates and lower growth adds to debt burdens.

On the monetary policy front, wherever the terms of trade have worsened sharply and the currency is not pegged, the study recommends that exchange rate should be allowed to depreciate to absorb part of the shock. Exchange rates have also come under pressure in countries where commodity exports do not play such a large role. Given the strong global forces behind these pressures, intervening here, too, would risk depleting scarce foreign exchange reserves. Accordingly, central bank intervention should focus on containing disorderly exchange rate movements. Monetary policy should respond only to second-round effects of exchange rate depreciations on prices and to other upward shocks to inflation.

Improving competitiveness, reducing inequality spurs growth

Beyond these more immediate challenges, the Regional Economic Outlook also discusses, in two background studies, how longer-term growth in the region can be supported by efforts to improve competitiveness and reduce inequality.

The first study suggests that the region’s recent period of high growth and substantial trade integration, has also been accompanied by a widening of trade imbalances and a weakening of competitiveness, especially among commodity exporters.

With some of the past sources of growth dissipating, the region needs to nurture new sources by increasing the sophistication of its exports and integrating into global value chains, which will only happen with greater competitiveness. The policy actions to achieve this objective depend on specific country circumstances, but progress can be facilitated by pursuing sound macroeconomic policies, investing in infrastructure while keeping debt on a sustainable path, continuing to eliminate trade barriers, and improving the business climate.

The second study considers the implications for sub-Saharan Africa of persistently high income and gender inequality. The region has among the highest levels of inequality in the world. With growing international evidence suggesting that persistent inequality can impede macroeconomic stability, the study finds that policies aimed at reducing inequalities to levels seen in some fast growing emerging Asian countries (for example by expanding access to education and health care) could potentially increase growth by one percentage point annually in sub-Saharan Africa. Carefully designed fiscal and financial sector policies and the removal of gender-based legal restrictions could also reduce inequality and improve long-term growth in the region, the study says.