Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : India Can Lock in Good Fortune with Private Investment, Structural Reforms

March 2, 2016

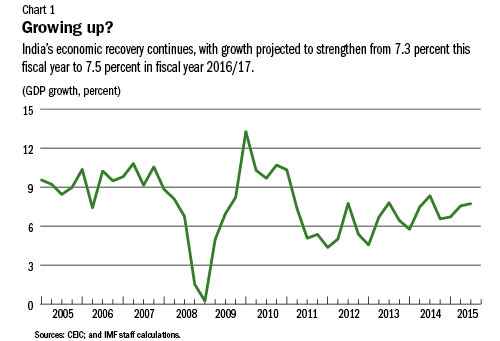

- Favorable outlook; growth projected at 7.5 percent this fiscal year

- Goods and service tax a priority

- Further reform of energy sector and labor markets would boost growth potential

Positive policy actions together with the decline in oil prices have helped make India one of the fastest-growing large economies in the world. Its resilience, however, is being tested by an unfavorable global environment and a slow investment recovery.

New Delhi, India. The recent budget proposes increased spending on rail, road, and other infrastructure, while sticking to the fiscal consolidation path (photo: Blaine Harrington III/Corbis)

ECONOMIC HEALTH CHECK

“The collapse in global oil prices is a large windfall gain for India,” said Paul Cashin, head of the IMF team for India. “The windfall has made room for more spending on goods and services, helped improve the external and fiscal positions, and allowed a sharp decline in inflation.”

India’s growth recovery also reflects improved economic management, the IMF said in its annual assessment of the economy. The government has taken policy measures to help reduce fuel and fertilizer subsidies, continue with fiscal consolidation, bolster the financial system, and strengthen the business climate, all of which have helped enhance confidence in the economy.

As a result, India’s growth outlook is favorable, with GDP growth projected to strengthen from 7.3 percent in this fiscal year to 7.5 percent in the upcoming fiscal year (see Chart 1).

Even so, the economic recovery has been uneven. The pick-up in the investment cycle is yet to gain strength, the banking system is weighed down by bad loans, and the weaker global economy has hit India’s exports.

There are also external risks. A further deterioration of the global growth outlook could weigh on the country’s growth prospects. In addition, “spillovers from global financial market volatility could be disruptive, including from unexpected developments in the course of U.S. monetary policy normalization or China’s growth slowdown,” said Cashin.

Reviving investment and broadening growth

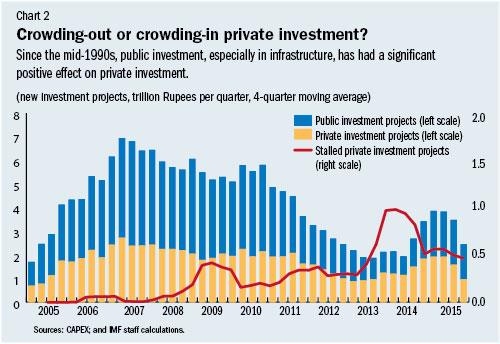

As private investment continues to show only a few signs of revival, the challenge for India is to sustain its growth momentum. An increase in public infrastructure investment and government initiatives to unclog stalled investment projects are helping bolster investor sentiment and having a positive impact on private investment (see Chart 2).

“Nonetheless, project implementation and supply-side challenges have been a drag on corporate investment for several years and they have chipped away at the financial strength of core industrial sectors, so the investment recovery is likely to be sluggish,” Cashin observed. Weakened bank asset quality and profitability means that banks are also becoming more cautious in their lending, which could hobble economic growth, he added, welcoming the Reserve Bank of India’s recent steps toward more stringent recognition and more effective resolution of distressed bank loans as well as raising of banks’ loan loss provisions.

Further, with global growth weaker, India will have to continue to rely mainly on domestic demand as a key source of growth. “Increasing capital buffers in public banks, which in our assessment is manageable even in a severe stress scenario, and implementing governance reforms in public sector banks along with the new bankruptcy law, are of key importance to ensure the durability of the Indian growth recovery,” Cashin said.

Inflation falling fast

Consumer price inflation declined to 5.6 percent in December 2015, down from an average of 10 percent during 2009-13, reflecting economic slack, an appropriately tight monetary policy stance by the Reserve Bank of India, lower global commodity prices, and government efforts to contain food inflation (through release of surplus grain buffer stocks and low minimum support for price increases in agriculture).

“The adoption of the flexible inflation-targeting framework in early 2015 is a very positive development,” says Cashin. “The new framework is simple, has clear objectives and provides operational autonomy for the RBI in setting monetary policy.” Nonetheless, the report notes that household inflation expectations remain high, and breaking away from this pattern will likely require a prolonged period of low inflation.

In the near-term, inflation risks stem from an unfavorable monsoon and expected wage increases of government employees as a result of a once-a-decade wage adjustment.

Putting public finances on a firm footing

The government’s strong fiscal consolidation efforts over the past several years signify its commitment to place India’s public finances on a solid footing. The quality and efficiency of public spending has improved and important revenue measures have been implemented.

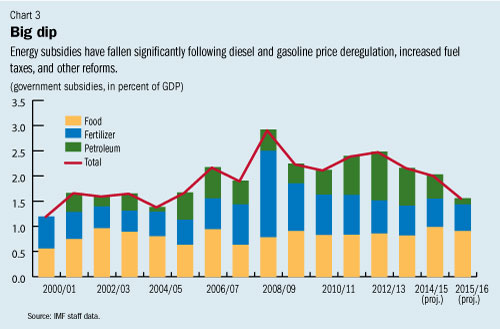

The deregulation of diesel prices has helped reduce the fuel subsidy bill from about 1 percent of GDP two years ago to just 0.1 percent of GDP this year (see Chart 3). Levies on petroleum products have also been raised. “This provides a cushion against possible upward swings in oil prices, helps finance increased investment outlays, and also mitigates negative externalities related to pollution and global warming,” Cashin observed.

The report suggests, however, that tax revenues can be increased further, including through better revenue administration. In addition, overhauling India’s food and fertilizer subsidy schemes through better targeting and further efficiency reforms would save substantial funds.

In this regard, the long-planned goods and services tax is a priority, as it would create a single national market, enhance the efficiency of intra-Indian movement of goods and services, and boost GDP growth. The report also encourages the authorities to pare back untargeted food subsidies, including by rationalizing the list of eligible beneficiaries and reforming the inefficient Food Corporation of India.

Boosting potential growth and generating jobs

India has a very young and dynamic workforce, and needs to create sufficient jobs for the roughly one hundred million young Indians who will enter the job market in the coming decade.

While India has made steady progress in recent years, raising India’s growth rate and ensuring the creation of sufficient jobs will require deeper structural reforms.

Priority areas for reforms are well known: addressing long-standing supply bottlenecks, labor and product market reforms, and further improving the business climate. Building on recent progress, key measures include:

• streamlining and expediting land acquisition and environmental clearance procedures, at both the center and state levels;

• greater labor market flexibility and product market competition, to encourage job creation and raise currently-low levels of female labor force participation;

• reforming the agricultural sector of the economy, to improve the efficiency of India’s public system for food procurement, handling, distribution and storage; and

• continuing to encourage cross-state competition in attracting investment.

Tackling these critical issues will accelerate Indian economic growth, help reduce poverty, and bolster macroeconomic stability.

“India’s potential is enormous,” said Cashin. “To remain in the economic ‘sweet spot,’ India must ensure forward momentum of economic reforms,” he concluded.