Graduating university students in Kaduna, Nigeria: growth remains too low to create the needed jobs for new entrants into the labor market (photo: Stringer/Reuters/Newscom)

External Risks Threaten Sub-Saharan Africa's Steady Recovery

October 11, 2018

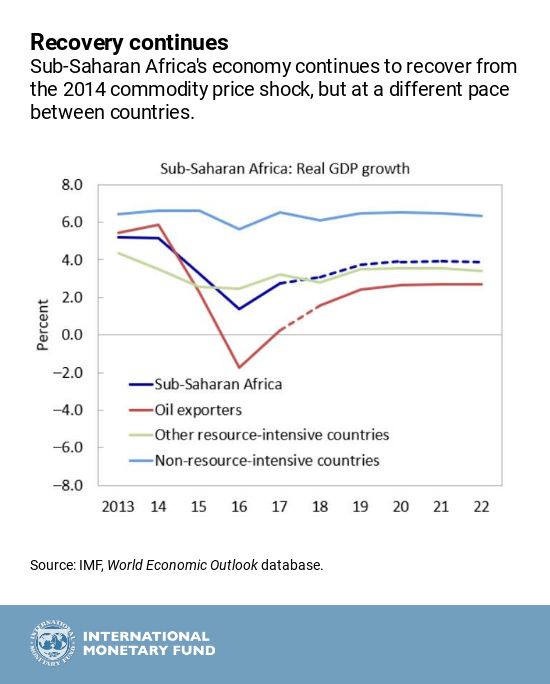

Sub-Saharan Africa’s economic recovery is expected to continue, reflecting a combination of domestic policy adjustments and a supportive external environment. Growth is projected to increase from 2.7 percent in 2017 to 3.1 percent in 2018, the IMF said in its latest Regional Economic Outlook for Sub-Saharan Africa.

Related Links

But the region faces increasing risks, particularly as underlying vulnerabilities have yet to be decisively addressed to shield the recovery against shocks. “Policies need to focus on reducing those vulnerabilities and strengthening policy frameworks,” said Abebe Aemro Selassie, Director of the IMF's African Department.

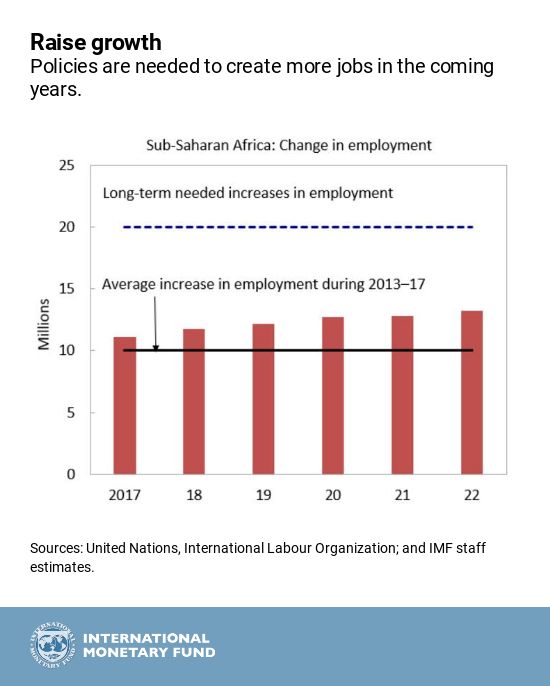

Potential growth over the medium term remains too low to create the jobs needed to absorb new entrants into the labor market. Enhancing resilience and raising the growth potential is essential, but policies vary across countries.

Here are six charts that tell the story.

- Economic recovery is expected to continue in sub-Saharan Africa.

It is not a single story. The past few years have been very difficult for oil exporters, such as Angola and Nigeria, following the sharp decline in oil prices in 2014. These countries and other resource-intensive countries have since experienced a growth recovery, but to levels well below those attained prior to the 2014 commodity price shock. Non-resource-intensive countries continue to sustain high growth.

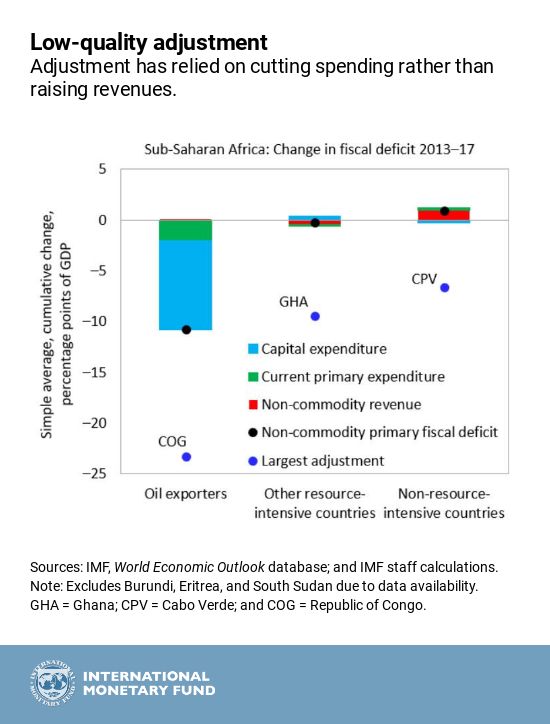

- Fiscal consolidation is proceeding, but its quality needs to improve

The average fiscal deficit for the region is set to shrink from 4.2 percent of GDP in 2017 to 3.3 percent in 2018. But so far, the deficit reduction largely reflects the oil price rebound for oil exporters coupled with sharp cuts in capital spending in a number of countries. At the same time, progress on improving much needed domestic revenue mobilization has been elusive, remaining far short of the region’s potential. Further revenue-based adjustment is needed to reduce debt vulnerabilities and generate resources for development.

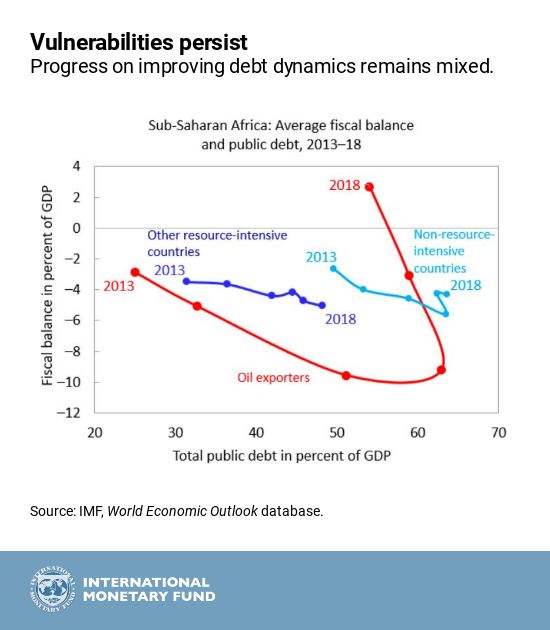

- Debt vulnerabilities persist

In 2017, 15 low-income sub-Saharan African countries were classified at high risk of debt distress (Burundi, Cameroon, Cabo Verde, Central African Republic, Ethiopia, The Gambia, Ghana, São Tomé and Príncipe, and Zambia) or in debt distress (Chad, Republic of Congo, Eritrea, Mozambique, South Sudan, and Zimbabwe). Debt dynamics for these countries mainly reflect large primary deficits, and in several cases, exchange rate depreciations. Debt reduction mainly reflects adjustment in oil exporters. Improving debt management frameworks could help better manage risks.

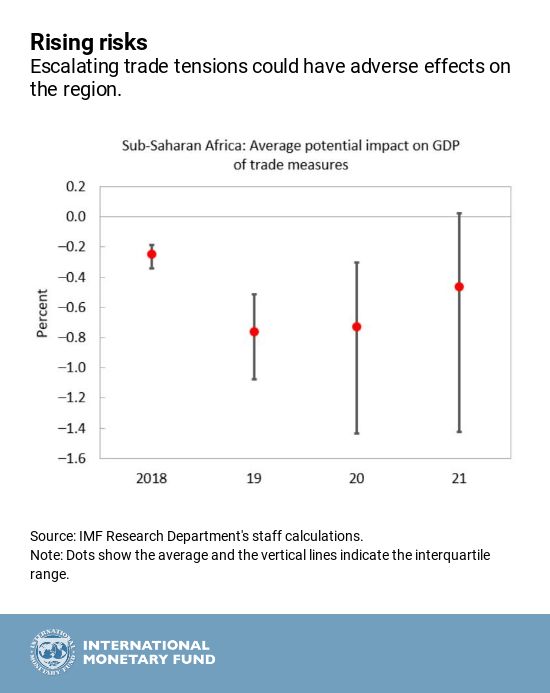

- Risks to the outlook are rising

The global economy is entering a period of unusually elevated policy uncertainty with significant risks that could have adverse impacts on many countries in the region. Escalating trade conflicts threaten to derail the global economic recovery in the near term and dampen medium-term growth prospects. Trade tensions between the United States, other major advanced economies, and China could entail a cumulative loss of GDP in sub-Saharan Africa of up to 1½ percent of GDP during 2018–21. Sub-Saharan African countries most affected by the trade war would be the commodity exporters and those countries (commodity exporters and importers alike) that are more integrated in global markets.

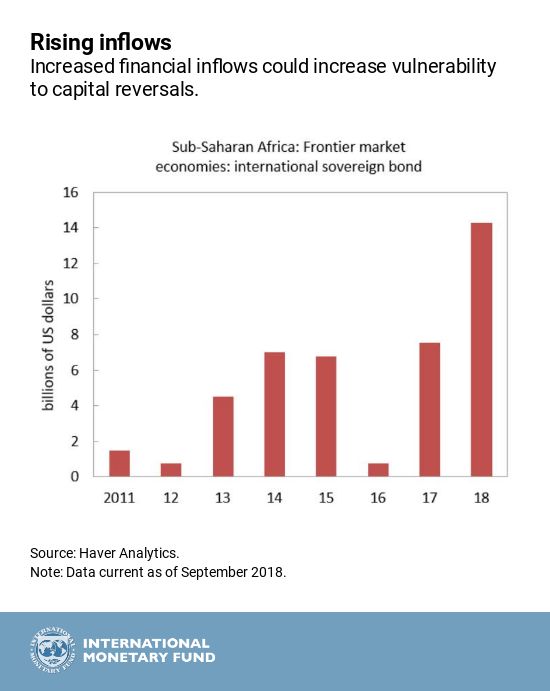

- Increased exposure to an unexpected tightening of global financial conditions

Tighter global financial conditions resulting from faster-than-envisaged monetary policy normalization in advanced economies, or a sudden shift in investors’ sentiment could constrain financing and growth for many sub-Saharan African countries. So far, frontier markets have weathered the bouts of volatility that have hit a few large emerging markets since mid-April 2018. Higher U.S. interest rates and a stronger dollar also heightens risks, as observed historically in emerging and developing economies. In particular, the probability of a large reversal in foreign flows in sub-Saharan Africa is significantly higher as U.S. interest rates go up.

- Policy actions are needed to lift living standards faster

Medium-term growth of 4 percent is too low for sub-Saharan Africa. The region needs to raise growth to create the additional 20 million jobs per year needed to absorb new entrants to labor markets. Creating strong, sustained, and inclusive growth will require several steps, including: deepening trade and financial integration (including in the context of the African Continental Free Trade Area); facilitating the movement of labor and capital through a better allocation of public spending; embracing the opportunities from the 4th industrial revolution by promoting digital connectivity and a flexible education system; removing market distortions; and undertaking policies that will foster private investment and risk-taking.