Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Financial Crises Yield More Synchronized Economic Output

September 30, 2013

- Regional and global output see increased correlations during financial crises

- Size of output spillovers depends on type of shock and strength of linkages with originating economy

- Financial globalization doesn’t necessarily induce greater output synchronization across countries—till crisis hits

The global panic set in motion by the 2008-09 financial crisis generated an unprecedented output collapse around the world that temporarily had countries moving in close lockstep, according to a new study by the IMF.

Countries’ economic performance was more correlated than usual during the crisis (photo: iStock)

WORLD ECONOMIC OUTLOOK

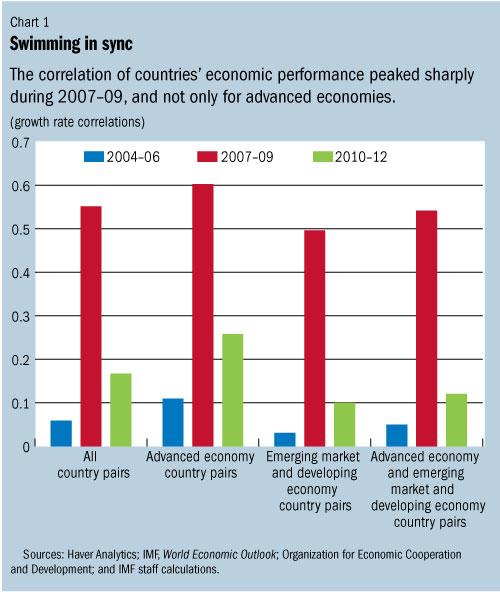

The output performance of the world’s economies moved together during the peak of the global financial crisis as never before in the recent history, according to a study published in the IMF’s October 2013 World Economic Outlook report. Correlations of various countries’ GDP growth rates had been modest before the crisis but rose dramatically during 2007–09 (see Chart 1).

The increased correlation or “comovement” was not confined to the advanced economies—which suffered most from the crisis—but was observed across all geographic regions. As in past episodes when output correlations spiked, the increase was temporary. In fact since 2010 output comovements have returned close to precrisis levels despite continued economic turmoil in Europe.

Lively debate persists on what caused the globally synchronized collapse and recovery and more generally what makes countries’ economies move together.

Trade and financial linkages are the most likely explanation because they can transmit country-specific shocks to other countries.

A second possibility is that greater comovements in output were induced by large, common shocks simultaneously affecting many countries at approximately the same time—such as a sudden increase in financial uncertainty or a “wake-up call” that triggered a change in investors’ perceptions of the world.

Finally, it could be that the nature of shocks changed. Shocks to countries’ financial sectors, such as banking crises and liquidity freezes, were more prevalent during the global financial crisis. These financial shocks might be transmitted to other countries in a more virulent manner during crises than are the supply and demand shocks—that are more prevalent during normal times.

Global spikes

Even though financial linkages may have played some role in pushing up comovements, the study finds that big spikes in regional and global output correlations tend to occur during financial crises, such as those in Latin America in the 1980s and in Asia in the 1990s. Moreover, when the crisis occurs in an economy like the United States—which is both large and a global financial hub—the effects on global output synchronization are disproportionately large. U.S. financial shocks generated spillover effects during the crisis years of 2007–09 that were about quadruple that during other periods. In other words, the global financial crisis had a much stronger impact on output than would have been predicted by the size of the underlying U.S. financial shock.

Contrary to expectations, trade linkages contributed little to spread the crisis across countries. Financial linkages helped spread financial stress across borders, but other factors—such as global panic, increased uncertainty, and “wake-up calls” that changed investors’ perceptions of risk and returns—acted as a common shock and played a much larger role in increasing the synchronization of output.

Cross-country linkages

The fact that comovements are now lower does not mean policymakers can ignore the effects of external shocks, such as growth slowdowns or monetary and fiscal tightening in major economies. But they need not worry equally about all potential shocks.

First, size matters. The United States still matters most from a global perspective, although the euro area, China, and Japan are important sources of spillovers within their respective regions.

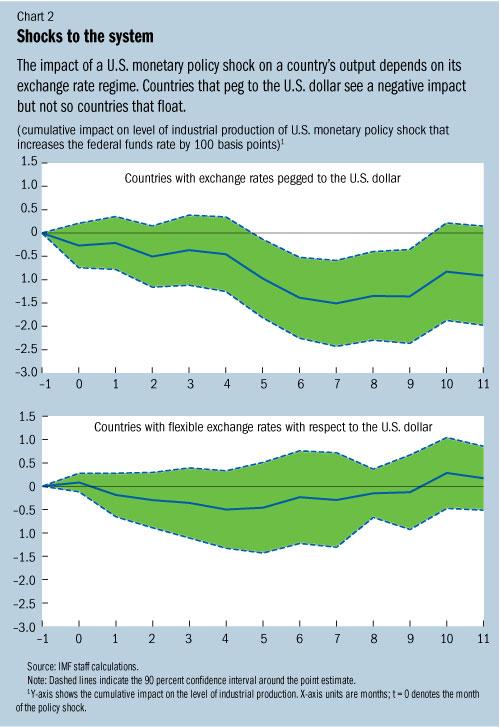

Second, the extent of the spillovers depends on the nature of the shock and the strength of linkages with the economy where the shock originates. For example, while a fiscal tightening in the United States or the euro area will most affect countries that have stronger trade linkages with these economies, the effect of interest rate normalization in the United States primarily affects countries that peg to the U.S. dollar through an interest rate channel (see Chart 2). In contrast, free floaters can rely on their exchange rate as a shock absorber.

Costs and benefits of financial integration

The conventional wisdom that financial globalization necessarily induces greater output comovement across countries is not true until a crisis hits. Financial linkages do transmit financial stresses across borders, but in normal times when real supply and demand shocks are dominant, financial linkages facilitate the efficient international allocation of capital. They shift capital where it is most productive. The key is to preserve the benefits of increased financial integration while minimizing the attendant risks through better oversight, including strengthened policy coordination and collaboration.