Protectionism could make the world less resilient, more unequal, and more conflict-prone

Four years ago, one of us wrote an article on the future of trade for the June 2019 issue of this magazine, celebrating the 75th anniversary of Bretton Woods. The message was that there was no strong evidence of a retreat from globalization, but international trade and the multilateral system that underpinned it were under attack, and their future would depend on policy choices. Since then, policymakers in some of the world’s largest economies have made choices to halt further international integration and, in several instances, to embrace protectionist or nationalist policies.

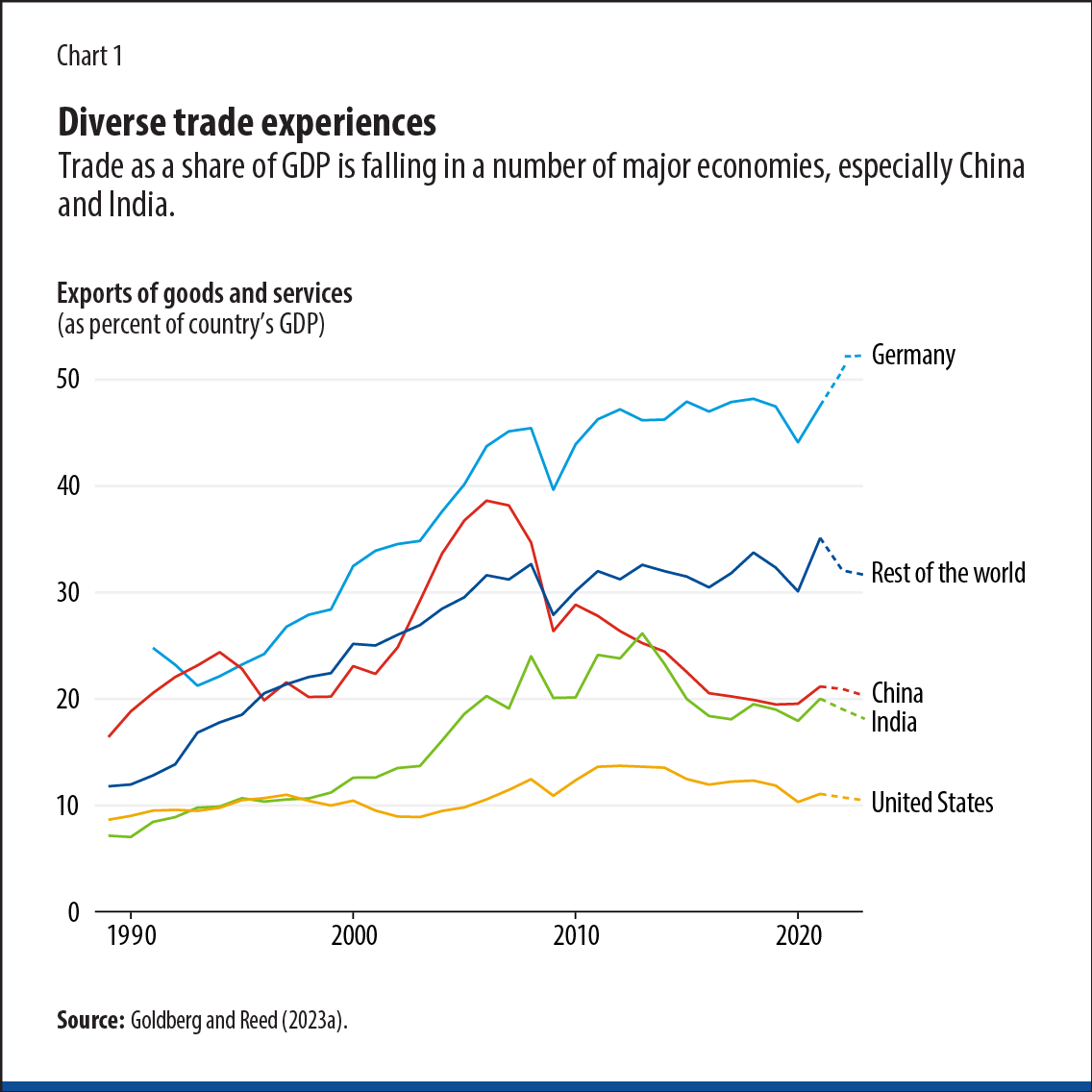

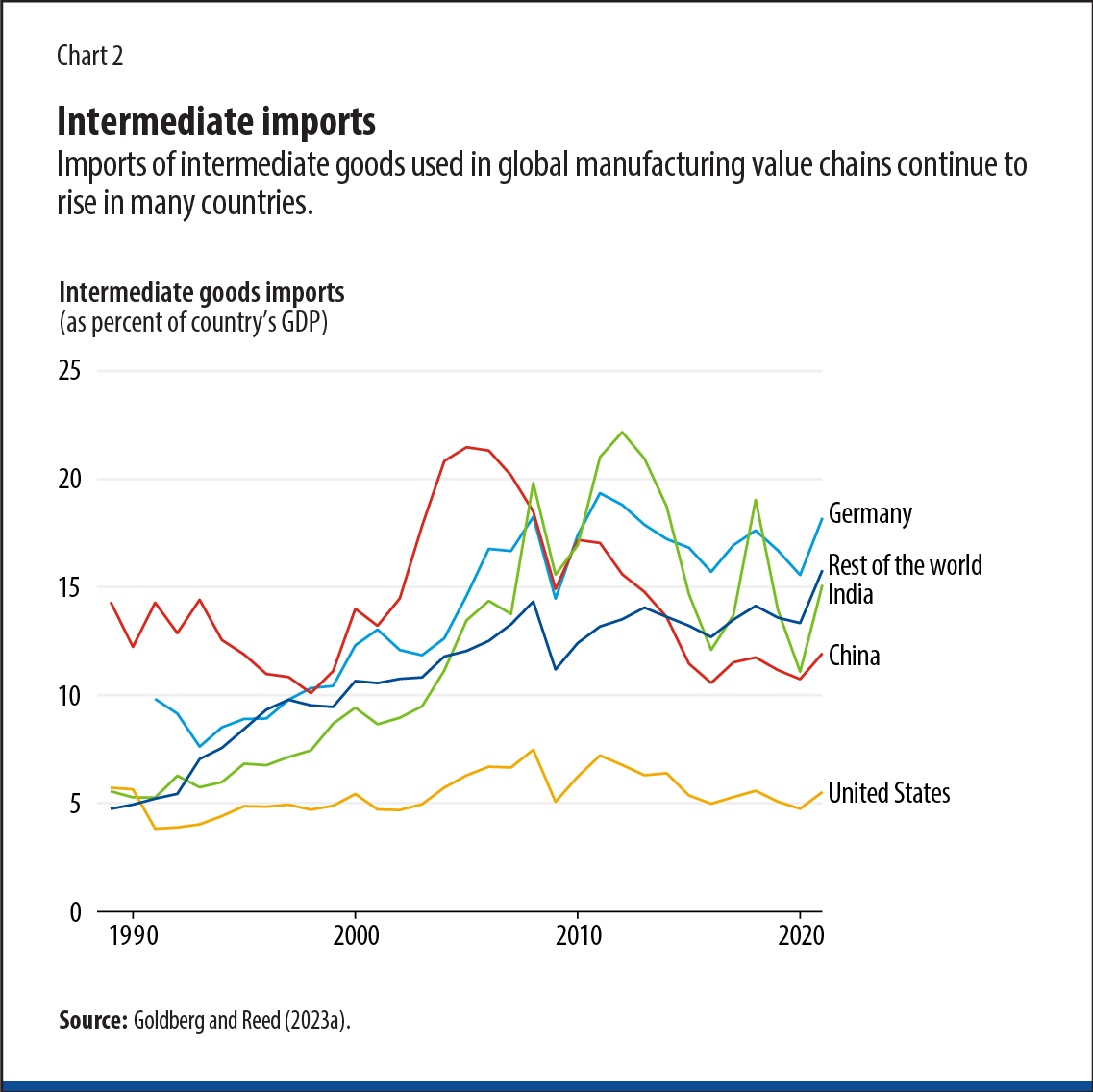

Today, there is still no conclusive evidence that international trade is deglobalizing. When measured in US dollars, global trade growth slowed after the global financial crisis in 2008–09 and declined sharply at the onset of the pandemic in 2020. But since then trade has rebounded to the highest value ever. As a share of GDP, global trade has fallen modestly, driven mostly by China—which for years has pursued a “dual circulation” strategy of prioritizing domestic consumption while remaining open to international trade and investment—and India (see chart 1). This reflects the end of an extraordinary export boom both countries experienced in previous decades as well as fewer imports of intermediate goods than in the past. Yet, as a share of GDP, imports of intermediates by the rest of the world are still growing (see chart 2). The same is true of exports.

American and Chinese tariffs introduced in 2018 did not reduce trade. They curbed trade between the US and China, as expected. But trade in the products most affected by tariffs grew among the rest of the world. In other words, trade was merely reallocated, not reduced. And the tariff war did not stop other countries—such as members of the African Union, the Association of Southeast Asian Nations, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership—from pursuing regional or plurilateral trade agreements.

The COVID-19 pandemic led many countries to temporarily restrict exports of medicines, and some halted shipments of wheat and other foods as prices spiked following Russia’s invasion of Ukraine. But many governments are still aggressively pursuing economic integration, for instance through deals that make it easier for professionals to work in foreign countries or that facilitate the flow of consumer goods through common safety standards.

Trade may, of course, respond with a delay to changes in the policy environment. And policy itself may lag changes in public sentiment. Terms such as “national security” and “reshoring” have shown up more frequently in news articles and research papers. Perhaps most telling are recent polls of economists by the University of Chicago’s Booth School of Business. In March 2018, 100 percent of those surveyed were against the initial US tariffs. Yet in January 2022, respondents were skeptical about global supply chains: only 2 out of 44 economists disagreed with the statement that reliance on foreign inputs had made American industries vulnerable to disruptions.

Hyperglobalization

The era of “hyperglobalization” that took shape from the 1990s onward was associated with great economic achievement. Extreme poverty as defined by the World Bank was dramatically reduced and expected to be eliminated in all but a small number of institutionally fragile countries, partly thanks to dramatic growth in East Asian countries. Standards of living, as measured by income per capita, increased across the world.

Consumers in economies open to trade gained access to an extraordinary variety of goods sourced from all over the planet at affordable prices. Smartphones, computers, and other electronics allowed people to be more productive and to enjoy more varied entertainment than previous generations had ever dreamed. Declining prices of air travel allowed people to visit other countries, exposing them to new cultures and ideas—an experience once reserved for the ultrawealthy.

While many factors contributed to this rise in living standards, openness and other market-oriented policies played an essential role. Trade with (at the time) low-wage countries influenced goods prices and wages in advanced economies, benefiting consumers in these countries and workers in exporting economies. Inflation remained surprisingly low—despite quantitative easing and increasing debt in the US.

Finally, the Western world enjoyed a historically rare long period of peace that fostered prosperity. The tight global interconnectedness achieved by the end of the 20th century was arguably a major contributing factor by giving everyone an incentive to behave. War in this hyperglobalized era meant disruption of global supply chains, with potentially dire consequences for the world economy—as we are in the process of finding out.

Yet beneath the surface, tensions were building that led to a backlash against globalization. We chart three phases of this deglobalization movement. The first phase began around 2015 as anxiety about globalization and competition from low-wage countries gave rise to Brexit, US tariffs, China’s retaliation, and a resurgence of extremist views in Europe.

Global backlash

While the average person in the world was better off at the end of the 2010s, many workers in advanced economies were feeling left behind, doing worse than their parents. There is substantial economic research documenting these distributional effects, which had a distinct geographic component: communities more exposed to import competition from low-wage countries thanks to preexisting spatial industrialization patterns did worse than communities that were sheltered from imports.

This, in turn, had important political consequences in the US and the UK. At the same time, globalization created big winners: multinational “superstar” firms that benefited from the hyperspecialization of global value chains, in the form of lower costs and higher profits, as well as a class of highly compensated individuals who reaped the rewards associated with expanding markets and new economic opportunities. Not only were some left behind; others were racing ahead.

Loading component...

It took time for mainstream economists to acknowledge these effects. But in many ways the effects were nothing new: they reflected the usual tension between overall welfare and distributional conflict generated by trade. However, the speed and intensity of these changes gave this tension a new dimension. Similarly, there was nothing fundamentally new about economists’ recommendations: most rejected protectionism as a solution and endorsed some form of redistribution from winners to losers.

At the same time, Western governments were becoming increasingly concerned that competition with China was “unfair,” given its use of subsidies as well as restrictions imposed on companies seeking access to its market. This spurred demands for more confrontational policies toward China, especially because it was no longer a poor developing economy.

Of course, there had been backlash against global trade before, notably at the 1999 Seattle protests. But these movements did not influence policy. There was little reason to believe that the backlash against globalization between 2015 and 2018 would have permanent consequences for the future of globalization either. After all, the world was too interconnected to revert to the old regime.

Pandemic pressures

The second phase of the deglobalization movement began with calls for resilience at the onset of the pandemic in 2020. But what is resilience? There is no clear benchmark. Defining and measuring resilience depend on the nature of the shock. COVID, for example, was both a supply shock—with key international suppliers facing lockdowns at different times, slowing deliveries—and a demand shock, as demand for medical goods and durable goods like cars and second homes grew rapidly.

During COVID, short-term delivery delays and shortages due to the disruption of international trade were widely described as a crisis. But much of this was blown out of proportion, and in fact markets proved extremely resilient (Goldberg and Reed 2023a). The US, for instance, imports medical goods and supplies from a diverse group of countries. The one exception is face masks. But in 2020 shipments of face masks from China arrived within months, and this meant that shortages were completely alleviated.

Such examples show that international trade increased resilience. Along the same lines, the US actually preserved trade relationships; importers traded with foreign partners more regularly and sought out new suppliers, even though overall trade volume fell. Other papers show, based on quantitative model simulations, that international trade makes economies more diversified and hence more resilient (Caselli and others 2020; Bonadio and others 2021). The intuition is that supply shocks are less correlated across economies than within them and that access to multiple suppliers makes it easier to respond to country-specific shocks.

Overall, arguments against trade that emphasize the fragility of supply chains are not consistent with evidence. These arguments were used to stoke the protectionist sentiment that had originated in the first phase, but ultimately the initial effects were not enduring. Trade grew fast in 2021 as the world turned a corner in management of the pandemic.

Geopolitical pressures

The third phase began with Russia’s invasion of Ukraine in February 2022. For the public, this highlighted new risks from international specialization. As Russia cut gas supplies to Europeans and energy prices skyrocketed, the pitfalls of reliance on a single country for imports of a critical input became clear. The concerns were not intrinsically about Russia. But by extrapolation, countries began to wonder what would happen if they had to decouple from China overnight. Policymakers concluded, if they had not already, that it would be better to decouple immediately on their own terms.

Around the same time, a new mindset was widely adopted—namely, that international welfare is a zero-sum game. The United States imposed a ban on exports to China of advanced logic and memory chips and the machinery to produce them. Semiconductor technologies certainly do have military applications, and the export bans could set back China’s military. But the technologies have many more applications in the civilian sector, and so these bans also retard civilian technological development. The world shifted from one in which trade, competition, and innovation in all countries were encouraged to one in which the most advanced economy sought not just to compete but to foreclose.

At this point any forecasts are highly speculative, since, as before, outcomes will be highly dependent on policy choices. One possibility is that this is as far as the deglobalization movement goes; interventions to foreclose technology access will be limited to products with a credible dual use, while trade in other products will continue to flourish. But another possibility is that the world will end up fragmented in rival camps and that a new cold war will unfold, this time between the US and China (and their respective allies). The consequences of the latter scenario could be severe.

New cold war

Many models of long-term growth emphasize the role of population size in research and development. The world’s largest and most populous economies are expected to have new ideas and develop absolute advantages, as evidenced by their leading market positions in a variety of products. If scientific collaboration between China and the US breaks down, the world could have fewer solutions to the next pandemic and endemic diseases.

More generally, separating from “non-friendly” partners means removing potential low-cost suppliers. When it comes to decarbonization, for instance, the cost of solar panels is substantially higher in the West than in China, and industry estimates suggest that tariffs have slowed installation. Addressing climate change is urgent. Every year lost results in more damage and substantially larger mitigation costs.

Is this the price of greater resilience? Restricting global trade is unlikely to lead to resilience. As we argued earlier, resilience cannot be evaluated without reference to specific shocks. Trade exclusively with “friendly” countries may imply greater resilience to geopolitical risks—at least in the near term—but the concept of friendship is itself subject to constant change. It may, however, lead to less resilience to other types of shocks, such as the recent health shock.

Within countries, inequality could increase. Greater trade barriers lead to higher prices, which mean lower real wages. Globalization may have contributed to more spatial inequality, but protectionism is not the cure: it will likely make the problem worse. Across countries, there is a risk of increased global inequality. Geoeconomic fragmentation could lead to more trade between high-income economies that are “friends.” Increasing emphasis on environmental and labor standards in trade agreements would raise entry barriers for very poor countries that find it difficult to meet these requirements. Without access to lucrative foreign markets, there is no clear path for poverty reduction and development in such economies (Goldberg and Reed 2022).

But the greatest risk may be to peace. Cold wars have often led to hot wars. During the interwar period in the 1930s there was a dramatic shift away from multilateral trade toward trade within empires or informal spheres of influence. Historians have argued that this shift exacerbated tensions between countries ahead of World War II. We can only hope that the coming years will not be a replay of this pre-belligerence era.

A more detailed discussion of this topic can be found in our paper published in the March 2023 Brookings Papers on Economic Activity (“Is the Global Economy Deglobalizing? And if So, Why? And What Is Next?”).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Bonadio, Barthélémy, Zhen Huo, Andrei Levchenko, and Nitya Pandalai-Nayar. 2021. “Global Supply Chains in the Pandemic.” Journal of International Economics 133 (November): 103534.

Caselli, Francesco, Miklós Koren, Milan Lisicky, and Silvana Tenreyro. 2020. “Diversification through Trade.” Quarterly Journal of Economics 135 (1): 449–502.

Goldberg, Pinelopi K., and Tristan Reed. 2022. “Demand-Side Constraints in Development: The Role of Market Size, Trade, and (In)Equality.” Yale University Working Paper, New Haven, CT.

Goldberg, Pinelopi K., and Tristan Reed. 2023a. “Is the Global Economy Deglobalizing? And if So, Why? And What Is Next?” Brookings Papers on Economic Activity (March).

Goldberg, Pinelopi K. 2023b. The Unequal Effects of Globalization. Cambridge, MA: MIT Press.