Financial stability risks contained so far, but despite improvements vulnerabilities remain elevated in some sectors

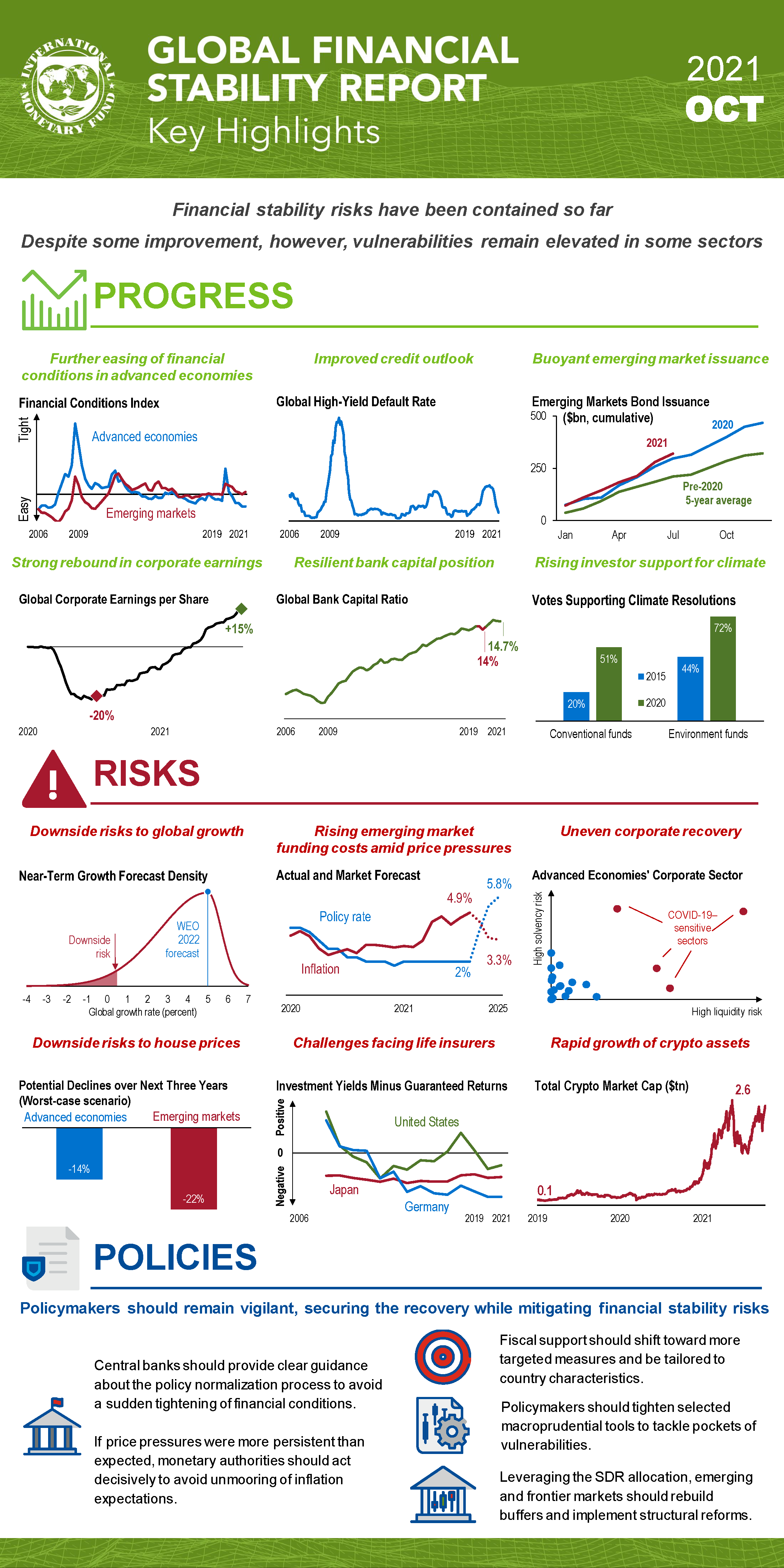

Financial stability risks have been contained so far, reflecting ongoing policy support and a rebound in the global economy earlier this year. Chapter 1 explains that financial conditions have eased further in net in advanced economies but changed little in emerging markets. However, the optimism that propelled markets earlier in the year has faded on growing concerns about the strength of the global recovery, and ongoing supply chain disruptions intensified inflation concerns. Signs of stretched asset valuations in some market segments persist, and pockets of vulnerabilities remain in the nonbank financial sector; recovery is uneven in the corporate sector.

Chapter 2 discusses the opportunities and challenges of the crypto ecosystem. Crypto asset providers’ lack of operational or cyber resilience poses risks, and significant data gaps imperil financial integrity. Crypto assets in emerging markets may accelerate dollarization risks. Chapter 3 shows that sustainable funds can support the global transition to a green economy but must be scaled up to have a major impact. It also discusses how a disorderly transition could disrupt the broader investment fund sector in the future.

Chapter 1: Global Financial Stability Overview: A Delicate Balancing Act

Chapter 2: The Crypto Ecosystem and Financial Stability Challenges

Chapter 3: Investment Funds: Fostering the Transition to a Green Economy

Publications

December 2025

Finance & Development

- More Data, Now What?

Annual Report 2025

- Getting to Growth in an Age of Uncertainty

Regional Economic Outlooks

- Latest Issues