Sovereign Debt

Overview

Public debt, or sovereign debt, is an important way for governments to finance investments in growth and development. However, it is also critical that governments are able to continue servicing their debt and that their debt burden remains sustainable. Entering into debt distress is often a painful process, which may threaten macro-economic stability and set back a country’s development for years. Supporting member countries in managing debt risks and resolving debt distress is therefore at the heart of the IMF’s work. This work takes multiple forms.

The IMF’s analytical work helps identify sovereign debt risks and provides policy advice on how to address these risks at an early stage. Jointly with the World Bank, the IMF fosters debt transparency and supports countries in strengthening their capacity to report and manage their public debt. Technical support to member countries on formulating a debt management strategy and developing their local currency bond markets are at the core of such assistance that promotes a prudent debt structure and adds resilience to withstand economic shocks.

Countries with high debt vulnerabilities need to tackle them through a combination of adjustment and measures to restore growth. An IMF-supported program can facilitate that adjustment, but the IMF can only lend to a member if its debt is sustainable. There are cases where debt is unsustainable, even taking the adjustment efforts into account. If a member country enters into debt distress, only the country’s government can decide whether to solve this by negotiating a debt restructuring with its creditors. An IMF-supported program can support a member in the context of a debt restructuring by providing sound economic policies and new financing, enabling the return to macroeconomic viability. The IMF is also lending its support to improving the international architecture for sovereign debt restructurings, which is critical to enable faster and more effective debt reduction.

Publications

Sri Lanka’s Sovereign Debt Restructuring: Lessons from Complex Processes

The Role of IMF Arrangements in Restoring Access to International Capital Markets

Global Sovereign Debt Roundtable: Cochairs Progress Report

Staff Guidance Note on Information Sharing in The Context of Sovereign Debt Restructurings

Review of the Debt Sustainability Framework For Market Access Countries

Staff Guidance Note on the World Bank-IMF Debt Sustainability Framework for Low-Income Countries

Staff Guidance Note on the Sovereign Risk and Debt Sustainability Framework for Market Access Countries

Modification to the Transparency Policy

Policy Papers on Debt-Sustainability in Low-Income Countries

Review of the Debt Sustainability Framework for Low-Income Countries

The Common Framework: Utilizing its Flexibility to Support Developing Countries’ Recovery

World Bank Group and International Monetary Fund Support for Debt Relief under the Common Framework And Beyond

Stock-Bond Diversification Offers Less Protection From Market Selloffs

Diversification has become harder since 2020 as stocks and bonds tend to move in tandem during sharp selloffs, adding to financial stability concerns

Global Economy Shakes Off Tariff Shock Amid Tech-Driven Boom

But risks are rising, including from the concentration of tech investment and the negative effects of trade disruptions, which may build over time

New Skills and AI Are Reshaping the Future of Work

Policy choices will determine whether workers and firms are adequately prepared for the AI revolution

Analyze This! Sovereign Debt Restructuring

When is a sovereign debt restructuring needed? And why can sovereign debt restructurings be difficult to achieve? Learn more about the main challenges and how the IMF can facilitate a solution.

Analyze This! Sovereign Debt

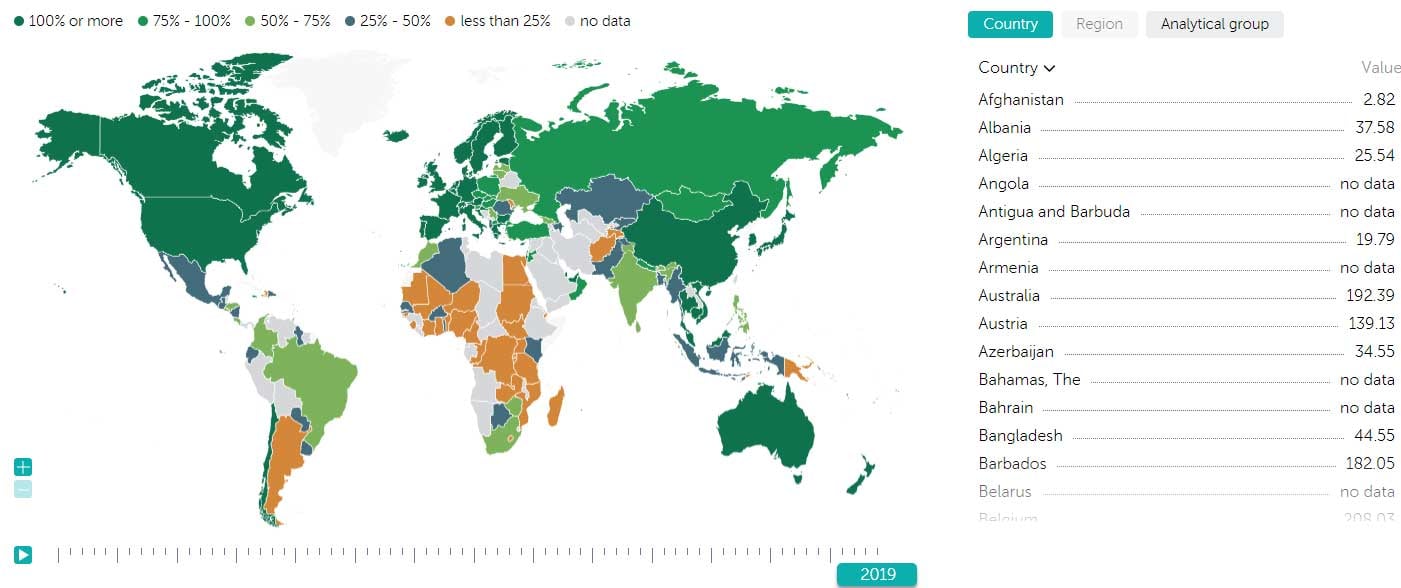

As governments around the world are taking on debt at levels surpassing those during World War II, some governments will be in a better position to sustain their debt than others. Find out how the IMF calculates where the risks lie.

Analyze This! Debt Sustainability

What is debt sustainability? Why is it important to maintain debt at sustainable levels? And what can borrowers and creditors do to address rising debt vulnerabilities and maintain debt sustainability? Also covered in imf.org/FandD.

Analyze This! Debt Transparency

What happens when a country’s debt gets too high and the money is not spent wisely? Here are three steps to avoid a debt crisis.

Abebe Aemro Selassie on Africa's Infrastructure Gap and Debt

In this podcast, Abebe Aemro Selassie says when governments invest in the right types of infrastructure, people are more willing to pay the taxes the government needs to service its debt.

Fanwell Bokosi on Taming Africa’s Debt Beast

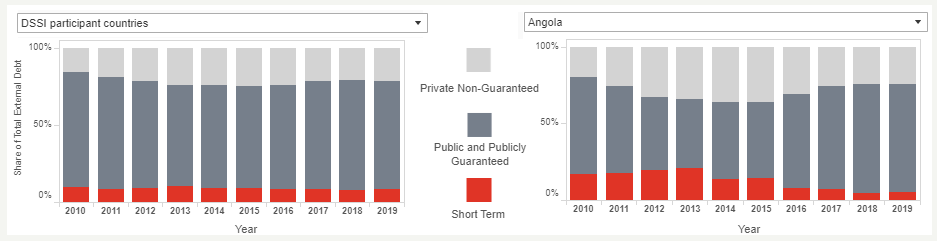

In this podcast, Bokosi says the nature of Africa's debt has changed in recent years, making it more difficult to find solutions for debt sustainability problems.