FISCAL RISK ASSESSMENT TOOL (FRAT)

FISCAL RISK ASSESSMENT TOOL (FRAT)

provides a high-level portfolio perspective on a wide range of fiscal risks which governments are typically exposed to. It provides a starting point for fiscal risk analysis by helping countries identify the largest and most important sources of fiscal risks that can be the focus of more detailed quantification using specific tools in the IMF's Fiscal Risk Toolkit.

What does the tool do?

- Provides a qualitative identification of fiscal risks complemented by some quantitative analysis.

- Offers a high-level portfolio perspective on a wide spectrum of 14 fiscal risks, covering macroeconomic, specific, and institutional risks.

- Is Microsoft Excel-based with intuitive interface and user-guidance embedded in the template (following 15 steps).

- Provides outputs on risk-by-risk level, portfolio level (e.g., historical risk realizations, information and data gaps, impact-likelihood matrix, risk mitigation, macro-fiscal forecast error analysis, time series analysis), and international comparisons (along 24 indicators).

- Allows users to choose flexible effort level (from 3 hours to 3 weeks).

Why analyze these risks?

Fiscal risks can have a significant impact on government finances and originate from a wide range of sources. Recent experiences, including the COVID-19 pandemic and the Global Financial Crises have illustrated how the realization of fiscal risks from various sources, including environmental risks, the financial sector, macroeconomic developments, and others, can lead to significant increases in government deficits and debt liabilities, and a deterioration of public sector net worth.

The realization of fiscal risks can be large, biased towards the downside, highly correlated, and their impact can be nonlinear. It is important for governments to have a holistic perspective on the range of fiscal risks they are exposed to obtain a portfolio perspective. This helps governments understand the interactions among risks, their macro-criticality, and how to prioritize scarce resources for risk management.

How can the tool support fiscal policymaking?

- Helps countries to identify the scale and source of their fiscal risk exposures.

- Supports fiscal risk management by helping countries to prioritize fiscal risk monitoring and mitigation efforts, assign institutional responsibilities for risk management, and identify information and data gaps.

- Contributes to macro-fiscal policy analysis, by identifying risks to be used to strengthen baseline projections and design stress scenarios for debt sustainability analysis, fiscal stress tests, and the calibration of fiscal rules.

- Inform amounts of budget provisions or fiscal buffers that may be required to accommodate risks.

- Helps foster fiscal transparency and accountability by supporting fiscal risk reporting (e.g., fiscal risk statements), accounting and statistical reporting.

Linkages to other IMF fiscal risk and macro-fiscal analytical tools

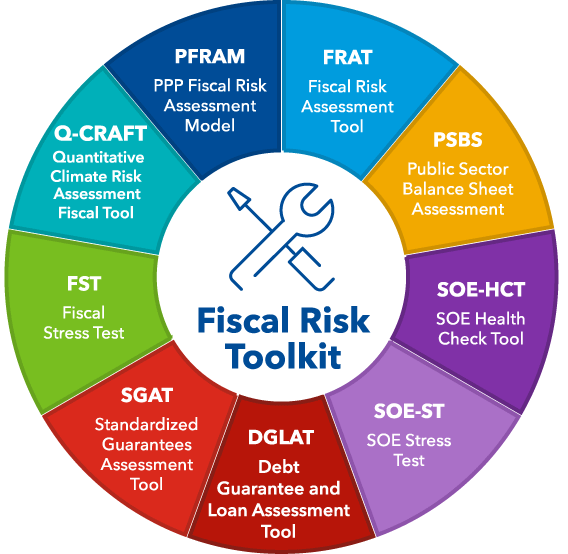

Insights generated by the FRAT can serve as inputs to macro-fiscal tools, including the Debt Sustainability Analysis for Low-Income as well as Market-Access Countries, and the Medium-Term Debt Management Strategy Analytical Tool, as well as the Fiscal Stress Test (to enhance baseline projections and to derive shock scenarios).

The FRAT can help identify priority risks for which in-depth analysis can be conducted using risk-specific tools (e.g., the SOE Health Check Tool, the SOE Stress Test Tool, the PPP Fiscal Risk Assessment Model, the Discrete Guarantee & Loan Assessment Tool, the Standardized Guarantee Assessment Tool). Users that have initially used these tools dedicated for the analysis of individual risks can use their outputs as inputs to the FRAT.

The sources of risks used in the FRAT are largely aligned with Pillar III of the Fiscal Transparency Code. Analyses from the FRAT (e.g., international comparisons, the availability of information and data) can be used to inform the Fiscal Transparency Evaluation of a country.