STATE-OWNED ENTERPRISE STRESS TEST TOOL (SOE-ST)

STATE-OWNED ENTERPRISE (SOE) STRESS TEST (ST) TOOL

provides a forward-looking assessment of the resilience of an SOE's financial position under a range of alternative scenarios. It assesses SOE financial positions under a baseline and macroeconomic stress scenario, and quantifies the potential impacts on public finances. The analysis can inform budget planning, decision making on whether, and under what terms, to extend state support to SOEs, and whether remedial actions may be required to strengthen an entities financial position and its resilience to future potential shocks.

What does the tool do?

- Projects individual SOEs financial position, including cash flows, liquidity and debt servicing ability under baseline and stress scenarios, over a multi-year horizon. The scenarios can be designed to be relevant for individual SOEs and may comprise macroeconomic and market-specific elements.

- Estimates net inflows to the budget and the contribution of SOEs to the public sector balance sheet under both scenarios.

- Benchmarks the performance of SOEs against peer comparators, using profitability, to help identify the most vulnerable ones and prioritize the most relevant ones in the stress testing analysis.

Why analyze these risks?

SOEs comprise a significant share of economic and public sector activity in many countries, managing public assets equivalent to half of global GDP. Well-governed, SOEs can promote economic development and have the potential to support the provision of important goods and services to the public, while generating financial returns for taxpayers. But, poorly performing SOEs can be costly for public finances and generate significant fiscal risks.

SOE financial performance is shaped by a range of external factors such as demand, input prices, or exchange rates, as well as uncompensated public policy obligations. These factors, combined with the quality of internal governance and management of an SOE, can impact on an its profitability and solvency.

Forward-looking SOEs assessment tools can help assess the resilience of SOEs. By assessing an SOEs financial performance under different economic scenarios, over a multi-year horizon, they can help identify the economic conditions under which fiscal costs are may materialize, and what their consequences on public sector finances might be.

How can the tool support fiscal policymaking?

- Supports fiscal risk analysis and monitoring by assessing the potential for fiscal costs to be realized under different scenarios.

- Provides important inputs for monitoring fiscal risks, by highlighting the main dynamic vulnerabilities of SOEs.

- Helps to identify SOEs that may be underperforming, whether financial weaknesses have a structural nature, and whether remedial actions may be required to address those weaknesses.

- Supports fiscal sustainability analysis by identifying potential fiscal costs that can be included in baseline and shock scenarios for debt sustainability analysis.

Linkages to other IMF fiscal risk and macro-fiscal analytical tools

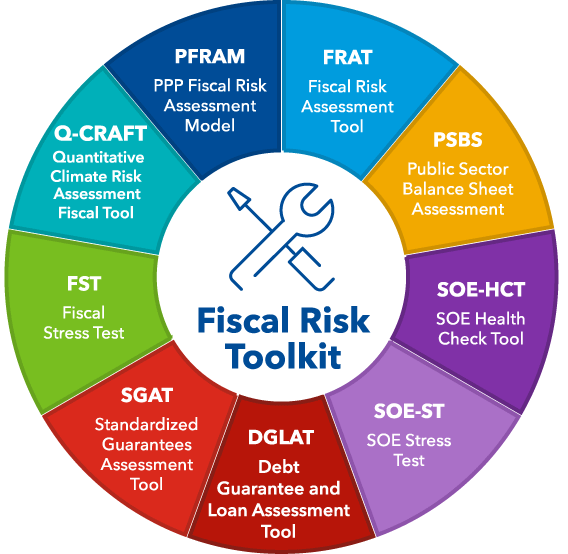

The Stress Test Tool and SOE Health Check Tool are complementary and help policymakers identify SOEs that may be financial vulnerable and are higher risk of generating fiscal costs. The tool can also support analysis related to other IMF tools including:

- The Discrete Loan and Guarantee Tool, as it projects the stock and service payments of SOEs' debt guaranteed by the government and identifies concrete triggers of financial distress that hamper those payments.

- Outputs of the Stress Test can inform broader Fiscal Stress Tests and public sector balance sheet analysis by generating baseline and stress scenarios for individual SOE cash flows and balance sheets and inform the size of potential contingent liability realizations.

- Provide inputs on SOEs debt stock and contingent liability realizations to IMF Debt Sustainability Analysis.