THE IMF's ROLE

Importance of Fiscal Risk Management

Fiscal risks can have a significant impact on government finances. Recent experiences, including the COVID-19 pandemic and the global financial crisis have illustrated just how costly fiscal risk realizations can be, leading to large increases in government deficits and debt.

Fiscal risks arise from a variety of sources, including macroeconomic and financial sector shocks, environmental risks, bailouts of state-owned enterprises and subnational governments, calls on government guarantees and obligations in public private partnerships.

A government's ability to respond to fiscal risks partly depends on the quality of its information about the sources and size of risks, its capacity to assess the likelihood of risks materializing, and the strength of its underlying public financial management institutions.

The IMF's Role

Recognizing the importance of fiscal risk management, the IMF has developed a range of practical tools, diagnostics, and guidance notes to help countries identify, quantify, disclose, and manage fiscal risks.

- The IMF's Fiscal Risk Assessments and Fiscal Transparency Evaluations help countries to identify the scope and scale of their fiscal risks, evaluate strengths and weaknesses in their fiscal risk management practices, and chart a course of actions to help address them. The Assessment draws on Pillar III of the Fiscal Transparency Code.

- The IMF's Fiscal Risk Toolkit provides several practical tools to help countries assess and monitor their fiscal risks.

The IMF’s Fiscal Affairs Department works closely with member countries to build their capacity to identify, analyze and manage fiscal risks. This capacity development can support countries to apply the fiscal risk toolkit, strengthen institutional arrangements for monitoring and managing fiscal risks, and enhance fiscal transparency by disclosing fiscal risks, including through the development of comprehensive fiscal risk statements. This can take place within the IMF’s broader public financial management and macro-fiscal capacity development offerings.

Fiscal Risk Management in Numbers

Over the past year the IMF's Fiscal Affairs Department and our Regional Capacity Development Centers have been engaged in close to 100 fiscal risk capacity development activities, supporting more than 50 member countries, and delivered 8 regional workshops. The IMF’s fiscal risk assessment tools have been applied in around 40 countries over the past two years and fiscal risk assessments have been undertaken as part of 35 Fiscal Transparency Evaluations completed since 2014. Some of the IMF's capacity development reports have been published, read more about them here.

Note: Country borders or names do not necessarily reflect the IMF’s official position.

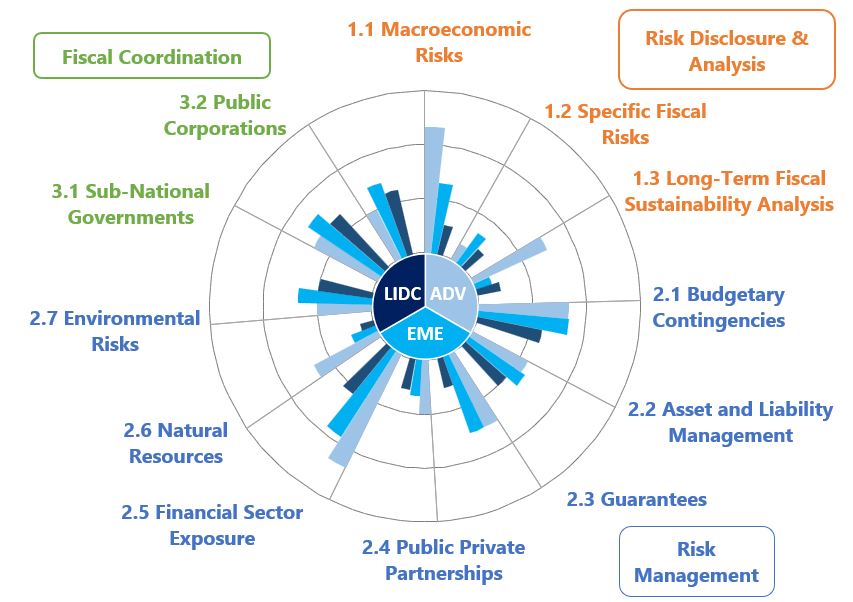

IMF Fiscal Transparency Evaluations of Fiscal Risk Analysis, Disclosure and Managements Practices

(Average scores by income group)

Source: IMF Fiscal Transparency Evaluations (multiple years).

Notes: 3 = advanced practices; 2 = good practices; 1 = basic practices.

AE= Advanced Economies; EME= Emerging Markets and Middle-Income Economies; LIDC= Low-Income Developing Countries.