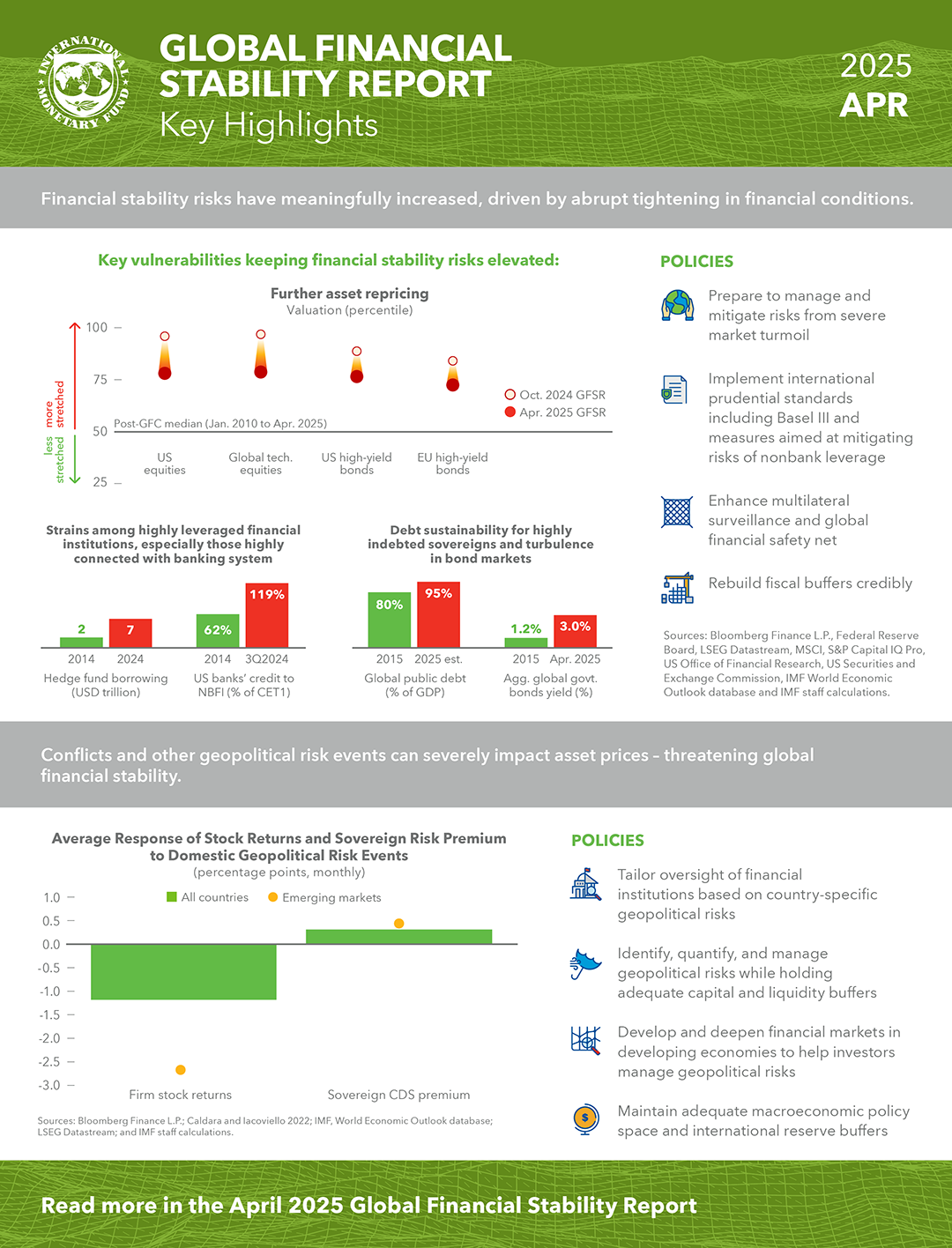

Global financial stability risks have increased significantly, driven by tighter global financial conditions and heightened trade and geopolitical uncertainty.

Against the heightened volatility of asset prices, Chapter 1 assesses that global financial stability risks have increased significantly. This assessment is supported by three key forward-looking vulnerabilities: (i) valuations remain high in some key markets; (ii) some highly leveraged financial institutions and their nexus with banking systems; and (iii) risks of market turmoil and challenges to debt sustainability for highly indebted sovereigns.

Chapter 2 shows that major geopolitical risk events can trigger a significant decline in stock prices and raise sovereign risk premiums, thereby posing a potential threat to macro-financial stability.

The assessments and analyses in this GFSR are based on financial market data available to IMF staff through April 15, 2025, but may not reflect published data by that date in all cases.

Chapter 1: Enhancing Resilience amid Global Trade Uncertainty

Chapter 2: Geopolitical Risks: Implications for Asset Prices and Financial Stability

Publications

December 2025

Finance & Development

- More Data, Now What?

Annual Report 2025

- Getting to Growth in an Age of Uncertainty

Regional Economic Outlooks

- Latest Issues

Transcript

Transcript