How Knowledge Spreads

More rapid diffusion of know-how is an important benefit of globalization

A Chinese company built a 10-house village with a 3-D printer in less than one day in 2014. A stretch of solar-power highway that converts sunlight into electricity and transfers it directly to the power grid opened in Jinan, eastern China, just last year. And a few years back, Korea switched on a road that wirelessly recharges online electric vehicles as they drive over it. These are just a few examples of the impressive technological advances that countries like Korea and—more recently—China have made in recent decades.

Until recently, production of the global stock of knowledge and technology was concentrated in a few large industrialized economies. From 1995 to 2014, three-quarters of the world’s patented innovations originated in the Group of 5 (G5) technology leaders—namely the United States, Japan, Germany, France, and the United Kingdom. With globalization and advances in information technology, however, the potential for knowledge to travel faster and further has increased dramatically, opening up greater opportunities for emerging market economies to learn from other, technologically advanced, countries and build their own innovation capacity.

In our research, which builds on the work of Giovanni Peri (2005), we examine the strength of technology diffusion and its evolution over the past two decades and the implications of these developments for the innovation landscape. Understanding exactly how this diffusion takes place is essential: technology transfer is the key to spreading knowledge and lifting incomes and living standards across the world.

New innovators emerging

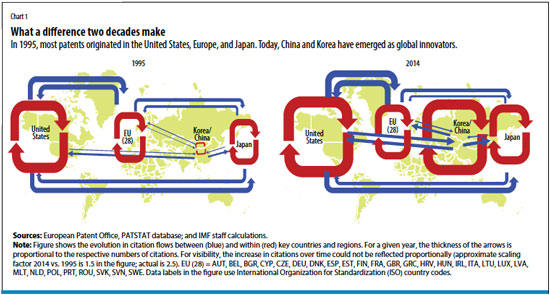

When inventors file a patent application to protect their intellectual property, they must cite related prior knowledge on which their innovation builds, such as patents from other inventors. The number of cross-patent citations is therefore a direct measure of knowledge flows. Our research examined citations obtained from the worldwide patent database PATSTAT covering more than 100 million patent documents. This measure is not without drawbacks and does not capture all knowledge flows—for example, it excludes hard-to-measure informal knowledge flows and patent infringement. However, it is a good starting point for gauging the spread of know-how across countries, as it is measurable and recorded systematically (see Chart 1).

In 1995, the United States, Europe, and Japan dominated global patent citations, but in more recent years, Korea and China have made increasingly large use of the global stock of knowledge as measured by their patent citations.

A more formal analysis of these cross-patent citations—to estimate the intensity of knowledge diffusion—also shows that the share of knowledge spreading from the G5 technology leaders to emerging market economies (beyond China and, formerly, Korea) has increased over the past two decades. In contrast, the share of knowledge that radiates from the G5 to other advanced economies has been broadly flat—even declining somewhat since the global financial crisis.

Emerging market economies have been able to capitalize on this greater access to global knowledge to enhance their innovation capacity and productivity. Knowledge flows from the G5 are found to give a significant boost to domestic innovation (as proxied by patenting) and productivity in both advanced and emerging market economies. For example, a 1 percent increase in knowledge flows from the G5 is associated on average with about a 1/3 percent increase in patenting activity by the recipient country-sector if the amount of domestic research and development (R&D) is held constant. And the strength of this effect has increased over time, especially for emerging market economies.

R&D’s role

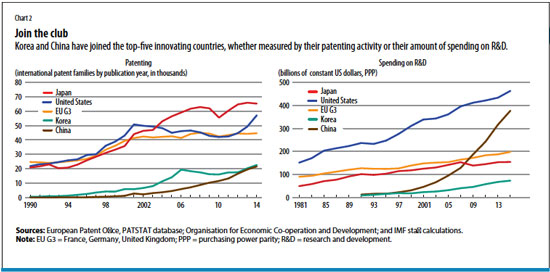

As a result of this catch-up, new global innovators have emerged. Although our results apply broadly to emerging market economies, Korea—an advanced economy since 1997—and China stand out, in part because they are large economies. Both have joined the top-five innovating countries, whether measured by their patenting activity or their amount of spending on R&D (see Chart 2). This success in part reflects learning through knowledge and technology transfer, but it was also made possible by substantial investment in domestic R&D and more generally by education that increased people’s ability to understand and apply that technology.

Domestic R&D serves a dual purpose—it can spur the development of new technologies and also help countries absorb existing foreign technologies. According to the Organisation for Economic Co-operation and Development—the main source for these data—China has increased its spending on R&D ninefold since the early 2000s, to $375 billion a year (in constant and purchasing-power-parity- adjusted terms). Its R&D spending is now second only to that of the United States ($460 billion) and is much larger than Japan’s ($150 billion). Korea, at $70 billion a year, spends close to the average of large European countries such as France, Germany, and the United Kingdom.

Another measure of the rise of Korea and China is growth in their patenting activity. An examination of international patent families—using a patent-count measure that includes only applications to at least two distinct patent offices, in order to exclude low-value patents—shows that China and Korea each patent about 20,000 inventions a year. Although this is still substantially below patenting in Japan and the United States (about 60,000 each), patenting activity in China and Korea is comparable to the average of France, Germany, and the United Kingdom. A deeper investigation into the types of patents by economic sector reveals that the rise of patenting in China and Korea is particularly pronounced in the electrical and optical equipment sectors and, in Korea, for machinery equipment as well.

Competition: good or bad?

The emergence of Korea and, more recently, China as global innovators is a striking development that promises to lift living standards for a large share of the global population. But do these developments discourage innovation in the traditional technology leaders, and could that have contributed to the global productivity slowdown? Our research does not address this question directly, but we do not believe that it has. Here’s why.

First, technology leaders benefit both directly and indirectly from exporting their technology and knowledge. They benefit directly by selling their technologies (whether embodied in machinery or through the licensing of patents) to other countries. Of course, this assumes that intellectual property rights are respected so that the acquirer pays a fair price for the technology. But technology leaders can also benefit indirectly: higher productivity in other economies means higher incomes, which fosters demand for exports more generally, including from traditional technology leaders.

Second, and more subtly, an important characteristic of knowledge—unlike most goods—is that it is a “nonrival” good. The fact that one person knows something and uses that information does not prevent others from knowing and improving on it. Knowledge gained, then, from past research efforts—whether domestic or foreign—is expected to increase the productivity of future research efforts (Grossman and Helpman 1991). As inventors in China and Korea develop new ideas and add to the global stock of knowledge, innovators in the traditional technology leaders (and, of course, the world more generally) can also benefit from that new knowledge.

Cross-patent-citations data suggest that this knowledge snowballing may already be taking place: for example, inventors in G5 countries increasingly cite Chinese patents. These citations are today approaching the same order of magnitude as those from G5 to other advanced economies. In our analysis, we find that knowledge flows are not one-directional from technology leaders to other countries. Traditional technology leaders benefit from each other’s innovations and reap even greater benefits than other (nonleader) countries do (Chen and Dauchy 2018).

Third, growing competition from China and other emerging market economies in global markets has been a stimulating force for innovation and technology diffusion. Although the relationship between competition and innovation is complex, our analysis shows that, for most countries and sectors, increased competition—measured either by import penetration from China or by the decline in global sales concentration associated with the rise of emerging market firms—has spurred innovation and adoption of foreign technologies. This evidence is based on the experience of advanced and emerging market economies outside the G5, but it nevertheless suggests that competition has been a positive force for innovation.

Level playing field

A look at trends in US innovation shows that aggregate R&D spending has continued its robust rise. Patenting activity and total factor productivity, however, show signs of leveling off. But this reduced productivity growth more likely reflects a temporary slowdown in innovation during the transition between two major innovation waves—the mid-1990s information and communication technology revolution and the much-anticipated automation and artificial intelligence revolution (Brynjolfsson, Rock, and Syverson 2017). Other structural and cyclical factors also likely contributed (Adler and others 2017).

In summary, technology diffusion and the emergence of new global innovators probably do not harm traditional innovating countries; competition has long been a key driver of ingenuity and innovation. But a fair and level playing field is essential: intellectual property rights must be well designed and enforced. Many G5 country concerns—especially with respect to China—revolve around forced transfer of technology at nonmarket, unfavorable terms in exchange for access to one of the largest and fastest-growing markets in the world.

Ultimately, innovation and technology diffusion are best served by respect for intellectual property rights. Without it, the world could see breakthroughs decline when innovators are unable to recoup their costs. Protection of intellectual property rights is no less important for emerging market economies if they want to benefit from multinationals’ technology transfer and their own inventors’ ingenuity. The explosion of Chinese patenting is perhaps an encouraging sign that, as the country develops valuable innovations of its own, it will come to recognize the value of intellectual property protection.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.