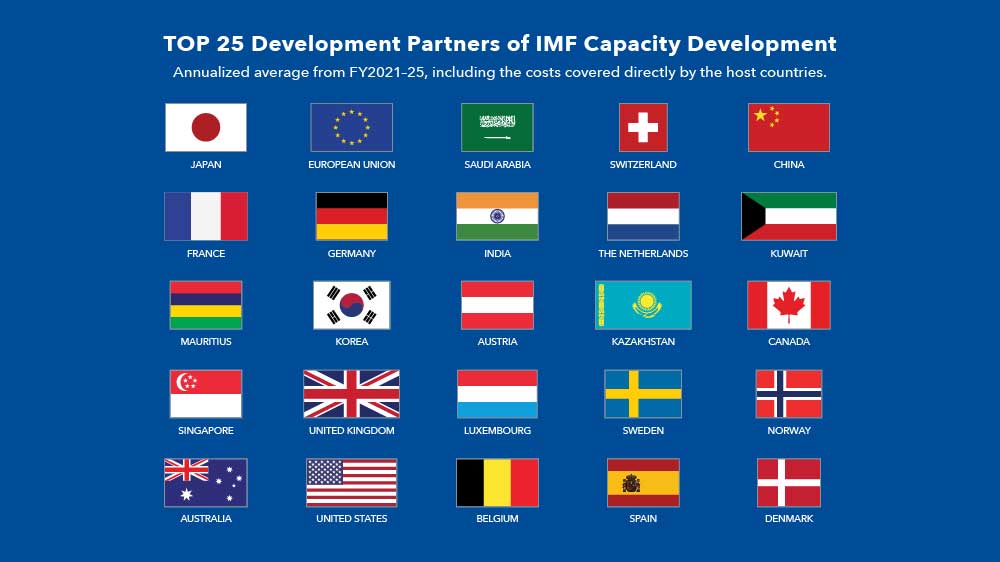

Our Partners

The IMF’s knowledge sharing efforts are demand-driven, meaning initiated by our member countries. Amid global economic challenges and the international community’s commitment to the Sustainable Development Goals, this demand has increased substantially in recent years. The IMF provides support to almost the entire membership of 191 countries.

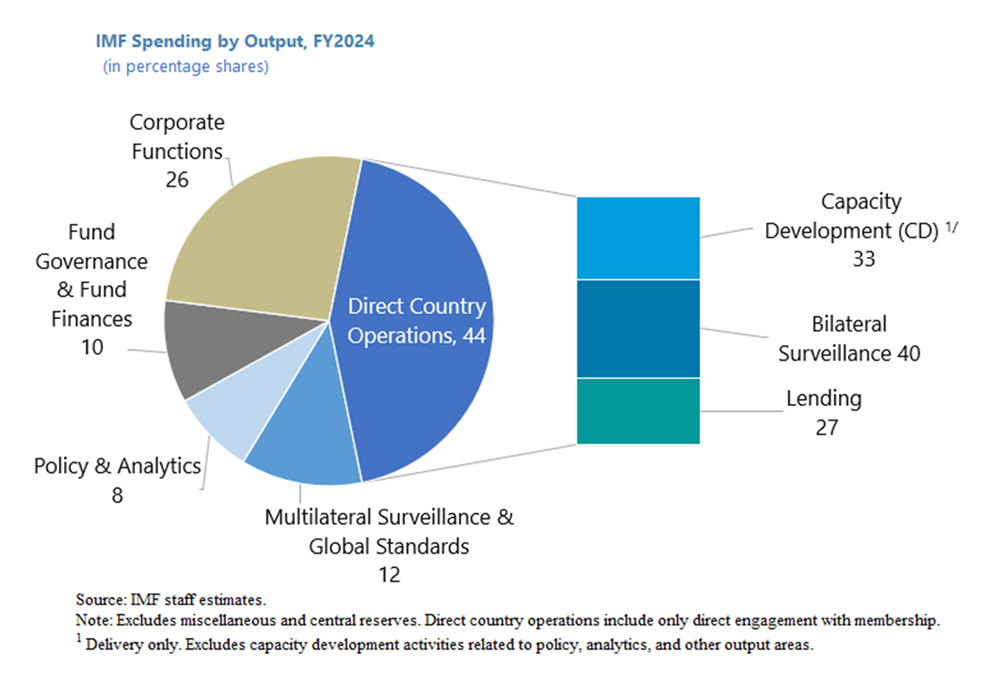

The IMF contributes a significant amount of its own resources to ensure that demand is met. Bilateral and multilateral partners also play a vital role in meeting this demand, and presently finance about one half of the IMF’s knowledge sharing efforts. Partners contribute to the IMF’s knowledge sharing work in a variety of ways — via our global network of regional capacity development centers and thematic funds focused on specialized areas, or through bilateral programs.

Japan

In 1990, Japan became the first partner to support the IMF’s capacity development efforts and is currently its single largest contributor, providing $807 million in funding to date. More than 100 IMF member countries across the globe have benefited from Japan’s support.

In fiscal year 2023 (FY2023), the Government of Japan provided a new contribution of $13 million to finance a large portfolio of 33 bilateral programs. In the past five years, Japan has consistently been responsible for about one-third of all external financing to IMF CD.

Japan-funded IMF programs address countries’ CD needs and are consistent with Japan’s international cooperation priorities and the IMF’s commitment to the Sustainable Development Goals (SDGs). Programs typically address fiscal issues, monetary and capital market reforms, macroeconomic statistics, and macroeconomic management.

Learn More: Forecast into Action: Building Capacity in Macroeconomic Policy Analysis through Japan’s Partnership (brochure, November 2025) 2025 Annual Report: English | Japanese 2024 Annual Report: English | Japanese 2024 JSA Evaluation: English 2023 Annual Report: English | Japanese 2022 Annual Report: English | Japanese 2021 Annual Report: English | Japanese 2020 Annual Report: English | Japanese 2018 JSA Evaluation: English |

European Union

The EU-IMF partnership promotes shared objectives to support economic growth in Africa and improve revenue mobilization and effectiveness of public spending in developing countries.

With steadfast support to regional capacity development centers and global thematic funds, as well as bilateral programs, the partnership covers a broad range of issues related to good economic governance and institution building, as well as related human capacity development needs, thus helping countries achieve sustained progress toward the Sustainable Development Goals (SDGs). The IMF also collaborates with the EU to support its Member and Accession states to build strong institutions and policies. Since 2006, the EU has contributed about US$388 million to IMF capacity development.

Learn More: The European Union-International Monetary Fund Capacity Development Partnership (brochure, January 2026) The European Union-International Monetary Fund Capacity Development Partnership (brochure, July 2024) The European Union-International Monetary Fund Capacity Development Partnership (brochure, June 2023) |

Saudi Arabia

The Saudi Arabia—IMF Capacity Development Partnership is built upon three pillars. First, the meaningful expansion of capacity development work in the Middle East, North Africa and Pakistan, through the activities of the IMF Regional Office in Riyadh, as well as capacity development delivered by the Middle East Technical Assistance Center and the Somalia Country Fund. Second, support for urgent and important capacity development in sub-Saharan Africa, delivered through the IMF’s network of Regional Capacity Development Centers in Africa. And third, capacity development in IMF global priorities, through support to our network of global thematic funds, focused on public finance, financial sector stability, anti-money laundering and statistics.

The Saudi Arabia—IMF Capacity Development Partnership is built upon three pillars. First, the meaningful expansion of capacity development work in the Middle East, North Africa and Pakistan, through the activities of the IMF Regional Office in Riyadh, as well as capacity development delivered by the Middle East Technical Assistance Center and the Somalia Country Fund. Second, support for urgent and important capacity development in sub-Saharan Africa, delivered through the IMF’s network of Regional Capacity Development Centers in Africa. And third, capacity development in IMF global priorities, through support to our network of global thematic funds, focused on public finance, financial sector stability, anti-money laundering and statistics.

The Regional Office Riyadh delivers support to economic policymaking in the Middle East, enhancing the IMF’s regional presence and its dialogue with the region’s policymakers, through conferences, workshops and outreach events. Fragile states are a key priority of the IMF’s capacity development work.

Learn More: 2025 Annual Report: IMF–Kingdom of Saudi Arabia Partnership on Capacity Development |

Switzerland

Since 1997, Switzerland, through its State Secretariat for Economic Affairs (SECO), has partnered with the IMF on capacity development, and has a large bilateral program of projects supporting capacity development in Swiss priority countries. As an early supporter of IMF multi-partner initiatives, it has contributed to regional capacity development centers in Africa and global thematic funds focused on key topics. The country’s support promotes economic stability and sustainable growth, helping countries reduce poverty. Switzerland has contributed approximately US$170 million towards IMF capacity development to date.

Funds for Capacity Development

The IMF’s thematic funds demonstrate a strategic and specialized approach to capacity development, addressing key areas such as fiscal policy, data quality, debt management, financial stability, and anti-money laundering. Learn more here.

These thematic and country funds support the IMF’s knowledge sharing on topics that are closely linked to the Financing for Development agenda and are delivered across all geographic regions. They include:

Funds for Capacity Development | Partners |

|---|---|

| Global Public Finance Partnership | Belgium, Denmark, European Union, France, Germany, Japan, Luxembourg, The Netherlands, Norway, Saudi Arabia, Sweden, Switzerland, United Kingdom |

| Revenue Mobilization (RM) | Australia, Belgium, Denmark, European Union, France, Germany, Japan, Korea, Luxembourg, the Netherlands, Norway, Sweden, Switzerland, United Kingdom |

| Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) | Canada, France, Germany, Italy, Japan, Luxembourg, the Netherlands, Qatar, Saudi Arabia, Switzerland, United Kingdom |

| Managing Natural Resource Wealth (MNRW) Fund | Australia, European Union, the Netherlands, Norway, Switzerland, United Kingdom |

| Debt Management Facility III (DMF III) (joint with World Bank) | Austria, European Union, France, Germany, Japan, the Netherlands, Norway, Switzerland, United Kingdom, United States, and African Development Bank |

| Tax Administration Diagnostic Assessment Tool (TADAT) | France, Germany, Japan, the Netherlands, Norway, Switzerland, United Kingdom |

| Data for Decisions (D4D) | China, European Union, Germany, Japan, Korea, Luxembourg, the Netherlands, Norway, Switzerland |

| Financial Sector Stability Fund (FSSF) | China, Germany, Italy, Luxembourg, Saudi Arabia, Sweden, Switzerland, United Kingdom, Germany, European Investment Bank |

Updated June 2024

The International Monetary Fund (IMF) launched the Global Public Finance Partnership in January 2024. This new strategic CD initiative covers all areas of public finances in which the IMF provides CD support to its member countries. It will integrate the IMF’s fiscal CD operations (including the Revenue Mobilization Thematic Fund, the Tax Administration Diagnostic Assessment Tool [TADAT], and the Managing Natural Resource Wealth [MNRW] Fund), combining under one roof its leading global expertise on domestic revenue mobilization, public spending, and public financial management.

Building sound economic institutions and developing the skills to sustain them is a key priority for fragile states.

Through the Somalia Country Fund, the IMF provides necessary capacity development to Somalia as the country strengthens its operating and technical capacity to make economic and financial institutions become more effective, transparent, and accountable. The Somalia Country Fund started its second five-year phase in 2021. Since its inception, it has benefitted from the support of Canada, the European Union, Italy, Sweden, the United Kingdom, the United States, and the Arab Fund for Economic and Social Development.

Through the Ukraine Capacity Development Fund launched in Kyiv in February 2024, the IMF scales up technical assistance and training in support of the Ukrainian government’s ambitious economic and financial reform agenda. It focuses on core areas of the authorities’ agenda, well aligned with reforms under Ukraine’s Extended Fund Facility-supported program. These include: fiscal reforms (including revenue mobilization, public financial management, and expenditure policy); monetary policy; financial sector policies; strengthening financial integrity and tackling corruption; strengthening data compilation and dissemination; as well as country-tailored training and technical assistance on macroeconomic frameworks. The Ukraine Capacity Development Fund is supported by the following donor partners: Canada, European Union, Ireland, Japan, Latvia, Lithuania, The Netherlands, Poland, Slovakia, and Switzerland.