IMF ANNUAL Meetings Update | OCTOBER 14, 2022

In the final recap for Friday, October 14, we discuss the outcome of the IMFC meeting, the economic outlooks for Asia, Europe, and sub-Saharan Africa, CBDCs for financial inclusion, and much more as we mark the end of the IMF-World Bank Annual Meetings.

ADAPTING TO A SHOCK-PRONE WORLD

The world is entering a new danger zone, one that is more prone to shocks that can quickly knock countries off course, Managing Director Kristalina Georgieva told officials from the IMF’s 190 member countries during the plenary session of the 2022 Annual Meetings. “After navigating extraordinary challenges over the past two-and-a-half years, further extraordinary challenges lie before us. Indeed, the path ahead is likely to be just as tough, if not tougher.” She added that bringing down inflation while formulating the appropriate fiscal policy was key. “Policymakers have an incredibly narrow path to walk—there is no room for missteps.” Facing the future, the right choices “begin with a more proactive, precautionary mindset to build resilience in a more shock-prone world.” For its part, Georgieva said, the IMF will continue adapting to the changing world, exploring all options to make sure it can support the evolving needs of its members.

IMFC Urges End to Russia's Invasion OF UKRAINE

The International Monetary and Financial Committee, which provides strategic direction to the IMF, concluded its meeting with a call to put an end to Russia’s invasion of Ukraine. In a subsequent press briefing, IMFC's Chair and Spain's economy minister, Nadia Calviño, said, "Peace is the most important economic policy tool right now." The war has worsened the economic crisis, slowing down growth and generating inflation, volatility, energy and food insecurity, and uncertainty. Fighting inflation and protecting the most vulnerable people while managing economic challenges remains the top priority, the IMFC said in a Chair’s statement. The IMFC also called for an urgent deepening of multilateral cooperation and, in coordination with global bodies and partners, agreed to work together to overcome the food crisis, including by lifting export restrictions on food and fertilizers.

CBDCs for Financial Inclusion

Nearly 24% of the world's adult population remains unbanked. Central Bank Digital Currencies could potentially bridge this gap, but significant policy, regulatory, design, and financial literacy challenges remain unresolved. Three distinct user groups—those without a bank account, smartphone, or access to internet—stand to potentially benefit from CBDCs, extending the reach of banking systems. “It makes inclusion faster, and it actually spreads it,” said Brookings Institution’s Vera Songwe at a seminar on Friday. But CBDCs can't solve every challenge in financial inclusion, said IMF's Deputy Managing Director, Bo Li. “CBDCs needs to go in a package to support awareness and generally when it comes to digital technologies…the private sector and the public sector have to walk hand in hand,” added BIS’ Innovation Hub head, Cecilia Skingsley.

Quote of the Day

Peace is the most important economic policy tool right now.

NADIA CALVIÑO, IMFC CHAIR AND SPAIN’S FIRST VICE PRESIDENT

Regional Outlook: Asia

Asia’s economy remains a relative bright spot versus much of the world, but the region still faces headwinds from rising global interest rate hikes, the war in Ukraine, and the economic slowdown in China. That was the main message in a press briefing by Krishna Srinivasan, director of the IMF’s Asia and Pacific Department, and two top deputies, after new forecasts released this week downgraded the region’s growth forecasts to 4% this year and 4.3% next year. There’s also a sharp rise of inflation across region that’s broadening to core inflation, Srinivasan noted. It’s important for central banks to tackle inflation head-on so expectations are anchored, and they remain credible, he said.

Regional Outlook: Europe

Russia’s invasion of Ukraine is taking a growing toll on Europe’s economies as a terms-of-trade shock from spiking energy prices has led to a cost-of-living crisis, Alfred Kammer, the director of the IMF’s European Department, told a press conference. Economic growth in advanced Europe is forecast to slow from 3.2% in 2022 to 0.6% in 2023—a downward revision of 0.7 percentage points from previous projection. In emerging European economies, growth is expected to fall from 4.3% to 1.7% in 2023—a downward revision of 1 percentage point. In the current environment, European policymakers face severe trade-offs and tough policy choices, Kammer said.

Africa’s Growth Abruptly Interrupted

The immediate challenge for governments is managing the food security crisis with tightening monetary conditions. Inflation in about 40% of the region's economies has risen to double-digits, while debt service costs are mounting. The combined effect of the debt and cost-of-living crises has pushed some countries into debt distress. Abebe Selassie, Director of the African Department, highlighted that policymakers most worry about, just how badly vulnerable households are being impacted and squeezed by developments like the sharp increase in food prices. He suggested countries target support to vulnerable households, rather than implement generalized subsidies, supplemented with investments in health and education.

Number of the Day

76%

Over the last decade a quarter of the world's adult population has gained access to financial services. Today 76% of adults globally are in some way financially included.

Learn more

BEHIND-THE-SCENES

Her Majesty Queen Máxima of the Netherlands delivers the opening remarks at the IMF seminar: CBDCs for Financial Inclusion: Risks and Rewards.

U.S. Treasury Secretary Janet Yellen briefs press at the 2022 Annual Meetings at the International Monetary Fund.

Managing Director Kristalina Georgieva, IMFC Chair Nadia Calviño, and UN Secretary-General António Guterres at the IMFC Plenary

The Flagship Reports in Rewind

World Economic Outlook

In this week’s World Economic Outlook, the IMF left its global growth forecast for 2023 unchanged at 3.2%, but lowered next year’s projection by 0.2 percentage points from July’s outlook to 2.7%. IMF's chief economist Pierre-Olivier Gourinchas told the press conference that inflation pressures were proving more persistent than anticipated and rapidly rising prices are causing serious hardship for households almost everywhere, particularly the poor.

Learn more

Global Financial Stability Report

Tobias Adrian, Director of IMF’s Monetary and Capital Markets Department, said that key gauges of systemic risk have risen. Speaking at the launch of the latest Global Financial Stability Report, he highlighted that there is a risk of a disorderly tightening in financial conditions that may interact with preexisting vulnerabilities.

Learn more

Fiscal Monitor

Launching the Fiscal Monitor on Wednesday, the IMF’s Vitor Gaspar said consistency between fiscal and monetary policy is paramount for economic and financial stability as high debts and deficits push more countries into budget crises. "Policymakers face painful trade-offs as the global economy goes through turbulent times, but most countries should stay the course by tightening fiscal policy further."

Learn moreUpcoming Events

The World of Finance. Where are the Women?

This high-level panel will bring together leaders in finance for a lively conversation to make the case for why more women are needed in the financial sector.

Event Details

Per Jacobsson Lecture: Joined at the Hip

Raghuram Rajan, professor of Finance at the University of Chicago’s Booth School, explains why climate action and continued globalization are joined at the hip.

Event Details

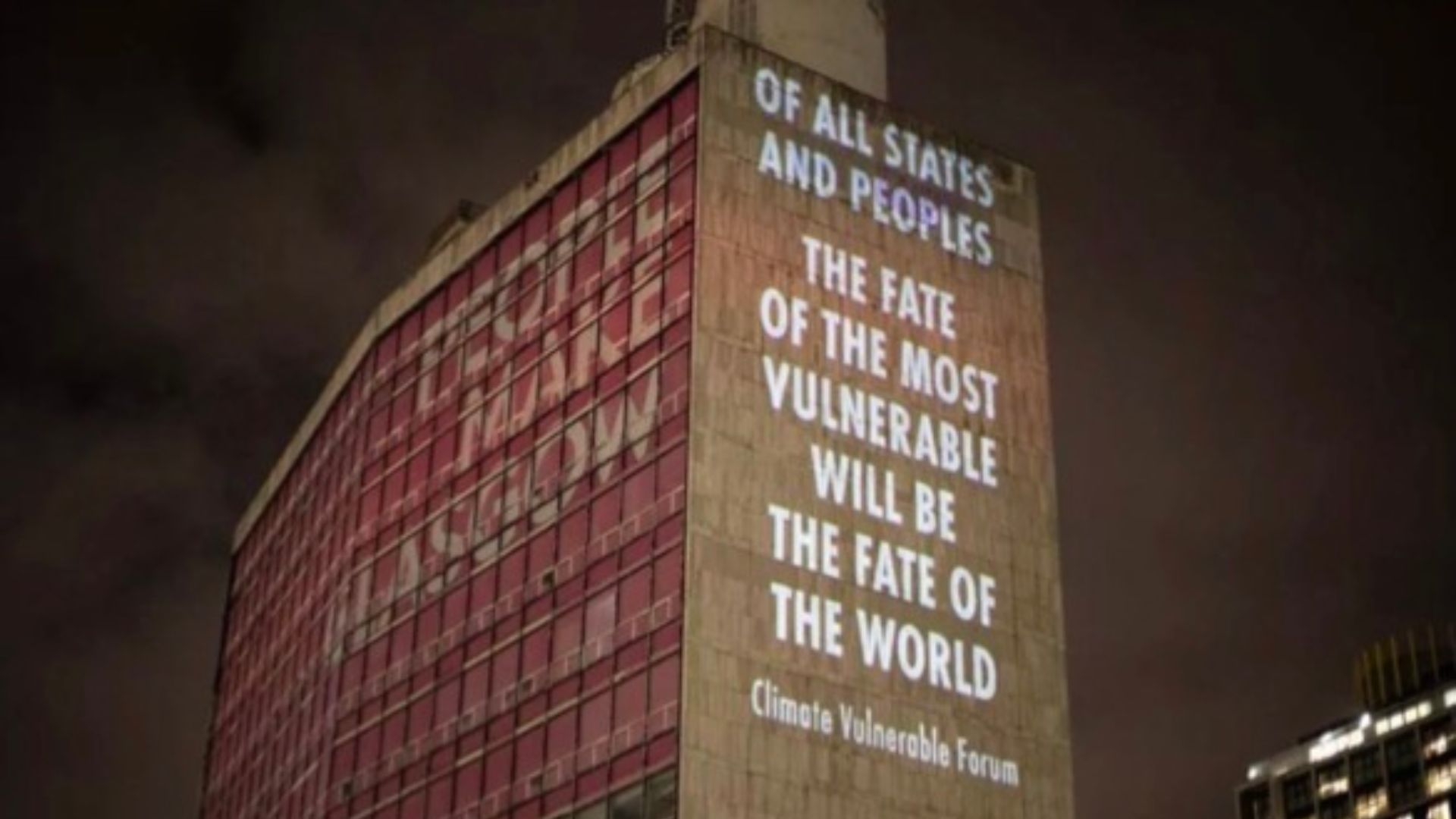

V20 Ministerial Dialogue IX

A high-level meeting: “When is Now?” for a Fit-for-Climate Financial Architecture for a Planet on Fire.

Event Details