IMF ANNUAL Meetings Update | OCTOBER 11, 2023

In the third daily recap on the Annual Meetings in Marrakech, today, October 11, 2023, we spotlight the challenges of containing global warming while keeping public debt in check, the disproportionate impact of shocks on the world’s poorest nations, the IMF’s continued support for Ukraine, and much more.

World Must Contain Global Warming While Keeping Debt in Check

Countries will need a new mix of policies with carbon pricing at the center if they hope to deliver on global climate goals while avoiding soaring public debt, according to the IMF’s Fiscal Monitor report released Wednesday. “Current national objectives and policies will fail to deliver net zero emissions, with potentially catastrophic consequences,” Vitor Gaspar, director of the IMF’s Fiscal Affairs Department, told a press briefing. Scaling up the current mix of climate policies, which relies mainly on subsidies and other spending measures, could increase public debt by as much as 50 percentage points of gross domestic product by 2050, he said. Worldwide, debt levels are generally elevated, and borrowing costs are climbing, making it more difficult for countries to devote adequate budget space to climate action.

Poorest Countries Suffer Most In Shock-Prone World

The poorest countries have been disproportionately affected by recent global shocks, IMF Deputy Managing Director Kenji Okamura told a seminar. In the past three years, low-income countries have seen a cumulative loss of more than 6% in real GDP, about five times more than advanced economies. Poor countries also face a historic funding squeeze due to tighter global financial conditions, elevated debt, and high sovereign spreads, Okamura said. “For the African continent alone, the IMF estimates the financing need for low-income countries to be $225 billion over the medium-term.” African Development Bank chief economist Kevin Chika Urama identified the current junction as an opportunity for shared prosperity for Africa and the world. “Over 30% of green minerals are found on the continent, so the future of the green transition also depends on how Africa utilizes that,” he said. Rania Al-Mashat, Egypt’s minister of international cooperation, said closing the Sustainable Development Goals gaps remains the best path forward.

Quote of the Day

We need to move from the culture of pointing fingers to the culture of holding hands. We are in this together.

IMF Managing Director Kristalina Georgieva, speaking at a climate-change seminar.

Continued support for Ukraine remains crucial, says IMF

President Volodymyr Zelensky thanked the international community for supporting Ukraine and emphasized the need for continued support at a ministerial roundtable, co-chaired by the Ukraine government, World Bank, and IMF. Priorities for the international partners include maintaining sanctions, supporting confiscation of aggressors’ assets, guaranteeing long term financial support, stimulating private investment, and boosting project financing. IMF Managing Director Kristalina Georgieva emphasized the IMF’s support for Ukraine—including through its Extended Fund Facility program—and applauded the authorities’ skillful economic management. She highlighted that while Ukraine’s economy is recovering faster than expected—with encouraging signs on growth and inflation—next year’s financing needs are higher than previously estimated. “Ukraine’s recovery can only be sustained with unwavering support.”

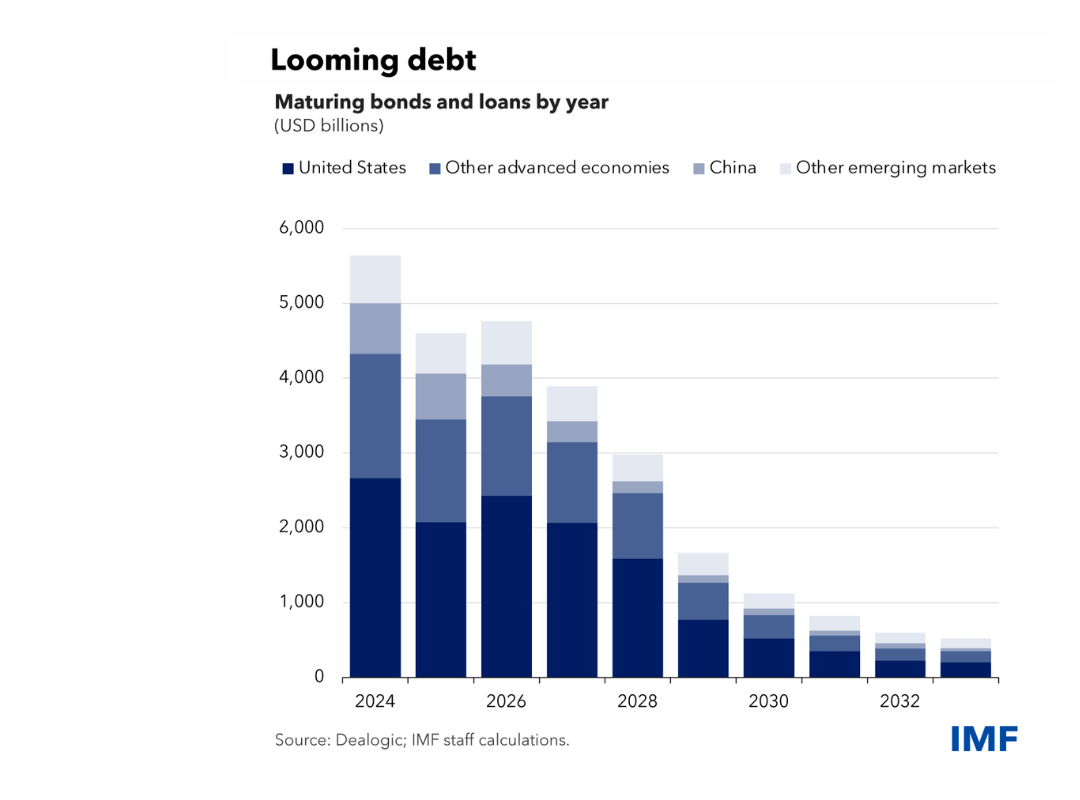

CHART of the Day

Increasing shares of small and mid-sized companies in both advanced and emerging market economies have barely enough cash to pay their interest expenses. As the Chart of the Day shows, these troubles are likely going to worsen in the coming year as more than $5.5 trillion of corporate debt comes due.

Learn more

Climate innovation CHALLENGE

One of the five winning teams of the Climate Innovation Challenge, an IMF-organized competition that started in 2021, launched their “Machine Learning Toolbox for Climate Policy Analysis” at a session on Wednesday. IMF researchers Yunhui Zhao and Li Tang described how their toolbox can identify large changes in carbon emissions and help policymakers address climate change. “The urgency of the climate crisis calls for bold policies,” IMF Deputy Managing Director Bo Li told the session.

Number of the Day

100% OF GROSS DOMESTIC PRODUCT

Slower economic growth, higher interest rates and pressure on primary deficits could drive global public debt to more than 100 percent of gross domestic product (GDP) by the end of the decade.

Learn more

Photos

Deputy Managing Director Bo Li heads to the Climate Innovation Challenge for the launch of an IMF-winning project analyzing emission patterns and mitigation policies.

Delegates gather for the start of the G20 Deputies Meeting.

Alessandra Sozzi delivers a presentation at an Analytical Corner event titled “Tracking Trade Disruptions from Space”.

Upcoming Events

Regional Economic Outlook for the Middle East and Central Asia

A press conference with Jihad Azour, director of the Middle East and Central Asia Department, to present the IMF's latest economic forecasts for the region, followed by a panel discussion.

Event Details

Boosting Growth with Domestic Resources: How to Pay for It All

The discussion will consider how to raise domestic resources in an economically sustainable manner, that imposes the least economic cost in terms of efficiency. The panel will also examine how to take advantage of emerging digital technologies and revenue sources.

Event Details

Reviving Growth and Shaping Transformations in Emerging Market and Developing Economies

The seminar explores the renewed need for well-designed and sequenced structural reforms—those aimed at improving the fundamentals of an economy—as a pivotal tool in accelerating growth and fostering sustainable structural transformations while mitigating immediate macro-policy trade-offs.

Event Details