Three Days at Camp David: How a Secret Meeting in 1971 Transformed the Global Economy

For the Caribbean, building resilience is a matter of survival

Besides their captivating beauty, one thing the Caribbean countries have in common is their vulnerability to frequent and costly natural disasters. Many are among the 25 most vulnerable nations in terms of disasters per capita or land area. Irma and Maria—the two Category 5 hurricanes that hit the Caribbean in September 2017—are the most recent tropical storms that have devastated the region, causing substantial loss of life and widespread destruction from the Turks and Caicos Islands to Dominica.

Natural disasters have massive economic and human costs: they take a deep toll on growth prospects and erode fiscal cushions. Huge reconstruction costs in their aftermath crowd out scarce resources for health, education, and social spending. And climate change will only intensify these risks. Countries can adopt policies to reduce the human and economic costs of disasters and build resilience to future shocks through better preparation and a more effective response.

High vulnerability

Since 1950, 511 disasters worldwide have hit small states—that is, developing economies with populations of less than 1.5 million. Of these, 324 were in the Caribbean, home to a predominant share of small states, killing 250,000 people and affecting more than 24 million through injury and loss of homes and livelihoods.

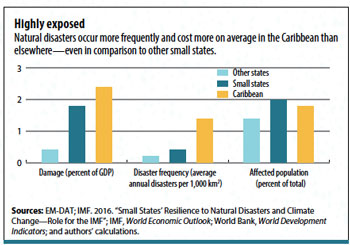

The Caribbean’s vulnerability is characteristic of small island states, but this region has typically suffered more damage than others. Average estimated disaster damage as a ratio to GDP was 4.5 times greater for small states than for larger ones, but six times higher for countries in the Caribbean. Moreover, the region is seven times more likely to be hit by natural disasters than larger states and twice as likely as other small states (see chart).

The economic cost of these disasters for the Caribbean is substantial, exceeding $22 billion (in constant 2009 dollars) between 1950 and 2016, compared with $58 billion for similar disasters globally. For some countries, the damage well exceeds the size of the economy: Hurricane Maria is estimated to have cost Dominica 225 percent of its GDP, while the hurricane damage for Grenada in 2004 was 200 percent of GDP, leaving huge reconstruction needs that can take years to fulfill.

Climate change is expected to compound the problem by making such disasters more frequent and severe. While the Caribbean accounts for a tiny part of greenhouse gas emissions globally, it is disproportionately more vulnerable to climate risks. Large shares of the region’s population live in high-risk areas with weak infrastructure. Moreover, their economies rely heavily on sectors sensitive to weather, such as tourism and agriculture, while capacity and resources to manage risk are limited. Recurrent floods, droughts, hurricanes, and rising sea levels pose a threat to agriculture and coastal areas and increase the risk of water and food insecurity. Climate-related disasters encourage migration, as noted by Michael Berlemann and Max Steinhardt in their 2017 paper “Climate Change, Natural Disasters, and Migration—A Survey of the Empirical Evidence.” This could become a significant policy concern for the Caribbean, where brain-drain poses a serious threat to growth.

Disasters have large and enduring economic effects that range from lost income to the destruction of physical and human capital, infrastructure, and property. Rebuilding provides a temporary boost, but indirect effects can spread throughout the economy and undermine investment, growth, and macroeconomic performance. Debt dynamics inevitably worsen as governments borrow to finance recovery and growth slows.

An analysis of 12 Caribbean countries with the largest damage costs relative to GDP since 1950 supports this view. Although most countries experienced reduced growth in the year of a disaster, they recovered in the subsequent year. But fiscal deficits increased in 7 of 12 countries, current accounts deteriorated, and debt-to-GDP ratios surged. In some, debt continued to rise, suggesting that exposure to frequent disasters interrupts efforts to sustain strong growth and improve public finances.

If these countries could reduce disaster damage, they might generate significant growth dividends and find their way out of the vicious cycle of high debt and low growth in which many are currently trapped.

An ounce of prevention

Preparing for disasters is generally more cost-effective than responding after the fact. The region must make it a priority to design adaptation measures that reduce the likelihood and cost of climate-related disasters and build resilience to future shocks. For a region so exposed to calamity, building such resilience is not a matter of choice but of survival.

The starting point is to assess the likelihood and potential impact of disaster and climate change risks. If these risks are deemed high, policymakers could integrate them explicitly into their policy frameworks and prepare plans to manage the exposure. Initiating information campaigns to raise awareness, setting up early warning systems, investing in disaster-resilient infrastructure, enforcing land-use and zoning rules to limit deforestation and coastal exposure, and ensuring appropriate building standards could go a long way toward reducing risks.

Risk cannot always be averted, however, and in those cases, countries should invest in ways to lessen the impact of disasters, including the following:

Self-insurance by building fiscal cushions can protect a country against a rainy day when it faces small but unpredictable financing needs. Building cushions in years when no disasters strike helps governments offset adverse effects when they do occur. Fiscal rules can provide the needed discipline to sustain buffers and guide policy. Several Caribbean states are establishing frameworks to self-insure systematically.

Insurance and hedging tools allow the public and private sectors to pool risk for moderate disasters, for which the cost of large buffers through self-insurance may become too high. They help protect governments from the economic burden of disasters and enhance their capacity to respond while reducing the pressure on public resources to cover private losses. These tools call for deeper and more developed financial markets that facilitate risk pooling, expand the insurance market, and provide access to financing for infrastructure projects that build resilience.

Innovative risk-sharing tools provide governments with additional relief in managing disaster risks. Parametric insurance bases payouts on the nature of a disaster and bypasses on-site loss assessment, offering quick relief. Risk pooling allows countries to share the high cost of insurance in developing markets. An example is the World Bank’s Caribbean Catastrophe Risk Insurance Facility— a regional fund that allows governments to limit the financial impact of natural disasters by providing quick liquidity when a major disaster strikes. Catastrophe bonds (cat bonds) are another risk-sharing tool that transfers the risk to markets in exchange for generous regular payments (coupons) and allows the issuer to forgo repayment of the principal if there is a major disaster.

Contingent lines of credit with bilateral, multilateral, and commercial creditors put financing in place before disaster hits, reducing funding uncertainty. The World Bank Catastrophe Draw-Down Option—a credit line that can be accessed after declaration of a state of emergency because of a natural disaster—offers middle-income countries immediate access to funds when liquidity is most scarce. This instrument has been used by several countries in Latin America, but there has been no uptake to date in the Caribbean, in part because of its cost and the stigma associated with borrowing.

Prepare for the worst

Better preparation should diminish the need for countries to finance the costs of rebuilding after disasters. But experience suggests that, despite the clear benefits of preparation, countries perennially underinvest in risk reduction and prevention.

Why is this so? Several factors may be at play. First, obtaining funds to prepare for a disaster is limited, given complex eligibility and disbursement criteria, information gaps, and the absence of coherent plans for access that may be hard to design in a low-capacity environment.

Second, insurance coverage remains low, given the high cost, shallow financial markets, limited competition, or when a particular disaster is not covered in the insurance contract. In Belize and Grenada, for example, insurance covered only 4.5 percent of the total damage in a recent large disaster.

Third, even though many Caribbean states subscribe to the Caribbean Catastrophe Risk Insurance Facility, payouts have been small compared with the costs, because countries simply cannot afford to pay for higher insurance coverage. Pooling risk to include other small states across the globe could reduce premiums, reflecting a lower risk that all countries will be hit by the same shock. The cat bond market for very large disasters is small and shallow, making cat bonds too expensive for a single country. While several Caribbean states are establishing contingency funds, more governments need to take these risks into account as they formulate policy.

When risk cannot be averted or mitigated at reasonable cost, relying on borrowing, external aid, or disaster-financing facilities from international financial institutions may be the only recourse. These options come with their own challenges, not least because most Caribbean countries have attained middle- or high-income status and do not qualify for financing at concessional rates of interest under the existing eligibility criteria. Moreover, the limits for financing facilities are typically low compared with the massive damages incurred.

The international community could make a difference by helping the region’s policymakers develop the capacity to manage risk. Advice could focus on designing systems to assess disaster and climate-change risks; developing affordable insurance and hedging markets; improving access to financing for preparation; and strengthening and diversifying economies so they can better absorb the economic impact of disasters.

Strengthening the Caribbean Catastrophe Risk Insurance Facility to broaden its capital base and membership as well as lower insurance premiums could help broaden insurance coverage. This instrument could also reduce insurance premiums for countries that make a concerted effort to prepare before disaster strikes.

Disaster financing should help countries reduce vulnerability and build resilience to shocks while rewarding efforts to prepare for and reduce risk. Some out-of-the-box thinking is needed to ensure that such financing holds both short- and long-term benefits and doesn’t exacerbate the region’s cycle of high debt and low growth.

This article draws on the 2017 book Unleashing Growth and Strengthening Resilience in the Caribbean by Trevor Alleyne, İnci Ötker, Uma Ramakrishnan, and Krishna Srinivasan.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.