The pandemic tests a new policymaking benchmark that includes civil society and social norms

Many workers deemed essential during the pandemic—such as those in eldercare, supermarkets, and distribution warehouses—are unable to make ends meet even in good times. And during the COVID-19 crisis the threat of serious illness has been added to low pay. Employers have required people to report to work—in meat-packing plants and restaurants—at grave risk to themselves and their families; their only recourse is to walk away from their jobs, risking their livelihoods.

These wrenching choices represent the collateral damage of the pandemic. Moral discomfort with the situation has spread even into economics—forcing the profession to confront ethical concerns that in ordinary times are consigned to religious leaders and philosophers. Along with the climate emergency, the pandemic has made it clear that market failure is now the norm not the exception, rendering the standard economic model anachronistic, much as massive and persistent joblessness in the Great Depression did for the idea that labor markets will equate supply to demand, eliminating unemployment.

The fallout from the pandemic will alter how we think about the economy and public policy—not only in seminars and policy think tanks, but also in the everyday vernacular people use to talk about their livelihoods and futures.

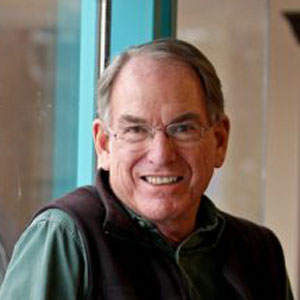

What students today care about hints at what a new economics paradigm might look like. Between 2016 and 2020 we asked 9,032 students in 18 countries, at the very beginning of their introduction to economics course, to name the most pressing problems today’s economists should be addressing (see Chart 1).

Their responses are shown above; the size of the font indicates the frequency of the response. The economics students cited inequality, climate change, and unemployment as top issues of concern between 2016 and 2020. A new benchmark model that is increasingly widely taught is already encouraging young people who care about these issues to stick with economics.

A new economic model alone will not change minds and policies. The successes of both the Keynesian New Deal and neoliberalism have taught us that a new economic model becomes a force for change when it is integrated into a powerful moral framework, illustrated by emblematic policy innovations, and articulated in everyday conversations.

Classical liberalism, for example, rested on commitments to order, equal dignity, anti-paternalistic liberty, and utilitarianism, which were synergistic with its economic model characterized by competitive markets, division of labor, and specialization. Free trade and antitrust policies were its hallmark. Ordinary discourse took up its truths, as when Alice whispered to the Queen (in Alice in Wonderland), “It’s done by everyone minding their own business.”

More recent economic paradigms were also founded on a synergy of complementary values and economic models.

For Keynesian economists, a commitment to reducing economic insecurity and raising the incomes of the less well-off through government programs and trade union bargaining was combined with a set of propositions about saving behavior, automatic stabilizers, and aggregate demand. Both the coherence and the rhetorical power of the Keynesian paradigm depended on the belief—very plausible under the circumstances—that the pursuit of its advocates’ egalitarian values through economic policy and organization would improve aggregate economic performance by supporting higher and more stable output and employment.

In like manner, what has come to be called neoliberalism advanced two normative pillars. The first was “freedom from” government coercion (rather than a more expansive “freedom to” and the absence of domination in private or public spheres). The second was a procedural view of justice, which deems outcomes—however unequal—as fair so long as the rules of the game are fair. Cementing neoliberalism’s philosophy to its economics was a view that people are individualistic and amoral—along with a representation of how they interact in the economy; namely, through exchange in competitive markets under complete contracts. Complete contracts, which cover all aspects of the exchange of interest and not only those of the exchanging parties, ensured against market failures arising from “spillovers” or “external effects,” such as epidemic spread or greenhouse gas emissions.

Extending the assumption of self-interested agents to the public sphere gave neoliberalism a view of public choice in which governments and other collective actors, such as trade unions, were simply special interest groups using up scarce resources in order to get a larger slice of a smaller pie. In this model of the economy, the limits on government that were advocated on philosophical grounds were also necessary for a well-functioning economy. The values and the model were brought together in emblematic policies such as school vouchers (allowing school choice) and a negative income tax (replacing antipoverty programs with direct government cash payments) and in memes such as “The government that governs best governs least.”

But integrating economic models and ethical values in a complementary manner does not alone allow a paradigm to succeed: for the advocated policies to work, the economic model must be a reasonable approximation of the empirical economy. Just as a changing economic reality spelled the demise of classical liberalism following the Great Depression, the Keynesian paradigm was challenged by the stagnant growth combined with inflation (so-called stagflation) of the 1970s. Similarly, disenchantment with neoliberalism strengthened after the global financial crisis of 2008, which appeared to many as the price to be paid for the market deregulation advocated by neoliberals. Disenchantment with laissez-faire individualism has since mounted in the face of growing inequality, the climate crisis—and now the pandemic.

To serve as a component of a new paradigm, a new benchmark economic model must take a position on fundamentals, including the economy as a component of the social system and biosphere, how we represent people as economic actors and decision makers, the key institutions that govern our interactions, and the characteristics of the technologies that underpin our livelihoods. Contemporary economics—the economics that researchers use and graduate students routinely are taught—provides a response on each of these dimensions.

The behavioral revolution in economics has taught us that people are neither omniscient nor entirely self-interested but are moved, as Adam Smith put it, by “moral sentiments” as well as material interests. Among those moral sentiments are dignity—the desire not to be taken advantage of by others—as well as ethical convictions and concern for others. These include not only altruism and reciprocity but also parochial intolerance and tribal hostility.

The way economics represents interactions among people has also undergone a fundamental transformation: we now recognize that most contracts are incomplete. The information economics pioneered by Friedrich Hayek and greatly extended in the past four decades to become a pillar of contemporary economics makes it clear that neither government nor private parties can stipulate in an enforceable contract the full range of what matters.

Effects on others—not covered by contractual provisions—are the rule, not the exception. These include not only the familiar market failures affecting our interaction with the biosphere, such as pollution, but also the central markets in a modern capitalist economy: for labor, credit, and information. In the labor market, for example, of great concern to both employees and employers is how hard and carefully a worker works. But there is no way to enforce or even specify this in a contract. In the credit market the promise to repay a loan can be included in the contract but may not be enforceable.

The incompleteness of contracts has wide-ranging consequences. Where they are incomplete, there will typically be excess supply or demand, even in highly competitive markets. Employers, for example, choose to pay wages higher than a worker’s next best alternative. This confers what economists call a rent on the worker, which means the worker is better off with the job than without. Fearing the loss of this rent is a powerful motive for the worker to implement the employer’s request to work hard and follow instructions. If it is costly to lose your job, then there must be potential workers who would prefer to have a job—namely, the unemployed.

In these interactions the exchange is governed in part by some combination of the contract, social norms (such as a work ethic on the part of the employee or truth telling by the borrower), and the exercise of power by the employer—or, in the case of the credit market, by the lender. Eight decades ago, Ronald Coase famously defined the employment contract as a transfer of power from the worker to the employer. An economic model recognizing this transfer of power—and able therefore to incorporate the abuse of employers’ private powers—gives policymakers a framework for addressing the plight of low-paid essential workers forced to choose between their livelihood and their health. Policy initiatives in this area range from expanding workers’ individual rights on the job to support for those who stay home so as to minimize the epidemic spread.

By extending economics to a new set of motivations—a commitment to justice, the demand for dignity and voice—the new benchmark economic model opens up a broader set of policy options. It offers changes to the rules of the game that can be implemented not only by market and government instruments but also by the exercise of private power and social norms.

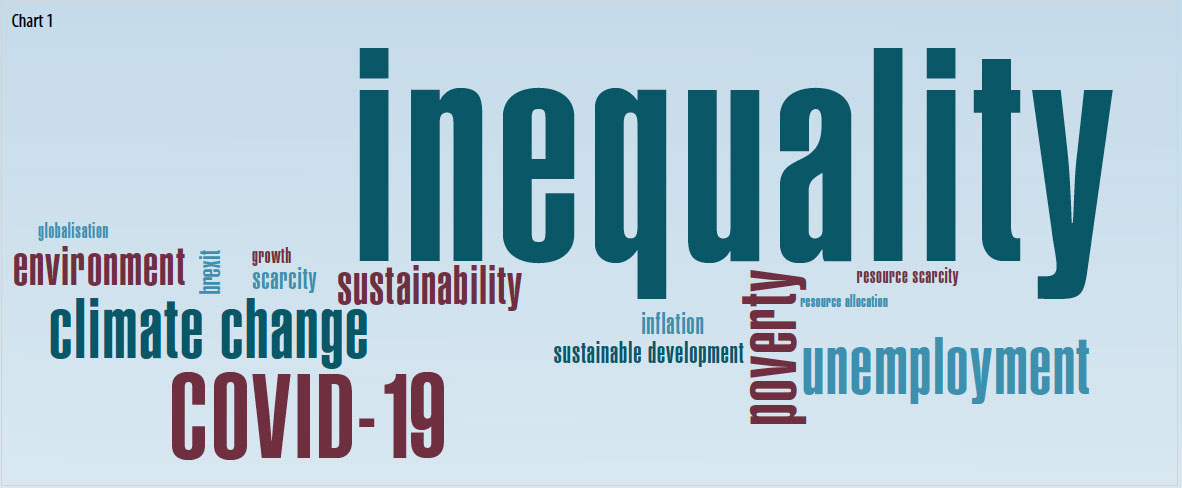

Take the policies “carbon tax and dividend” (in which the government sets a price on carbon emissions) and “cap and trade” (in which the government sets limits on emissions and lets the market determine the price). Each uses a different combination of state capacity and market mechanism to deliver lower carbon emissions, as shown by their different positions on the horizontal line in Chart 2. But this is a cramped one-dimensional continuum of policy options. It presumes that both private and government actors have sufficient information to design mechanisms adequate to address issues such as climate change—or a global pandemic. Its narrowness overlooks the opportunities for solutions involving a third dimension that arises from the social character of people and the power of social norms.

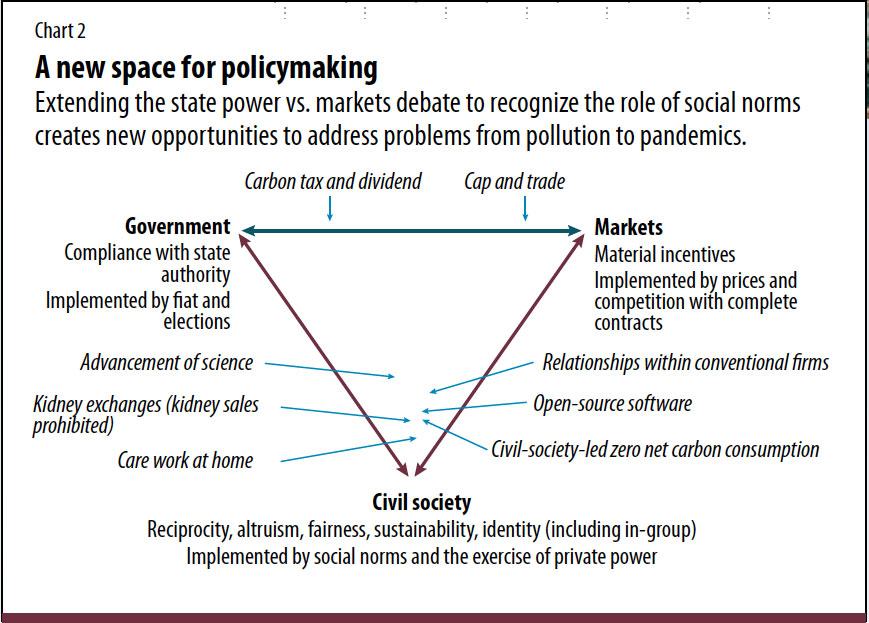

Chart 2 illustrates policies that combine motivation and implementation mechanisms of three poles that work in synergy rather than as substitutes: government, markets, and civil society. Such policies fall at various points inside the triangle. A position toward the center would use a mixture of all three mechanisms—for example, research, production, distribution, and population coverage of a vaccine for COVID-19 (see Chart 3).

As a result of the pandemic, ethical considerations are unavoidable, especially those of fairness and solidarity, even among strangers. Debates about who should have priority access to vaccines, and about which workers are essential during a pandemic, make it clear that we cannot rely on the price system or indeed compliance with government fiat to capture the values that matter to us.

The expanded space offered by the new economics benchmark provides an analytical framework integrating these ethical concerns with an economic model appropriate to a world in which people are connected not only by markets and contracts but also by the private exercise of power, the spread of infection, effects on the biosphere, ties of in-group membership, and a concern for the common good.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily represent the views of the IMF and its Executive Board, or IMF policy.