Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Turkey: Growth is Robust but More Structural Reforms are Needed

April 25, 2016

- Turkish economy did well in 2015

- But external imbalances persist

- Government should encourage private saving

Turkey proved resilient to outside turbulence and posted good growth figures recently. The IMF mission that assessed the country’s economic performance in 2015 acknowledges the achievement but warns of a high current deficit that could hamper growth in the medium term.

Street vendor pouring tea in Istanbul.

The economy is doing well, but more people should enter the formal market (photo: Marc Dozier/Hemis/Corbis)

Economic Health Check

IMF Survey talked about the details of the assessment with Turkey Mission Chief Antonio Spilimbergo and Senior Economist Gregorio Impavido.

IMF Survey: How could you summarize the findings of the mission in Turkey?

Spilimbergo: The Turkish economy did quite well in 2015, especially when compared with other emerging countries. The latest data confirm that the economy grew by 4 percent in 2015.

This growth was quite surprising because the Turkish economy confronted a series of negative factors last year. Like many emerging markets, it had to deal with capital outflows. In addition, some of the traditional export markets for Turkey, including Russia and the Middle East, performed poorly. Domestically, there were two elections with the political uncertainty that goes with them, and investment was weak. And, of course, the security situation was difficult, including a number of terrorist attacks. Despite these challenges, private consumption was resilient.

IMF Survey: What are the reasons for the sustained consumption?

Spilimbergo: There are several factors at play. First, oil prices kept falling, which is important as income not spent on fuel could be spent on other items instead. Second, many households have deposits in foreign currencies. These savings increased in value owing to the depreciation of the lira. Third, credit growth continued, even if at a slower rate. Fourth, the already large and increasing number of refugees contributed to the growth of domestic demand. Fifth, interest rates remained low. Finally, consumers probably brought forward their purchases of durable goods, especially cars, fearing that further depreciation would lead to price hikes. We project that private consumption growth will continue thanks to the very generous—30 percent—increase in the minimum wage, which affects over 8 million workers from the beginning of 2016.

IMF Survey: The IMF has already warned that Turkish households should save more. What happened on that front?

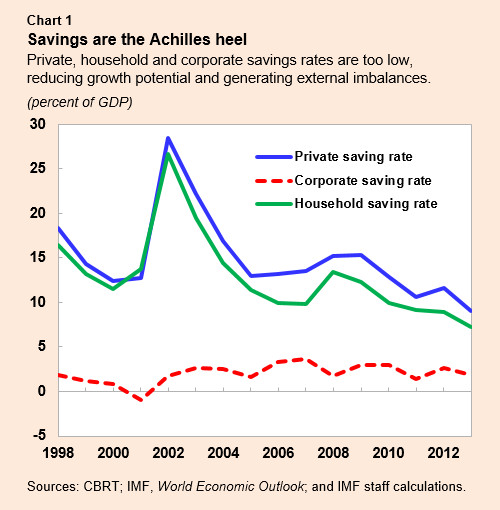

Impavido: The low private saving rate has been the Achilles heel of the Turkish economy for some time (Chart 1). This generates two problems: there is low investment to support high, job-creating growth and there is a need to tap foreign savings to fund whatever investment takes place. In other words, Turkey cannot generate income fast enough to catch up with the per capita income of advanced economies and it is highly indebted with the rest of the world through repeated and very large current account deficits. External debt and its refinancing remain the main challenges for Turkey: foreign debt amounts to 52 percent of GDP while gross financing needs around 25 percent of GDP every year.

And the current account deficit is here to stay. If we disregard the effect of falling oil prices, the current account balance has not improved, which is a sign that the economy is not getting more competitive. The deficit may increase when the oil price goes up again.

There are many structural reforms that could improve this outlook, for example, increasing domestic savings and competitiveness and, over time, boosting potential output. The government is fully aware of these challenges and is implementing a series of structural measures.

IMF Survey: With the Turkish government engaged in a rather ambitious structural reform agenda, what should the policy priorities be?

Impavido: There are two main directions for structural reforms in Turkey. The first is to deal with the external balance by increasing the domestic saving rate. The second is to increase potential output growth by improving the labor market. The Turkish labor market struggles with rapidly increasing labor costs, stagnant productivity, and a low employment rate, especially among women. Notice that Turkey has one of the lowest employment rates for women among countries at the same level of development, and it employs many people in low productivity sectors. Future growth rates could be higher if more people entered the labor force and skill mismatches got reduced.

Increasing the potential output growth will take some time, and the government has ambitious plans in this respect. But because of the high current account deficit and a large external financing need, the economy will remain exposed to external shocks. To mitigate these before structural reforms have an impact, we recommend to contain consumption by a tighter mix of monetary and fiscal policies.

IMF Survey: Let's return a bit to the role of monetary policy and the policy mix. You say that the monetary framework should be strengthened.

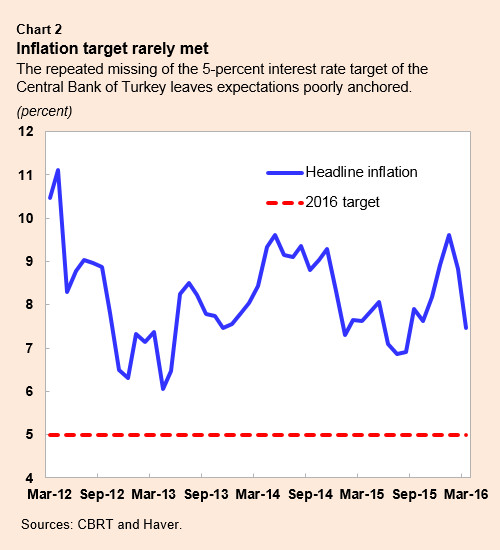

Impavido: The Central Bank of Turkey has an inflation target of 5 percent, but it has rarely met it (Chart 2). As a result, inflation expectations are poorly anchored. Unfortunately, the monetary framework is still unduly complicated with too many instruments at which liquidity is provided. Also, monetary policy has not been tight enough. We therefore recommend simplifying the monetary framework and, at the same time, tightening monetary policy to re-anchor expectations and lower inflation.

IMF Survey: The Syrian conflict spilled over to Turkey which hosts a growing number of refugees. At the same time, the country secured €6 billion in support from the European Union. Altogether what is the effect of the conflict on Turkish economy, and how should the country deal with the refugees?

Spilimbergo: Since the spring of 2011, about 2.5 million refugees moved from Syria to Turkey. This number could easily grow in the future as there are an estimated 8 million people internally displaced within Syria. The Syrian refugees already in Turkey represent about 3 percent of the Turkish population, which is a really large share. The impact of these refugees on the informal labor markets, real estate markets, business ownership, the government budget, schools and the like is difficult to measure The Turkish authorities estimate that there are sizable costs, paid by the state and through private organizations. The government estimates that the overall cost has gone over US$10 billion since 2011. Giving Syrian refugees the right to work, even if with some limitations, was an important and welcome step in January 2016.

Turkey mission team (left to right): Enrique Flores, Natalia Novikova, Alexander Tieman, Antonio Spilimbergo, and Gregorio Impavido (Photo: IMF)