Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : External Shocks Dim Growth Prospects for Caucasus, Central Asia

October 23, 2015

- Lower commodity prices, coupled with Russia’s slowdown, have reduced growth

- Depreciations help absorb shocks but inflation, financial concerns linger

- Fiscal consolidation, structural reforms vital for sustainable growth, economic stability

A wave of external shocks—primarily falling commodity prices, spillovers from Russia, and movements in major exchange rates—continue to weaken growth prospects and heighten financial vulnerabilities in the Caucasus and Central Asia (CCA) region, the IMF said in its latest assessment.

Currency exchange office in Almaty, Kazakhstan. Many CCA oil exporters have allowed exchange rates to depreciate to maintain competitiveness, says IMF (photo: Anatoly Ustinenko/ITAR-TASS/Corbis)

REGIONAL ECONOMIC OUTLOOK

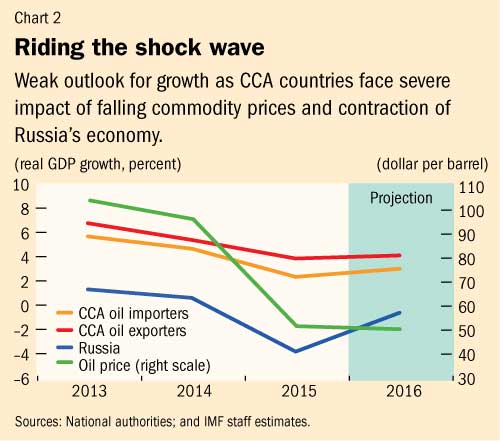

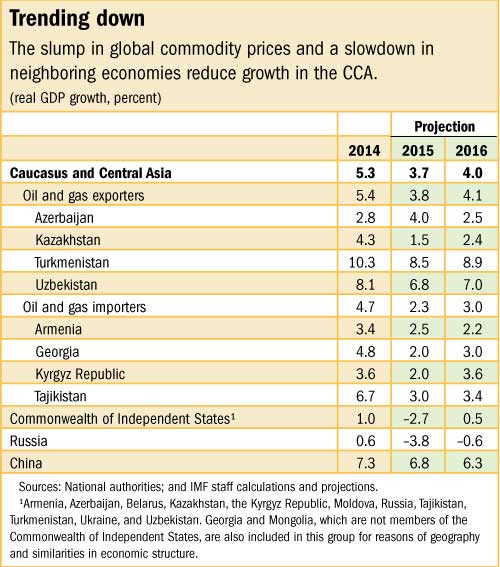

The IMF’s Regional Economic Outlook: Middle East and Central Asia, released on October 21 in Dubai and October 23 in Almaty, predicts growth in the CCA region as a whole to reach about 3¾ percent this year, 1½ percentage points lower than in 2014. Economic activity is expected to recover gradually, reaching 4 percent in 2016, on the back of an expected improvement in key trading partners such as Russia and those in the euro area, the report said (see table).

While some CCA countries deployed fiscal stimulus and allowed their currencies to depreciate to soften the immediate impact of external shocks, the report recommended accelerating structural reforms to boost potential growth. Greater exchange rate flexibility and medium-term fiscal consolidation were also emphasized to support stability over the medium term.

“The long-lasting nature of the shocks means that deeper and more durable policy changes will be needed,” Juha Kähkönen, Deputy Director of the IMF’s Middle East and Central Asia Department told reporters in Almaty, Kazakhstan. “Structural reforms would help move these countries to a higher growth path.”

Oil importers rocked by lower remittances and exports

In the CCA’s oil importers—Armenia, Georgia, the Kyrgyz Republic, and Tajikistan—growth will slow to 2¼ percent this year. That’s largely the result of the recession in Russia and the weakening of the ruble, which have had a severe impact on these countries, particularly through remittances and trade.

The drop in remittances is also erasing external gains from lower oil prices, and the current account deficit for these countries is expected to remain high at about 10 percent of GDP this year, the IMF said.

To ensure that public debt does not increase further, and to cultivate more inclusive growth, the report emphasized that oil importers should improve the quality of public spending and return to fiscal consolidation as soon as conditions allow, while preserving capital and social expenditure.

Oil exporters feel impact of lower oil prices

Growth in the oil exporters—Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan—will decline by 1½ percentage points to 3¾ percent in 2015 as economic activity continues to wane as a result of the decrease in oil prices and the contraction in Russia.

The drop in domestic confidence from weakening currencies and slow growth in oil production in Kazakhstan have also contributed to the region’s slowdown.

Despite recent depreciations, export losses from lower oil prices have translated into significant fiscal revenue losses, with the current account balance expected to go from a surplus (3¼ percent of GDP) in 2014 to a deficit (2¾ percent of GDP) in 2015.

Many of the region's oil exporters have been able to draw on savings built up when oil prices were higher. In the short term, this has helped them tackle their immediate fiscal challenges, but more needs to be done. In the medium term, the report recommends that countries consolidate their fiscal position, implement structural reforms, and intensify efforts to diversify away from oil. These steps will help to ensure savings are not depleted and support economic growth and resilience.

Exchange rates under pressure

Many CCA countries have allowed their currencies to depreciate against the U.S. dollar to adjust to large external shocks. Yet volatility in foreign exchange markets has raised concerns about implications for stability in heavily dollarized financial systems. Countries have also had to confront a sharp drop in their international reserves and rising inflationary pressures (see Chart 1).

Policy responses have been generally appropriate in the short run, Kähkönen said. Moving forward, he warned, the effects of the recent shocks would be persistent and, moreover, downside risks are likely to linger as weaker growth in Russia, China, and the euro area could weigh heavily on the region’s export revenue and potentially reduce capital inflows.

To adjust to the lasting shocks and to combat the risks, Kähkönen emphasized adopting greater exchange rate flexibility to limit the rundown of reserves, absorb the fiscal effect of lower commodity prices, and reduce losses in export competitiveness while employing monetary policy to curb inflationary pressures and strengthening supervision to safeguard financial stability.

Structural reforms needed to improve economic prospects

Kähkönen also said that adopting structural reforms will be instrumental to making the CCA more open, competitive, diversified, and regionally and globally integrated.

“While some CCA countries have implemented reforms,” he said, “more can be done to raise the quality of education, promote financial development, improve the business environment, and diversify exports.” Greater efforts by policymakers in these areas will help to create jobs, alleviate poverty, and boost long-term growth, especially in the face of adverse shocks (see Chart 2).