Remarks for the Inaugural Conference of The China Center for International Economic Exchanges by Mr. Takatoshi Kato, Deputy Managing Director of the International Monetary Fund, Beijing

July 6, 2009

Beijing, July 3, 2009

As Prepared for Delivery

| Download the presentation (300 kb PDF) |

Thank you, Mr. XU Kuangdi for your kind introduction.

Good morning, ladies and gentlemen. I am very pleased to participate today in the inaugural Global Think Tank Summit organized by the China Center for International Economic Exchanges.

I am particularly honored to participate in this summit alongside His Excellency ZENG Peiyan, People’s Bank Governor ZHOU Xiaochuan, Secretary Elaine Chao, Vice President Bindu Lohani and other distinguished speakers and guests.

Today I want to talk about the impact of the global financial crisis on Asia as well as offer some thoughts on its implications for China and also for the IMF.

The Impact of the Global Financial Crisis

What has happened in the past year has been a sobering reminder of how quickly the economic environment can change. It has also become painfully evident that Asia has not “decoupled” from the West but, rather, that we are all far more interconnected in the modern economic system than we have been in the past.

I would like to highlight two dimensions of this interconnectedness that recent events have brought into stark relief:

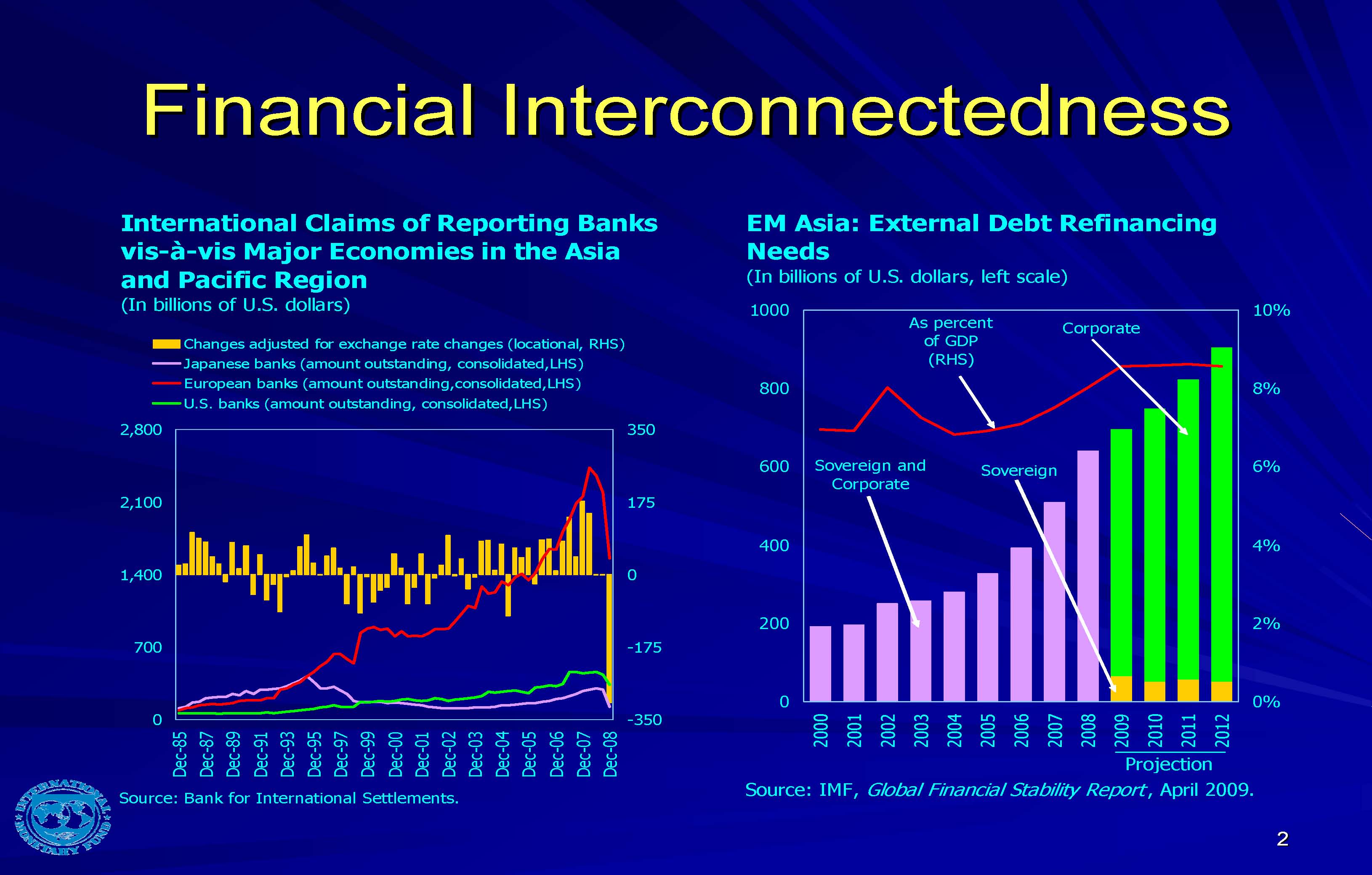

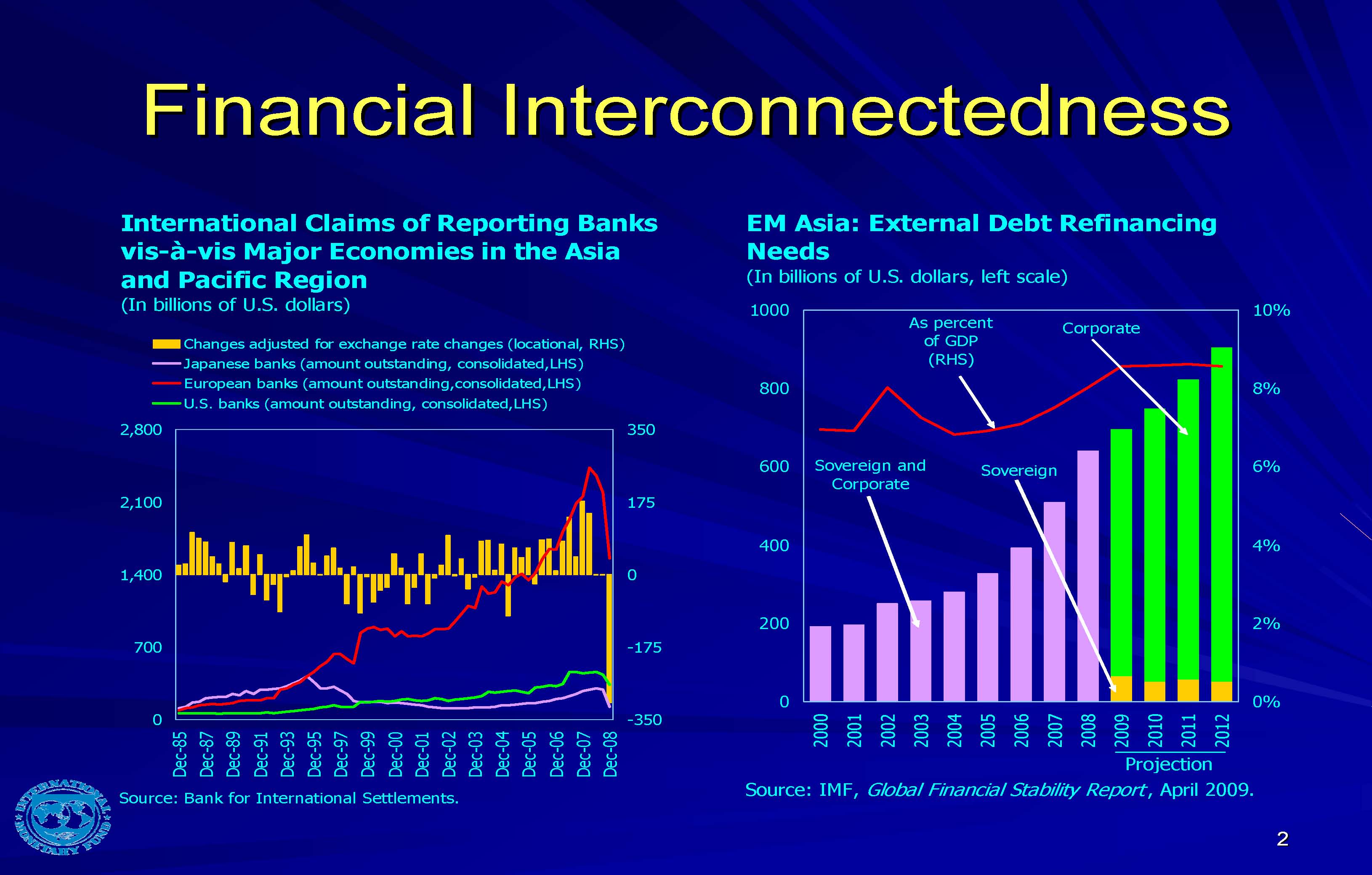

Despite the fact that Asian financial institutions did not hold sizable amounts of the “toxic” assets at the center of the global crisis, Asia was still subject to significant shockwaves as global liquidity dried up.

• Asian banks were much more reliant on international wholesale funding than many had realized. As such, they were particularly exposed to global deleveraging and the resulting shortage of US$ funding.

• Asian corporates—despite reducing overall leverage following the Asian crisis—had increased their reliance on foreign funding (bond, equity, and loan issuance) in recent years and were thus directly impacted as refinancing foreign borrowing became more difficult.

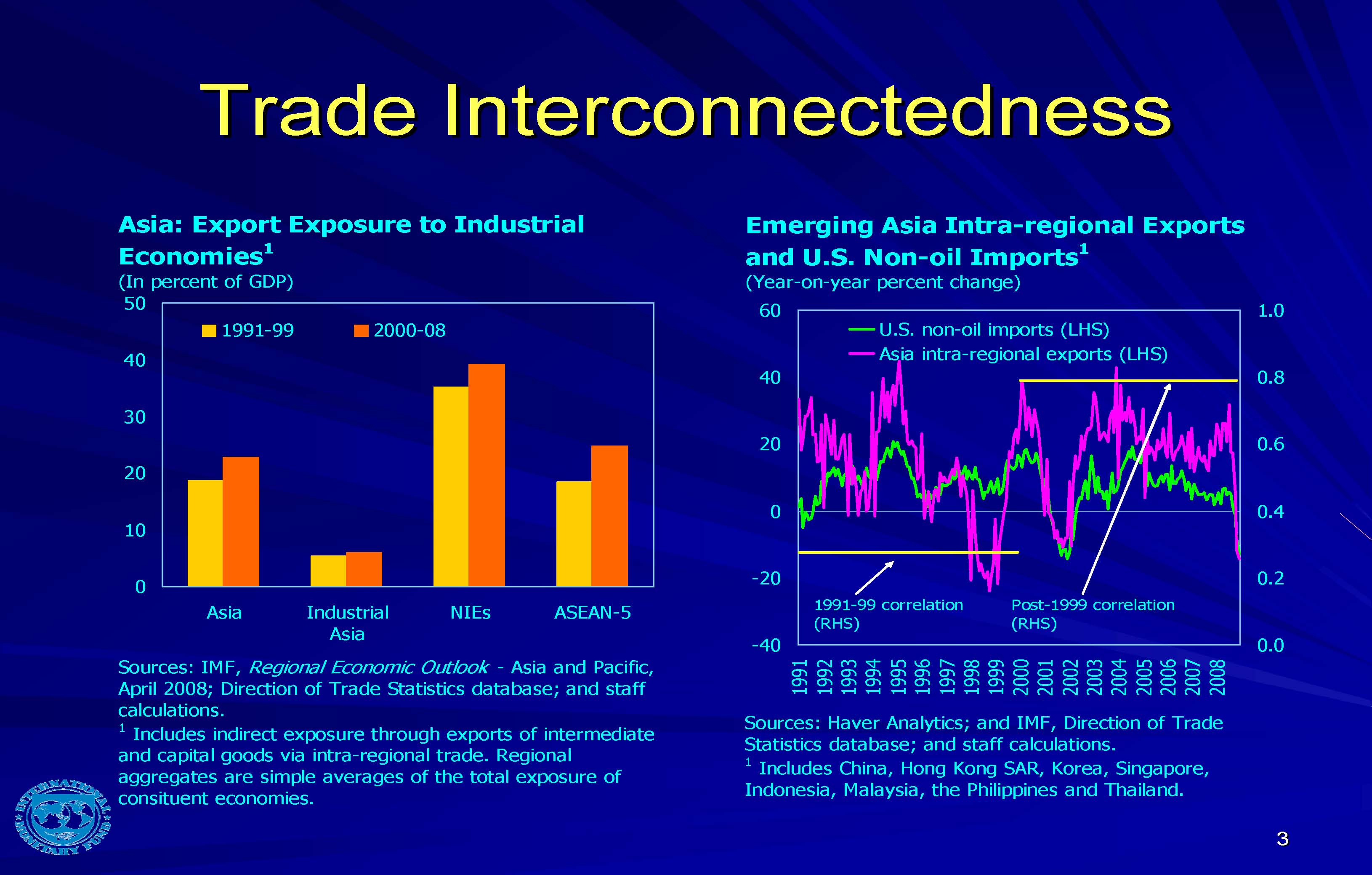

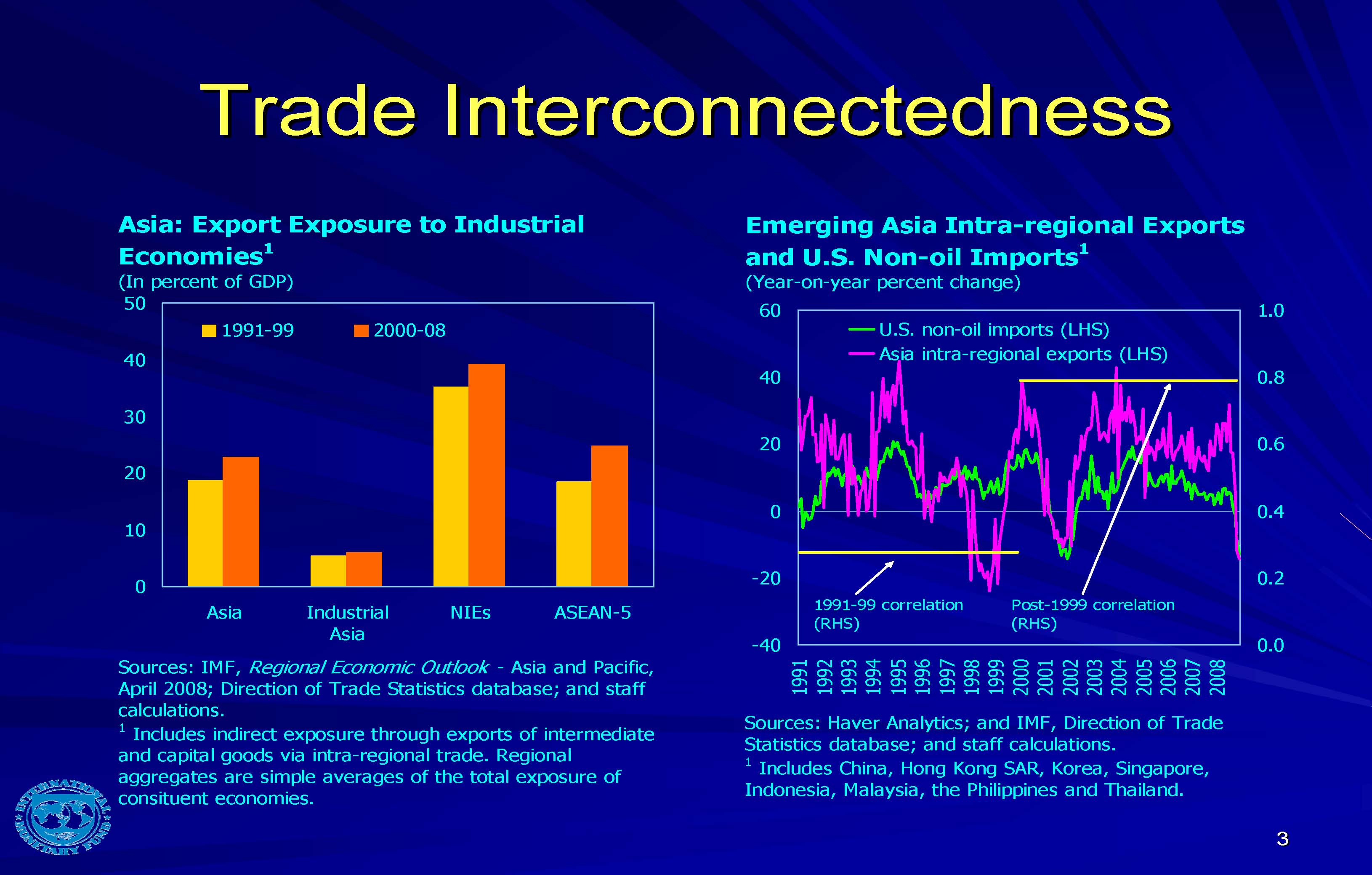

The increased share of inter-regional trade prior to the crisis might have suggested that Asia should have been much less affected by a slowdown in demand from the industrial countries. However, trade channels were far more potent than many expected.

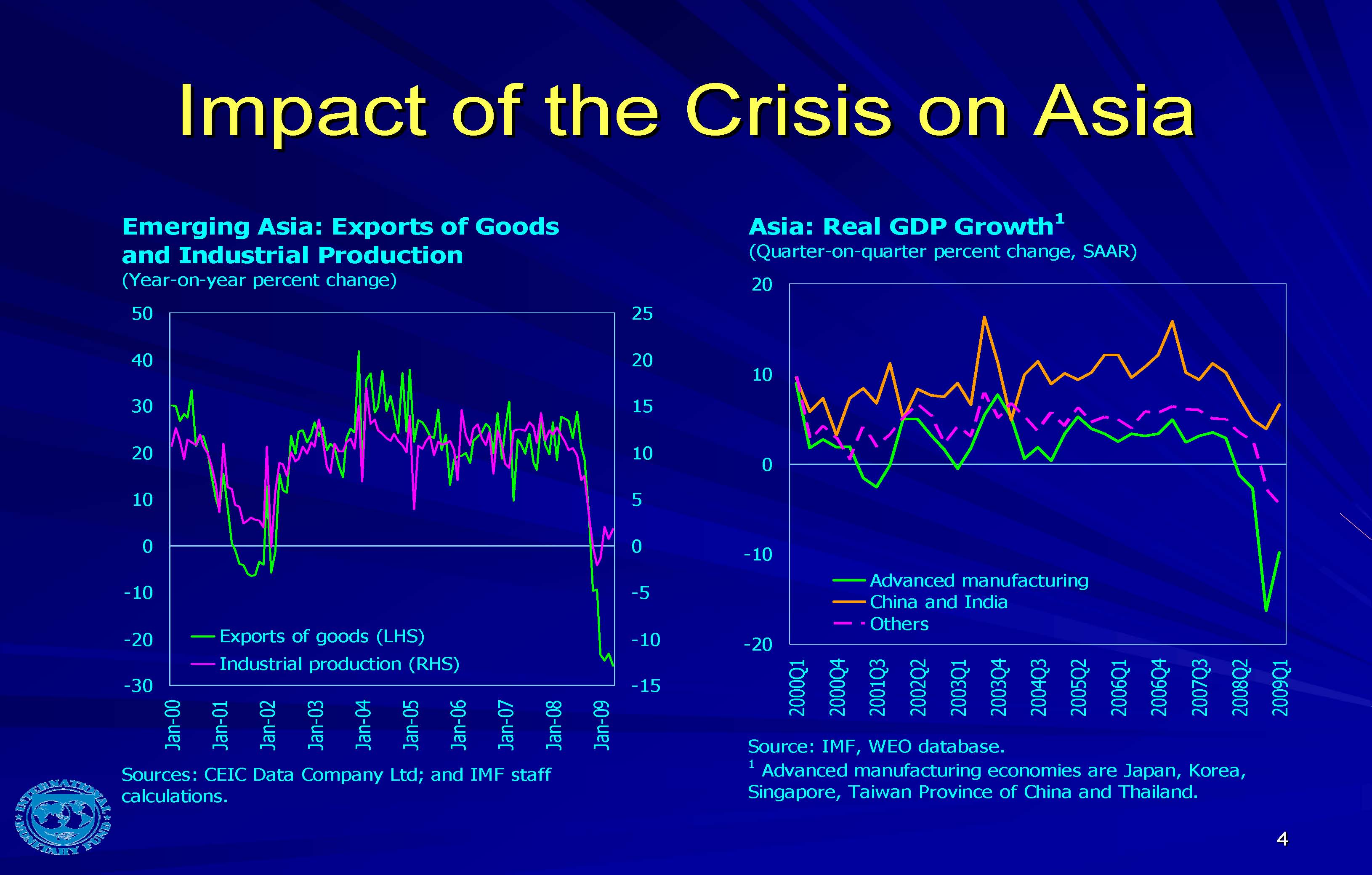

• As demand collapsed in the West, the purchases of big-ticket, technologically advanced products (such as autos and electronic) were particularly hard hit. These were products in which Asia specialized and, as a result, exports and industrial production in the region collapsed .

• Intraregional trade also collapsed, as it became clear that much of that trade was ultimately tied to demand shock in the U.S. and Europe.

All in all, as in the past, global demand remains a key factor behind Asian output and export growth and, if anything, this linkage has actually been strengthening over time.

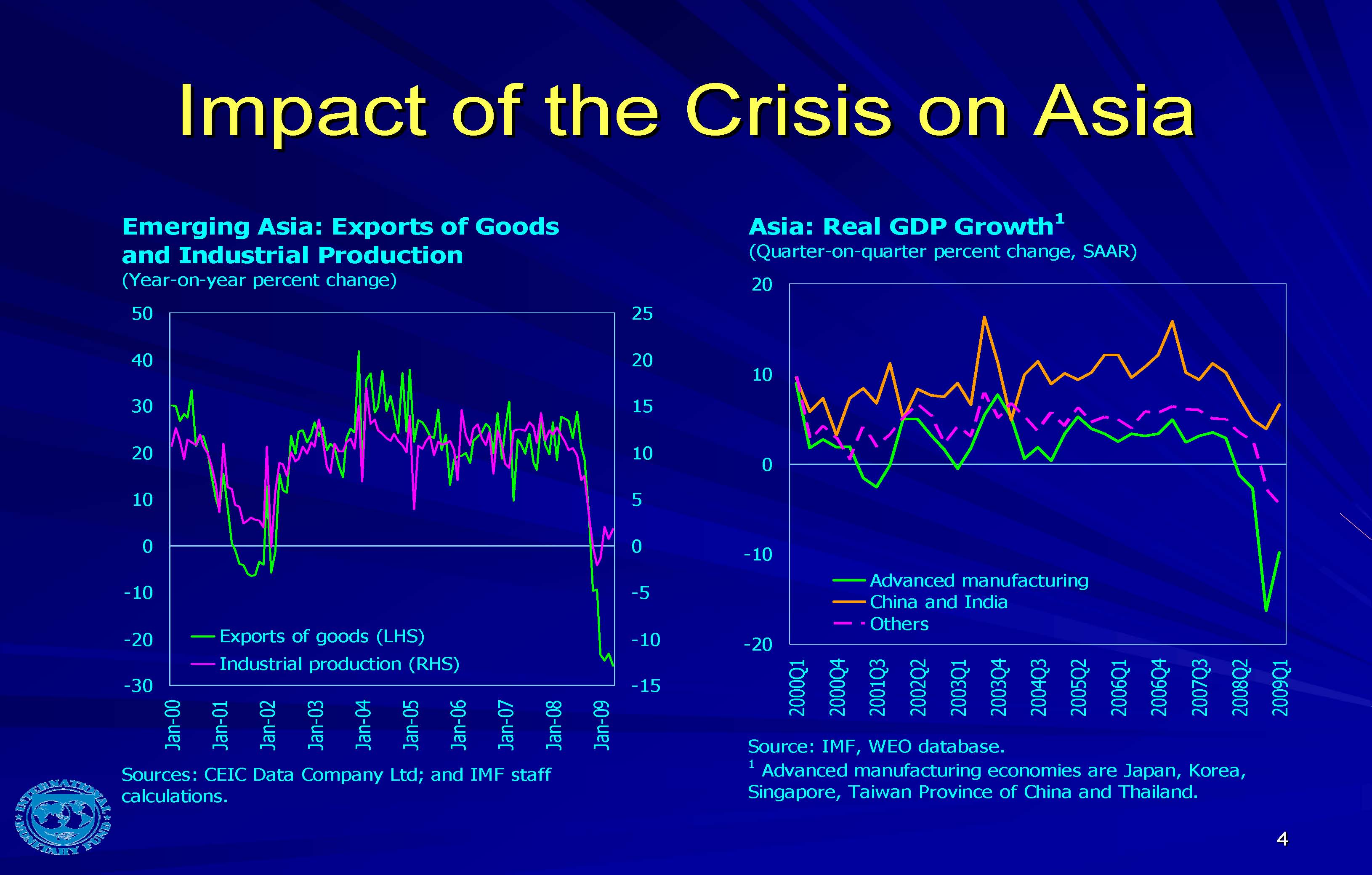

As a result of these powerful trade and financial channels of spillover and contagion, output growth in Asia decelerated at a breathtaking pace during the latter part of 2008. Japan, Hong Kong SAR, Taiwan Province of China, Singapore, Malaysia and Thailand have all been pushed into a recession.

Some had hoped that the first quarter of 2009 would bring some better news, but those optimists were disappointed. In more recent data there are, however, signs that in some countries, including China, the downturn is bottoming out. I shall turn now to discuss our view on the global and regional outlook.

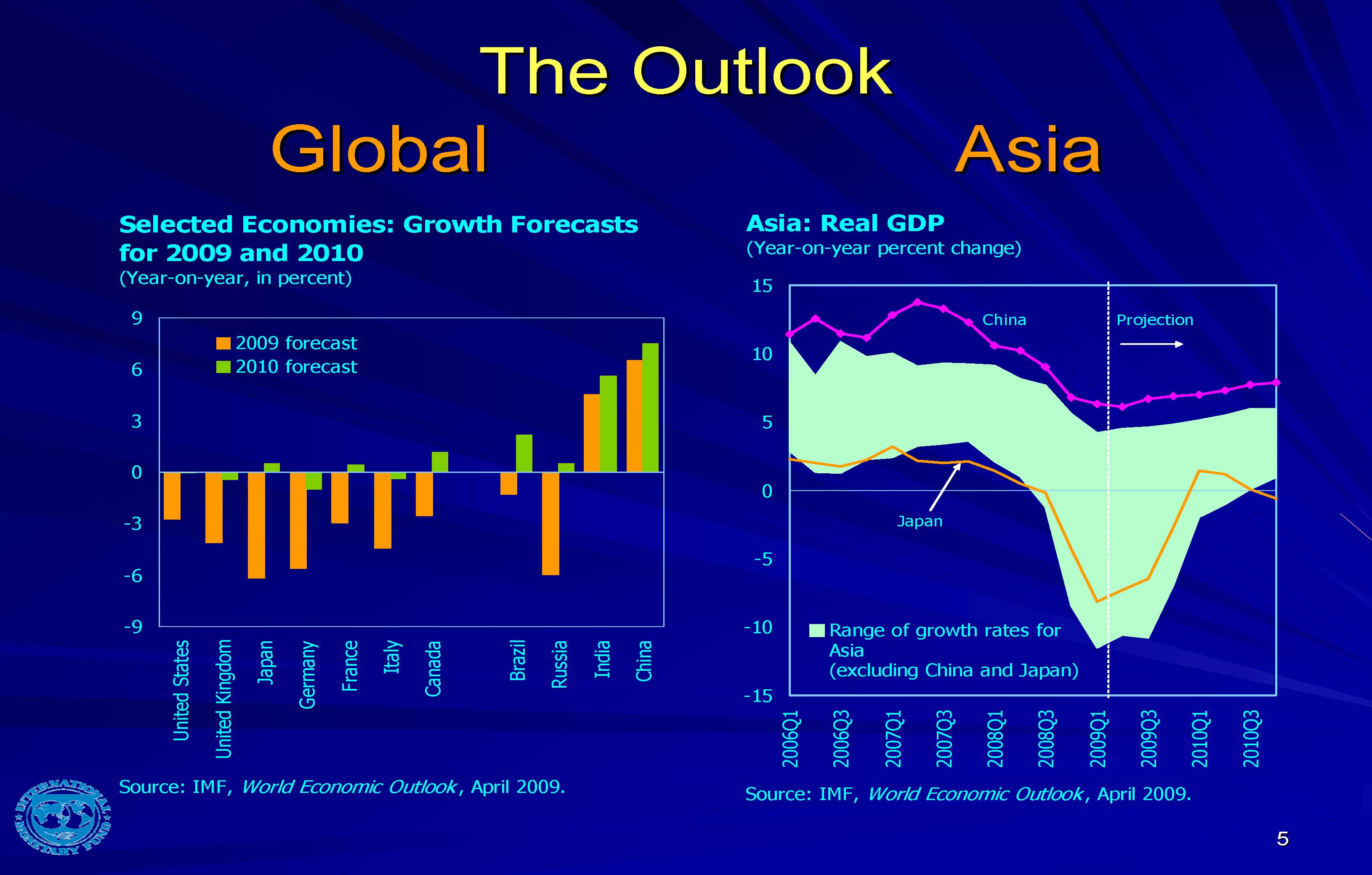

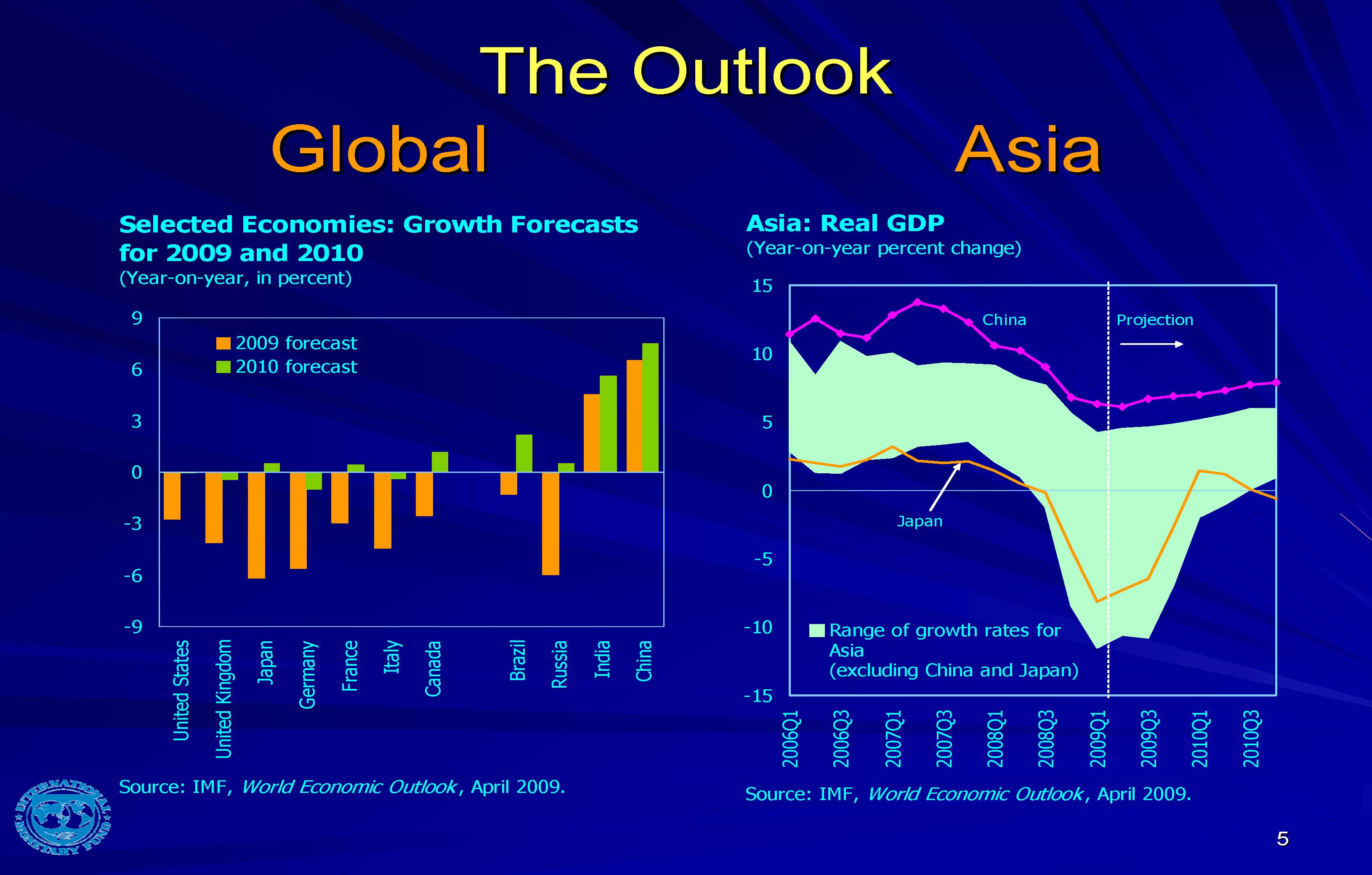

As our most recent World Economic Outlook forecasts shows, the IMF currently expects that the global economy will contract this year for the first time in the post-war period. I should perhaps note here that these forecasts will be updated next week and in all likelihood our global forecast will be modestly higher. The outlook for the U.S. and Japan is slightly better than a few months ago. However, the situation, is still very difficult. Our belief is that, by 2010, a recovery should begin to take shape but it will be weak with output staying well below potential for quite some time to come. All in all, despite some positive recent data, this will surely be the longest and deepest global recession of the post-war period.

Just as Asia has shown itself to be intimately linked to global developments as the downturn took hold, so too will Asia’s recovery be inextricably coupled to the future fortunes of the global economy. This means that Asian growth is also likely to remain weak throughout 2009 and pick up only gradually in 2010.

Looking out past the immediate aftermath of the global crisis, we fully expect that there will be a discrete change in the pattern of global growth. U.S. consumption will no longer be the force it once was, and it will take many years to repair the damage that has been done to household balance sheets. This should mean an increase in U.S. savings and improved prospects for the U.S. current account deficit. At the same time, though, it is likely that global demand for Asian produced goods will remain suppressed over a longer horizon.

Asia’s longer-term recovery will mean that the region’s reliance on external drivers for growth will have to diminish and greater emphasis will need to be placed on domestic sources of demand, particularly on consumption. This is a challenging task for a region that has benefited greatly from an export-oriented growth model geared toward competing in international markets. Nevertheless, it will be essential that this challenge be taken seriously and policies be redirected toward achieving this goal. Doing so will allow healthy growth rates to be sustained in Asia even in the context of sluggish demand from the West.

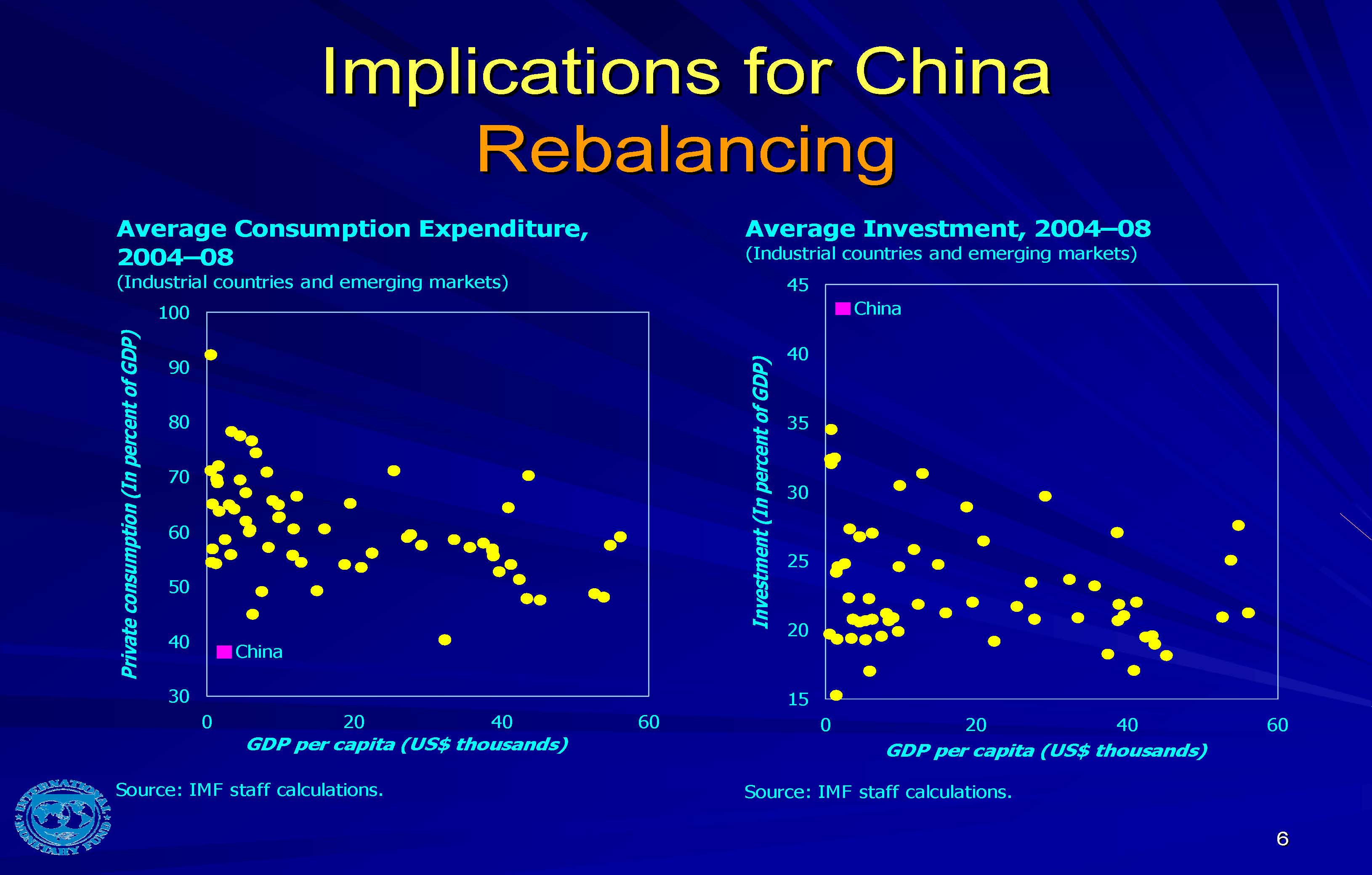

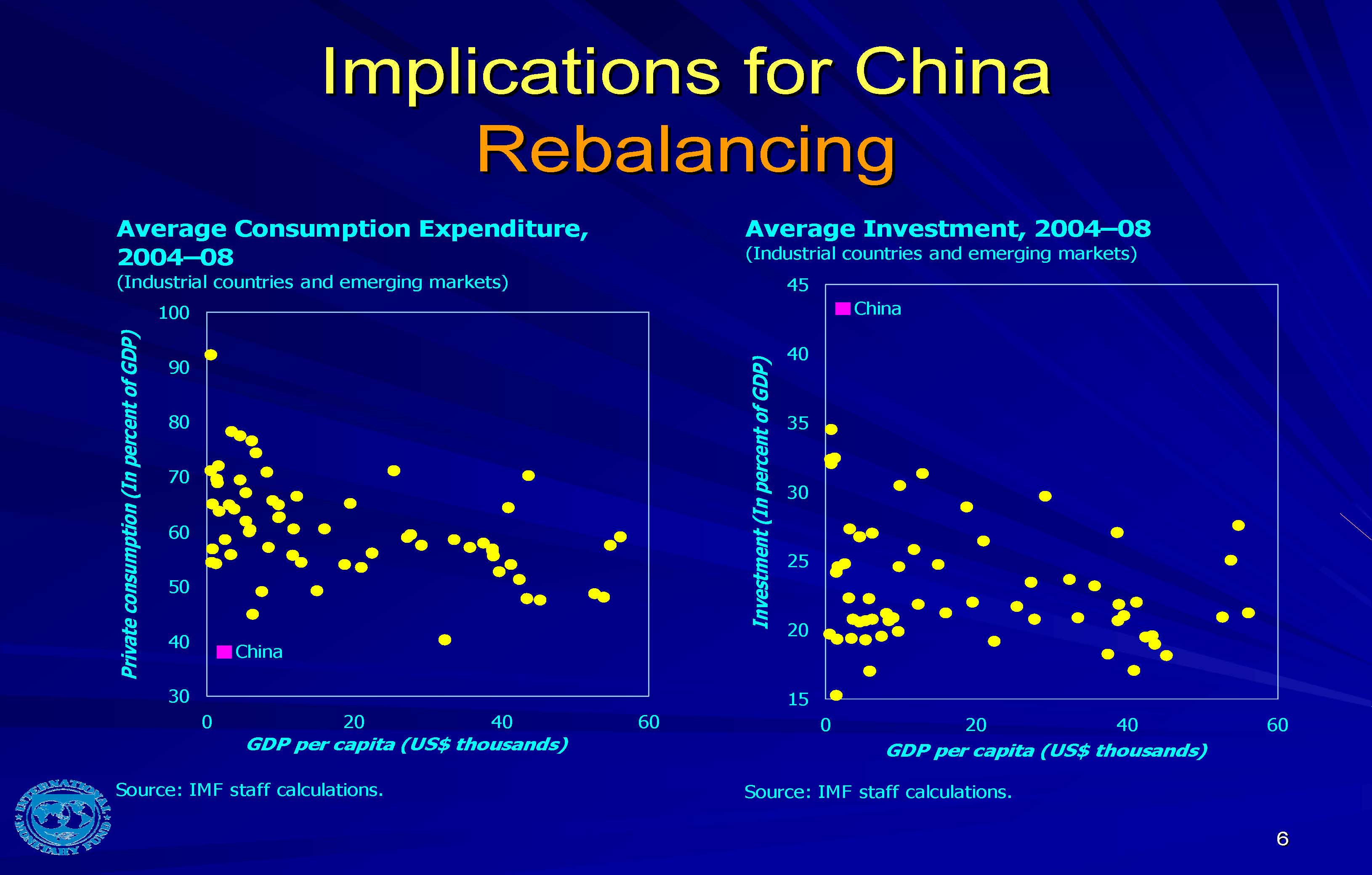

What does this global and regional context mean for China? The IMF has had a long-held view, one that I believe is fundamentally shared by the Chinese government, that it is very much in China’s interests to rebalance towards domestic consumption and away from investment in capital-intensive tradable sectors and exports. Rebalancing in this way will require concerted effort along multiple fronts. However, the permanent changes that are underway in the global economy, including the prospects of suppressed external demand for some time to come, make the need for reorienting the economy more essential than ever.

Over the short-term, China’s efforts to provide significant stimulus to domestic demand will be instrumental in insulating the economy from the worst aspects of the global crisis. This has already facilitated a healthy pace of consumption growth and there are impressive improvements underway in much needed infrastructure and low income housing. However, more will be needed to sustain higher levels of consumption and to permanently rebalance the economy.

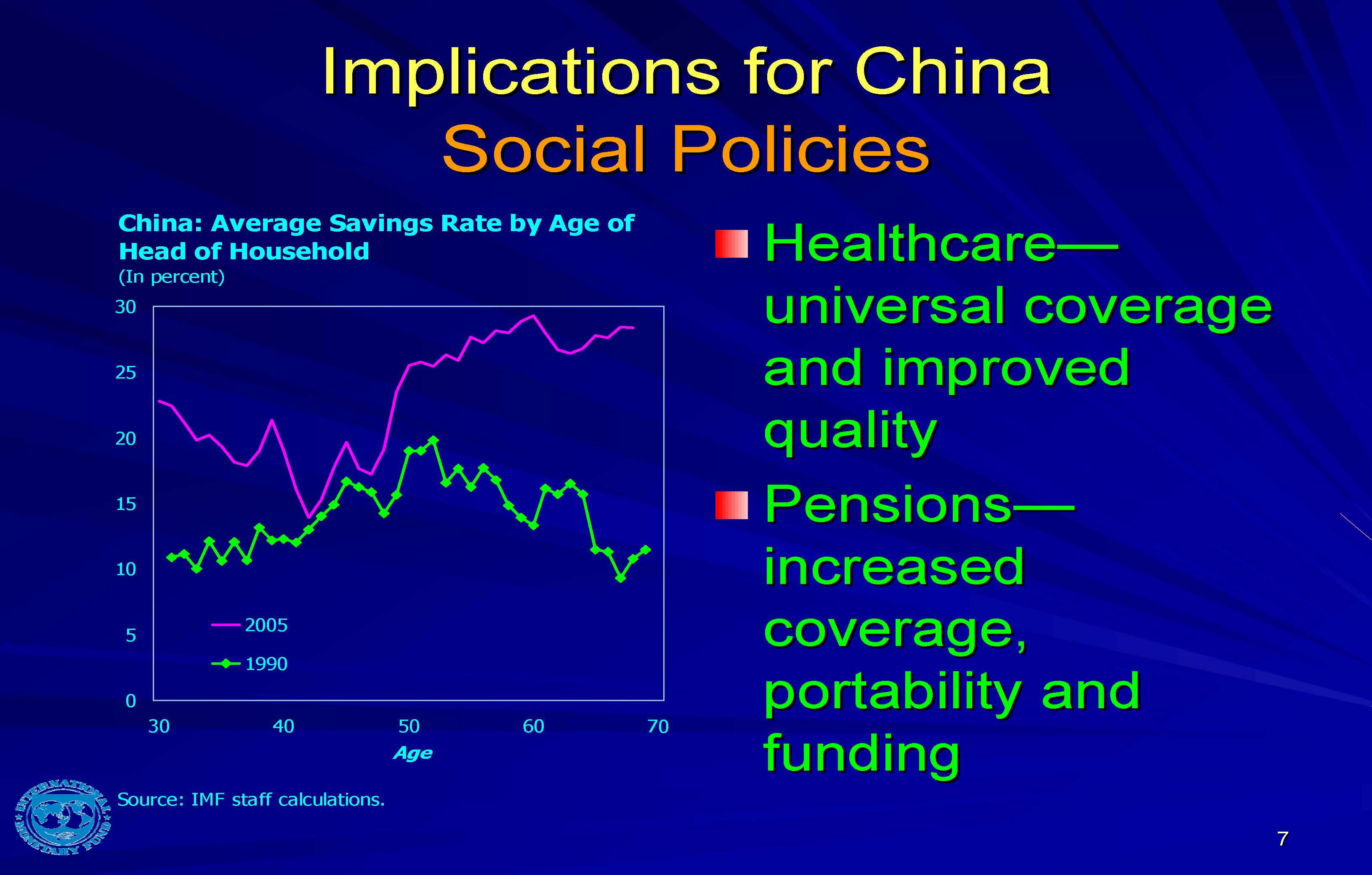

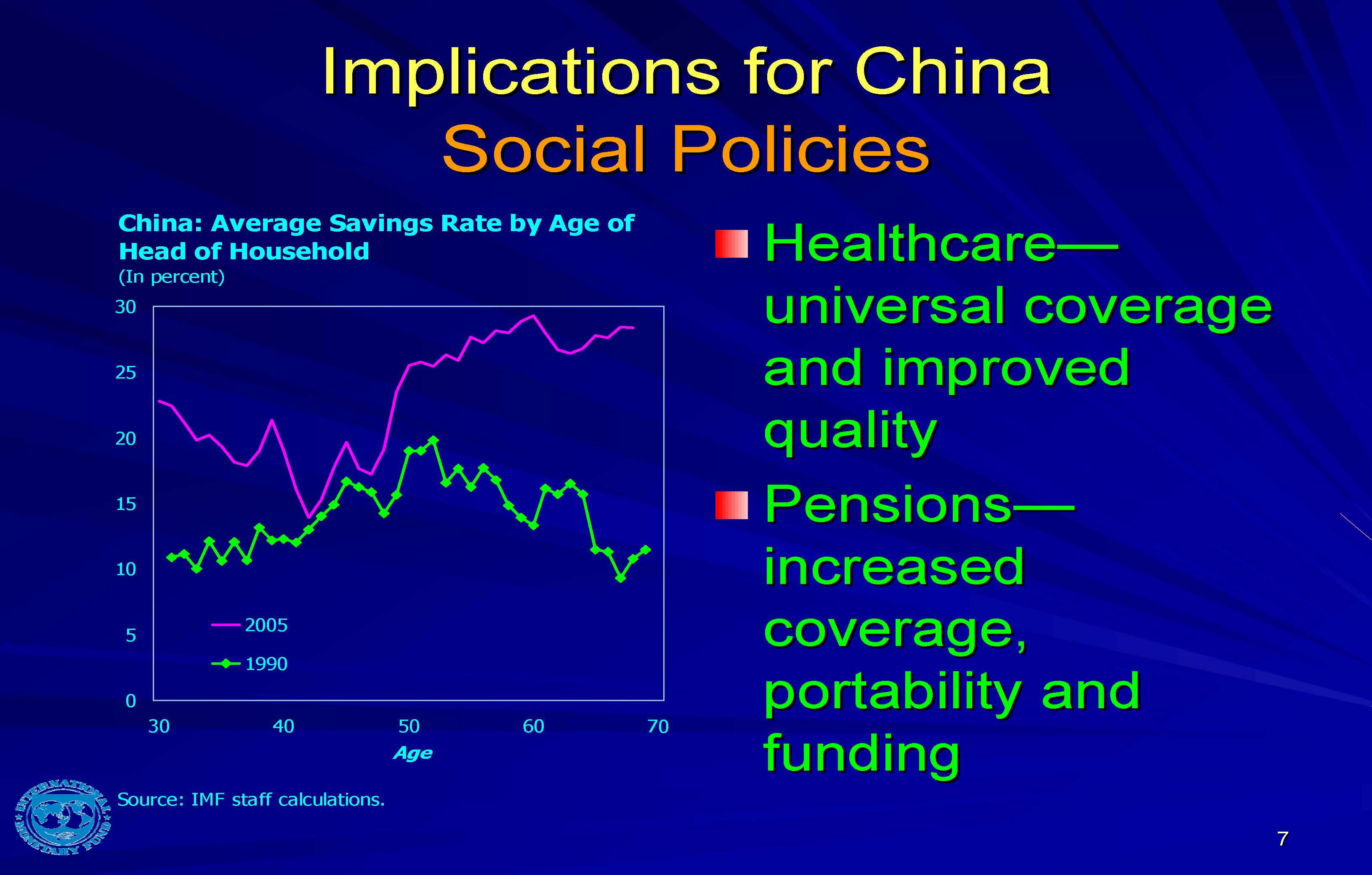

We know that a big motivation for household savings revolves around the risks associated with aging. Lessening that desire for precautionary savings will require that policies are put in place to assure citizens that their needs will be provided for in old age. In this regard I would highlight two key areas:

• Healthcare. There are already tremendously important efforts underway to reform healthcare provision in China. The government intends a substantial increase in resources to fund healthcare and there is now a clear roadmap towards near-universal health coverage and an improvement in the quality of health services.

• Pensions. Equally important will be a comprehensive change to the current system of pension benefits. Increasing pension coverage, portability, and funding for pensions are top of the list.

On top of these social policies, further financial development will be key.

On top of these social policies, further financial development will be key.

• Increasing the range of savings vehicles for households to provide alternatives to bank-intermediated financing and increase household disposable income.

• Expanding the availability of commercial insurance products—for health, life insurance, annuities—to reduce the incentives for private savings and raise consumption.

• Removing distortions in credit markets—for example by further liberalizing deposit and loan rates—as a means to increase the cost of capital, raise household income, improve the allocation of capital and lower corporate savings.

• Increasing the costs of other inputs such as water, energy, and land. This would prevent a further build-up of excess capacity in tradable sectors and an worsening of credit quality over the medium-term. It would also be aligned with the government’s goals for increasing energy efficiency and protecting the environment.

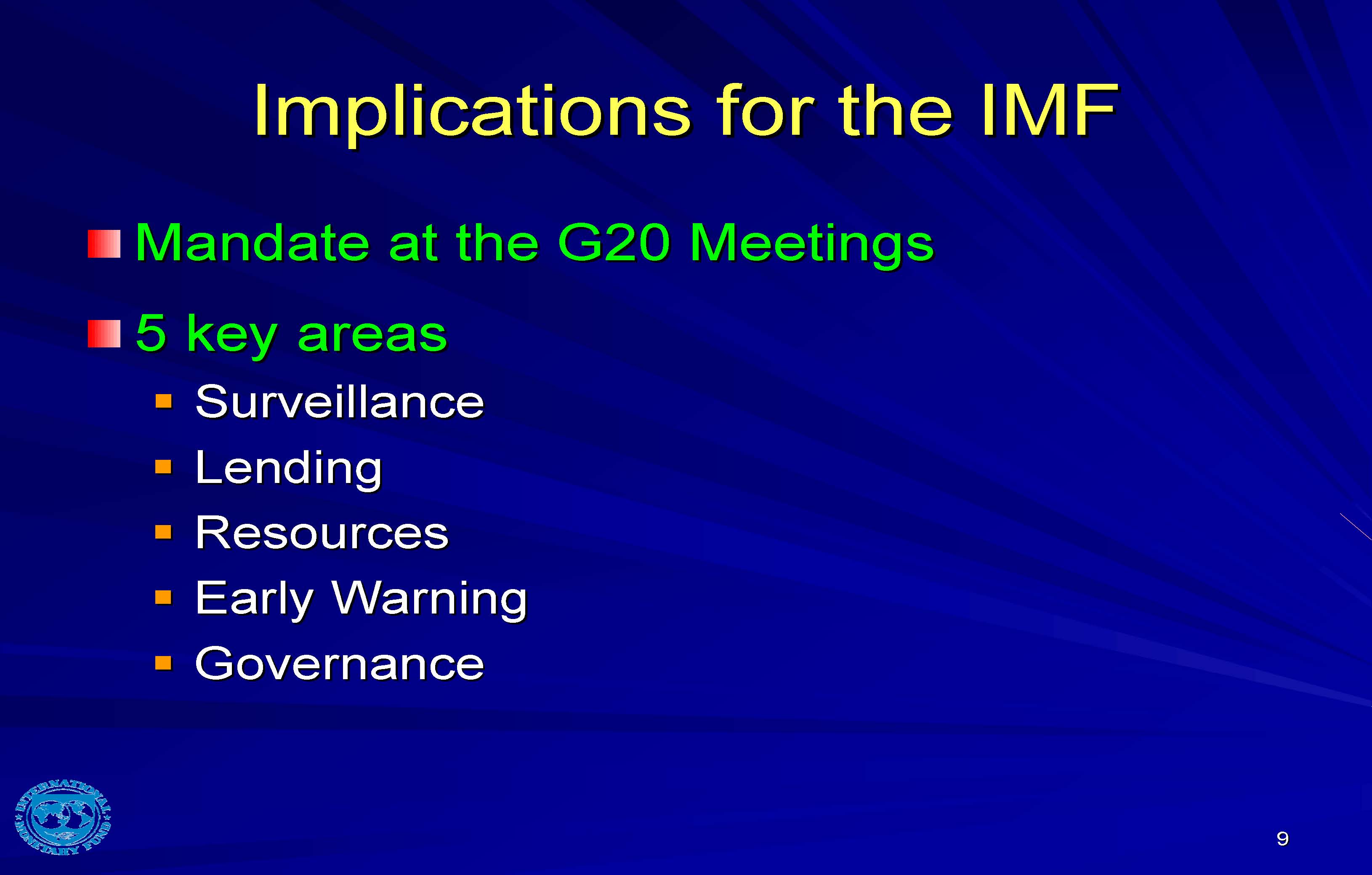

Of course, recent global events have also had clear implications for the role of the IMF. The global financial crisis has put the IMF front-and-center in the effort to contain the effects of the crisis and return the world economy to stability and steady growth. In particular, there was a clear consensus at the recent G20 Heads of Governments Summit in London that the IMF should play a pivotal role in helping the global economy overcome the current crisis.

We at the IMF are moving ahead quickly in various areas:

1. Surveillance. The IMF is fully engaged in providing candid, even-handed and independent surveillance. This surveillance work is particularly focusing on monitoring and assessing the implementation of fiscal and financial policies that have been put in place to counter the current global downturn.

2. Lending. We are revamping our lending facilities. In this context, although the major Asian countries have not approached the IMF for support so far, we stand ready to assist qualifying countries with our new instrument, the Flexible Credit Line. We are also working to improve access to IMF financing for low income countries at concessional rates and arranging the funding needed to support such concessional lending.

3. Resources. We are working to increase the resources that the IMF can draw upon as needed. Many countries have already agreed to put substantial sums at the IMF’s disposal. In this, I would highlight the importance of China’s intention to invest in IMF notes. With this, the Chinese authorities have signaled strong support for the international economic and financial system and their efforts will be beneficial to all. China’s investment in Fund securities will boost the Fund’s capacity to help member countries—particularly developing and emerging market countries—cope with the crisis and thus benefit all members by facilitating an early recovery of the global economy. At the same time, the new notes will offer members a safe investment instrument with reasonable return.

4. Early Warnings. We will launch our efforts at producing an Early Warning Exercise later this year and we are coordinating closely with the Financial Stability Board in this area.

5. Governance. This is a very important component of the reform effort to increase the legitimacy of the IMF as a truly representative multilateral forum and we are working to improve that. In particular, the IMF Executive Board will initiate work on the 14th general quota review before the 2009 Annual Meetings take place this October and that review will assess the appropriate overall increase in quotas and further realign members’ quotas with their weight in the global economy.

* * *

Finally, in closing, I want to wish the CCIEE much success in the future as a forum to foster an international exchange of views on key economic issues that concern us all. It is through exchanges such as these that important progress can be made in multilateral policy collaboration. Better international collaboration, remember, is one of the striking features that distinguishes today's events from those that occurred during the Great Depression, and it is that collaboration that we must continue to emphasize.

Despite the fact that Asian financial institutions did not hold sizable amounts of the “toxic” assets at the center of the global crisis, Asia was still subject to significant shockwaves as global liquidity dried up. • Asian banks were much more reliant on international wholesale funding than many had realized. As such, they were particularly exposed to global deleveraging and the resulting shortage of US$ funding. • Asian corporates—despite reducing overall leverage following the Asian crisis—had increased their reliance on foreign funding (bond, equity, and loan issuance) in recent years and were thus directly impacted as refinancing foreign borrowing became more difficult.

The increased share of inter-regional trade prior to the crisis might have suggested that Asia should have been much less affected by a slowdown in demand from the industrial countries. However, trade channels were far more potent than many expected. • As demand collapsed in the West, the purchases of big-ticket, technologically advanced products (such as autos and electronic) were particularly hard hit. These were products in which Asia specialized and, as a result, exports and industrial production in the region collapsed . • Intraregional trade also collapsed, as it became clear that much of that trade was ultimately tied to demand shock in the U.S. and Europe. All in all, as in the past, global demand remains a key factor behind Asian output and export growth and, if anything, this linkage has actually been strengthening over time.

As a result of these powerful trade and financial channels of spillover and contagion, output growth in Asia decelerated at a breathtaking pace during the latter part of 2008. Japan, Hong Kong SAR, Taiwan Province of China, Singapore, Malaysia and Thailand have all been pushed into a recession. Some had hoped that the first quarter of 2009 would bring some better news, but those optimists were disappointed. In more recent data there are, however, signs that in some countries, including China, the downturn is bottoming out. I shall turn now to discuss our view on the global and regional outlook.

As our most recent World Economic Outlook forecasts shows, the IMF currently expects that the global economy will contract this year for the first time in the post-war period. I should perhaps note here that these forecasts will be updated next week and in all likelihood our global forecast will be modestly higher. The outlook for the U.S. and Japan is slightly better than a few months ago. However, the situation, is still very difficult. Our belief is that, by 2010, a recovery should begin to take shape but it will be weak with output staying well below potential for quite some time to come. All in all, despite some positive recent data, this will surely be the longest and deepest global recession of the post-war period. Just as Asia has shown itself to be intimately linked to global developments as the downturn took hold, so too will Asia’s recovery be inextricably coupled to the future fortunes of the global economy. This means that Asian growth is also likely to remain weak throughout 2009 and pick up only gradually in 2010. Looking out past the immediate aftermath of the global crisis, we fully expect that there will be a discrete change in the pattern of global growth. U.S. consumption will no longer be the force it once was, and it will take many years to repair the damage that has been done to household balance sheets. This should mean an increase in U.S. savings and improved prospects for the U.S. current account deficit. At the same time, though, it is likely that global demand for Asian produced goods will remain suppressed over a longer horizon. Asia’s longer-term recovery will mean that the region’s reliance on external drivers for growth will have to diminish and greater emphasis will need to be placed on domestic sources of demand, particularly on consumption. This is a challenging task for a region that has benefited greatly from an export-oriented growth model geared toward competing in international markets. Nevertheless, it will be essential that this challenge be taken seriously and policies be redirected toward achieving this goal. Doing so will allow healthy growth rates to be sustained in Asia even in the context of sluggish demand from the West.

What does this global and regional context mean for China? The IMF has had a long-held view, one that I believe is fundamentally shared by the Chinese government, that it is very much in China’s interests to rebalance towards domestic consumption and away from investment in capital-intensive tradable sectors and exports. Rebalancing in this way will require concerted effort along multiple fronts. However, the permanent changes that are underway in the global economy, including the prospects of suppressed external demand for some time to come, make the need for reorienting the economy more essential than ever. Over the short-term, China’s efforts to provide significant stimulus to domestic demand will be instrumental in insulating the economy from the worst aspects of the global crisis. This has already facilitated a healthy pace of consumption growth and there are impressive improvements underway in much needed infrastructure and low income housing. However, more will be needed to sustain higher levels of consumption and to permanently rebalance the economy.

We know that a big motivation for household savings revolves around the risks associated with aging. Lessening that desire for precautionary savings will require that policies are put in place to assure citizens that their needs will be provided for in old age. In this regard I would highlight two key areas: • Healthcare. There are already tremendously important efforts underway to reform healthcare provision in China. The government intends a substantial increase in resources to fund healthcare and there is now a clear roadmap towards near-universal health coverage and an improvement in the quality of health services. • Pensions. Equally important will be a comprehensive change to the current system of pension benefits. Increasing pension coverage, portability, and funding for pensions are top of the list.  On top of these social policies, further financial development will be key.

On top of these social policies, further financial development will be key.

• Increasing the range of savings vehicles for households to provide alternatives to bank-intermediated financing and increase household disposable income. • Expanding the availability of commercial insurance products—for health, life insurance, annuities—to reduce the incentives for private savings and raise consumption. • Removing distortions in credit markets—for example by further liberalizing deposit and loan rates—as a means to increase the cost of capital, raise household income, improve the allocation of capital and lower corporate savings. • Increasing the costs of other inputs such as water, energy, and land. This would prevent a further build-up of excess capacity in tradable sectors and an worsening of credit quality over the medium-term. It would also be aligned with the government’s goals for increasing energy efficiency and protecting the environment.

Of course, recent global events have also had clear implications for the role of the IMF. The global financial crisis has put the IMF front-and-center in the effort to contain the effects of the crisis and return the world economy to stability and steady growth. In particular, there was a clear consensus at the recent G20 Heads of Governments Summit in London that the IMF should play a pivotal role in helping the global economy overcome the current crisis. We at the IMF are moving ahead quickly in various areas: 1. Surveillance. The IMF is fully engaged in providing candid, even-handed and independent surveillance. This surveillance work is particularly focusing on monitoring and assessing the implementation of fiscal and financial policies that have been put in place to counter the current global downturn. 2. Lending. We are revamping our lending facilities. In this context, although the major Asian countries have not approached the IMF for support so far, we stand ready to assist qualifying countries with our new instrument, the Flexible Credit Line. We are also working to improve access to IMF financing for low income countries at concessional rates and arranging the funding needed to support such concessional lending. 3. Resources. We are working to increase the resources that the IMF can draw upon as needed. Many countries have already agreed to put substantial sums at the IMF’s disposal. In this, I would highlight the importance of China’s intention to invest in IMF notes. With this, the Chinese authorities have signaled strong support for the international economic and financial system and their efforts will be beneficial to all. China’s investment in Fund securities will boost the Fund’s capacity to help member countries—particularly developing and emerging market countries—cope with the crisis and thus benefit all members by facilitating an early recovery of the global economy. At the same time, the new notes will offer members a safe investment instrument with reasonable return. 4. Early Warnings. We will launch our efforts at producing an Early Warning Exercise later this year and we are coordinating closely with the Financial Stability Board in this area. 5. Governance. This is a very important component of the reform effort to increase the legitimacy of the IMF as a truly representative multilateral forum and we are working to improve that. In particular, the IMF Executive Board will initiate work on the 14th general quota review before the 2009 Annual Meetings take place this October and that review will assess the appropriate overall increase in quotas and further realign members’ quotas with their weight in the global economy. * * * Finally, in closing, I want to wish the CCIEE much success in the future as a forum to foster an international exchange of views on key economic issues that concern us all. It is through exchanges such as these that important progress can be made in multilateral policy collaboration. Better international collaboration, remember, is one of the striking features that distinguishes today's events from those that occurred during the Great Depression, and it is that collaboration that we must continue to emphasize. |

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |