At work in a Chinese steel factory, Huaibei city, China (photo: Imagine China/Newscom)

Getting China’s ‘Trusted Sons’ Back into Shape

April 27, 2017

State-owned enterprises are sometimes called the “trusted (eldest) sons of the People’s Republic of China,” reflecting their contributions to economic development over the past decades. Yet, as Premier LI Keqiang declared last year, these enterprises now need to “go on a diet and get back into shape.”

Reform of these enterprises has indeed been a lynchpin of China’s economic transformation, as highlighted in a recent IMF publication, Modernizing China: Investing in Soft Infrastructure. China needs to accelerate the pace of reforms to improve growth potential and contain risks associated with ballooning corporate debt. Preliminary evidence suggests that reforms could raise China’s output by 3–9 percent over a decade.

The government recognizes the importance of advancing reforms to raise efficiency of the state enterprises and create room for the private sector to prosper. The recently concluded National People’s Congress called for “leaner, healthier, and more productive” state enterprises, as noted in the 2017 Report on the Work of the Government.

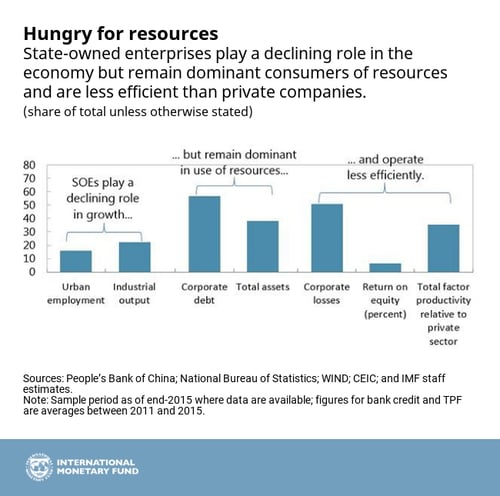

Some analysts argue that state-owned enterprises no longer play a significant role in the economy, pointing to privately owned technology giants like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. and the mushrooming of small businesses. Indeed, the share of state enterprises in total value-added and employment has declined significantly and now accounts for less than 20 percent of the total, down from 40 percent in the late 1990s.

Consuming resources

Yet eight of the top ten companies by market capitalization listed on the Shanghai stock exchange are state-owned; all told, some 167,000 nonfinancial enterprises owned by the central or local governments still operate nationwide.

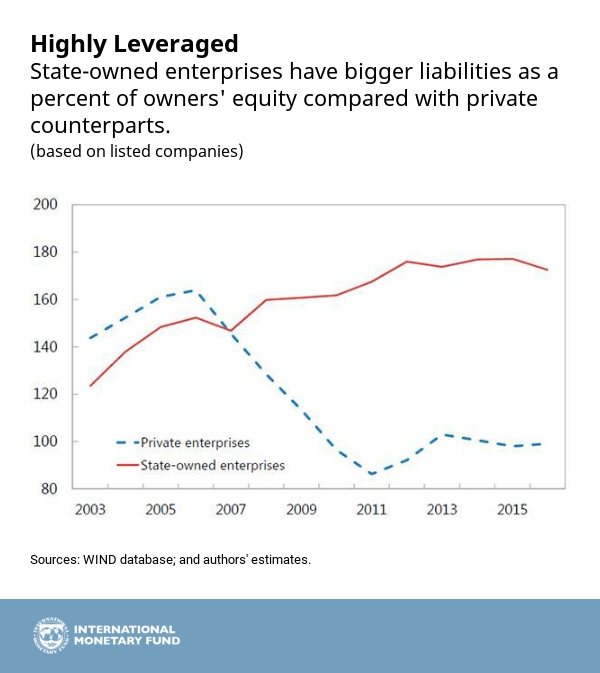

What’s more, these enterprises continue to consume a large share of resources: they account for more than half of bank credit and about 60 percent of total corporate debt. They also tend to be less productive than their private counterparts and are heavily represented among “zombie” firms (which are nonviable but kept afloat with credit and other support) and in sectors burdened by excess capacity, such as coal and steel.

Lower productivity, to be sure, partly reflects the role of state-owned enterprises in non-commercial functions, such as implementing national development strategies, smoothing business cycles, running fringe benefits such as schools and hospitals, or serving as an employer of last resort.

Meanwhile, state-owned enterprises enjoy significant implicit support in the form of land endowment; some also benefit from protected markets. Apart from contributing to a misallocation of resources, these distortions make it difficult for private companies to compete on a level playing field.

State-owned enterprises have featured prominently in key national policy and reform documents, including the 13th Five-Year Plan covering the years 2016 to 2020. Current proposals aim to raise efficiency and reposition the state as a capital investor instead of directly managing business operations. At the same time, to address their high level of debt, reforms envisage exits of nonviable “zombie” firms and phasing out overcapacity in state-dominant upstream industries.

Limited progress

So far, however, progress has been limited. This is so in part because vested interest groups are resisting, and because the scope of reforms focuses on consolidation of state-owned enterprises and mixed-ownership reforms to bring in other investors. Also, significant ambiguity remains in the role of the market relative to the state; for example, reforms stressed not only greater market discipline but also stronger state leadership. This may lead to conflicting objectives and undermine market discipline.

Key elements of successful reform

Comprehensive reform needs to pursue these three goals simultaneously:

- Deal with excessive debt;

- Channel new resources to the most productive users; and

- Create a level playing field for private and foreign companies.

Key elements of reform should aim to:

-

Restructure fundamentally sound enterprises and liquidate nonviable ones. Operational restructuring by improving corporate governance should be emphasized by kick-starting the endeavor with a few high-profile pilot cases for indebted enterprises. Noncore objectives, such as social functions, should be transferred to the government budget. Government budget support can complement local safety nets to help retrain and relocate workers who lose their jobs.

-

Harden budget constraints. Implicit guarantees, such as preferential access to credit, should be gradually ended through greater tolerance of defaults, and carefully allocating losses to firm owners and creditors will improve market assessment of credit risks. Removing implicit support would not only help address excessive debt but also improve the efficiency of new credit allocation. Transferring a larger portion of profits (currently less than a half of the target of 30 percent by 2020) to the government budget and allocating capital to social security funds would help harden budget constraints.

-

Reduce entry barriers and phase out restrictions that give state-owned enterprises a privileged role. Competition could be fostered by allowing entry of private or foreign firms into state-dominated service industries such as logistics, health care, and telecommunications (currently more restrictive than in Organization for Economic Cooperation and Development markets); breaking up administrative monopolies; and promoting the growth of dynamic small and medium-sized enterprises.

-

Advance complementary reforms, including reform to grant access to public services regardless of where a household resides, rural land property rights, and a framework for insolvency and resolution of state-owned enterprises. Fiscal measures to improve the portability of social security benefits across provinces and cities and align intergovernmental finances will help address legacy issues to provide social functions.

China’s bold reform of state enterprises in the late 1990s created the conditions for strong growth, despite the short-term costs such as a temporary rise of unemployment. It is now time to further reshape these “trusted sons” to help ensure a bright future.