Assessing Global Financial Stability

October 27, 2017

As Prepared for Delivery

It is a great pleasure for me to be back at the London School of Economics (LSE), where it seems like just yesterday that I was studying economics—or, more precisely, econometrics and mathematical economics—often right here in the Shaw Library. The School gave me a feeling of connection with the numerous economists who have been such a remarkable part of the school tradition.

LSE’s motto—“To Know the Causes of Things”—encapsulates the mission of all our leading institutions. That ideal certainly motivates work at the International Monetary Fund. And, since LSE’s current leader, Minouche Shafik, has been a Deputy Managing Director of the IMF, there’s an especially close bond to the LSE.

In line with the LSE’s mission, let’s discuss a critical issue: the forces of the global economy that are reshaping the outlook for financial stability. We face the urgent task of identifying the vulnerabilities that could soon undermine our recent, still-incomplete economic recovery. These vulnerabilities, without vigorous policy action, could soon put growth at risk.

Considerable progress has been made in assessing risks to financial stability. Countries around the world conduct financial stability assessments. The IMF has been producing a Global Financial Stability Report (GFSR) for 15 years. These regular assessments provide the basis for authorities to take prudential actions necessary to increase the resilience of their financial systems. Today, I want to present a framework to develop estimates of how risks to financial stability could be translated to risks to economic growth. This framework results in a financial stability metric—Growth-at-Risk—that makes financial stability assessments more quantitative and, hence, more actionable. I will start by talking about the IMF’s current assessment of risks to global financial stability, based on the GFSR that we released a couple of weeks ago. I will then sketch out a conceptual framework that maps financial stability risks into macroeconomic performance. I will also showcase some empirical estimates of Growth-at-Risk, which are presented in one of the analytical chapters of the GFSR. Finally, I will offer some preliminary thoughts on further steps for strengthening the analytical framework for financial stability.

Current Assessment of Risks to Global Financial Stability

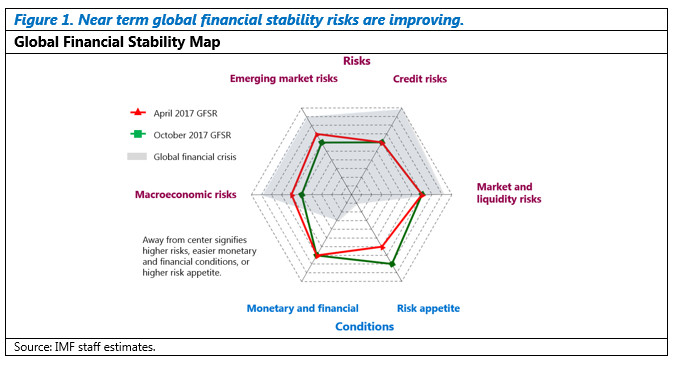

Global financial stability has continued to improve in recent quarters, as the economic recovery broadens and global markets are buoyant [Figure 1]. But while the waters seem calm, vulnerabilities are building under the surface, as risks are rotating away from banks to financial markets in the form of a search for yield, compressed risk premiums, and higher leverage. If left unattended, these developments could undermine market confidence, with repercussions that could put global growth at risk.

There are good news: near-term financial stability risks are lower, driven by a decline in macroeconomic and emerging market risks.

As outlined in the IMF’s most recent World Economic Outlook, the upswing in global activity has gained further steam, with global growth projected to rise to 3.6 percent in 2017 and 3.7 percent in 2018—in both cases 0.1 percentage point above our previous forecasts, and well above the global growth rate of 3.2 percent in 2016. This is laying hopes for a sustained recovery and should allow for the eventual normalization of monetary policies.

The core of the global financial system is stronger. Systemically important banks and insurers continue to enhance their resilience by raising capital and liquidity, addressing legacy issues, and adapting their business models to the evolving regulatory and market environment.

In emerging markets, capital flows are rebounding, driven in part by stronger fundamentals. Portfolio inflows to emerging market economies are on track to reach $285 billion in 2017, more than twice the total over the past two years. The cost of financing is low, and their currencies and equity prices have strongly appreciated this year.

Globally, supportive monetary and financial conditions and buoyant financial markets have helped foster growth and repair balance sheets.

Yet, while near term risks are lower, market and liquidity risks remain elevated and medium-term vulnerabilities are rising. Monetary accommodation remains necessary to support activity and boost inflation, and markets expect monetary policy will remain accommodative for a prolonged period before it will be fully “normalized.” Our key concern is that this environment is leading to complacency as financial excesses and vulnerabilities build on several fronts.

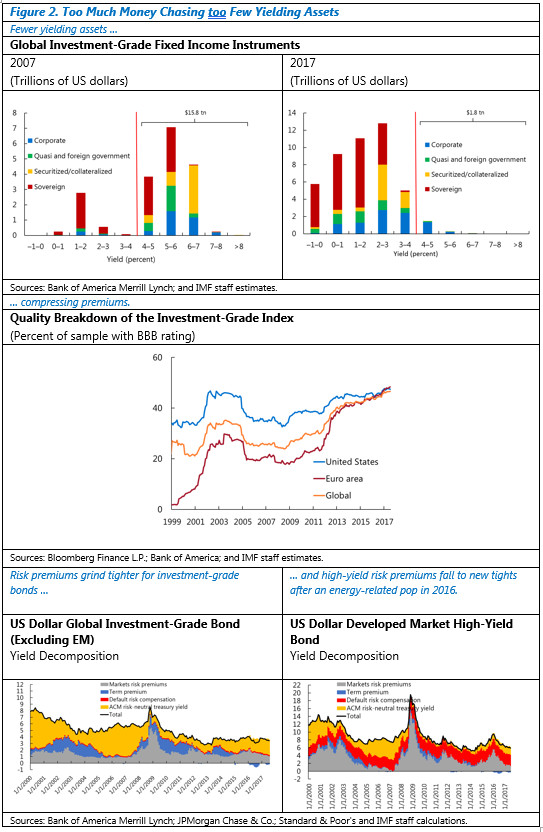

Let me emphasize five vulnerabilities. First, market risk is rising. There is simply too much money chasing too few yielding assets [ Figure 2]. While the size of fixed-income investment-grade assets has more than doubled to some $45 trillion, the share that yields more than 4 percent has fallen to 5 percent, compared to 80 percent in 2007. This is important because it is drawing institutional investors out of their natural risk habitats in a search for yield, exposing their balance sheets to increased credit, maturity, and liquidity risks. This has compressed risk premiums: despite the deteriorating health of corporate balance sheets, credit spreads are close to historic lows and provide virtually no compensation for uncertainty around default risk. If such compensation reverted to the average levels of 2000 to 2004—a period of high defaults— investment grade bond spreads would need to rise by about 200 basis points, and high-yield bond spreads by 450 basis points.

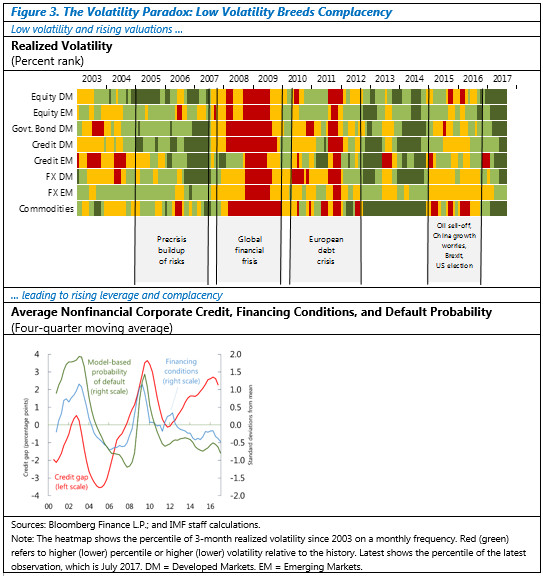

Second, extremely low volatility across asset classes may be encouraging investor complacency and masking risks from corporate leverage and other potential shocks. Easy financing conditions have led to lower model-based default probabilities for firms, fueling complacency and facilitating a build-up in corporate leverage. This is the volatility paradox [ Figure 3]—as financing is cheap and easily available, risks of higher firm debt appear lower and facilitates a further build-up of leverage. But if financial conditions were to tighten unexpectedly—for example, as we saw in the global financial crisis—the debt load could become a vulnerability. With volatility extremely low across asset classes, markets also appear complacent about other potential shocks. These include geopolitical risks, upside inflation surprises, a “snapback” in long-term interest rates due to a sudden rise in term premiums, and possible downside economic risks.

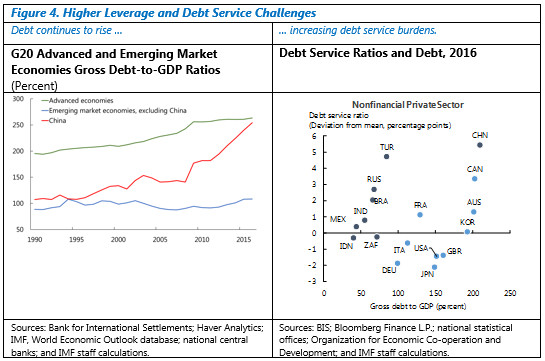

Third, debt levels are increasing in G20 economies [ Figure 4]. Leverage (as measured by gross debt to GDP) is now higher than prior to the financial crisis. About 80 percent of the $60 trillion increase in debt since 2006 has been in the sovereign and nonfinancial corporate exposures, with China and the United States each accounting for about one-third of the total increase. Also, despite low yields, debt service burdens have increased along with rising leverage in several major economies, including Australia, Canada, and China, and the household sector in Korea. This poses greater risks over time from sharp increases in interest rates.

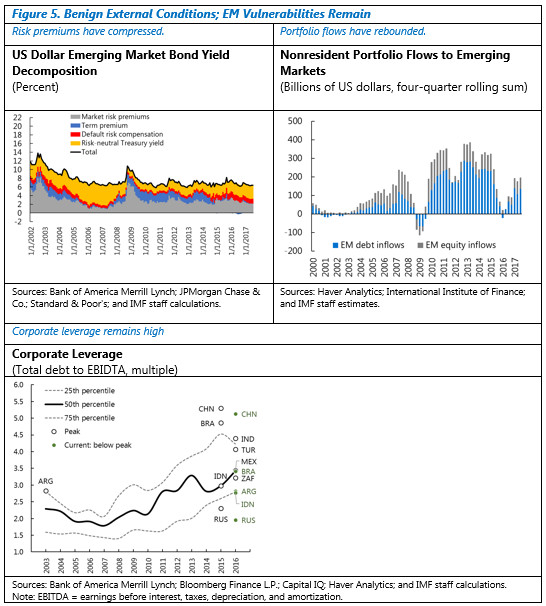

Fourth, external borrowing in emerging market and low-income countries has also increased [Figure 5]. Risk premiums continued to be compressed for emerging market borrowers, reaching multi-year lows. This has led to a rise in issuance relative to the past two years as investor search for yield has pushed some beyond their traditional risk habitats. Africa has been a main beneficiary. This is broadly good news, supporting growth prospects in these countries. But this greater reliance on foreign borrowing may at some point become a vulnerability as global risk premiums decompress, particularly for low-income countries, if those resources are not put to good use. As debt levels in these countries increase, the debt servicing share of revenues is expected to rise significantly, implying a deterioration in debt burden.

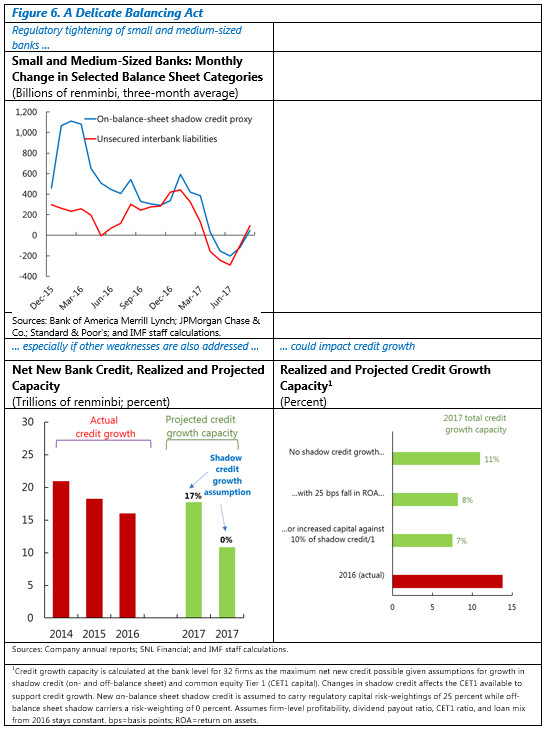

Fifth, in China, the size, complexity, and pace of expansion of credit in the financial system—particularly shadow credit—point to elevated risks to financial stability [Figure 6]. The authorities are very aware of these challenges and have recently introduced a range of measures to contain growth in shadow credit. The authorities nonetheless face a delicate balance in tightening financial policies, as such measures could have a large impact on bank credit capacity and hence potentially on economic growth.

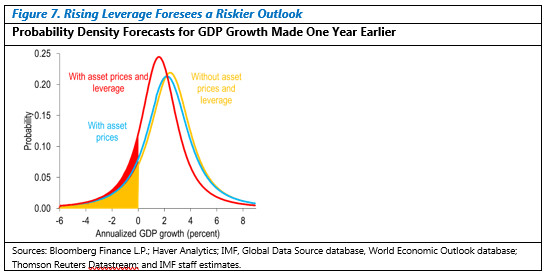

These growing vulnerabilities could derail the recovery, putting growth at risk. As shown in Chapter 3 of the most recent GFSR, financial conditions provide powerful signals about the distribution of risks to future economic growth. In particular, higher leverage and credit growth provide a significant signal of increasing tail risks to GDP growth over the medium term [Figure 7]. While the current buoyant financial conditions support a sanguine view of risks to global growth in the near term, growing leverage may be increasing downside risks to growth down the road.

Against this backdrop, the key challenge policymakers face is to continue providing the appropriate monetary policy support for the recovery, while containing the buildup of underlying financial vulnerabilities. As noted in the GFSR, financial regulators should deploy macroprudential policies to curb leverage and stability risks.

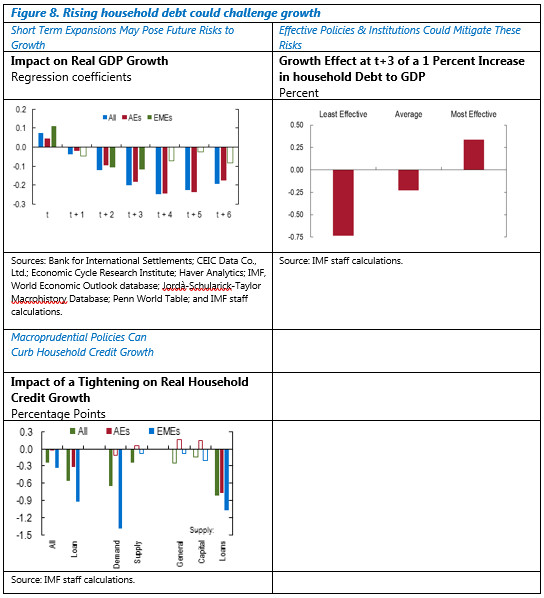

More specifically, we find that macroprudential policies can tame household credit growth, particularly in emerging market economies [ Figure 8]. Country characteristics and institutions also play an important role in mitigating these risks. Better financial regulation and supervision, less dependence on external financing, and flexible exchange rates lessen the impact of rising household debt on risks to growth.

Our suggestion is that policymakers take action on other fronts as well. In particular: major central banks should ensure a smooth normalization of monetary policy; supervisors need to put increased focus on business models of major banks; emerging market countries need to take advantage of benign financing conditions to address risks like imbalances, leverage, and external debt; and the global regulatory reform framework must be completed and fully implemented. Toward this end, global cooperation remains essential.

To summarize, our key message is that this is time for policy action on the part of authorities because vulnerabilities are building, and this could put growth at risk in the future.

A Conceptual Framework for Financial Stability Risks and Macroeconomic Performance

A challenge for policymakers is how to take information about their assessments of potential risks to financial stability and incorporate it into their decision-making framework. Micro- and macroprudential authorities rely on a variety of ways—such as expert judgement, stress tests, and early warning indicators—to assess the probability of bank capital shortages or financial crises. Based on these assessments, regulators can adjust capital and liquidity requirements, or other tools, to increase resilience in the financial sector.

But resilience is important because the financial sector is needed to provide credit (and other intermediation) to support economic growth. That role suggests that risks to financial stability can be expressed in terms of risks they pose to economic growth. Below I sketch out a framework that maps how we can link financial sector risks to growth risks through macrofinancial linkages.

In terms of financial stability, I have two related definitions. First, risk to financial stability is the likelihood that there is a disruption in the capacity of the financial system to perform its functions, especially its capacity to provide credit to the economy. These risks are greater when vulnerabilities are high or shocks are large. Vulnerabilities are high when financial firms are highly levered; when they have large funding mismatches in maturity, liquidity, or currency; or when they are highly interconnected and opaque. Such vulnerabilities can lead to fire sales, investor runs, and contagion in response to a negative shock, and disrupt financial intermediation (see Adrian and Liang (2016) for a review of papers that model these channels, and a matrix of vulnerabilities to monitor).

A second definition focuses on its dynamic aspects because vulnerabilities in the financial system can be procyclical and increase endogenously. When the economy has been strong and investors’ required compensation for risk—the price of risk—has been declining, financial vulnerabilities can build up because of frictions, such as risk management practices or extrapolative expectations. The greater the imbalances that have built up during times of easy financial conditions, the larger the risks of a sharp fall in financial conditions. Thus, risks to financial stability can be viewed as the likelihood of a sharp downward movement in financial conditions and increased risks to economic growth (Adrian, 2017). Even if the sharp adjustment does not result in a systemic disruption of financial intermediation, it can lead to a prolonged period of economic recovery, and some output losses can become permanent.

By either definition, higher financial stability risks ultimately increase risks to economic growth and to its sustainability through macrofinancial linkages. These are the transmission channels between financial conditions and output growth, where financial conditions measure the price of risk and financial vulnerabilities. In particular, financial conditions may be helpful for predicting the probability distribution of future GDP growth.

This specification for Growth-at-Risk is based on amplification channels from vulnerabilities that go beyond traditional credit-channel effects. In traditional channels, because of an external finance premium and asymmetric information, lenders will restrict credit when a borrower’s net worth falls (Bernanke and Gertler, 1989; Gertler and Kiyotaki, 2009). But, while these models help to explain how financial frictions can amplify cycles, they do not explain the sharp, discontinuous adjustments of the economy to high vulnerabilities. High leverage and funding mismatches at banks, nonbanks, market intermediaries, or high debt of households and businesses can lead to sharp nonlinear adjustments, when net worth falls when occasionally binding collateral constraints are activated (He and Krishnamurthy, 2013; Brunnermeier and Sannikov, 2014). That is, potential downside risks from investor runs, fire sales, or contagion in the financial sector can be non-linear. Similarly, downside risks from excess borrower credit can generate aggregate demand externalities, which can result in borrowers being forced to deleverage (Bianchi, 2011; Korinek and Simsek, 2016). Moreover, these downward adjustments are not likely to be matched by behaviors that would generate upside risks.

In addition, downside risks to growth can be evaluated over different projection horizons. In this way, the framework also can illustrate the volatility paradox, in which easy financial conditions can sow the seeds for the buildup of vulnerabilities (Brunnermeier and Sannikov, 2014). Ease of financing can mask problems and lead to increases in debt, which leads to a sharp increase in volatility when financial conditions tighten and problems become apparent. This paradox suggests there is a tradeoff for policymakers between the degree of resilience and the level of activity in normal times.

Estimating Growth-at-Risk

In the October 2017 GFSR, we present measures of Growth-at-Risk consistent with this conceptual framework (Chapter 3). Formally, Growth-at-Risk is the value-at-risk of future GDP as a function of financial conditions. It estimates the conditional distribution of GDP growth in the future, based on the current level of GDP growth and current financial conditions [1] . We compute Growth-at-Risk at various horizons of one quarter, one year, and three years ahead. The calculations are done for 21 major advanced and emerging market economies (11 advanced and 10 emerging market).

To measure financial conditions we use a set of financial variables, including variables like: term spreads, credit spreads, equity and house prices; indicators of financial sector strength; and borrower credit. [2] We then build country-specific indices of financial conditions that reflect the pricing of risk and leverage in domestic markets. Those indices also include global financial conditions, as measured by commodity prices, exchange rates, and a volatility index—the VIX.

The chapter documents that financial conditions are powerful forecasters for the downside risks to GDP growth over a horizon of one to four quarters. In line with the existing literature, we find that tighter financial conditions predict increased downside risks to GDP growth in most advanced economies, and a more uncertain growth outlook in several emerging market economies. There is an inverse relationship between tighter financial conditions and the forecast for global growth in the following year, for different points in the distribution of growth forecasts (whether it is the median, or the the 95th or 5th percentiles). The estimated impact of financial conditions on growth are largest for the 5th percentile, while the effect on the median growth rate or upper percentiles are quite small—suggesting important asymmetries. Intuitively, the upper quantiles of the GDP distribution is fairly constant as capacity constraints prevent GDP growth from jumping upwards when financial conditions are buoyant, while the lower quantiles can drop sharply during financial distress. This asymmetry is especially pronounced in advanced economies.

Of course, the impact of financial sector conditions depends on the type of economy. This appears clearly when we evaluate the effects of each component—domestic price of risk, leverage, and external conditions— on the distribution of growth. External conditions, which include commodity prices, have a significant impact on downside risk for emerging market economies. Unsurprisingly, rising commodity prices appear beneficial for exporters, while they increase the risk of a downturn in commodity-importing countries.

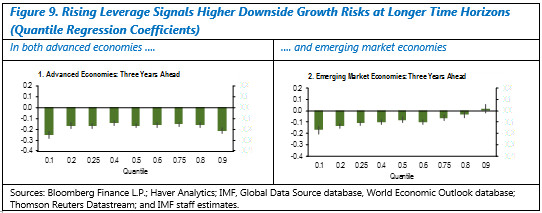

Over the medium term—in the two to three years following a change in financial conditions—we found that, while the price of risk does not affect the shape of the conditional growth distribution significantly, higher leverage does have significant predictive power at longer horizons. [ Figure 9] shows that the effects of rising leverage is significantly impacting downside risk of the GDP distribution for both advanced and emerging market economies.

In other words, our analysis indicates that the price of risk and external conditions appear to signal downside risks to growth in the near-term, while leverage signals risks at longer horizons.

Our estimations were done for a sample of countries, using data that were common across those countries. But countries could also elaborate and calibrate more tailored measures of FCIs and models to quantify risks to their future growth. Such measures and models—if adequately calibrated to reflect each countries’ characteristics, and regularly maintained to track structural trends—would be a natural complement to their existing financial stability surveillance tools. Policymakers could use them to conduct macrofinancial surveillance and evaluate policy options, as they would provide a basis to assess the odds of a recession or of any other adverse growth scenario one quarter, one year, or further ahead, given the current financial conditions. Such measures and models could also be used to analyze hypothetical scenarios, such as how a change in some financial variables would affect those odds, or to learn whether variables that signal low risks to growth today, may at the same time signal high risks to growth tomorrow.

Let me illustrate this by applying our model to the global economy. Global growth has averaged about 3½ percent in the last 25 years, and the probability of it being below one percent has averaged 5.8 percent. But the changes in financial conditions observed in the first quarter of 2008 pulled up the probability of global growth falling below one percent in the first quarter of 2009 to as high as 20 percent—the model would have raised a red flag for policy makers in a timely manner. Another application is to consider a tightening of financial conditions of half the size of what was observed during the financial crisis. For example, if spreads were to rise in the United States to a level of five times their historic average, or if the VIX were to increase to a level of twice its historic average, the probability of global growth falling below one percent would rise to 35 percent at the current juncture.

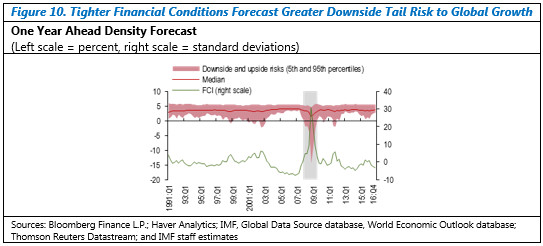

So, what are the current level of financial conditions signaling through the lens of this model? The FCI—shown in [Figure 10]—is well below zero, reflecting low credit spreads and low volatility in financial markets. This suggests a relatively benign outlook for growth at a one-year horizon. In particular, the FCI predicts limited downside risk. That’s the good news. But while the price of risk is low, debt levels have been growing, as I mentioned earlier, which in this model signals higher downside risks down the road.

The estimates of Growth-at-Risk derive from an empirical, econometric model. This is a reduced-form approach to modeling the financial stability monitoring framework. It is also possible to adopt a more structural approach to illustrate the (nonlinear) response of output growth to shocks to financial conditions.

In the GFSR, we also run a simulation exercise based on an open economy structural model [3] , which allows to evaluate the effects of macroprudential policies.

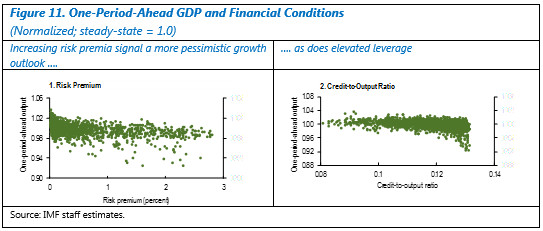

The model can be used to simulate the distribution of future growth, using alternative asset prices and credit-to-GDP ratios [ Figure 11]. In the simulations, as in reality, output and asset prices can fall significantly as fire sales and deleveraging lead to tighter credit conditions; this can create a negative feedback loop. Results from the model indicate that the distribution of future growth in the next period differs depending on asset prices (risk premiums). When asset prices are low (risk premiums have risen), growth in the next period declines, and declines all the more that increases in risk premiums are large [Figure 11, left panel]. The effects of higher credit-to-GDP ratios on growth in the next period are also striking, and illustrate a crisis (defined as a decline in output of more than three percent) [Figure 11, right panel]. When changes in the credit-to-GDP ratio are moderate, the conditional density of output widens, but the downside risks for larger changes in credit-to-GDP is substantially greater.

The simulation exercise provides consistent outcomes with the Growth-at-Risk approach, and confirm that financial conditions are leading indicators of risks to GDP growth. They also confirm that the probability distribution of GDP growth is asymmetric with downside risks to growth being larger than upside risks.

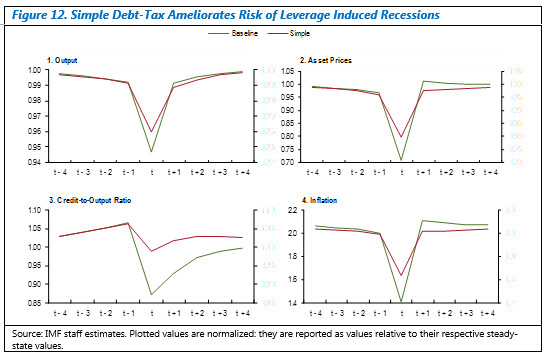

The exercise also allows us to simulate the effects of using macroprudential policy tools in response to a rise in vulnerabilities. In particular, imposing a tax on borrower leverage that depends on the level of financial conditions can mitigate the negative effects of excess leverage for future growth. Without a tax, the probability of a recession driven by a financial crisis is 1.3 percent, and downside risks are large. If an optimal state-contingent debt tax or loan-to-value limit were implemented, the probability of a recession would fall to 0.5 percent, and downside risks would be significantly contained. While an optimal tax is likely too complicated to implement in practice, it can be approximated by a simple rule based on risk premiums.

These results are shown in [Figure 12], which compares outcomes of a baseline crisis scenario, and the outcomes of a crisis scenario where a simple policy rule is implemented. The charts show the behavior of output, asset prices, credit-to-output, and inflation. As can be seen, a simple policy rule moderates the sharp reductions in output and the other variables, suggesting important welfare gains from macroprudential policies based on financial conditions.

These types of model estimates can help policymakers take appropriate actions to reduce the costly effects of a crisis. Indeed, the GFSR shows that macroprudential policies can mitigate Growth-at-Risk (Chapter 2). For example, detailed panel regression analysis shows that demand-side measures, such as limits on the debt-service-to-income ratio and loan-to-value ratio, seem effective in restraining credit growth. While counter-cyclical macroprudential policy is often described as mitigating systemic risk in the time dimension, in practice, this amounts to aiming at mitigating the risk of sharp reversals in financial conditions. The reduction of systemic risk—the tail of the distribution of changes in financial conditions—is therefore an important outcome of these policies.

To sum up, the October 2017 GFSR presents some tentative results showing how the term structure of global financial stability risks is forecast by the price of risk in the near-term and by borrower leverage in the medium-term. It also offers an analysis of how macroprudential tools can mitigate the downside risks to growth. One can visualize a term structure of financial stability risks, which is spanned by different indicators at different horizons.

Future Work

There could be extensions to a financial stability monitoring framework that focuses on the externalities stemming from vulnerabilities. For instance, we are now working to estimate Growth-at-Risk conditional on the level of financial conditions and vulnerabilities. In other words, we are assessing whether the effect of financial conditions on Growth-at-Risk differs when excess private nonfinancial credit is high or low. This conditioning addresses the question of whether there is a steeper tradeoff between benign conditions in the near-term and a recession or crisis down the road when excess credit is high rather than low. [4] Preliminary results for advanced economies suggest there is a steeper tradeoff when credit is high, which could suggest policy actions could be warranted when vulnerabilities are building.

This framework would provide a tool for countries to regularly estimate Growth-at-Risk in future quarters, and to help guide policies to avert serious downside risks to growth. Both macroprudential policies and monetary policy can be used to affect financial conditions and to lean against building vulnerabilities. Importantly, the framework highlights the importance of credit and leverage, in addition to the price of risk. Authorities could tighten macroprudential policies, such as a tax on borrower debt or a higher bank-capital requirement, to increase the price of risk or reduce credit growth to mitigate the buildup of leverage before it reaches levels that would signal substantial downside risks. Or they could raise monetary policy to tighten broader financial conditions.

While countercyclical macroprudential policies and monetary policy can both, in principle, be used to lean against easy financial conditions and building of vulnerabilities, there are important differences. The advantage of macroprudential policies is that they can be targeted at certain sectors or financial entities, which is less costly if vulnerabilities are clearly identified and narrow rather than broad. In addition, tools such as the countercyclical capital buffer or loan-to-value ratios, can build resilience and improve the ability of banks and borrowers to absorb losses in the event financial conditions tighten in the future.

A key advantage of using monetary policy more systematically to steer financial conditions is that it can get into all the “cracks,” while macroprudential policy can be arbitraged across jurisdictions, markets, or institutions. But there are also limitations to using monetary policy to offset building vulnerabilities, because the effects may be too broad and thus too costly in terms of meeting its price stability mandate. Communication challenges may also be more pronounced in the event there were to be a potential contrast between financial stability and price stability objectives.

Even within an inflation targeting framework, monetary policy has to consider financial stability risks as Growth-at-Risk directly enters into monetary policy makers’ objectives, and monetary policy impacts financial conditions directly. . The issue to be debated, and where more research is still needed, is on whether monetary policy should be used to directly alter financial conditions and vulnerabilities based on its effectiveness, possible conflicts with a price stability mandate, or how it could be complementary to macroprudential policies (Adrian and Liang, 2016; Svensson, 2016). My expectation is that the Growth-at-Risk measures will contribute to this debate, in that they can quantify risks to financial stability in the same metrics as used for setting monetary policy.

References

Adrian, Tobias. 2017. “Macroprudential Policy and Financial Vulnerabilities”. Speech at the European Systemic Risk Board Annual Conference, Frankfurt.

Adrian, Tobias, Nina Boyarchenko, and Domenico Giannone. 2016. “Vulnerable Growth.” Federal Reserve Bank of New York Staff Report 794.

Adrian, Tobias, and, Nellie Liang. 2016 “Monetary Policy, Financial Conditions, and Financial Stability.” Federal Reserve Bank of New York Staff Report 690.

Aikman, David, Andreas Lehnert, Nellie Liang, and Michele Modugno. 2016. “Financial Vulnerabilities, Macroeconomic Dynamics, and Monetary Policy.” Finance and Economics Discussion Series, 2016-055, Federal Reserve Board.

Bernanke, Ben S., and Mark Gertler. 1989. “Agency Costs, Net Worth, and Business Fluctuations.” American Economic Review 79 (1): 14–31.

Bianchi, Javier. 2011. “Overborrowing and Systemic Externalities in the Business Cycle.” American Economic Review 101 (7): 3400–26.

Brunnermeier, Markus K., and Yuliy Sannikov. 2014. “A Macroeconomic Model with a Financial Sector.” American Economic Review 104 (2): 379–421.

Gertler, Mark, and Nobuhiro Kiyotaki (2010). “Financial Intermediation and Credit Policy in Business Cycle Analysis,” Handbook of Monetary Economics 3(11), 547-599.

Korinek, Anton, and Alp Simsek. 2016. “Liquidity Trap and Excessive Leverage.” American Economic Review 106 (3): 699–738.

He, Zhiguo, and Arvind Krishnamurthy. 2013. “Intermediary Asset Pricing.” American Economic Review 103 (2): 732–70

Svensson, Lars E. O. 2016. “Cost-Benefit Analysis of Leaning Against the Wind: Are Costs Larger Also with Less Effective Macroprudential Policy?” IMF Working Paper WP/16/3.

[1] This empirical specification builds on Adrian, Boyarchenko, and Giannone (2016).

[2] The choice of variables builds on a long literature that explains the forecasting power of financial metrics for expected growth. That literature finds that increased volatility and wider credit spreads will point to trouble in the near term (a year or less); that is, they predict expected negative growth.

[3] We use a New Keynesian open economy model that embeds an occasionally binding collateral constraint on borrowers.

[4] This conditioning is suggested by empirical findings for the United States that the response of the economy to changes in financial conditions differs by whether the credit-to-GDP gap is high or low. Looser conditions when the credit gap is high leads to growth in the near term but signals a recession risk in the longer term as credit continues to build up, leaving the economy vulnerable to shocks (Aikman, et al, 2016)

IMF Communications Department

MEDIA RELATIONS

Phone: +1 202 623-7100Email: MEDIA@IMF.org