Belgium—Staff Concluding Statement of the 2020 Article IV Consultation

February 20, 2020

Belgium’s economic engine has continued to run relatively well so far, with strong job creation and historically low unemployment. However, the public finances are deteriorating, and with a caretaker government in the driver seat, maneuverability is limited, while risks remain . In the near term, policymakers must focus on limiting risks, including by strengthening spending controls and resisting pressures that would further worsen the deficit . A new government should use its fresh mandate to address population aging, put public debt on a downward path, boost employment and productivity growth, deliver on climate change commitments, and safeguard financial stability.

Context and challenges

1. Economic activity has held up so far despite prolonged political uncertainty. Belgium has been without a full-fledged government since December 2018. Nonetheless, real GDP growth remained solid, reaching 1.4 percent in 2019, above the euro-area average. The labor market also improved, with over 70,000 jobs created last year, while the unemployment rate reached a historical low of 5.4 percent.

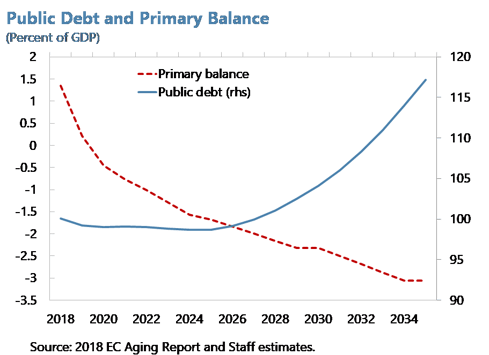

2. The public finances, however, deteriorated sharply. Revenue collection declined on the back of the ongoing tax shift and waning temporary factors. Moreover, social-benefit spending increased, although it was largely offset by a lower interest bill. At around 100 percent of GDP, public debt was among the highest in the euro-zone.

3. The outlook remains clouded by uncertainty and downside risks. Growth is projected to moderate to around 1.2 percent this year and next and stabilize at its potential rate of around 1.3 percent in the medium term. However, materialization of external risks, such as escalating trade tensions, further euro-area growth slowdown, or rapid spread of the coronavirus, could also lead to a weaker outlook. In addition, prolonged political uncertainty could eventually weigh on confidence and activity.

4. Medium- and long-term structural challenges persist. The previous government advanced key labor market, tax, and pension reforms. But the agenda remains incomplete, and the policy paralysis due to the inability to form a new government has prevented efforts to address Belgium’s remaining challenges: high public and rising private debt, an aging population, slowing productivity growth, and climate change.

5. Re-igniting the reform engine to address these challenges is key, even as the reform speed depends on political developments. The cost of policy inaction is likely to increase and be compounded by existing risks. In the near term, policymakers must focus on limiting risks through selective measures where common ground can be found across party lines, while ensuring that the fiscal deficit does not deteriorate further. A new government should use its fresh mandate to implement comprehensive reforms to enhance fiscal and financial resilience and boost growth.

Rebuilding fiscal buffers and safeguarding sustainability

6. Under current policies, the fiscal deficit is set to widen further, while public debt will be on a rising long-run trajectory. This year, the deficit is expected to reach around 2¼ percent of GDP, as revenues decline and social spending rises further, on the back of automatic increases and demographic developments. Looking forward, aging pressures will boost pension and health spending, leading to a further deterioration of the deficit in the medium term and putting debt on a rising trajectory in the coming decade. If adverse shocks were to materialize, the deficit and debt would rise sooner and faster, while the room available for using discretionary fiscal policy to respond to shocks is limited.

7. Belgium needs a credible medium-term consolidation to build fiscal buffers and safeguard sustainability. In the near term, the caretaker authorities should strengthen spending controls and resist pressures that would further worsen the deficit. Maintaining budget discipline at the sub-national level is also key. As soon as a new government is formed, it should take advantage of low interest rates and the still favorable conjuncture to implement a credible and balanced consolidation strategy to reach structural fiscal balance by 2024 through a fiscal effort of around ½ percent of GDP per year.

8. Growth-friendly spending reforms should underpin the adjustment. A sustained effort to reduce the high level of primary spending while improving its efficiency is key to meeting deficit targets, lowering debt, and reorienting the budget toward more growth-friendly areas (e.g. public investment, active labor-market policies):

- Healthcare: Aging is adding to healthcare costs, which are high relative to peers. Strengthening overall cost controls, promoting preventive healthcare, and focusing reimbursements on generic medicines could help contain pressures.

- Pensions: Building on previous reforms, further measures are needed to restore the sustainability of the system in the face of aging pressures. This could include revisiting the pace of increase of the effective retirement age (while linking it to gains in life expectancy) and the mechanism governing real-benefit growth.

- Other social benefits: There is scope to improve the targeting of social benefits while protecting the most vulnerable, including by reforming the unemployment insurance system to strengthen incentives to return to work, tightening controls on disability benefits, which have grown rapidly, and better targeting family benefits to support women’s labor-force participation.

- Subsidies: Spending on subsidies, especially exemptions, has increased to levels well above peers. Thus, there could be scope to improve their efficiency, including for R&D, where evidence suggests that overlapping schemes lead to decreasing returns. The company-car scheme, which is costly and adds to pollution, should also be revisited.

- Wage bill and administrative costs: Reforms could focus on reducing fragmentation and duplication of functions in the public administration.

9. Further tax reforms could provide space to reduce labor costs in a budget neutral way. Belgium’s tax wedge remains among the highest in Europe even after recent reforms. Further base-broadening reforms could help create space to lower the labor tax wedge in the medium run to support employment and growth. Moreover, the authorities could examine how the taxation on capital can be simplified and be made more neutral.

Raising potential output

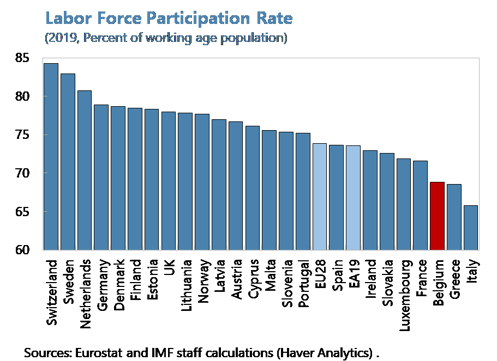

10. Reforms to boost labor-force participation, especially for vulnerable groups, should be prioritized. Despite recent reforms, Belgium’s labor-force participation rate remains among the lowest in Europe, especially for the young, low-skilled, non-EU born, and women. Near-term efforts should thus focus on active labor-market policies and more effective training programs targeted at vulnerable groups and at reducing skills mismatches. These should be complemented with further reforms to: (i) bolster female labor-force participation by revisiting parental-leave policies and reducing tax disincentives; (ii) support mobility by improving public transport across regions and reducing real-estate regulatory and tax barriers; and (iii) boost flexibility by better aligning wages with productivity at the firm level (including via opt-outs and revisiting seniority pay) and increasing the flexibility of collective dismissals.

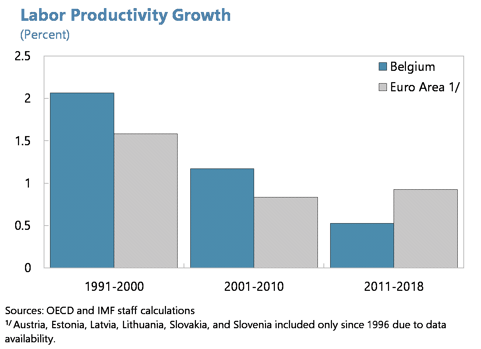

11. Complementary reforms are also needed to boost productivity growth. Belgium’s labor-productivity growth has slowed considerably over the last two decades. Reversing this trend is essential to support higher standards of living and safeguard fiscal sustainability. Reducing red tape for startups and lowering regulatory barriers to competition in professional services, retail trade and distribution would help boost investment and growth. The authorities should also continue to support access to venture capital for innovative firms. Public investment in infrastructure, fiscal space permitting, can have positive spillovers across the economy.

12. The new government should prepare a comprehensive and coordinated policy strategy to address climate change and take advantage of the opportunities from the transition to a green economy. Belgium has ambitious objectives for reducing emissions of greenhouse gasses in the medium and long run. However, progress has been limited, and current policies will be insufficient to attain the targets. Among policy options that could be considered by the new government, in collaboration with regional governments and EU institutions, are: (i) feebates or regulations to incentivize reductions in emissions; (ii) carbon taxes, the revenues from which could be used to compensate vulnerable households and boost green investment; and (iii) extending the emissions-trading system (ETS) to cover more sectors.

Safeguarding financial-sector stability

13. While resilient, the financial sector faces new challenges. Bank balance sheets have been strengthened in recent years, and capital and liquidity ratios remain adequate. Likewise, insurance companies have bolstered solvency ratios. Nonetheless, the low-for-long interest rates are putting pressure on profitability, leading banks to ease credit standards. The ensuing robust credit growth has pushed up household and corporate leverage, raising concerns about pricing of risk and future loan performance.

14. The authorities have taken proactive macro-prudential action to address financial-stability risks. Last year, the authorities activated the Countercyclical Capital Buffer and issued supervisory expectations setting limits on the share of new high-risk mortgage loans. Looking forward, they should continue to monitor risks, assess the effectiveness of ongoing measures, and stand ready to take further measures—including by extending expiring measures and making use of additional borrower-based tools—if risks intensify. Revisiting the framework for macro-prudential decision-making could help ensure the ability to deploy macro-prudential policies effectively and timely. The authorities should also encourage banks to rationalize costs, strengthen governance, and adapt business models to prepare for the challenges of digitalization.

The mission thanks the authorities for their constructive policy dialogue and kind hospitality.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Meera Louis

Phone: +1 202 623-7100Email: MEDIA@IMF.org