Are Household Inflation Expectations De-anchoring?

May 17, 2022

Good morning. I am pleased to be here and have the opportunity to discuss our latest analysis on household inflation expectations and possible de-anchoring of longer-term inflation expectations.

Over the past year, inflation has been increasing around the world. The increase has affected both advanced economies and emerging markets, although conditions vary greatly across individual countries. While increases have been most pronounced in headline inflation, measures of core inflation have also risen markedly in many countries.

The rise in inflation is driven by a multitude of factors. These include, in particular, strong demand amid the recovery from the pandemic—often compounded by substantial policy stimulus—and pandemic-related supply bottlenecks. We have also observed a shift in spending toward goods, as in-person services were more disrupted by pandemic restrictions, which has caused goods prices to outpace services prices by some margin.

Several of these factors have contributed to sharp increases in energy and food prices, but inflation has rapidly become much more broad-based. The war in Ukraine is further amplifying the pressures.

Comparison across different time horizons

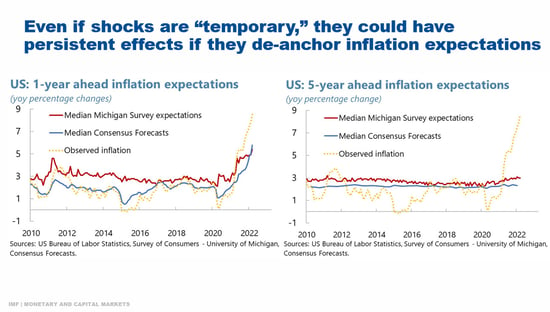

Even if these shocks ultimately prove temporary and reverse—as was widely expected last year—it is clear that they are already having persistent effects on inflation. And the challenge of bringing down inflation will become much more formidable if inflation expectations become de-anchored to the upside. Therefore, inflation expectations need to be watched carefully. For example, in the United States, the median expectations of households and of professional forecasters have been rising sharply at the 1-year time horizon, tracking the development of actual inflation.

Looking further out at the 5-year time horizon may be even more informative when we think about anchoring of inflation expectations. There, the developments have been considerably more muted. But at these longer time horizons too, median inflation expectations have risen.

Shifts in longer-term expectations are also evident in market-based measures of investors’ future inflation expectations. Indeed, here we see an even more pronounced rise, particularly at the longer time horizons. For instance, in both the United States and the euro area, the increase in inflation breakevens has been very strong at the 5-year time horizon.

Looking at the second half of the 10-year maturity spectrum, 5-year-5-year forward inflation breakevens also show significant movement in the United States and euro area, although to a lesser extent than the 5-year. The increases in the 5-year-5-year forward have been driven mainly by higher inflation risk premia since the invasion of Ukraine—signaling higher uncertainty around future inflation—although the expected inflation component has also started to rise.

Inflation expectations as measured in household surveys

Today I would like to focus specifically on the inflation expectation of households, as measured in household surveys. Household expectations tend to get less attention than the other, more readily available, measures of inflation expectations, but they may contain important information.

Recent studies show, for instance, that household inflation expectations matter for consumption and saving decisions, and for financing and home-ownership decisions. From a theoretical perspective, they should also affect wage negotiations and labor supply decisions, although more research is needed to establish this link empirically.

It has further been shown that household expectations are relatively closely aligned with the expectations of small- and medium-sized enterprises. As such, they are a proxy for the inflation expectations that inform investment, hiring, and price-setting decisions of smaller firms.

Finally, while median household expectations are often found to have somewhat less predictive power than other inflation expectations measures, some recent studies suggest that changes in their distribution can provide important signals.

Recent developments in household inflation expectations

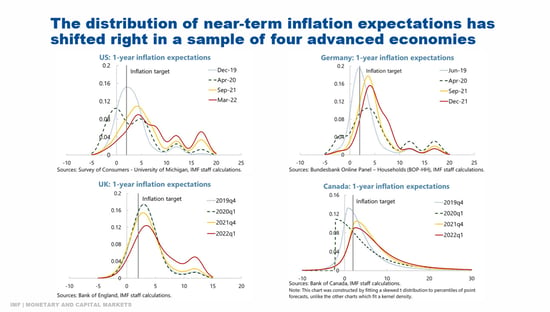

To analyze the recent developments related to household expectations, we examined household survey micro-data for the United States, the United Kingdom, Germany, and Canada. In the case of the United States (where we use data from the Michigan Survey) and for the United Kingdom (where we use the Bank of England survey) these data are readily available. For Canada and Germany, the data are not publicly available, and the Bank of Canada and the German Bundesbank kindly provided us with additional data from their respective surveys that we used for this analysis.

A picture begins to take shape when we plot the densities of the point forecasts of 1-year ahead inflation at four different points in time since 2019, with the most recent observations being the first quarter of the current year (except for Germany where we have data only through end-2021). From this data, we can clearly see that at the 1-year time horizon, shifts in household expectations are underway. The distributions have shifted rightward everywhere, with more and more households expecting higher inflation outcomes. In the United States, United Kingdom, and Canada, a significant share of households are expecting inflation greater than 10 percent one year out.

Given the short horizons of these expectations and the recent developments in actual inflation, these results may not be surprising. It shows that households are aware of what is happening to inflation.

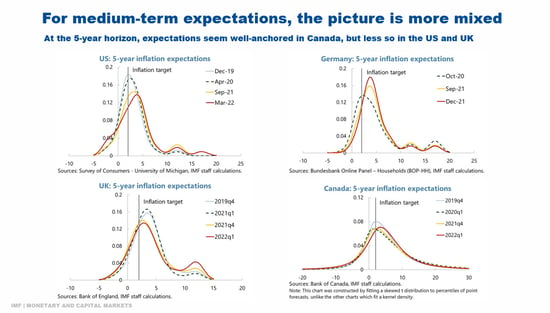

To get a better sense of how well longer-term expectations are anchored, we look at data from the same surveys, but for expectations at the 5-year time horizon. Here, the picture is more mixed. While 5-year expectations appear rather well-anchored in Canada, this is much less the case in the United States, the United Kingdom, and Germany. The shifts depicted could well signal the beginning of a de-anchoring of household expectations.

The question remains, of course, how much importance we should give these household expectations compared to other measurements of inflation expectations? How closely are they correlated with future inflation developments?

Assessing the predictive power of household expectations

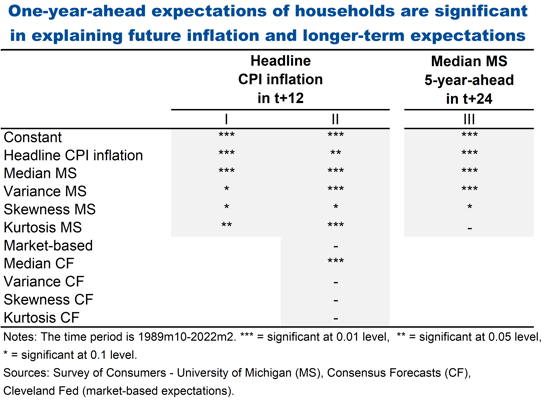

In new research currently underway at the IMF, we look at the predictive power for future US inflation of various moments of the distribution of the Michigan survey data.

We find that changes in US household expectations at the 1-year horizon contain important information about future inflation and potential de-anchoring. In particular, there is information contained in the shapes of the distribution; it is not enough to simply look at average expectations, one needs to examine the micro-data. Looking deeper into the summary statistics associated with the data, the changes in median, variance, skewness, and kurtosis all have very substantial predictive power for one-year ahead inflation.

Importantly, this remains the case even after including market-based expectations and expectations of professional forecasters in the equations—which is evidence that household expectations add considerable information over the other measures.

In a separate exercise, we also find that higher disagreement among households on near-term inflation prospects is a predictor for increases in future 5-year expectations, such that higher disagreement even on 1-year expectations may be an early warning sign of de-anchoring risk.

This result is consistent with other recent findings showing that shifts in the distribution of inflation expectations have presaged a rise in mean inflation in US data. And it underscores that the shifts in the distributions—in the case of our data across major advanced economies—are a cause for concern.

Conclusion

To conclude, the analysis suggests that household inflation expectations and their distributions contain valuable information about future inflation trends and about possible de-anchoring of longer-term inflation expectations. They are therefore useful complements to market-implied inflation measures and surveys of professional forecasters.

A closer look at recent developments in household inflation expectations in Canada, Germany, the United States, and the United Kingdom suggests that expectations have started to shift—in both obvious and more subtle ways. Recent moves in 5-year expectations in the United States and the United Kingdom, and Germany may be particularly concerning.

Advanced-economy central banks need to remain very alert to such shifts in inflation expectations, and they need to take decisive policy action to rein in inflation and ensure that expectations remain appropriately anchored.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org