Middle East and Central Asia

Regional Outlook Reflecting Global Developments

April 2017

A more favorable global environment is helping to improve economic prospects in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) and Caucasus and Central Asia (CCA) regions, although growth prospects remain subdued.

To improve growth and boost living standards, countries in the MENAP region face an ongoing need to enact strong and lasting structural reforms, while consolidating their fiscal positions.

While growth is improving in the CCA, growth levels are still half of what they were during the last decade. Like MENAP, the CCA is facing a number of structural reform priorities, including repairs to its vulnerable financial sector.

Reports and Related Links:

MENAP And the Global Outlook: Middle East, North Africa, Afghanistan & Pakistan

The global factors shaping the world economic outlook for 2017 will be reflected in the outlook for the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region through their impact on commodity prices, export demand, remittance flows, exchange rates, and financial conditions. Global growth is gaining momentum and is projected to reach 3.5 percent in 2017 and 3.6 percent in 2018, a steady improvement over the 2016 growth rate of 3.1 percent. Forecasts for growth in the United States and Europe, in particular, have been revised up since the fall. And, while the outlook for emerging market and developing economies has been revised slightly down, growth projections for China have been marked up. The global outlook is consistent with somewhat higher commodity prices and stronger global trade, which will support economic activity in the MENAP region; stronger growth in China will also support anticipated investment in some countries. However, the outlook also implies higher interest rates, which will, to different degrees, increase fiscal vulnerabilities across the region.

Risks to the global outlook remain skewed to the downside. These include the potential inward shift in policies toward protectionism, and possible faster-than-expected U.S. monetary policy normalization, which could trigger a more rapid tightening of global financial conditions and further appreciation of the U.S. dollar.

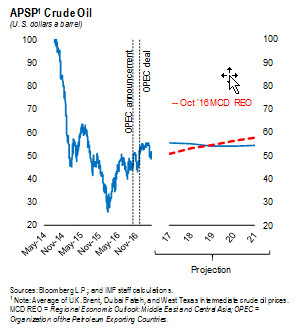

The outlook for the oil market is also uncertain. Last year’s agreement by major oil-producing countries to cut crude oil output (the “OPEC+” agreement) has helped increase oil prices, although prices remain variable. The baseline medium-term oil price outlook is little changed from that of the October 2016 Regional Economic Outlook. The key uncertainties are related to the degree of compliance with the agreement, prospects for higher production by countries either exempt or not participating in it, and lower oil demand given the downside risks to global growth.

These global factors, including the anticipated cut in oil production by MENAP oil exporters, provide the backdrop for the regional outlook (see table).

Oil Exporters: Adjustment Needed

The OPEC+ agreement has helped improve the outlook for oil prices in the near term, but prices remain volatile. Under the baseline projection for oil prices, fiscal and external positions in oil-exporting countries of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region are expected to strengthen. That would support the projected firming of non-oil growth, even though overall growth will moderate in 2017 due to the cuts in oil production. Over the medium term, oil prices are expected to remain low and highly uncertain, so further sustained fiscal adjustment remains critical. This fiscal consolidation means non-oil activity will remain modest in most countries. Moreover, countries need to maintain their focus on implementing their economic diversification plans—and the supporting structural reforms—to strengthen economic resilience. In conflict countries, oil production has surprised on the upside, but long-term economic recovery is predicated on improved security conditions.

Oil Production and Fiscal Plans Driving Growth Outlook

Growth in MENAP oil-exporting countries is expected to slow in 2017 because of the oil production cuts agreed to under the terms of the recent OPEC+ deal (see Global Developments section). In contrast, although the outlook varies across individual countries, overall growth in the non-oil sector is expected to accelerate in 2017 as the pace of fiscal consolidation eases.

In particular, non-oil growth in the countries of the Gulf Cooperation Council (GCC) is projected to strengthen from almost 2 percent in 2016 to 3 percent in 2017, while Iran is expected to see non-oil growth accelerate from ¾ percent in 2016 to almost 3½ percent in 2017. In contrast, non-oil growth in Algeria is expected to continue to slow.

Over the medium term, although overall growth in the GCC and Algeria will be supported by a projected recovery in oil production, non-oil growth will remain constrained by continued fiscal tightening in countries with significant adjustment needs (Algeria, Bahrain, Oman, Saudi Arabia). In Iran, the outlook continues to be hampered by remaining sanctions and domestic structural weaknesses, such as in the financial sector.

Prospects for countries affected by conflict remain very uncertain; they are driven by the security situation and the related impact on oil production, and a lack of reliable data makes it difficult to assess the non-oil economy. Libya increased oil output significantly at the end of 2016, boosting growth prospects for 2017. Iraq surpassed oil production expectations in 2016, but limited fiscal space for oil-related investments implies little potential for further growth in oil output in the near term (Figure 1.1).

Fiscal Adjustment Needs to Continue over the Medium Term

Across MENAP oil exporters, the sharp fall in oil prices between late 2014 and the second quarter of 2016 was reflected in a surge in fiscal deficits (blue bars in Figure 1.2). The average fiscal deficit reached about 10 percent of GDP in both 2015 and 2016. However, the underlying fiscal stance, which is measured by the non-oil primary balance and excludes the effect of oil price movements, improved substantially in 2016, with non-oil primary deficits reduced by 5¼ percentage points of non-oil GDP in the GCC (driven by Oman and Qatar) and 11 percentage points in Algeria (diamonds in Figure 1.2). This improvement resulted from energy price reforms and spending cuts (Algeria, Oman, Qatar, Saudi Arabia), as well as increases in non-oil revenue in some countries (Algeria, Oman, Saudi Arabia). In Iran, the fiscal stance was loosened slightly to support non-oil growth, while in countries in conflict as a whole it tightened.

Across MENAP oil exporters, the sharp fall in oil prices between late 2014 and the second quarter of 2016 was reflected in a surge in fiscal deficits (blue bars in Figure 1.2). The average fiscal deficit reached about 10 percent of GDP in both 2015 and 2016. However, the underlying fiscal stance, which is measured by the non-oil primary balance and excludes the effect of oil price movements, improved substantially in 2016, with non-oil primary deficits reduced by 5¼ percentage points of non-oil GDP in the GCC (driven by Oman and Qatar) and 11 percentage points in Algeria (diamonds in Figure 1.2). This improvement resulted from energy price reforms and spending cuts (Algeria, Oman, Qatar, Saudi Arabia), as well as increases in non-oil revenue in some countries (Algeria, Oman, Saudi Arabia). In Iran, the fiscal stance was loosened slightly to support non-oil growth, while in countries in conflict as a whole it tightened.The projected increase in oil prices and continued consolidation will reduce 2017 overall fiscal deficits significantly to 4¼ percent of GDP on average. Planned adjustment in the GCC and Algeria, for example, implies that non-oil primary deficits will improve by 3¼ and 5½ percentage points of non-oil GDP respectively. Adjustment measures include further increases in energy prices (Algeria and Bahrain, planned in Saudi Arabia), expatriate labor fees (Bahrain, planned in Saudi Arabia), excise taxes (Algeria, GCC), increases in tax rates (Algeria, Oman), control of current spending (Algeria, Bahrain, Oman, Qatar), and reductions in capital spending (Algeria, Oman). In Iraq, the fiscal stance is expected to loosen somewhat as the receipt of previously delayed donor financing relaxes the cash constraint faced in 2016. In Iran, the fiscal stance is expected to tighten slightly.

IMF staff projections suggest that the fiscal deficits of MENAP oil exporters could fall below 1 percent of GDP by 2022—a big improvement over 2016. These projections are conditional on the sustained implementation of ambitious fiscal reforms. For example, policymakers plan further energy price reforms (Algeria, Iraq, GCC), while the GCC is planning to introduce a value-added tax in 2018. This envisioned fiscal adjustment is necessary for long-term fiscal sustainability, despite already significant efforts. However, the pace of consolidation should be calibrated to country-specific circumstances. Countries with large buffers, such as Kuwait, Qatar and the United Arab Emirates can adjust more gradually to minimize adverse effects on non-oil activity; countries with smaller buffers will need to move faster. When choosing a specific consolidation path, countries should prioritize growth-friendly measures such as further energy price reforms (Box 1.1), additional cuts to current spending, and measures to increase revenues, including through improved tax administration (see the October 2016 IMF Departmental Paper Diversifying Government Revenue in the GCC: Next Steps).

Successful implementation of fiscal plans will be helped by strengthening fiscal institutions. Although a work in progress across the region, there have been notable advances in setting up medium-term fiscal frameworks (Algeria, Kuwait, Qatar, Saudi Arabia) and debt management offices (Kuwait, Saudi Arabia). Iran is revamping its public financial management system, including introducing accrual accounting, modernizing the Financial Management Information System, and developing a Treasury single account.

Cumulative overall budget deficits for the five-year period between 2016 and 2021 are estimated at $375 billion, down from $565 billion in the October 2016 Regional Economic Outlook (REO). This is a substantial improvement predicated on the sustained implementation of these ambitious fiscal plans and helped by projected oil price trends. Recognizing the need to strike a balance between drawing down assets and issuing debt, countries have increasingly used debt to finance deficits, and this is expected to continue in 2017 (see Chapter 5 of the October 2016 REO). External sovereign issuance reached $50 billion in 2016, more than five times the 2015 amount, which also played a key role in financing external deficits. Conditions in global markets remain favorable for oil exporters with market access, which will likely encourage continued issuance of international debt1.

In particular, sovereign yields on GCC U.S. dollar–denominated bonds increased by about 10 basis points between November 1, 2016, and March 24, 2017, much less than the 60-basis point increase in the benchmark 10-year U.S. Treasury bond. However, reliance on external financing is vulnerable to sudden changes in global risk aversion, so the associated risks need to be actively managed.

Domestic debt issuance would reduce risks related to external financing, and would help develop local financial markets. However, any domestic issuances need to be considered carefully to avoid crowding out private sector credit, especially where liquidity conditions are already tight.

External Balances Improving

After a couple of years of sizable deficits, higher oil prices and fiscal consolidation are expected to return the total current account of MENAP oil exporters to broad balance this year. However, external challenges remain, which the projected fiscal adjustment discussed above will also help alleviate. In GCC countries, reflecting their fixed exchange rates, real exchange rates have appreciated due to the recent strengthening of the U.S. dollar, reducing competitiveness and raising demand for imports. Algeria has seen both its nominal and real effective exchange rates appreciate in recent months as well. In Iran, preparations for exchange rate unification are continuing. The ongoing conflicts in Yemen and Libya have caused sharp depreciations in parallel exchange rates, reflecting security concerns and foreign exchange shortages.

Financial Sector Appears Healthy Overall; Credit Starting to Slow

Banks in the region remain generally well capitalized. However, profitability is declining, liquidity has tightened in most countries—although it has eased in recent months in Saudi Arabia and the United Arab Emirates—and pressures on asset quality are emerging in some countries. There are pockets of vulnerability; the Iranian banking sector needs recapitalization and restructuring, and Iraq is working toward addressing challenges with state-owned banks. Banking sector regulatory reforms are progressing, and a number of countries are strengthening their resolution frameworks, including introducing bankruptcy laws (passed in the United Arab Emirates and planned in Saudi Arabia) and developing crisis management frameworks (Kuwait).

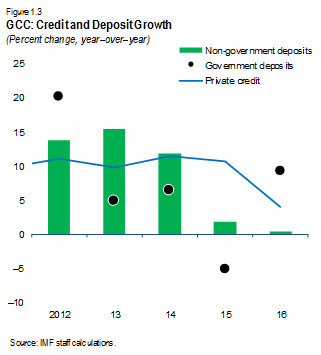

Credit markets were initially shielded from the slowdown in deposit growth that resulted from lower oil prices (Figure 1.3).

To support credit, banks increased foreign wholesale funding (Bahrain, Qatar) and substituted from foreign assets (Oman, Saudi Arabia, United Arab Emirates). However, credit growth slowed significantly in 2016. Beyond 2016, credit demand could decelerate further as higher U.S. interest rates are reflected in lending rates, although idiosyncratic factors—the 2022 FIFA World Cup (Qatar) and Expo 2020 (Dubai)—will support credit demand in Qatar and the United Arab Emirates.

To support credit, banks increased foreign wholesale funding (Bahrain, Qatar) and substituted from foreign assets (Oman, Saudi Arabia, United Arab Emirates). However, credit growth slowed significantly in 2016. Beyond 2016, credit demand could decelerate further as higher U.S. interest rates are reflected in lending rates, although idiosyncratic factors—the 2022 FIFA World Cup (Qatar) and Expo 2020 (Dubai)—will support credit demand in Qatar and the United Arab Emirates.Countries will need to adapt to this environment of lower oil prices and liquidity to ensure the continued availability of credit to support the private sector. Recent measures include the relaxation of the loan-to-deposit ratio, the introduction of longer-term repos (Saudi Arabia), and tailoring programs of Treasury bill auctions to liquidity conditions (Qatar). Central banks will need to become more active liquidity managers, which will require improvements in the institutional framework in some countries—this process is underway, for example, in Algeria, where the central bank recently reintroduced refinancing instruments. Continued efforts to improve private sector access to finance will be needed to support successful diversification.

Structural Reforms: From Design to Implementation

Persistently lower hydrocarbon revenues mean that the current development model based on a redistribution of oil wealth through government jobs and generous subsidies is no longer sustainable. The challenge, therefore, is to develop a new model of economic growth that is both resilient and inclusive. In particular, there is a need to reduce the dependence on oil and generate private sector jobs for the rapidly growing labor force.

Last year saw the design of ambitious strategic development plans. But countries need to maintain a steady focus on the implementation of those plans and on other supporting reforms.

Efforts to encourage greater foreign investment are underway. New investment laws in Algeria (passed by Parliament) and Oman (currently under consideration) could boost foreign direct investment, while allowing foreign ownership outside free economic zones in the United Arab Emirates could have the same effect. Saudi Arabia has introduced reforms to its equity and bond markets, including the easing of restrictions on foreign investment.

More needs to be done, however, to improve the business environment as progress has been uneven. For example, the recent opening of the Kuwait Business Center (a business-facilitating one-stop window) is an important step in the right direction. But, while Algeria and the United Arab Emirates improved their World Bank Doing Business rankings by seven and eight places, respectively, on average MENAP oil exporters gained only one place. And MENAP oil exporters not affected by conflict lost three places, on average, in the World Economic Forum’s competitiveness rankings.

Since public sector employment growth will be much more limited in the future, new private sector jobs will be needed for the 6.5 million labor force entrants expected by 2022 in Algeria, Iran, and the GCC. Labor market reform, including as part of improving the broader business environment, will be key to this process. In Saudi Arabia, authorities are planning to increase fees on expatriate labor. These will need to be part of a broader package of labor market reforms to encourage the increased employment of Saudi nationals in the private sector.

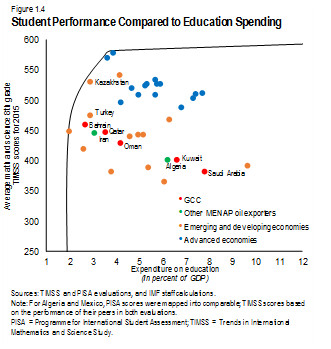

Enhancing human capital will also be critical to policymakers’ efforts to boost productivity and address the challenge of creating jobs for young jobseekers. For example, MENAP oil exporters need to improve the quality of their education to catch up with emerging markets such as Kazakhstan and Turkey, which score better in the Trends in International Mathematics and Science Study (TIMSS – Figure 1.4), a ranking of the performance of students around the world.

In conflict countries, stabilization of the security situation will be the key prerequisite. For example, school dropout rates exceeded 50 percent in Syria in 2013, the most recent year for which data are available.

1 For example, in March, Oman covered more than 70 percent of its 2017 financing need through a Eurobond issue and Kuwait raised $8 billion through its debut bond issue, while, in April, Saudi Arabia raised $9 billion in a debut international sukuk.

Box 1.1. Pre-Tax Energy Subsidy Reform in MENAP Oil-Producing Countries

MENAP oil exporters have taken significant steps in energy price reform to adjust to the ongoing environment of lower oil prices. However, more needs to be done, not only to underpin the needed fiscal consolidation but also to promote greater economic efficiency.

Despite recent price adjustments, MENAP oil exporters still maintain by far the lowest energy prices in the world (Figure 1.1.1). The provision of cheap energy has been an important policy mechanism to allow consumers to benefit from their country’s oil wealth. But this policy has also come with significant side effects. It creates the incentive to use energy-based technologies, which pushes the structure of economies toward energy- and capital-intensive industries. It reduces the cost of energy-inefficient transportation, buildings, and infrastructure, which makes it difficult to reduce energy intensity in the future and has implications for congestion and pollution; and it typically requires expensive subsidies.

MENAP oil exporters have the largest energy subsidy bill in the world.1 As a group, these countries accounted for more than one-fifth of global energy subsidies in 2015 (Figure 1.1.2), estimated at $115 billion (or just over 5 percent of their GDP) out of $436 billion total worldwide. This captures forgone revenue that could otherwise have been captured by aligning retail prices to market-based prices. However, subsidies often represent an actual budget expenditure or transfer. Reducing subsidies can generate budget resources for other forms of critical spending (such as growth-enhancing capital investment, education, health, and social protection).

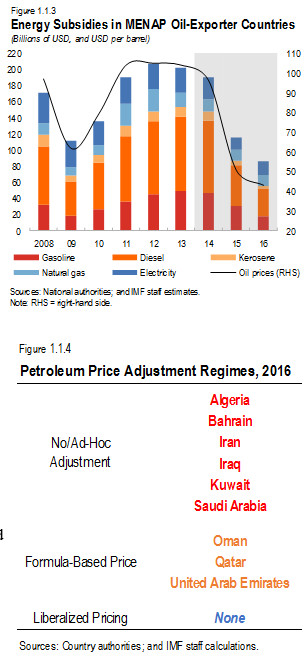

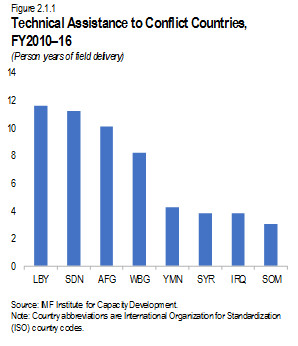

Initial steps in energy price reform are welcome, but more should be done now. Energy subsidies in MENAP oil exporters dropped from $190 billion in 2014 to an estimated $86 billion in 2016 (Figure 1.1.3). However, these savings were driven largely by the decline in international prices. Nevertheless, countries that have taken steps to introduce a formula-based pricing regime have enjoyed a relatively greater reduction in subsides (Figure 1.1.4).

For example, subsidies in Oman, Qatar, and the United Arab Emirates dropped by 61 percent on average between 2014 and 2016, compared with an average decline of 54 percent across the remaining MENAP oil-exporting countries. Overall, price regulation leaves countries vulnerable to higher subsidies if international prices rise, although less so in countries with a formula-based pricing approach.

Successful elimination of price gaps and subsidies calls for a well-developed strategy. International experience shows energy sector reforms take years to fully implement and require a firm and sustained commitment from policymakers. Success is much more likely if stakeholders are involved in the design of reforms from the start and if goals and objectives are clearly communicated to the public. In particular, the opportunity costs of energy subsidies should be disclosed (for example, crowding out investment and other critical expenditures). Reforms should be depoliticized and perceived as such, ideally by moving toward either market-based or formula-based adjustments. Adjustments could be gradual in order to allow households and industries to adapt, including by moving toward more energy-efficient technologies. Although subsidies are regressive and accrue relatively more to the wealthy, their elimination is likely to disproportionally hurt the poor. Therefore, properly designed safety nets are essential to shield the most vulnerable. Other compensatory measures, preferably front-loaded and temporary, may also be needed to ease the adjustment.

Subsidies are currently relatively low, which means that the time for further reforms in energy pricing is now. Adopting a more market-based pricing framework would help preserve the savings achieved, even if global oil prices were to rise again.

1 Algeria, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates; Libya is excluded due to data limitations.

Oil Importers: A Fragile Recovery

Underpinned by past reforms, improved confidence, and increasing external demand, output growth in most MENAP oil importers is gradually recovering. But unemployment is still too high, especially among the youth, conflicts and refugee pressures continue to weigh on the regional outlook, and vulnerabilities remain elevated. To strengthen their resilience and promote inclusive growth, oil importers need to continue their fiscal consolidation efforts while protecting much-needed social spending and public investment. Broad-based, job-rich growth will also require the implementation of structural reforms that improve the business climate and boost productivity.

From a Low Base, Growth Is Improving

The period following the global financial crisis and the Arab Spring has been a difficult one for MENAP oil importers. Although low oil prices have provided some respite over the past couple of years, security concerns and regional conflicts continue to take a toll on confidence and activity—resulting in growth rates that have failed to address high unemployment or improve living standards (Figure 2.1). That said, recent indicators suggest a gradual recovery is underway.

Regional growth is expected to increase from 3.7 percent in 2016 to 4 percent in 2017 and to 4.4 percent in 2018. In part, this rebound will reflect a fading of idiosyncratic shocks from 2016 (drought in Morocco, weak cotton harvest in Pakistan). More generally, the improved outlook reflects the continued dividends from past reforms, which have reduced fiscal deficits and improved the business climate (Morocco, Pakistan), supported by a scaling up in public investment (Pakistan). In addition, growth will be supported by the broader global recovery, which is expected to boost demand from the region’s main export markets (Figure 2.2).

Against this backdrop, however, activity across the region’s oil importers will vary significantly. Growth will be particularly robust in Djibouti, where foreign-financed infrastructure spending will remain a key driver, and in Pakistan, where implementation of the China-Pakistan Economic Corridor will boost investment. In Jordan and Lebanon, on the other hand, growth will remain relatively modest, owing to the ongoing impact of regional conflicts on tourism, confidence, and investment. And in Tunisia, the projected near-term recovery has been revised down slightly, as a result of continued uncertainty and weak tourism.Inflation Pressure Easing in the Medium Term

Although inflation in many countries is expected to increase in 2017, it should ease over the medium term. Continuing a trend since 2016, average regional inflation will rise again in 2017, reaching almost 13 percent. A portion of this increase reflects higher international oil prices. But in many instances, rising inflation also reflects reductions in energy subsidies (Egypt, Sudan), implementation of a value-added tax (Egypt), the removal of tax exemptions (Jordan), rising food prices (Djibouti, Egypt, Somalia), and the pass-through of recent exchange rate depreciations (Egypt, Sudan). In the case of Egypt, the move to a flexible exchange rate regime was accompanied by a sharp depreciation of the pound, which has pushed inflation above 25 percent. As the impact of these one-off factors fades over time, and supported by prudent fiscal and monetary policy, inflation is expected to moderate over the medium term.

Sound Fiscal Policies Needed to Boost Resilience

Despite improvements over the past few years, large fiscal vulnerabilities remain. Public debt levels remain high, exceeding 90 percent of GDP for a number of MENAP oil importers (Egypt, Jordan, Lebanon). Such large debt stocks not only undermine investor confidence, they can also add to financial stability risks, given large holdings of debt by the banking sector and generally shallow financial markets. Moreover, the associated debt-service burden is significant for a number of MENAP oil importers (Egypt, Lebanon, and Pakistan, where it absorbed between 28 and 48 percent of revenues in 2016), leaving less scope for social spending or public investment.

However, recent fiscal trends are encouraging. For the broader region, the average fiscal deficit fell from a peak of 9¼ percent of GDP in 2013 to about 7 percent of GDP in 2016. In large part, this improvement reflects reduced fuel subsidies (Egypt, Morocco, Sudan), lower transfers to energy-related state-owned enterprises (Jordan, Lebanon), and efforts to increase revenue (Pakistan) (Figure 2.3).

Nevertheless, maintaining the pace of consolidation will remain a challenge. In 2016, revenues were weaker than expected compared with the October 2016 REO due to weaker tax collection (Morocco, Tunisia), delayed reforms (Tunisia), and subdued growth (Jordan, Morocco, Tunisia). Moreover, although the savings from low oil prices and reduced subsidies have allowed for increased spending on infrastructure, health care, education, and social services (Egypt, Morocco, Pakistan, Tunisia), it will be increasingly difficult to maintain this spending now that oil prices are expected to be higher. There is, therefore, a need to push subsidy reforms through to completion (Egypt, Sudan, Tunisia) and to contain losses from state-owned enterprises—including through automatic tariff mechanisms for energy companies (Jordan, Lebanon, Tunisia).

More generally, a key priority for oil-importing countries is to generate higher revenues by broadening the existing tax base. This will require measures to rationalize multiple value-added tax rates (Morocco, Tunisia), while simplifying the tax rate structure and eliminating exemptions (Djibouti, Egypt, Jordan, Lebanon, Morocco, Pakistan, Sudan, Tunisia). It will also require renewed efforts to strengthen tax administration (Afghanistan, Mauritania, Morocco, Pakistan, Somalia, Sudan, Tunisia). In this context, the IMF’s technical assistance and engagement in some conflict-affected countries (Box 2.1) is helping strengthen revenue administration (Afghanistan, Iraq).

With Limited Fiscal Space, Durable and Inclusive Growth Requires Continued Structural Reform

Across MENAP oil importers, growth rates are too low to reduce unemployment or provide a broad-based and resilient improvement in incomes. And fiscal constraints will prevent country authorities from boosting growth through public spending alone. Therefore, there is a strong need for structural reforms that promote private sector activity and boost productivity (Figure 2.4).

Progress has already been made in this direction, including upgraded investor protection and regulations (Jordan, Mauritania, Morocco, Tunisia) and the easing of key infrastructure bottlenecks, such as poor energy supplies (Egypt, Jordan, Pakistan). But further measures are still needed to promote competition (Egypt, Jordan, Morocco), reduce the infrastructure gap (Lebanon), and address the chronic skills mismatch between jobseekers and employers (Djibouti, Egypt, Jordan, Morocco, Tunisia). More broadly, persistently high unemployment calls for further progress with labor market reform, including efforts to increase female labor force participation (Egypt, Jordan, Morocco).Productivity-enhancing reforms are also needed to improve competitiveness. Despite steady external demand, many MENAP oil importers have seen a drop in their export shares (see the October 2016 REO), suggesting weakening competitiveness and growing vulnerability to external shocks. Part of this decline can be explained by regional security concerns and fewer tourists (Egypt, Jordan, Lebanon, Tunisia), as well as by a breakdown in traditional trade routes (Jordan, Lebanon). Another factor may be the recent strengthening of the U.S. dollar, which has helped boost real exchange rates—particularly for countries with rigid exchange rate arrangements (Figure 2.5). A larger part, however, may reflect instead an underlying productivity problem for exporting firms.

Structural reforms to improve competitiveness—combined with exchange rate flexibility for countries with an appropriate monetary anchor—will help these firms compete on a more solid footing, enabling them to benefit more completely from the anticipated global recovery.

A Sound Financial Sector Will Also Underpin Growth

Sustained, broad-based growth requires a healthy financial system. For the most part, banks within the region are stable, liquid, and adequately capitalized. However, given five consecutive years of subdued growth, along with an uncertain outlook, these banks face a challenging environment, particularly with relatively high levels of nonperforming loan ratios. Nonetheless, credit growth remains moderate, with developments largely unchanged compared with the October 2016 REO (the exception here is Egypt, where tighter monetary policy could weigh on lending growth in 2017). The authorities need to strengthen their regulatory and supervisory frameworks (Djibouti, Mauritania, Tunisia); their insolvency and bankruptcy regimes; and, in some cases, their deposit insurance arrangements (Egypt, Jordan, Pakistan, Tunisia).

Risks Remain to the Downside, Partly Reflecting the Uncertain Global Environment

The outlook remains vulnerable to changes in oil prices and the global outlook, and to geopolitical developments.

- Although the medium-term outlook for oil prices is broadly unchanged compared with the October 2016 REO, the near-term path is about $5 a barrel higher (see Global Developments section). Oil import prices in 2017, therefore, will be almost 30 percent higher than last year, and any further increases could undermine consumption, increase fiscal risks, and worsen external imbalances. However, this downside risk would be partly offset by higher remittances and other foreign support from oil-exporting countries in the region, principally benefiting Egypt, Jordan, Lebanon, and Pakistan.

- Global policy uncertainty has also increased (see Global Developments section). A general increase in protectionism could undermine the global recovery and weaken demand for MENAP oil-importer exports, which would particularly impact countries with strong links to global trade and shipping (Djibouti).

- Countries are also exposed to changes in global financial conditions. While sovereign spreads for many oil importers have narrowed recently (Figure 2.6), U.S. interest rates have risen, and tighter and more volatile global financial conditions could increase borrowing costs for MENAP oil importers and their banks, adding to fiscal sustainability concerns, weighing on bank balance sheets, and undermining private sector activity. Such tightening could be particularly challenging for countries such as Egypt, Jordan, Lebanon, Pakistan, and Tunisia, which will be competing for funds in international markets. 1

- In this context, although current account deficits are expected to narrow slightly over the near term (from more than 4.8 percent of GDP in 2016 to 4.3 percent by 2018), external imbalances will remain sizable for many countries (Djibouti, Egypt, Jordan, Lebanon, Mauritania, Tunisia), suggesting a continuing need for fresh external inflows.

- A worsening of security conditions or social tensions (Afghanistan, Egypt, Lebanon, Pakistan, Somalia, Sudan, Tunisia), slower implementation of reforms (Afghanistan, Egypt, Jordan, Mauritania, Morocco, Pakistan, Tunisia), and increased spillovers from regional conflicts (Jordan, Lebanon, Sudan, Tunisia) could derail policy implementation and weaken economic activity.

However, upside risks are also emerging for some countries. In Sudan, the recent easing of U.S. sanctions could boost investment, while in Lebanon, the initiation of a series of reforms after the end of an extended political impasse may increase confidence, strengthen capital inflows, and accelerate growth.

1Egypt and Tunisia have already successfully tapped international markets in January and February, respectively.

Box 2.1 How the IMF Is Working in MENAP’s Conflict-Affected Countries

Together with international partners, the IMF helps countries affected by conflict cope with the adverse economic consequences and avoid economic collapse and supports rebuilding efforts once conflicts ease. The IMF also assists neighboring countries with mitigation of the associated economic spillovers.

In addition to severe humanitarian costs, conflicts have massive economic costs, not only for the countries directly affected, but also for their neighbors. 1 Countries exposed to conflict may face deep recessions, high inflation, worsening fiscal and financial positions, and weaker institutional quality. In addition, their ability to provide basic services collapses, with dire consequences for health and education and limiting their capacity to respond to other disasters, such as famine and epidemics. Neighboring countries experience spillovers through large flows of refugees; the impact on trade; and the economic effects of increased insecurity, including on investor sentiment. Once conflicts ease, the challenge is to achieve a sustainable recovery, including through rebuilding institutions and infrastructure and strengthening economic and social resilience.2

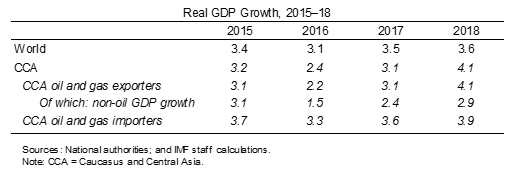

To help mitigate the economic implications of conflicts and their spillovers, the IMF provides tailored policy advice in the following areas: (1) building reliable macroeconomic frameworks; (2) monetary and exchange rate policies; (3) prioritizing spending, including to protect critical social spending, and securing debt sustainability; and (4) fostering inclusive growth. Where appropriate, the IMF also delivers significant amounts of technical assistance to its members (Figure 2.1.1),3 including through the Middle East Technical Assistance Center in Lebanon. This assistance focuses mainly on rebuilding and strengthening economic institutions, especially central banks, to support the resilience of the payment and banking systems (Afghanistan, Iraq, West Bank and Gaza); improving economic policymaking, such as public financial management (Afghanistan, Iraq)

and tax policy and administration (Tunisia, Somalia); complying with regulations on anti–money laundering and combating the financing of terrorism (Libya, West Bank and Gaza); and preparing statistics (Afghanistan, Iraq, West Bank and Gaza). For example, under the umbrella of a multi-donor trust fund, the IMF has been providing broad-based and tailored technical assistance to Somalia, which has helped the government develop the capacity to prepare a national budget and the central bank develop modern banking supervision tools. The IMF closely coordinates its technical assistance support with external partners (Somalia).

In addition to its own financing support (Afghanistan, Iraq), the IMF also helps mobilize additional resources from donors and other international financial institutions (Iraq, Jordan, Somalia) and plays a key role in supporting the dialogue of the international community by providing an assessment of economic developments and participating in donor meetings (Libya, West Bank and Gaza).

The acute nature of the refugee crisis in the MENAP region—with more than 10 million registered refugees 4 having originated from the MENAP region (mostly from Afghanistan, Somalia, Sudan, and Syria), of which more than half are being hosted in the region itself (mostly in Iran, Jordan, Lebanon and Pakistan)—requires significant and coordinated international support. Recognizing this need, the IMF has been a strong voice in encouraging fundraising efforts to deal with this refugee crisis, such as the high-level conference on Supporting Syria and the Region in London in 2016. IMF arrangements in countries affected directly or indirectly by conflicts have been tailored to take into account the impact of refugees and the internally displaced (Iraq, Jordan).

1 The following countries are experiencing the direct or indirect impacts of conflicts in the MENAP region: Afghanistan, Egypt, Iraq, Jordan, Lebanon, Libya, Pakistan, Somalia, Sudan, Syria, Tunisia, West Bank and Gaza, and Yemen.

2 See Rother, B, and others, 2016, The Economic Impact of Conflict and the Refugee Crisis in the Middle East and North Africa, IMF, Staff Discussion Note.

3 Although the West Bank and Gaza is not a member, the IMF provides technical services, including policy advice in the macroeconomic, fiscal, and financial areas, as well as technical assistance.

CCA and the Global Outlook: Caucasus and Central Asia

The global factors affecting the world economic outlook for 2017 will influence economic activity in the Caucasus and Central Asia (CCA) region through their impact on commodity prices, export demand, remittance flows, exchange rates, and financial conditions. Global growth is gaining momentum and is projected to reach 3.5 percent in 2017 and 3.6 percent in 2018, a steady improvement on the 2016 growth rate of 3.1 percent. This includes firmer growth in Russia, a key driver of remittance flows and exports for the CCA, and an upward revision to growth in China, a key investor and increasingly important trade partner for the region. This improved global outlook is also consistent with somewhat higher commodity prices. All these factors will support growth in the CCA, and represent an opportunity for countries to implement the longer-term reforms necessary to secure higher, more durable, and inclusive growth.

However, the outlook also implies higher interest rates, which could exacerbate debt vulnerabilities and, in some cases, tighten liquidity.

Risks to the global outlook remain skewed to the downside. These include the potential inward shift in policies toward protectionism, and possible faster-than-expected U.S. monetary policy normalization, which could trigger a more rapid tightening of global financial conditions and further appreciation of the U.S. dollar.

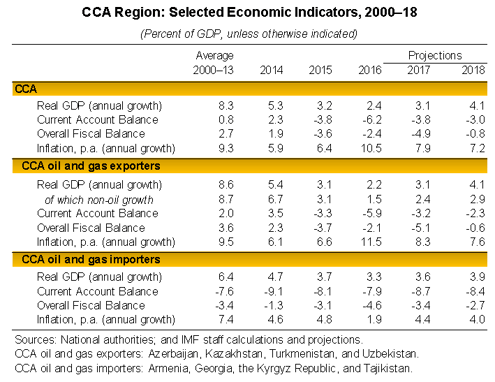

The outlook for the oil market is also uncertain. Last year’s agreement by major oil-producing countries to cut crude oil output (the “OPEC+” agreement) has helped increase oil prices, although prices remain variable. The baseline medium-term oil price outlook is little changed from that of the October 2016 Regional Economic Outlook. The key uncertainties are related to the degree of compliance with the agreement, prospects for higher production by countries either exempt or not participating, and lower oil demand given the downside risks to global growth. These global factors provide the backdrop for the regional outlook (see table).

CCA: : Recovery Remains Fragile

After a significant slowdown in economic activity in 2016, growth in the Caucasus and Central Asia (CCA) region is expected to pick up in 2017 and further accelerate in 2018. However, this reflects mainly higher commodity prices and a more benign outlook in key trading partners. While fiscal accommodation and exchange rate adjustment have been appropriate responses to earlier external shocks, they have left a legacy of higher public debt and generally weaker financial systems across the region. Against this backdrop, growth-friendly fiscal consolidation needs to proceed promptly, while monetary policy frameworks should be further strengthened to support the increased exchange rate flexibility and keep inflation under control. Weaknesses in the highly dollarized financial sectors need to be addressed urgently to minimize systemic risks and limit the potential impact on public finances. With medium-term growth prospects remaining relatively subdued, implementation of structural reforms is essential to successfully diversify away from commodities, reduce reliance on remittances, and ensure sustained and inclusive growth.

Regional Growth Bottoming Out

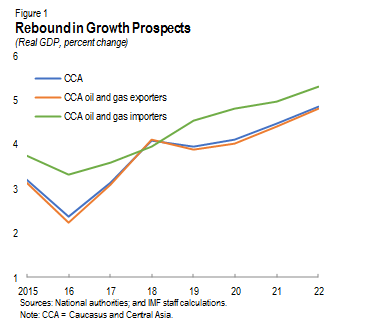

External conditions in 2016 were more favorable than envisioned in the October 2016 Regional Economic Outlook. The prices of oil and other key commodities staged partial recoveries, Russia saw a milder contraction, and growth in China was stronger. In spite of these improvements, the region continued to suffer the lingering effects of earlier external shocks, in particular, the slump in commodity prices since mid-2014, and weak economic activity in key trading partners. Growth in the CCA was 2.4 percent in 2016, 1 percentage point higher than projected last October, yet 0.8 percentage point lower than in 2015 (Figure 1).

The improvement relative to October also reflected significant revisions to economic activity in Kazakhstan due to the impact of currency adjustment, lagged effects of earlier fiscal stimulus, and oil production from the new Kashagan field.

The improvement relative to October also reflected significant revisions to economic activity in Kazakhstan due to the impact of currency adjustment, lagged effects of earlier fiscal stimulus, and oil production from the new Kashagan field. With the slightly more benign external conditions anticipated to continue, growth in the CCA is projected to pick up to 3.1 percent in 2017 and further accelerate to 4.1 percent in 2018.

However, despite recent improvements, external conditions are expected to remain relatively subdued over the medium term. At the same time, the legacy of earlier external shocks has left the CCA more vulnerable, with higher public debt and weak financial sectors. In that context, CCA growth is projected to average 4.3 percent in 2018–22, well below the 8.1 percent the region experienced in 2000–14.

In oil exporters, growth slowed to 2.2 percent in 2016, 0.9 percentage point lower than in 2015 and the lowest since 1998. In Azerbaijan, growth fell due to the impact of lower oil production in the context of lower oil prices, a sharp weakening of construction activities, and the drag from financial sector vulnerabilities. In Kazakhstan, growth slowed, despite relatively strong activity in agriculture, construction, and transportation.

Growth for CCA oil exporters is projected to rebound to 3.1 percent this year and further accelerate to 4.1 percent in 2018, though with some differences across countries. In Kazakhstan, growth is projected to pick up this year and next, supported by higher oil production from the Kashagan field, the continued impact of earlier targeted fiscal stimulus initiatives, and the assumption that financial sector issues will be tackled and, consequently, that bank credit will resume. Economic activity in Azerbaijan is projected to improve only gradually, curtailed by lower oil production this year, in line with the recent OPEC+ agreement, the impact of ongoing financial vulnerabilities, and the foreseen impact of fiscal consolidation. Both Turkmenistan and Uzbekistan are expected to experience relatively steady growth over the next few years, although a large external deficit will be an impediment to economic activity in Turkmenistan. Over the medium term, growth in oil exporters is projected to continue to pick up, in part reflecting more favorable economic conditions in China and Russia.

For oil importers, owing to the lingering impact of lower commodity prices and reduced remittance flows, growth in 2016 amounted to 3.3 percent, the lowest since the global financial crisis. This reflects weaker-than-anticipated domestic demand in Armenia, exacerbated by a poor agricultural harvest, and in Georgia. In contrast, stronger trade, construction, and agricultural activities supported growth in the Kyrgyz Republic, while Tajikistan’s pickup in economic activity came from stronger investment.

As remittance flows and external demand recover—supported by higher prices of key commodities, including copper, aluminum, cotton, and gold—growth in CCA oil importers is projected to accelerate to 3.6 percent in 2017 and 3.9 percent in 2018 and continue to improve over the medium term.Fiscal Consolidation Needed

With few exceptions, overall fiscal balances deteriorated in 2016, especially among oil importers. Policymakers continued to use fiscal policy to offset the impact of earlier external shocks, with public expenditure increasing in most countries (Figure 2). While this provided much needed support to economic activity, fiscal space has declined and public debt is higher (see below).

Most countries are therefore in a more vulnerable position, and are expected to reduce spending this year and next. This consolidation is anticipated to materialize mostly through reduced public investment, which, in some instances, will reflect the appropriate reversal of past investment booms that have generated little improvement in productivity or growth. In that context, countries need to focus on strengthening the efficiency of public spending, and ensuring the preservation of critical social expenditure that protects the poor and vulnerable. Countries need to develop strong frameworks to identify and monitor growth-enhancing public investment projects.

Most countries are therefore in a more vulnerable position, and are expected to reduce spending this year and next. This consolidation is anticipated to materialize mostly through reduced public investment, which, in some instances, will reflect the appropriate reversal of past investment booms that have generated little improvement in productivity or growth. In that context, countries need to focus on strengthening the efficiency of public spending, and ensuring the preservation of critical social expenditure that protects the poor and vulnerable. Countries need to develop strong frameworks to identify and monitor growth-enhancing public investment projects. - For oil exporters, the non-oil fiscal deficit amounted to 14.9 percent of non-oil GDP in 2016, an improvement of 3.6 percentage points relative to the previous year. This reflects mainly reduced capital expenditure, and a pickup in non-oil revenues in Azerbaijan and Kazakhstan, largely as a result of currency adjustment. The non-oil fiscal deficit for oil exporters is projected to increase to 20.6 percent (of non-oil GDP) in 2017. This is explained primarily by a one-time support package to the banking system in Kazakhstan, and an extraordinary transfer from the Oil Fund to the Central Bank of Azerbaijan for the repayment of debt obligations. In 2018, the deficit is projected to decline to 13.5 percent as Azerbaijan continues to reduce nonproductive public investment, and Kazakhstan’s fiscal stimulus expires.

- For oil importers, the overall fiscal deficit rose to 4.6 percent of GDP in 2016, 1.5 percentage points larger than in 2015. This reflects increased spending in all countries, especially the Kyrgyz Republic, where fiscal accommodation continued amid a shortfall in tax revenues. Overall deficits for this group are projected to decline to 3.4 percent in 2017 and 2.7 percent in 2018. With revenues anticipated to remain broadly unchanged, these reductions rely on the implementation of consolidation plans that include, for example, lower public investment in Armenia and lower current expenditures in Georgia.

With subdued growth prospects, the pace of fiscal consolidation must be well calibrated. Too much fiscal restraint could negatively affect growth and impede economic diversification efforts; too little could compromise medium-term fiscal sustainability. This is especially true given that public debt, while still low relative to international standards, has increased rapidly in many CCA countries, and further increases are anticipated over the next few years (Figure 3).

Of particular concern is the share of public debt denominated in foreign currency. On average, almost half of the increase in public debt reflects valuation changes from local currency depreciations since 2014. To reduce reliance on external financing, and as part of a broader effort to reduce dollarization and develop domestic financial markets, some countries, such as Kazakhstan, are planning to introduce a broader range of debt instruments denominated in local currency. A second concern arises from the fact that, in some countries, borrowing by state-owned enterprises is not recognized as a contingent liability, which implies that consolidated government obligations might be underestimated. To secure fiscal sustainability, countries should continue to focus on developing credible multiyear fiscal frameworks that guide the pace of adjustment and are reinforced by well-designed policies that aim to identify new sources of income and reduce their dependence on commodity-related revenue. With increased exchange rate flexibility in the region, asset-liability management frameworks—covering sovereign wealth funds and foreign exchange reserves—should be reviewed to ensure they adequately capture the full extent of balance sheet risk exposures.

A More Favorable External Environment

Current account deficits widened in most CCA countries in 2016, largely reflecting the effects of the various external shocks that have hit the region since 2014. Better prospects for growth in key trading partners, especially China and Russia, combined with the firming of commodity prices, are anticipated to contribute to a reduction in the current account deficits of oil exporters over the next few years. However, little improvement is anticipated in the current account deficits of oil importers.

Among oil exporters, the projected current account deficit of 3.2 percent of GDP in 2017 implies an improvement of 2.7 percentage points relative to the previous year, effectively reverting to 2015 levels. The current account deficit for the group is anticipated to improve further to 2.3 percent of GDP in 2018, due to a sharp acceleration in exports, partly associated with higher oil prices and improved external demand.

Oil importers’ current account deficit is set to widen to 8.7 percent of GDP in 2017, from 7.9 last year, but marginally improve to 8.4 percent in 2018. Higher prices of imports, driven by higher oil prices and currency depreciation, are expected to be only partially offset by a pickup in remittances and an increase in the value of commodity exports.

Monetary Policy to Be Focused on Inflation

At 11.5 percent last year, inflation among oil exporters reached double digits for the first time in eight years. This reflects the effects of past depreciations in Kazakhstan and Azerbaijan due to the large negative terms-of-trade shock. In Azerbaijan, inflation was also affected by increases in the administrated prices for gas and electricity and the introduction of import duties on agricultural products. Inflation in oil exporters is expected to decline to 8.3 percent in 2017 and 7.6 percent in 2018. These projections reflect easing inflation pressure in Kazakhstan associated with the recent appreciation of the tengeand lower government spending. Moderating inflation prospects in Azerbaijan due to the projected fiscal consolidation are also a factor, as well as tighter monetary policy as the country moves toward a fully flexible exchange rate regime—the Central Bank of Azerbaijan announced a move to a free- floating exchange rate regime in early January 2017.

With the exception of Tajikistan, inflation among oil importers in 2016 was lower than in the previous year, with average inflation for this group declining to 1.9 percent, some 3 percentage points lower than in 2015. Deflation continued in Armenia from weak domestic demand and lower import prices. The Kyrgyz Republic saw near zero inflation amid subdued growth, currency appreciation, and declining food prices. Inflation in Georgia declined as a result of weak demand and low global oil and food prices. However, as economic activity continues to recover, inflation in oil importers is projected to accelerate to 4.4 percent in 2017 and remain around 4 percent in 2018.

As countries continue to move toward increased exchange rate flexibility, monetary policy will need to continue to focus on inflation developments. Currency stabilization and easing inflation pressure have allowed some central banks to reduce policy rates on various occasions since early 2016. This has been the case in Kazakhstan, among oil exporters, as well as in Armenia, Georgia, and the Kyrgyz Republic, among oil importers (Figure 4). Conversely, monetary policy tightened significantly in Azerbaijan to support the exchange rate and to address inflation pressure and, to a lesser extent, in Tajikistan, also to stem inflation pressure from currency depreciation and excess liquidity.

Further improvements to monetary policy frameworks are needed to support exchange rate flexibility and inflation targeting. This requires a

sustained effort to develop appropriate policy instruments and strengthen central bank independence, analytics, and communications to establish the credibility critical for the success of these frameworks.

sustained effort to develop appropriate policy instruments and strengthen central bank independence, analytics, and communications to establish the credibility critical for the success of these frameworks. Financial Sector Weaknesses Need to Be Resolved

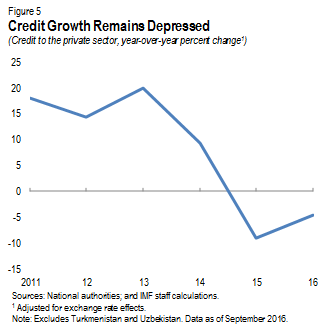

Financial sector vulnerabilities continue to increase, and repair is urgently needed. With few exceptions, restructured and overdue loans have increased further as dollarization remains high and banks remain undercapitalized. These weaknesses represent a drag on future economic activity with credit growth continuing to decline in a number of countries (Figure 5). At the same time, lack of transparency and ownership issues continue to inhibit operations and reduce confidence in the banking sectors of several countries. In some cases, governance issues and limited supervisory independence impede the resolution of deep-rooted problems.

Against this backdrop, authorities have taken some steps to address these vulnerabilities. In Armenia, for example, all banks have complied with the recent central bank-mandated increase in minimum capital, which has also led to some mergers and a consolidation of the banking system. In Georgia, efforts to strengthen the regulatory framework and reduce dollarization are underway. In Azerbaijan, capital injections and government purchases of bad loans continue, but additional bank closures might be necessary as new capitalization plans are developed. In Kazakhstan, the authorities are engaged in the merger between the two largest banks, which will require significant public financial support.In Tajikistan, a recapitalization plan for two major banks and the liquidation of two smaller banks have been announced. However, financial sector weaknesses continue in that country, with regulatory forbearance and resolution of nonperforming loans remaining a challenge.

For the CCA more broadly, much remains to be done to contain risks and enhance financial intermediation. And this will be challenging in this difficult context of legacy and governance issues, coupled with regulatory forbearance and subdued economic growth. First, any weaknesses with bank balance sheets must be properly diagnosed and effectively remedied. Second, timely intervention of weak banks is crucial to avoid systemic risks. Support for bank resolution needs to be provided under strict conditions. For example, public funds should support only viable systemic institutions, with well-defined and fully collateralized guarantees, and shareholders must not retain any claims on assets when support is provided. Liquidation of bad assets—and allowing new investors to purchase these assets—should follow a transparent and market-oriented approach that promotes competition in the banking system. Forbearance must be avoided and corporate governance of state-owned enterprises, major debtors in many jurisdictions, should be improved. In parallel, regulators should continue to strengthen lending practices and crisis management frameworks while enforcing prudential regulations. Addressing financial sector issues promptly could have positive implications for growth, not only as financial intermediation accelerates but also as potential pressures on public finances diminish.

With Risks Tilted to the Downside, the Need for Structural Reform Is Even More Urgent

While baseline assumptions point to a pickup in growth, risks to the outlook for the CCA region remain to the downside, including, for some countries, due to regional geopolitical tensions. A weaker-than-expected recovery could undermine prospects for credible fiscal consolidation plans. At the same time, failing to quickly address financial sector weaknesses could not only reduce growth prospects further, but would also increase systemic risk, adding to fiscal pressures in a number of CCA countries.

In this context, the external shocks that have hit the region since 2014 have increased the urgency of diversifying away from oil and other commodities and reducing reliance on remittances. This is ever more important considering the large uncertainty surrounding the policy positions in the United States and other advanced economies, which could have significant global ramifications (see Global Developments section). Although trade and financial linkages with advanced economies are relatively limited for CCA countries, the effects on key trading partners that could arise from an inward shift in policies, including toward protectionism, and a subsequent disruption of trade and capital flows, could be significant. The impact of lower global growth on key commodity prices would also dampen the regional outlook.

In contrast, firming prices of oil and other commodities, together with a somewhat more favorable outlook in key trading partners, risk leading to complacency, which in turn could delay the implementation of the structural reforms needed to unleash the region’s growth potential. While some initiatives have been launched—such as the 100 Concrete Steps in Kazakhstan and the Four Point Reform Plan in Georgia, which cover administrative reforms, improvements in the business environment, and the strengthening of the legal framework—their implementation will require a reduction in the role of the state, which may prove challenging. Any delays to the reform process in the CCA could further stall gains in living standards in these countries.

Statistical Appendix

The following statistical appendix tables contain data for 31 MCD countries. Data revisions reflect changes in methodology and/or revisions provided by country authorities.

- The IMF's Middle East and Central Asia Department (MCD) countries and territories comprise Afghanistan, Algeria, Armenia, Azerbaijan, Bahrain, Djibouti, Egypt, Georgia, Iran, Iraq, Jordan, Kazakhstan, Kuwait, the Kyrgyz Republic,

Lebanon, Libya, Mauritania, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tajikistan, Tunisia, Turkmenistan, the United Arab Emirates, Uzbekistan, the West Bank and Gaza, and Yemen.

A number of assumptions have been adopted for the projections presented in the Regional Economic Outlook: Middle East and Central Asia. It has been assumed that established policies of national authorities will be maintained, that

the price of oil1 will average US$55.23 a barrel in 2017 and US$55.06 a barrel in 2018, and that the six-month London interbank offered rate (LIBOR) on U.S.-dollar deposits will average 1.7 percent in 2017 and 2.8 percent in 2018. These are, of course, working hypotheses rather than forecasts, and the uncertainties surrounding them add to the margin of error that would in any event be involved in the projections. The 2017 and 2018 data in the figures and tables are projections. These projections are based on statistical information available through early April 2017.

Somalia is excluded from all regional aggregates due to a lack of reliable data.

2011 data for Sudan exclude South Sudan after July 9; data for 2012 onward pertain to the current Sudan.

All data for Syria are excluded for 2011 onward due to the uncertain political situation.

All data refer to the calendar years, except for the following countries, which refer to the fiscal years: Afghanistan (March 21/March 20 until 2011, and December 21/December 20 thereafter), Iran (March 21/March 20), Qatar (April/March), and Egypt and Pakistan (July/June) except inflation.

Data in Tables 7 and 8 relate to the calendar year for all aggregates and countries, except for Iran, for which the Iranian calendar year (beginning on March 21) is used.

Data for West Bank and Gaza are included in all tables except in 3–6, 8, 10, 13, and 14.

In Tables 3, 6, 13, and 14, "oil" includes gas, which is also an important resource in several countries.

REO aggregates are constructed using a variety of weights as appropriate to the series:

- Composites for data relating to the domestic economy (Tables 1, 3, 7–8, and 10–17), whether growth rates or ratios, are weighted by GDP valued at purchasing power parities (PPPs) as a share of total MCD or group GDP. Country group composites for the growth rates of broad money (Table 9) are weighted by GDP converted to U.S. dollars at market exchange rates (both GDP and exchange rates are averaged over the preceding three years) as a share of MCD or group GDP.

- Composites relating to the external economy in nominal terms (Tables 18–20 and 22) are sums of individual country data. Composites relating to external economy in percent of GDP (Tables 21 and 23) are weighted by GDP in U.S. dollars as a share of MCD or group GDP in U.S. dollars.

- Composites in Tables 2, 4, and 5 are sums of the individual country data.

The following conventions are used in this publication:

- In tables, ellipsis points (. . .) indicate "not available," and 0 or 0.0 indicates "zero" or "negligible." Minor

discrepancies between sums of constituent figures and totals are due to rounding.

________________

1Simple average prices of U.K Brent, Dubai, and West Texas Intermediate crude oil.