If properly designed, tax-based fiscal consolidation does not have to be politically costly

Most countries around the world have rightfully taken a “whatever it takes” approach to combating the COVID-19 pandemic. On the fiscal side, extraordinary and far-reaching tax and spending measures have been implemented to save lives, support individuals and firms, and set the stage for recovery. It is still too early to predict an endgame for this crisis. But once the virus is beaten back and the global recession bottoms out, public finances will have to be put back in order, especially in countries where debt was already high before the pandemic arrived. This will inevitably raise questions about what taxes to increase and which spending to cut, decisions that are politically unpopular.

Jean-Claude Juncker, the former president of the European Commission, referring to the political obstacles facing those undertaking structural reforms, famously remarked, “We all know what to do; we just don’t know how to get re-elected after we’ve done it” (Economist 2007). One could argue that this applies especially to fiscal consolidation. Among consolidation measures, tax hikes are typically associated with higher short-term growth costs than spending cuts (Alesina, Favero, and Giavazzi 2015). But does that mean governments always pay a price at the ballot box for raising taxes?

While there is broad agreement on the economic benefits of fiscal adjustments to reduce runaway deficits and debt, the political ramifications are less clear-cut.

On the one hand, tax increases may generate gains for society as a whole only in the longer term while inflicting short-term pain on certain segments of society. Those affected may be highly vocal and well organized. The rich and middle-class voters may also have very different notions about which tax hikes are palatable (Alt, Preston, and Sibieta 2010). This suggests that voters can penalize governments for undertaking actions that go against their policy preferences and economic interests.

On the other hand, tax hikes may not be a deal breaker if voters themselves are fiscally prudent and view them as being economically necessary. It could also be the case that the electorate places relatively less weight on fiscal adjustments—even when unpopular—if undertaken alongside other beneficial reforms, or if they care more about other political attributes, such as party ideology.

What, then, can be learned from past tax-based consolidations?

Tax reform and election outcomes

In a recent study, we sought to answer this question, using a newly compiled database of tax-based fiscal consolidations for 10 advanced economies (Dabla-Norris and Lima 2018). The database has comprehensive information on a series of tax reforms, including their magnitude, precise announcement and implementation dates, and the motivation behind each. We looked at both direct (corporate and personal income tax) and indirect tax (value-added tax and excises) reforms from 1973 to 2014. We then examined electoral outcomes such as reelection of the incumbent government party, its leader (usually the prime minister, or the president in presidential regimes), or the percentage of votes the incumbent government party received when reelected. We controlled for a wide range of other economic and political factors (for example, government popularity at the time of reforms, parliamentary support for the government), other country-specific characteristics, and global shocks that could affect reelection outcomes.

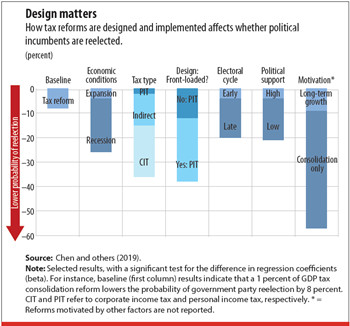

Voters indeed seem to punish political incumbents for undertaking tax-based fiscal consolidation (see chart). The likelihood of reelection of the incumbent government or its leader falls significantly after these episodes. For example, 1 percentage point of GDP tax consolidation lowers the probability of reelection of the government by about 8 percentage points. The incumbent party is also likely to receive fewer votes than in the previous election.

A political strategist in the United States once noted, “It’s the economy, stupid.” This is not just a pithy catchphrase—prevailing economic conditions do make a difference at the ballot box. Voters tend to penalize the ruling party even more when tax reforms are implemented during recessions. This is because when countries tighten fiscal policy during bad times, the economy can contract even further, creating more short-term pain than would otherwise be the case (Auerbach and Gorodnichenko 2012). When voters are subjected to this additional pain, tax hikes become more challenging politically.

Further, not all tax reforms are equal from an electoral perspective. On the surface, voters appeared to penalize governments equally for implementing direct and indirect tax reforms. But among direct taxes, corporate income tax increases can exact a higher cost at election time than personal income taxes. This is not entirely surprising, since corporate income tax reforms affect more organized and politically influential interest groups. By contrast, personal income tax increases are more diffuse because they often include offsetting measures targeted toward specific groups. For instance, higher tax rates for certain income tax brackets are typically accompanied by changes to particular allowances and deductions, tax credits, and special tax treatment for capital gains—all of which tend to have a differential impact on taxpayers.

Reform design in terms of the timing of tax measures and the electoral cycle can shape political costs. Voters tend to penalize governments more for announcing front-loaded reform efforts that result in higher tax payments immediately than for back-loaded measures that entail a gradual increase in tax liabilities.

Does this indicate electoral myopia? Yes, but not entirely. While reforms announced in the run-up to elections entail higher electoral costs, the effect again depends on reform type. For example, personal income tax reforms have virtually no impact on reelection odds when announced two years before the beginning of the government’s new mandate but can exact a heavy toll just before an election (the probability of reelection falls by almost 15 percentage points). Politically influential corporate lobbies that are narrowly focused on their interests, however, tend to be less forgiving if corporate income tax reforms are implemented, irrespective of the electoral cycle.

Ideology matters

A popular government that enjoys broad-based support for its policies, as measured by the percentage of votes it received when first elected, is less likely to be punished in subsequent elections for implementing tax reforms, even politically costly corporate income tax hikes. Not surprisingly, voters have no such reservations when it comes to governments with a weaker political mandate, which invariably pay a price at the polls.

Interestingly, the political orientation of the incumbent government matters for some tax reforms. Voters, on average, tend to punish right-wing governments, which typically run on low-tax, pro-business platforms, for implementing personal income tax reforms that lower the progressivity of the tax system and—to a lesser extent—for raising corporate income taxes.

Finally, voters seem to care about the reasons behind the tax consolidation. Contractionary tax measures aimed primarily at lowering existing deficits and debt entail larger electoral costs than consolidation measures aimed at improving long-term growth prospects. Examples of such long-term growth reforms include measures announced by the Australian government in September 1985 or the UK government in 1991, when some tax rates were increased to finance long-term growth. This is because voters care about their own long-term prospects or the well-being of future generations. Or voters may perceive tax measures implemented to ameliorate existing large deficits and debt as a signal of the government’s inability to tackle economic problems.

Bottom line

Politicians may view the eventual consolidation of public finances from the COVID-19 shock with some trepidation given the tough fiscal choices they will inevitably face. But tax-based fiscal consolidation does not necessarily have to be politically costly. Electoral costs can be avoided, or at least significantly reduced, if economic and political considerations are factored into policy design.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Alesina, A., C. Favero, and F. Giavazzi. 2015. “The Output Effect of Fiscal Consolidation Plans.” Journal of International Economics 96 (S1): 19–42.

Alt, J., I. Preston, and L. Sibieta. 2010. “The Political Economy of Tax Policy.” In Dimensions of Tax Design, edited by S. Adam and others. Oxford: Oxford University Press.

Auerbach, A., and Y. Gorodnichenko. 2012. “Measuring the Output Responses to Fiscal Policy.” American Economic Journal: Economic Policy 4 (2): 1–27.

Chen, C., E. Dabla-Norris, J. Rappaport, and A. Zdzienicka. 2019. “Political Costs of Tax-Based Consolidations.” IMF Working Paper 19/298, International Monetary Fund, Washington, DC.

Dabla-Norris, E., and F. Lima. 2018. “Macroeconomic Effect of Tax Changes.” IMF Working Paper 18/220, International Monetary Fund, Washington, DC.

Economist . 2007. “The Quest for Prosperity.” Special Report, March 17.