Sovereign borrowing—meant to spur investment and smooth ups and downs in revenue—may do just the opposite

Since the 1970s, emerging market and developing economies have aggressively tapped into global sovereign debt markets, seeking to jump-start growth or make up for transitory shortfalls in output and tax revenue. Has this borrowing had the intended effect? An analysis of the data suggests that sovereign borrowing may actually leave citizens worse off, increasing volatility and lowering investment.

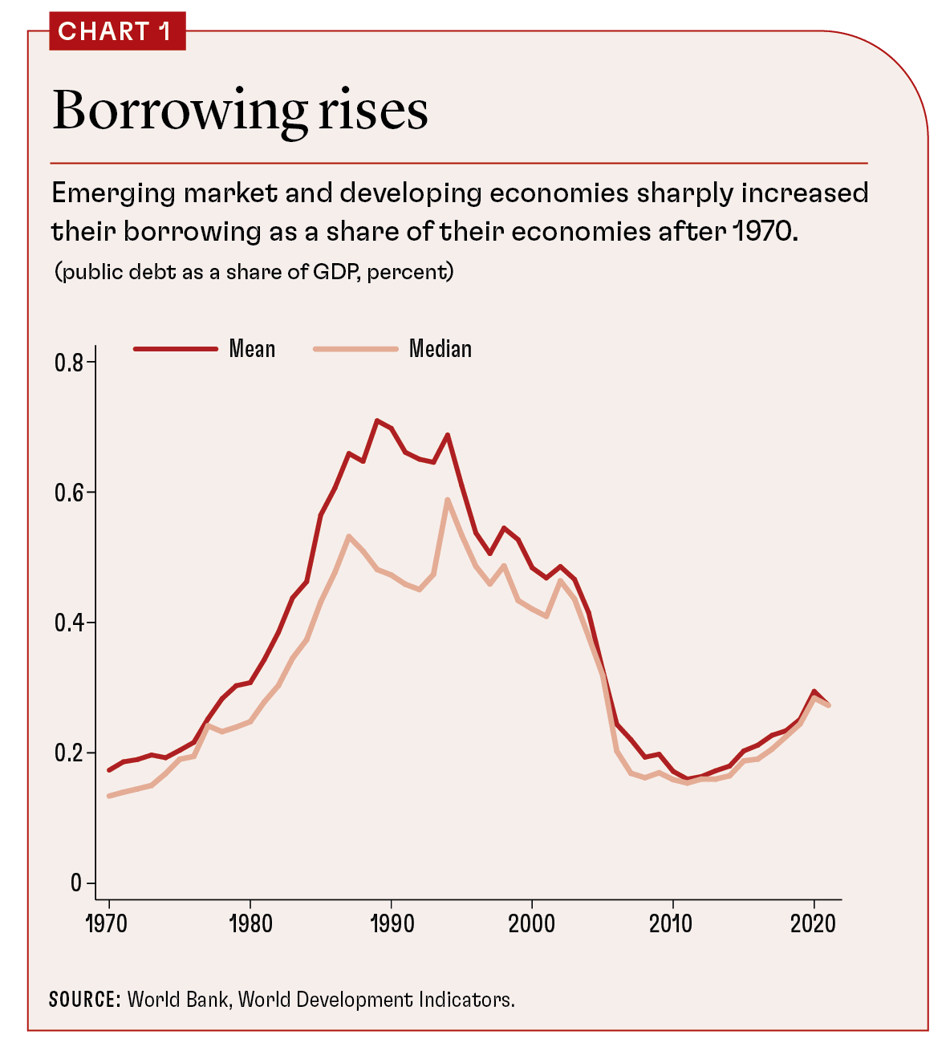

The ratio of external sovereign debt to GDP rose dramatically between 1970 and the mid-2000s, based on the average and median for a balanced sample of 52 developing and emerging market economies. Over the last 20 years of the sample, this trend has partially reversed, as shown in Chart 1.

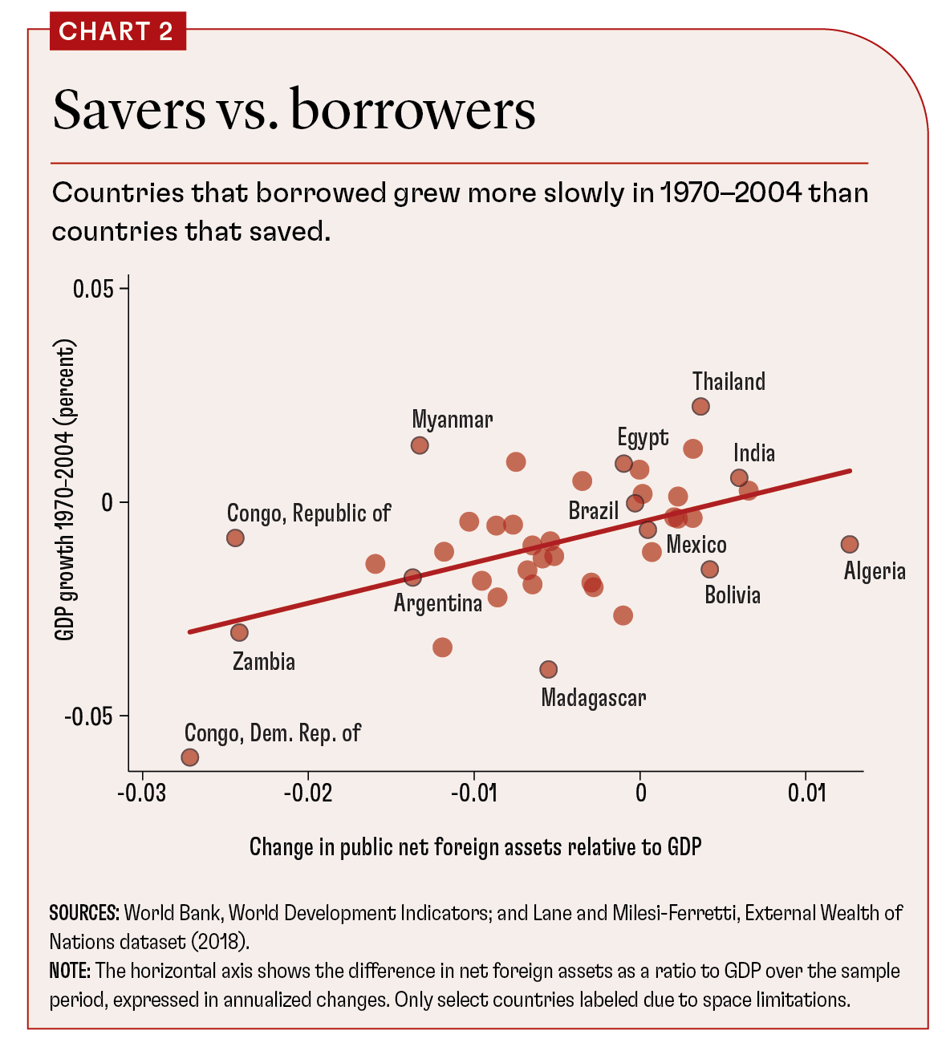

What are the costs and benefits of the surge in sovereign borrowing for the citizens of these economies? The promise, implicit or explicit, in standard economic models is that access to global capital markets facilitates investment and allows economies to insulate ("smooth") government spending from large fluctuations in output. That is, borrowing can fund large investment projects or cover temporary shortfalls in revenue, without drawing on domestic private savings. I refer to this as the "neoclassical paradigm." It predicts that countries that borrow (all else equal), should have faster growth and less volatile spending. However, this is exactly the opposite of what we see in the data. Chart 2 shows a scatter plot of the increase in government net foreign assets (foreign reserves minus external debt) on the horizontal axis and annualized per capita GDP growth relative to the United States on the vertical axis. The time period is 1970-2004, the period of the large increases in debt seen in Chart 1. The data show countries that had external public savings (foreign reserves exceeding external debt) experienced faster growth, while those that borrowed stagnated.

Impatient politicians

An alternative to the neoclassical paradigm holds that governments borrow due to present bias. That is, political incumbents prefer spending to occur while they are in office, which, without a sound set of political institutions, leads to excess borrowing. Given a large stock of debt, governments are tempted or forced to tax private activity, including private investment and capital income. This alternative perspective, developed in detail in my papers with Manuel Amador and Gita Gopinath, predicts that public borrowing crowds out private investment and retards growth. This is consistent with the scatter plot of Chart 2. It also makes a sharp distinction between public and private flows, a feature also consistent with the data. Chart 2 implies that over the long run, countries with low trend growth rates tended to borrow more.

The preceding focused on the period in which countries dramatically increased their debt. As noted, the latter half of the sample shows a decrease in debt to income, on average. The correlation depicted in Chart 2 does not hold for the later period. In fact, countries that decreased debt relatively more had slower growth in the period 2004-2022. One issue with the latter sample is that the reductions in debt sometimes resulted from debt forgiveness or default and restructuring. The data suggest that starting from low debt (as most countries did in 1970) is inherently different from low debt due to forgiveness or default. That is, the level of debt matters, but so does the history that led to that level of borrowing.

This suggests that countries that have large levels of debt differ along many dimensions besides debt. Indeed, countries differ in political institutions, which in turn induces differences in the level of debt. The ideal experiment would change the stock of debt without changes to other underlying fundamentals. In the absence of such an experiment, the best we can do is combine theory and data to distinguish cause and effect. Doing so makes a strong case that government debt crowds out investment and lowers growth. The neoclassical paradigm, in which debt and investment go hand in hand, faces a tougher challenge when confronted with the data.

Smoothing volatility

The neoclassical paradigm also holds that sovereign borrowing allows countries to smooth fluctuations in income. This is also counterfactual in the sense that over longer horizons, countries that borrow show more volatility in government expenditure and private consumption. In particular, there is a positive relationship between changes in debt and volatility of spending, indicating that more borrowing is associated with more volatile public spending. Again, this is contrary to the "smoothing" motive for borrowing predicted by the standard model.

One consideration is whether countries borrow due to large negative shocks, such as natural disasters or military conflict, generating a positive correlation due to luck rather than policy. Again, this is why it is important to have a long enough time series to smooth out the effects of temporary shocks. If a country frequently experiences large, negative shocks, they eventually come to be expected, and governments should respond by building up a buffer stock of reserves to be drawn on as necessary, rather than increasing debt levels. Clearly, this is not the case on average in the sample of countries depicted in the chart.

The data suggest that sovereign borrowing is associated with lower long-run growth and investment and greater volatility in spending. This runs counter to the neoclassical conventional wisdom but is consistent with a model of present bias due to political turnover combined with capital taxation. In short, sovereign borrowing generates volatility rather draws on it, and it is a drag on growth, rather than a means to tap into global savings to fund investment. We now turn to the question of whether the citizens of emerging market and developing economies would be better off if their governments had zero access to sovereign debt markets.

Loading component...

Welfare consequences

There has been a large literature developing quantitative models of sovereign debt. This class of models can successfully replicate key empirical patterns, including large runups in debt and subsequent defaults. The key ingredient in these models is that the government faces a volatile income process and taps into international debt markets to delink spending from revenues. If the government defaults, it is excluded from international debt markets for a period of time and suffers a reduction in output, reflecting the disruption of trade and financial markets often associated with default. Given the costs involved in default, and the shocks to income that may induce default, there is the question about why governments borrow rather than build up a buffer stock of reserves. Typically, the models assume governments are much more impatient than lenders, and thus their present bias leads them to default.

A few features of the models’ prediction are worthy of note. One is that governments default when debt is high and output is low. Second, lenders price debt with a view toward breaking even on average; in particular, interest rates are higher than the comparable risk-free bond, but lenders only get paid if output turns out to be relatively high. This implies that bond prices vary over the business cycle, with the spread over risk-free interest rates increasing when a recession is likely, and decreasing in a boom. This induces the government to borrow more in a boom than a bust, the opposite of smoothing income shocks. Thus, government consumption goes up in booms, partly due to the increased income and partly due to the additional borrowing. This is the procyclical fiscal policy observed in many emerging market and developing economies.

Loading component...

With the models in hand, we can ask a simple question. If the private citizens are relatively patient compared with their governments, does access to sovereign debt markets increase or decrease the welfare of the population? Would the typical citizen prefer a government that has to balance its budget year to year over one that can borrow or save? Simple calculations following my paper with Manuel Amador and Stelios Fourakis show that a modest amount of disagreement about how to discount the future generates the striking result that the citizenry would be better off if the government was denied access to debt markets. The extra volatility induced by procyclical borrowing and subsequent default is not in the best interests of private agents if they are not as present-biased as their governments.

This raises another question: would making debt markets more efficient improve welfare? If citizens and their governments agree on how to evaluate the costs and benefits of borrowing, then the answer is a clear yes. If there is disagreement, however, then removing frictions to make credit markets operate more smoothly may only make matters worse.

Lenders of last resort

Take, for example, the fact that debt markets are vulnerable to runs (or self-fulfilling panics). Specifically, a government that needs to roll over maturing debt must find a willing set of new bondholders that enable it to repay maturing debt without issue. Otherwise, it experiences a failed auction in which it cannot sell new bonds and thus is forced to default on maturing bonds. Either outcome may happen, depending on lender beliefs about how other lenders will behave. This mechanism is the same as a classic bank run. The typical policy prescription is to have a third party (in the international context, for example, the IMF may play this role) promise to lend if there is a failed auction. Lenders then have no need to worry about default due to self-fulfilling panics, and actively participate in bond auctions. Thus, the panic outcome can be eliminated.

Without such a third-party lender, other lenders demand a high premium to cover the risk of a run. This limits the amount an impatient government is willing or able to borrow. The advantage of this is that it constrains an impatient government's borrowing, increasing the welfare of the average citizen. The disadvantage is that there may still be a run, after which the citizens bear the costs of default. Again, calculations using a model with runs indicate that if the citizens are not excessively impatient, they may prefer a world without a lender of last resort. While the country is exposed to panics, the benefit is that the government cannot easily borrow.

The value of sovereign debt markets to the borrowing countries is ambiguous, whether viewed from the perspective of the data or quantitative models. With small differences over the rate of time discounting or risk-reward valuations, it may be that access to sovereign bond markets leaves economies worse off. The political economy distortions in many developing or emerging markets are severe enough that governmental access to global capital markets turns out to be counterproductive—increasing volatility and lowering investment. Even something like a lender of last resort that can unambiguously identify a panic may make things worse, not better.

This conclusion is undoubtedly provocative. It is not meant to be the last word on the subject. Rather, the approach is to use data and theory to show that the welfare calculus behind the conventional wisdom may indeed be wrong. There should be a heavy dose of skepticism of the promises made by the neoclassical paradigm. The implication for practical policymaking is to proceed with extreme caution in facilitating borrowing in developing and emerging markets. This may involve raising the threshold for interventions in a crisis or reconsidering the welfare costs of direct lending. It also calls for more research into the costs and consequences of sovereign borrowing.

This article is based on the 2023 Mundell-Fleming Lecture delivered by the author at the IMF’s 24th Jacques Polak Annual Research Conference. Read the analysis.

Podcast

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Aguiar, Mark, Manuel Amador, and Gita Gopinath. 2009. “Investment Cycles and Sovereign Debt Overhang.” Review of Economic Studies 76 (1): 1–31.

Aguiar, Mark, and Manuel Amador. 2011. “Growth in the Shadow of Expropriation.” Quarterly Journal of Economics 126: 651–97.

Aguiar, Mark, Manuel Amador, and Stelios Fourakis. 2020. “On the Welfare Losses from External Sovereign Borrowing.” IMF Economic Review 68 (1): 163–94.