Opportunity in a Time of Change

October 8, 2025

As prepared for delivery

Good morning.

And thank you, Mike, for inviting the IMF to be part of the opening of this beautiful new center. I cannot think of a better place to talk about the pursuit of opportunity than here—it is exactly what the center is about.

As I look at the world over the decades, I see incredible progress, but also unfulfilled dreams. The average person today is much better off than, say, 30 years ago, but the averages conceal deep undercurrents of marginalization, discontent, and hardship.

Many people in many places—especially the young—are taking their disappointment to the streets: from Lima to Rabat, from Paris to Nairobi, and from Kathmandu to Jakarta, all are demanding better opportunity.

In the U.S., your chances of growing up to earn more than your parents keep falling. Here too, discontent has been evident—and has helped precipitate the policy revolution that is now unfolding, reshaping trade, immigration, and many international frameworks.

All of this plays out against a backdrop of deep transformations: in geopolitics; in technology; in demographics, with populations surging in some places and shrinking in others; and in the mounting harm we do to our planet.

The result is exceptionally high uncertainty: globally it has shot up and continues to climb. Buckle up: uncertainty is the new normal and it is here to stay.

***

Next week, as the world’s finance ministers and central bank governors gather at our Annual Meetings, the most pressing questions will be about the global economic impact of these forces of transformation and the policy turbulence we are seeing.

How is the world economy coping? Short answer: better than feared, but worse than we need.

When we met in April, many experts—not us—predicted a U.S. recession in the near term, with negative spillovers to the rest of the world. Instead, the U.S. economy as well as many other advanced and emerging markets, and some developing countries, have held up.

As our World Economic Outlook will explain next week, we see global growth slowing only slightly this year and next. All signs point to a world economy that has generally withstood acute strains from multiple shocks.

How do we explain this resilience? I would point to four reasons:

- One, improved policy fundamentals;

- Two, private sector adaptability;

- Three, less severe tariff outcomes than initially feared—for now; and

- Four, supportive financial conditions—for as long as they hold.

Let me elaborate.

First reason: better policy fundamentals and global coordination.

In many parts of the world, sustained efforts have delivered more credible monetary policy, deeper local currency bond markets, new fiscal rules, and—during the pandemic—swift, decisive, and globally coordinated fiscal action to limit the immediate pain and the lasting scars.

Emerging market economies, especially, have significantly upgraded their policy frameworks and institutions. We just put out a report on progress, quantifying the gains. These economies now perform better when shocks strike than before the global financial crisis.

Good policy makes a difference.

Second reason for resilience: private sector adaptability. Just look at private initiative in world trade: companies have been frontloading import orders in advance of tariff hikes and reorganizing their supply chains.

Corporate balance sheets are generally strong after years of robust profits, reflexes are quick after the dry runs of shock after shock, artificial intelligence is becoming mainstream, and change is faced as a challenge and embraced as an opportunity.

Third reason: tariffs, where the shock has not been as large as initially announced.

The U.S. trade-weighted tariff rate has fallen from 23 percent in April to 17½ percent now—still much higher than before. The U.S. effective rate is now far above the rest of the world’s, which has held relatively steady this year, with very few cases of retaliation.

In short, the world has avoided a tit-for-tat slide into trade war—so far. But openness has nonetheless taken a big hit.

And the story is not over—U.S. tariff rates keep moving. Trade deals with the UK, the EU, Japan, and soon Korea have nudged some rates down while disputes with Brazil and India have pushed others up. Other countries’ rates are also likely to move.

Fourth reason: supportive financial conditions. Fired up by optimism about the productivity-enhancing potential of AI, global equity prices are surging. This, plus tight risk spreads, leaves funding markets generally wide open—and the dollar’s slide earlier this year gives precious relief to non-U.S. borrowers with dollar-denominated debt.

So there we have it: four factors behind the economic resilience we have seen this year.

***

But before anyone heaves a big sigh of relief, please hear this: global resilience has not yet been fully tested.

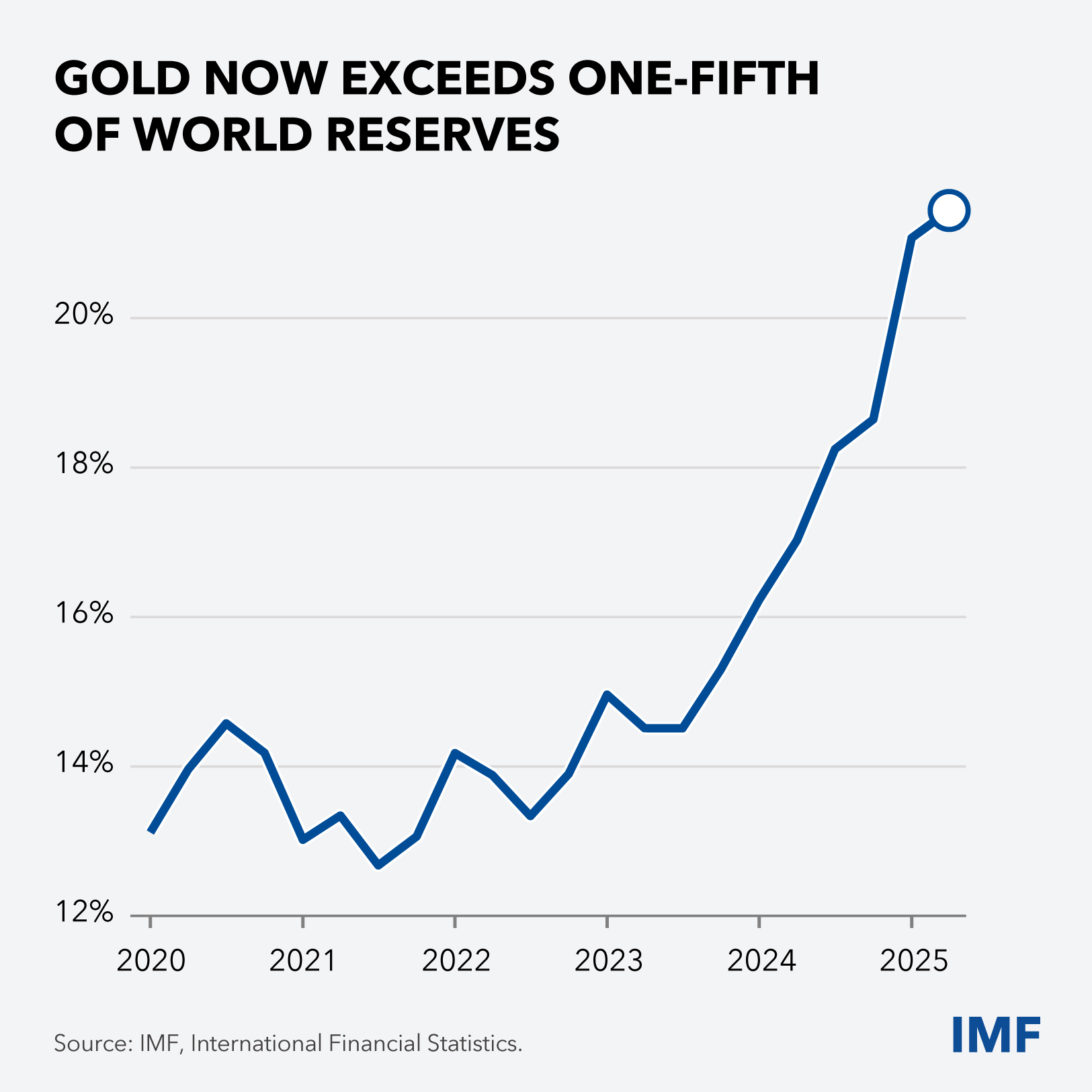

And there are worrying signs the test may come. Just look at the surging global demand for gold. Spurred by valuation effects and net purchases—partly reflecting geopolitical factors—holdings of monetary gold now exceed one-fifth of the world’s official reserves.

On tariffs, the full effect is still to unfold. In the U.S., margin compression could give way to more price passthrough, raising inflation with implications for monetary policy and growth. Elsewhere, a flood of goods previously destined for the U.S. market could trigger a second round of tariff hikes.

Yes, world trade is rippling but still flowing—like water, it’s not easy to plug and stop. For now, most of the world’s trade still follows the rules. We at the IMF urge the world’s policymakers: please keep it this way; preserve trade as an engine of growth.

As for easy financial conditions—which are masking but not arresting some softening trends, including in job creation—history tells us this sentiment can turn abruptly.

Today’s valuations are heading toward levels we saw during the bullishness about the internet 25 years ago. If a sharp correction were to occur, tighter financial conditions could drag down world growth, expose vulnerabilities, and make life especially tough for developing countries.

***

In this multi-polar world of rapid change, it is paramount that policymakers do much more to capture and deliver opportunity so they can meet the aspirations of their citizens, especially young people.

At the IMF, we propose three medium-term policy goals:

- First, to durably lift growth, so the economy can create more jobs, more public revenue, and better public and private debt sustainability;

- Second, to repair governments’ finances, so they can buffer new shocks and attend to pressing needs without driving up private sector borrowing rates; and

- Third, to address excessive imbalances, both domestic and external, so they do not emerge as a spoiler.

Let me address these one by one.

First, growth. Global growth is forecast at roughly 3 percent over the medium term—down from 3.7 percent pre-pandemic. Global growth patterns have been changing over the years, notably with China decelerating steadily while India develops into a key growth engine.

Durably lifting growth requires higher private sector productivity. And for this, governments must provide and protect the basic building blocks of free markets, including property rights, rule of law, good data, effective bankruptcy codes, strong financial sector oversight, and independent yet accountable institutions.

In too many economies, private sector productivity is tangled up in red tape and startups can neither start nor grow. Competition is key, and regulation must not tolerate or create unfair advantage.

So today I call on all our member countries to embrace a regulatory housecleaning to release entrepreneurial energy, supported by strong institutions and governance. This is not a time for self-inflicted injuries: it is a time to get the house in order.

To Asia, I say: deepen internal trade to include more final goods and more services and press forward with reforms to strengthen the service sector and access to finance. Our analysis suggests a push for more regional integration—notably by lowering nontariff barriers—could raise GDP by 1.8 percent in the long run.

To Sub-Saharan Africa, I note: gains from reforms in this region can be especially large given the young and growing labor force. Comprehensive business-friendly reforms, combined with progress in building the Continental Free Trade Area, could lift the real GDP per capita of the median African country by over 10 percent.

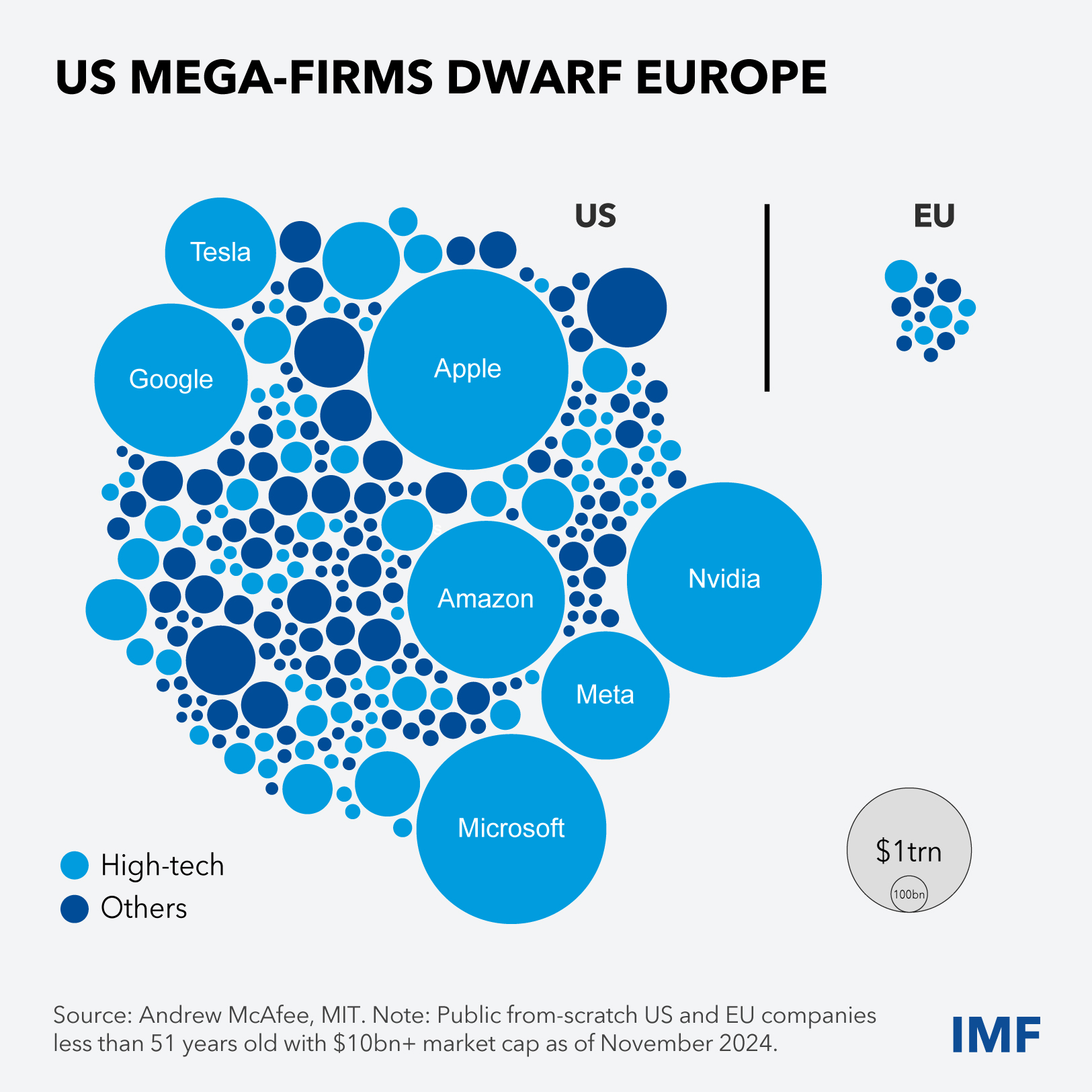

And to my beloved, native Europe, some tough love: enough lofty rhetoric on how to lift competitiveness—you know what must be done. It is time for action. Consider appointing a “single market czar” with real authority to drive reforms forward. Remove border frictions in the labor market, goods and services trade, energy, and finance. Build a single European financial system. Build an energy union. Complete your project. And catch up with the private sector dynamism of the U.S.

A picture can say a thousand words: see how seven U.S. mega-firms—none of which existed 51 years ago—boast market capitalization dwarfing that of firms of similar vintage in Europe.

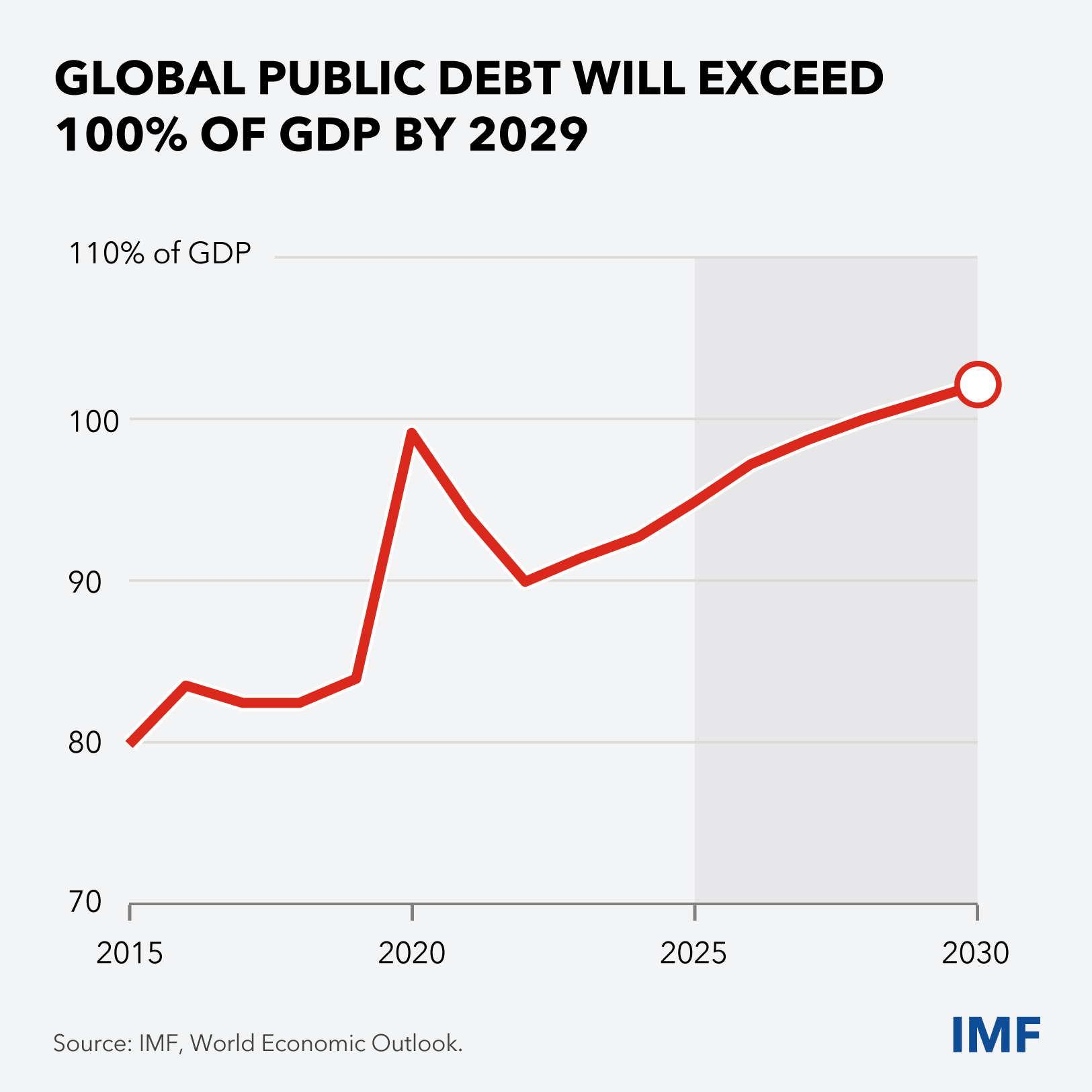

Let me now turn to fiscal affairs, starting with the sobering reality that global public debt is projected to exceed 100 percent of GDP by 2029, led by advanced and emerging market economies.

Rising debt inflates interest payments, exerts upward pressure on borrowing costs, constrains other spending, and reduces governments’ ability to cushion shocks.

One casualty is advanced economies’ development assistance to the world’s neediest countries, which continues its regrettable decline. For the low-income countries on the receiving end, this means more self-help—including setting a minimum tax-to-GDP target of 15 percent.

Fiscal consolidation is necessary in countries rich and poor alike.

Consolidation is difficult—as many of the recent episodes of social unrest show. But if planned, communicated, and implemented well, significant deficit reduction can be delivered—especially if helped by higher medium-term growth.

With that, let me now turn to the third task: reducing resurgent current account imbalances.

As we have seen, these imbalances can trigger a protectionist backlash and—being mirrored by net capital flows—can fuel financial stability risks. We at the IMF are working hard to refine our external sector assessments and will keep pushing key players for policy correctives.

To the U.S., where both private consumption and the fiscal deficit are high and the current account deficit is at levels not seen since the early 2000s, we will urge action along two broad dimensions:

- First, steps to address the federal government deficit, noting that the federal debt-to-GDP ratio is on a path to exceeding its all-time high after World War Two. We need sustained action that goes beyond discretionary spending.

- Second, steps to incentivize household saving, where consideration could be given, for instance, to expanding existing plans that provide favorable tax treatment for retirement saving, among other possible tax policy adjustments.

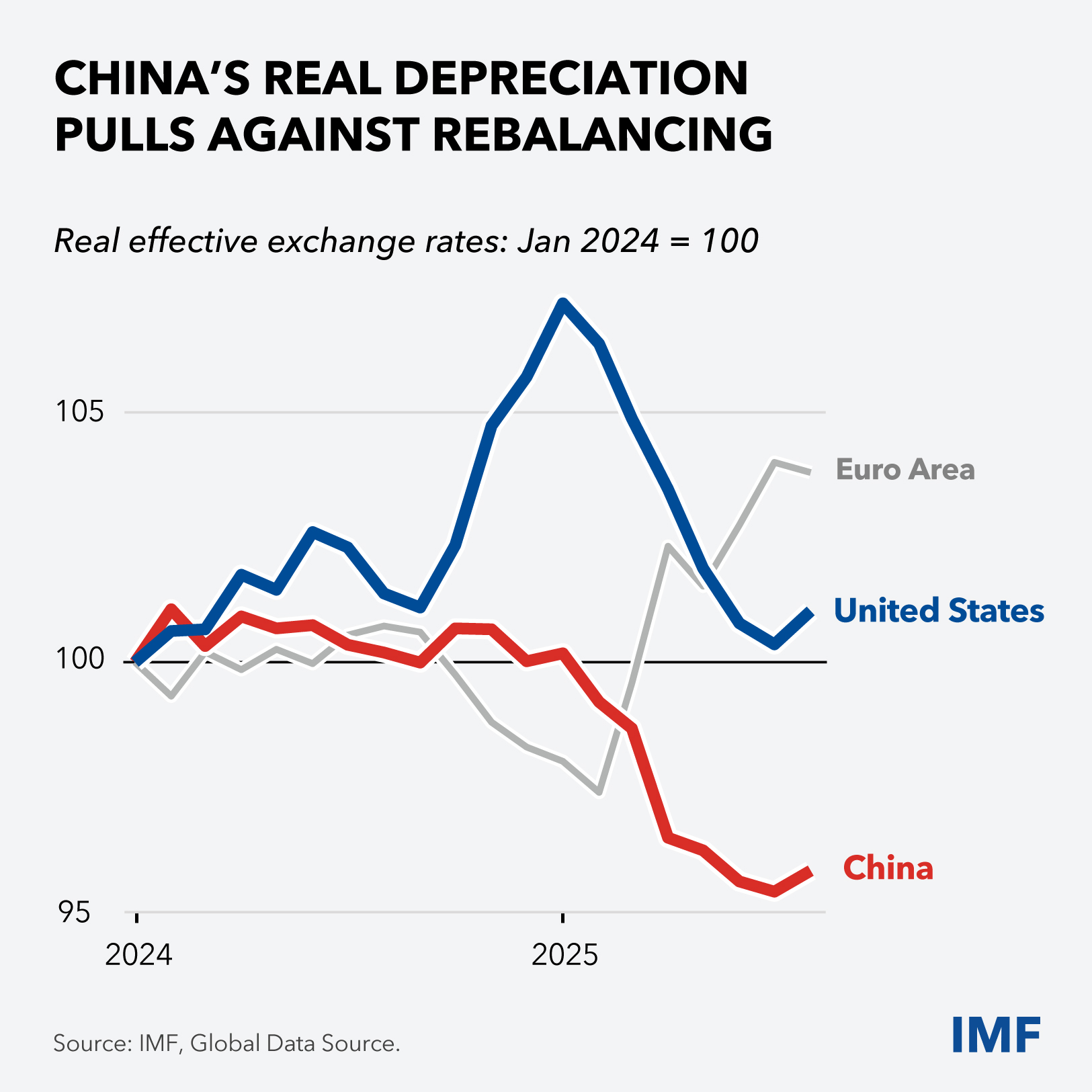

To China, where private savings are chronically high and domestic demand is held back by protracted real estate adjustment and deflationary pressures, we urge transitional fiscal expansion and permanent fiscal recomposition.

China needs a fiscal–structural package to boost private consumption, transition to a new growth model, and reflate its economy—which will also help counter the recent depreciation of its real exchange rate, which pulls against rebalancing.

Among other items, China’s package should include more spending on social safety nets and property sector clean-up, and much less on industrial policy—where a new IMF paper estimates the costs at a very high 4.4 percent of GDP per year.

And as for Germany, its recent structural shift to a more expansive fiscal policy—which should help bring down the current account surplus—shows that, yes, corrections can be made. Public spending on infrastructure, by improving incentives for private investment at home, will be especially beneficial as Germany seeks to inject new dynamism into its private sector.

***

As I close, let me go back to youth aspirations. It is with a sense of deep responsibility that I lead an institution where our basic duty is to influence policy in ways that maximize economic opportunity for all people.

So today my parting words are these: if we all pull together in this complex and uncertain world, we can deliver good policies that underpin free markets with smart regulations, strong institutions, reliable data and robust safety nets—policies with the power to further increase resilience and accelerate growth.

To finish with words I read here from the wall of this very room, “A dream you dream alone is only a dream. A dream you dream together is reality.”

Let’s get it done—and deliver opportunity in this time of change.

Thank you.

IMF Communications Department

MEDIA RELATIONS

Phone: +1 202 623-7100Email: MEDIA@IMF.org